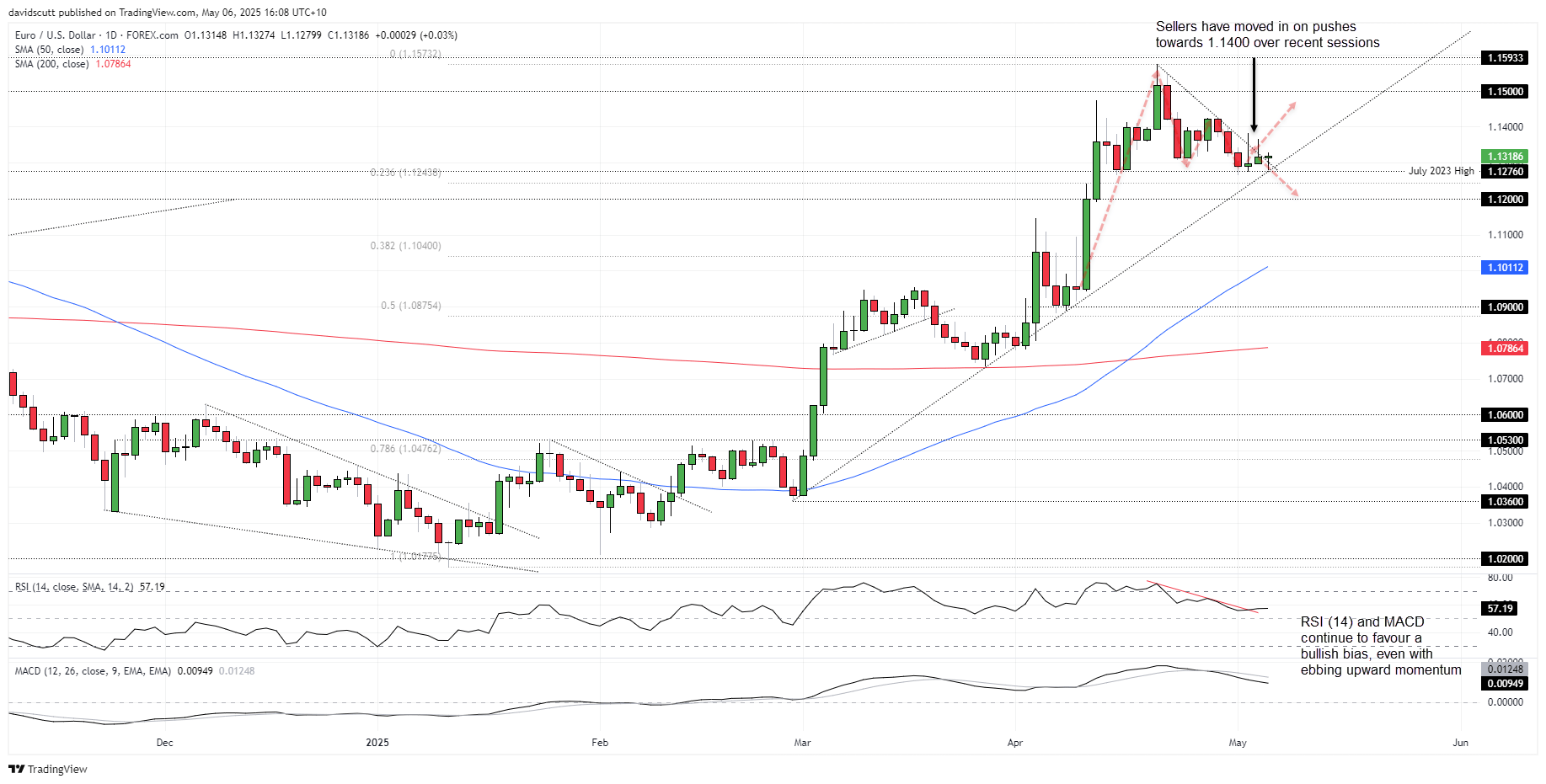

- EUR/USD testing key trendline support near 1.1276

- Bounce favours bulls, break signals increased downside risk

- MACD, RSI still lean bullish despite fading momentum

Big Session for Euro

Tuesday looms as a pivotal session for EUR/USD, with the pair resting at the intersection of downtrend resistance from the April highs and major uptrend support established in late February.

While EUR/USD is trading above the downtrend line early in the European session, that’s been the case in the prior two sessions as well—only to run into sellers during North American trade. A third straight rejection could see the uptrend come under pressure.

Source: TradingView

Trade Ideas

The confluence of downtrend resistance, uptrend support and July 2023 high at 1.1276 marks a key decision point for the pair, offering a reference level around which both bullish and bearish setups can be built depending on how the price reacts.

A bounce from trend support appears the slightly higher-probability outcome, though the recent hesitant price action doesn’t make it a slam dunk for the bulls. Some may prefer to wait for another test and bounce from 1.1276 before entering long positions, allowing a stop to be placed just beneath for protection.

Sellers may reemerge at 1.1372, where the pair stalled either side of the weekend. However, improved risk-reward may come from targeting 1.1425 or the April high.

Alternatively, if EUR/USD were to close beneath 1.1276, it would generate a setup where shorts could be established with a stop above the level for protection. With the 23.6% Fib retracement of the Jan-Apr move and resistance at 1.1200 found just below, some may prefer to wait for a potential break beneath the latter before entering positions.

Downside targets include 1.1100, the 38.2% Fib at 1.1040, and the 50-day moving average.

MACD and RSI(14) continue to flash bullish signals, even as upward momentum shows signs of waning. That leans toward buying dips rather than selling rallies, but price action should take priority in what remains a headline-driven environment.

PMIs Unlikely to Move Needle

Final reads of eurozone services PMIs are unlikely to move the needle after last week’s flash releases. Instead, U.S. trade headlines and the upcoming 10-year Treasury auction loom as more important drivers of intraday direction. Positive developments on either front could support the USD in this environment.

-- Written by David Scutt

Follow David on Twitter @scutty