View related analysis:

- AUD/USD Weekly Outlook: AU inflation, US Core PCE on Tap

- Japanese Yen Forecast: USD/JPY Eyes Bullish Break as Risk Sentiment Takes Charge

- ASX 200 Set to Snap 4-Week Losing Streak With 8k Now in Bullish Sights

Market positioning from the COT report – 18 March 2025:

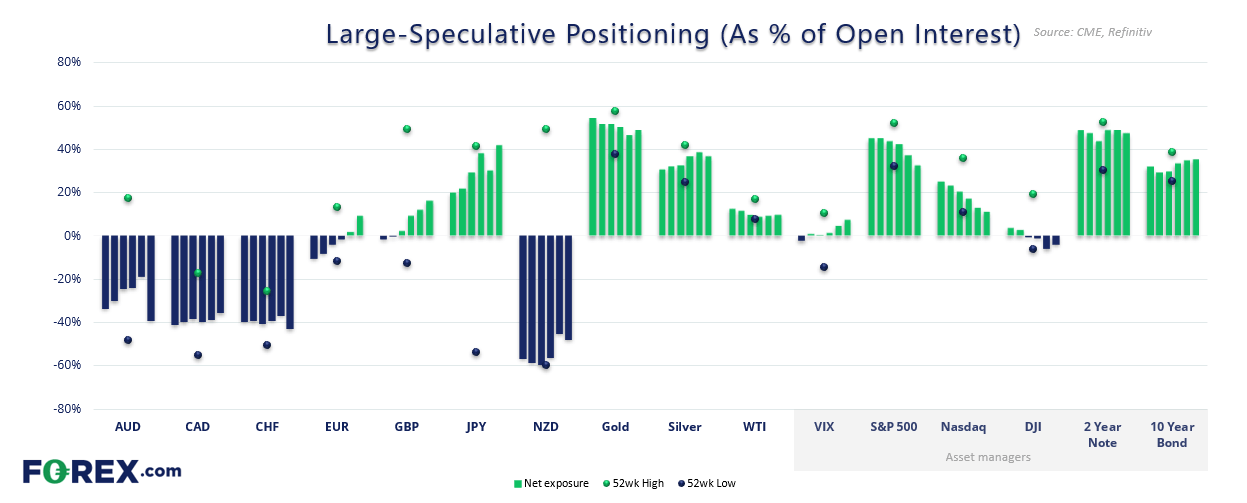

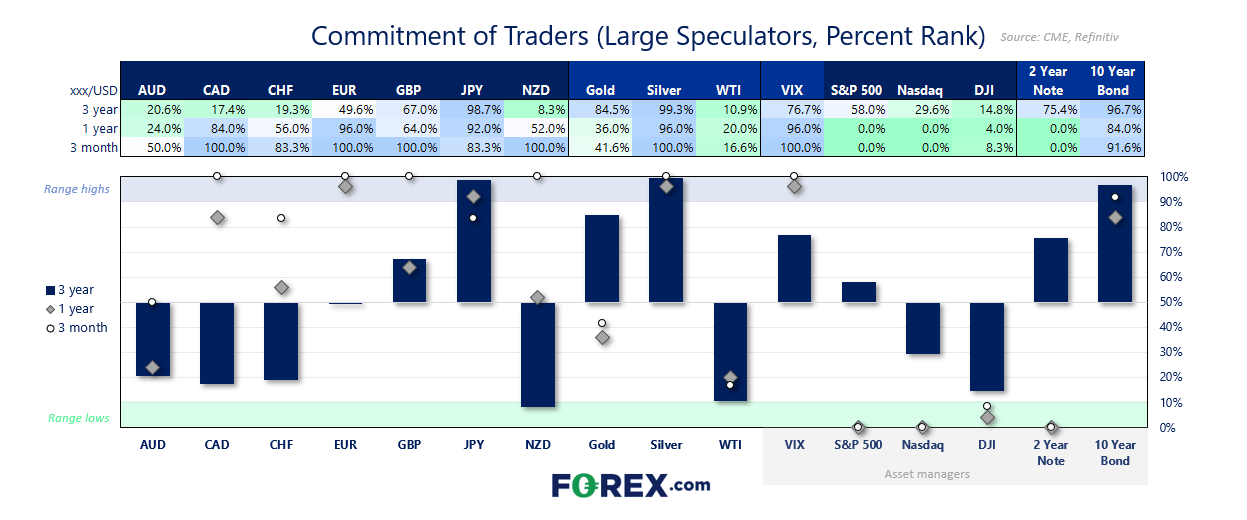

- Asset managers reduced their net-long exposure to USD dollar index futures for a ninth week

- Large speculators increased their net-long exposure to EUR/USD futures to a 25-week high, asset managers to a 23-week high

- They were also net-long GBP/USD futures for a fourth week, though effectively unchanged on the week at +29.4k contracts

- Net-short exposure to AUD/USD rose to a 6-week high

- Net-short exposure to NZD/USD futures fell at its fastest weekly place since December 2022

- Net-short exposure to Swiss franc futures fell to an 11-week low

- Asset managers continued to shy away from Wall Street indices, with their net-long exposure to S&P 500 and Nasdaq 100 futures falling for a fourth week

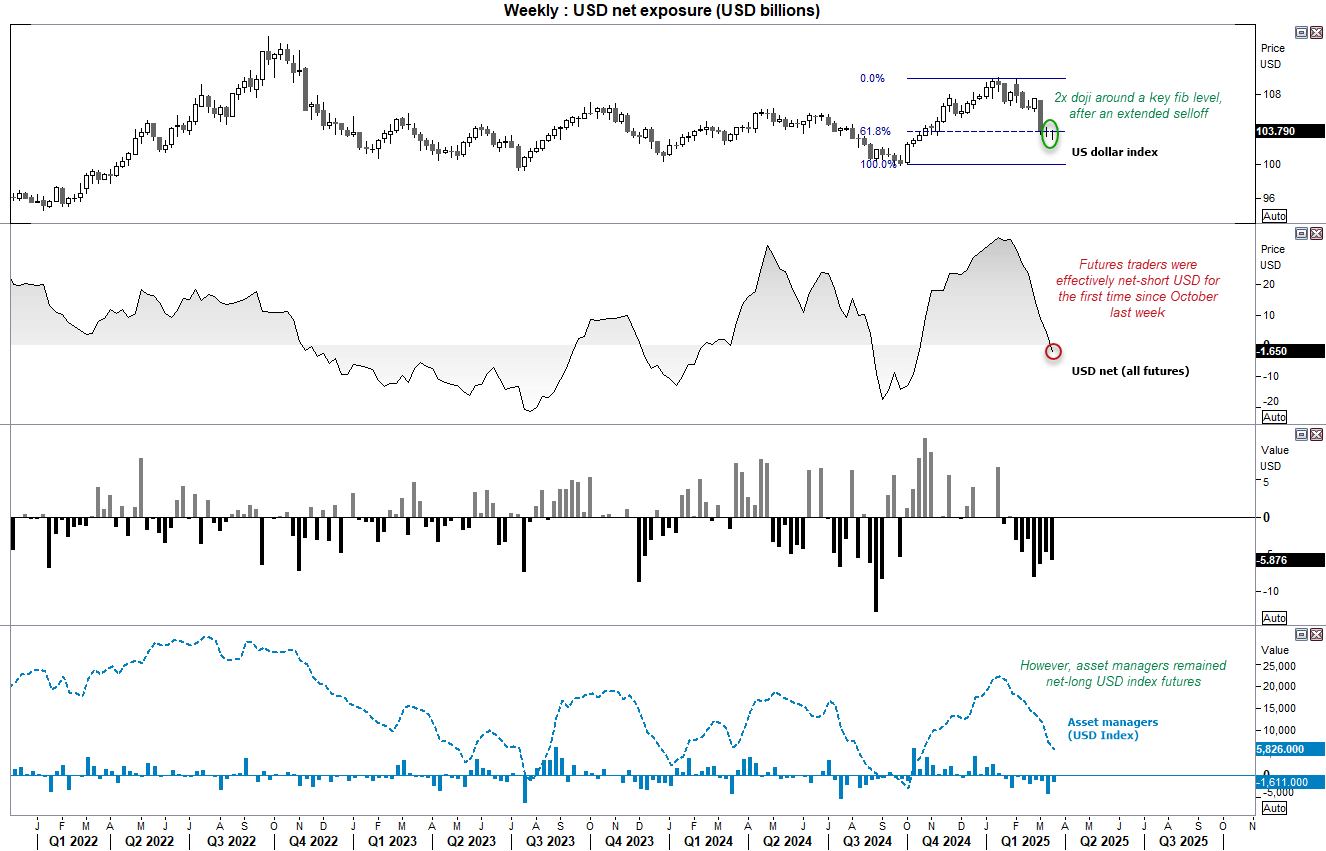

US dollar positioning (IMM data) – COT report:

Traders were effectively short the US dollar for the first time since October, according to data from IMM (International Money Market). Net-long exposure was reduced by -$1.7 billion last week, taking them to a net-short exposure of -$1.7 billion. It also marked the seventh consecutive week that net-long exposure was reduced.

Still, asset managers remained net long the USD index by 5.8k contracts, despite having reduced their net-long exposure for a ninth week. And the fact that the USD index has produced a small bullish hammer and small-ranged doji around a 61.8% Fibonacci level, after an extended move lower, to me suggests the US dollar is in need of a bounce before losses resume.

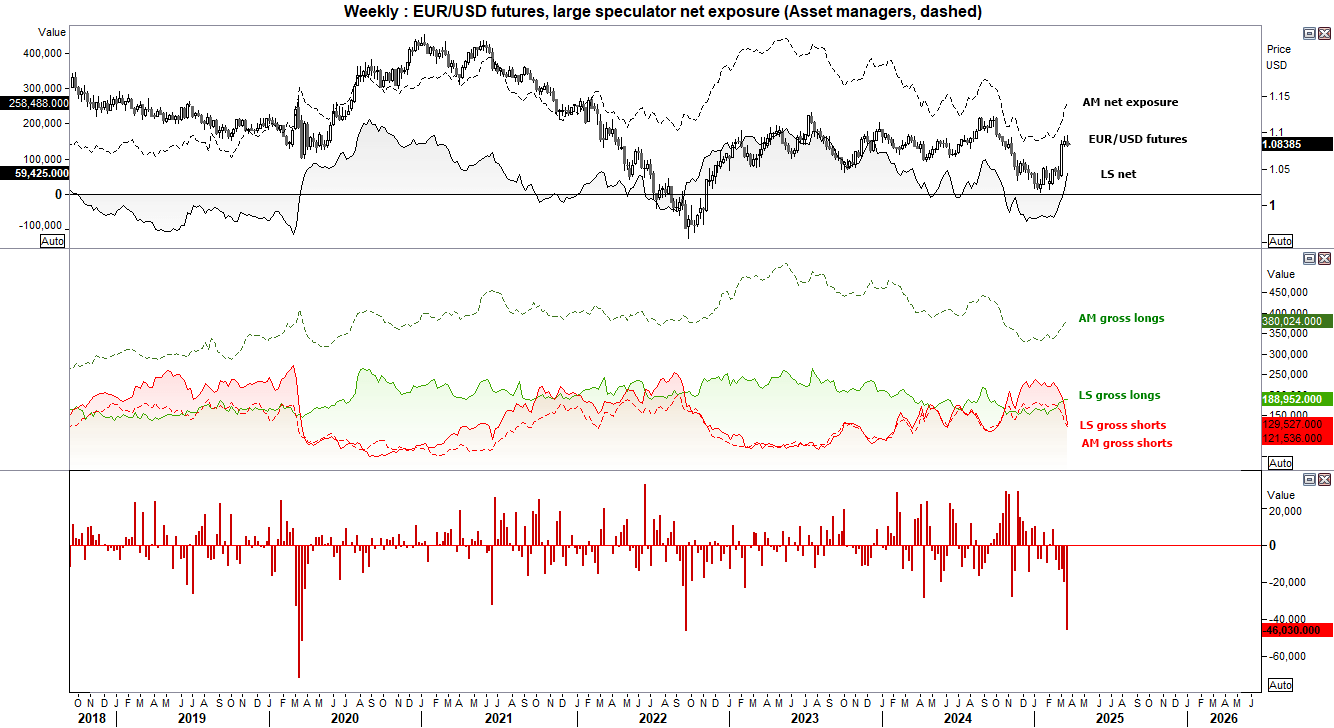

EUR/USD (Euro dollar futures) positioning – COT report:

A spike of short-covering on EUR/USD futures sent net-long exposure to EUR/USD futures to a 25-week high among large speculators. The -46k reduction of short contracts marked the fastest pace of short-covering to the euro since March 2020. It also markets the fifth week of gross-longs being closed by large speculators, taking the total reduction over this period to just over 1000k contracts.

Gross longs also increased for a seventh week, though at the less-hasty pace of 35.3k contracts over the seven weeks.

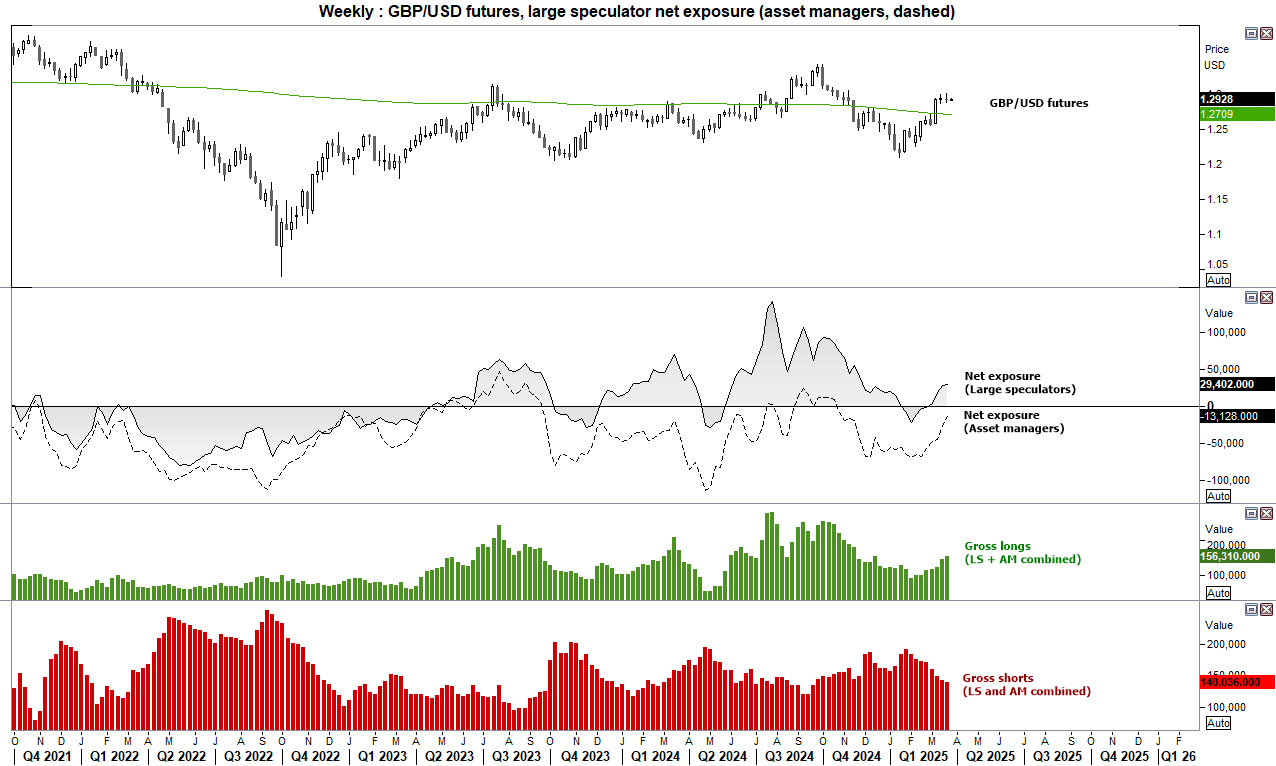

GBP/USD (British pound futures) positioning – COT report:

Asset managers trimmed their net-short exposure to GBP/USD futures ahead of the Bank of England’s (BOE) meeting last week, which now sits at just -13.1k contracts net short. Large speculators were net-long for a fourth week, though effectively flat on the week at 29.4k contracts.

While the BOE struck a more cautious tone to future cuts at the meeting, and only of the nine MPC members voted to cut (the consensus was 7-2 in favour of a hold), market pricing still favours two more cuts to arrive this year.

And given the doji and shooting star week on the GBP/USD chart and potential for a USD bounce, asset managers may remain net-short and net-long exposure for large speculators could remain limited from here.

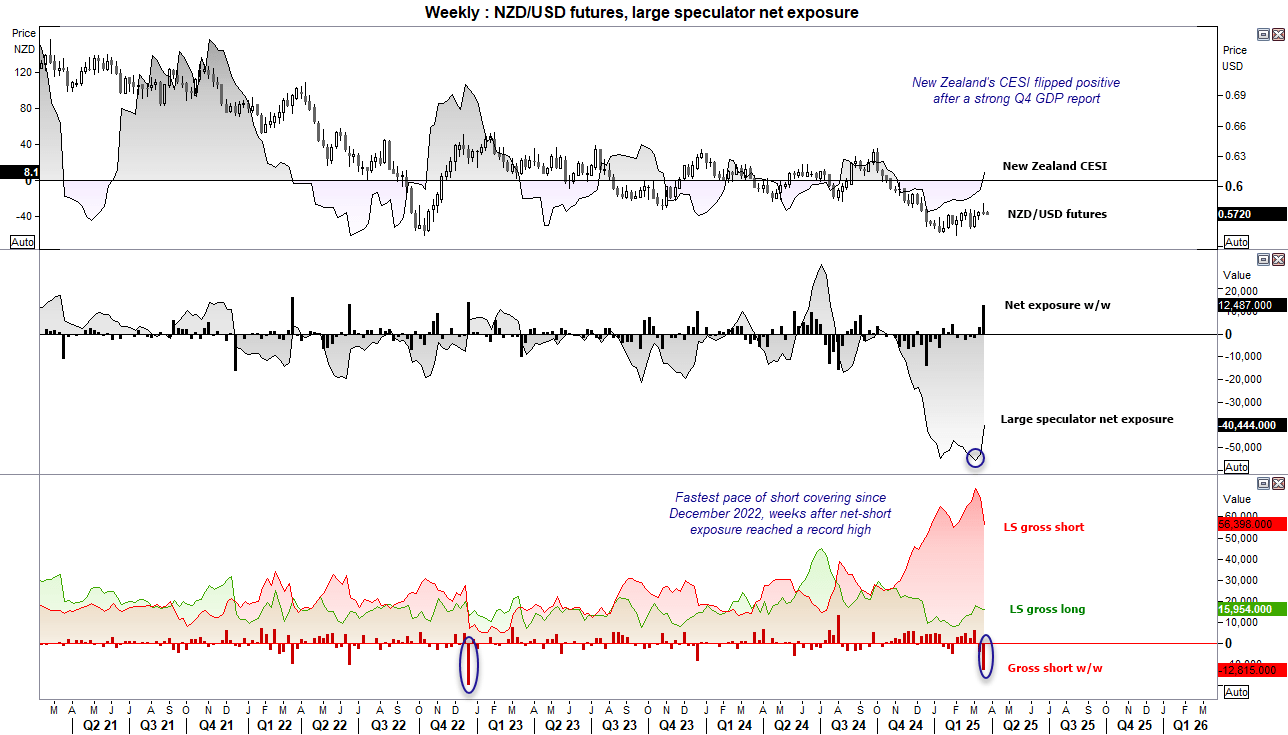

NZD/USD (New Zealand dollar futures) positioning – COT report:

New Zealand’s economy outpaced expectations in Q4, rising 0.7% q/q and officially dragging the economy out of its technical recession. It is interesting to note that futures traders were short-covering heading into the data, with large speculators closing shorts at their fastest weekly pace since December 2022. That this is just weeks after their reached a record level of net-short exposure screams ‘capitulation’ after a sentiment extreme I have been suggesting for a couple of months.

Also note that the Citi Economic Sentiment Index (CESI) moved back into positive territory last week, to show economic data is outperforming the consensus estimates overall.

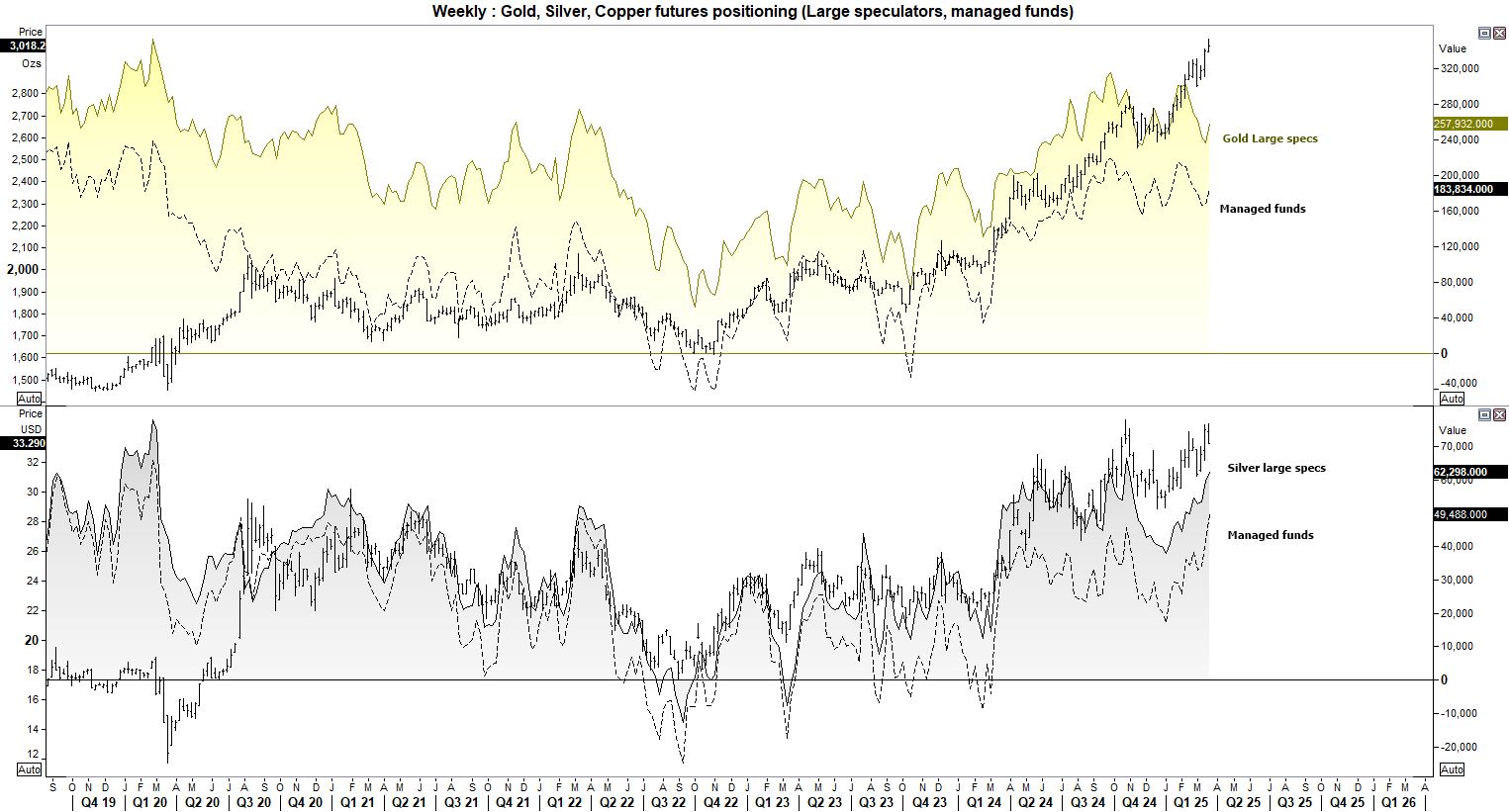

Metals (gold, silver) futures - COT report:

I have argued in rent weeks that we might see futures traders chase gold prices higher, and that now appears to be the case in the latest COT data. Large speculators increased their net-long exposure for the first week in six, and fastest pace in nine. The 25.4k gross longs added was the strongest week of bullish initiation since September.

Asset managers also increased their net-long exposure for a second week.

Silver speculators have done a better job of increasing their net-long exposure alongside silver prices in recent weeks, though it seems silver is in no rush to break above its October high for now.