- EUR/USD remains supported amid dollar hesitancy and firm euro sentiment

- Middle East tensions driving oil but not much the dollar yet

- Focus also remains on G7 and the FOMC decision tomorrow

The EUR/USD trend continues to hinge on geopolitical tension and trade talks. At the heart of the matter lies the escalating conflict between Iran and Israel, a drama that’s feeding volatility in both crude oil and, to a lesser degree, the dollar. Yesterday’s temporary dip in oil prices, inspired by fleeting ceasefire hopes, gave risk assets some room to breathe. But with missiles still being exchanged and the situation far from resolution, oil swiftly rebounded, dragging equities back down with it today. But the oil market volatility has not been enough to convincingly spark a rally in the dollar yet, which is helping to keep the EUR/USD forecast in an overall bullish direction. But could that change, soon?

Dollar eases as Trump leaves G7 early

The US dollar has struggled to find a clear direction as geopolitics remain in flux. Oil remains the primary transmission mechanism into FX, and while markets appear reluctant to price in the worst-case scenarios, the premium on crude suggests there’s still plenty of caution. Washington was reportedly trying to mediate, but with Trump telling reporters he was looking for “a real end, not a ceasefire” to the conflict, and leaving the G7 meetings early, there is little progress on any near-term peace prospects and on the trade front. So, traders remain on edge. With the G7 summit still ongoing in Canada, there is now not much hope either that anything meaningful will come out of the summit. Traders had hoped that a softening stance or even an extension to the tariff moratorium could have lifted the dollar, at least temporarily. But without Trump’s presence, it is difficult to see that happening now.

Don’t expect US retail sales to inspire much life into USD

Meanwhile, US data remains largely on the softer side. The Empire manufacturing index fell sharply yesterday, with a print of -16.0 vs. -5.9 eyed, highlighting tariff-induced weakness. Today’s US retail sales release could steady the ship if it beats expectations – though few are betting big ahead of tomorrow’s FOMC announcement. Headline sales are expected to decline 0.5% m/m while core sales are seen rising 0.2%. All told, dollar moves may remain constrained in the very short term, with a still bearish bias. Against this backdrop, the EUR/forecast remains modestly bullish.

EUR/USD forecast steady amid broader dollar weakness

On the European side of the EUR/USD forecast, the single currency continues to benefit not just from dollar softness, but also from its own outperformance against other majors – notably sterling. That said, the euro’s recent gains aren’t entirely self-made; much depends on external factors like oil. If crude prices were to slide meaningfully – perhaps on peace signals from the Middle East – markets may reassess the timing of the next ECB cut. That could add some pressure on the euro. For now, though, there’s little urgency to bring October’s expected move forward.

As for Eurozone data, today’s ZEW survey in Germany surprised to the upside. Yet, that wasn’t enough to vault the pair above the 1.16 level at first glance. Still, traders seem happy to buy dips, with positioning suggesting the path of least resistance remains to the upside. Unless the dollar mounts a convincing comeback, the EUR/USD could soon be testing the 1.20 region.

Technical EUR/USD forecast remains constructive

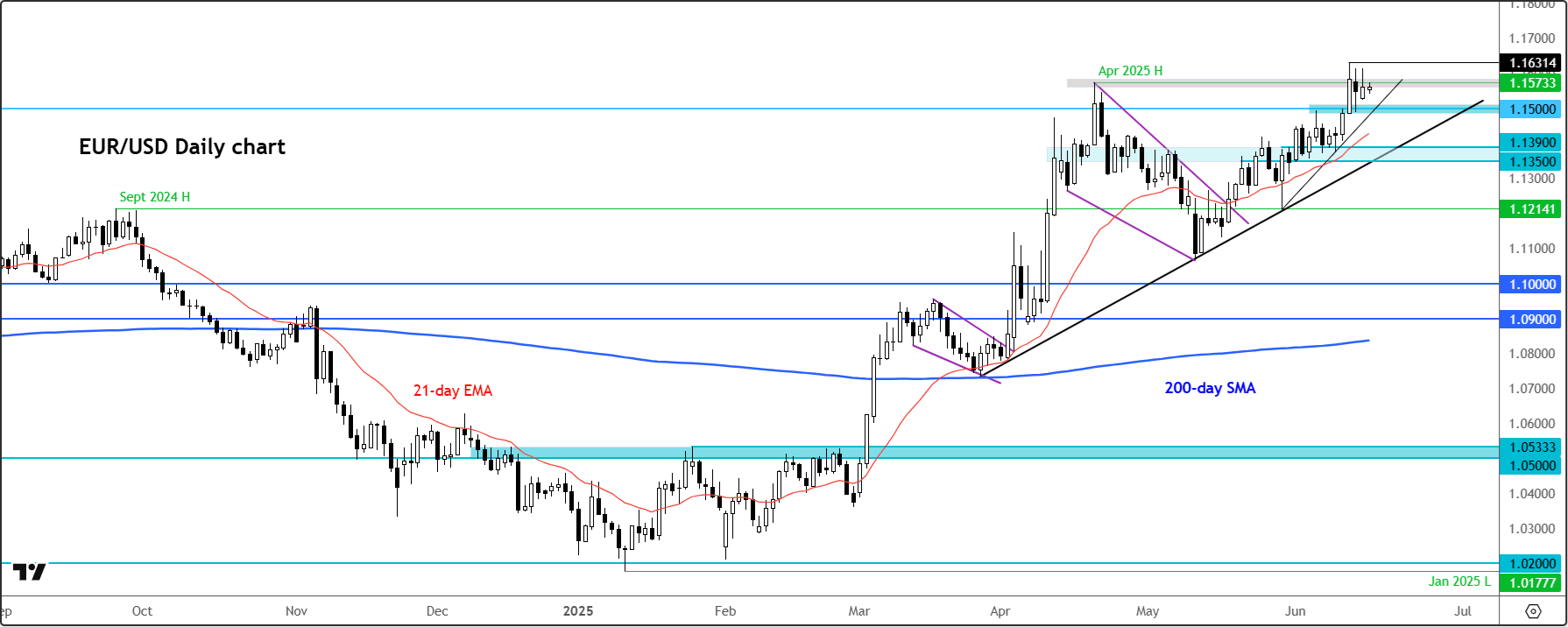

Source: TradingView.com

The technical EUR/USD forecast is still bullish thanks to the constructure price action driven by favourable macro conditions. The higher highs and higher lows are all you need to know about the trend direction. Add to that the fact that price continues to make new 2025 highs with minimal pullbacks point to a strong trend. So far, all the major and minor pullbacks have been bought, including Friday’s one. Last week’s high of 1.1631 remains the immediate upside target, followed by the next round handles like 1.1700, 1.1800 etc. Support at 1.1500, which was tested on Friday, held. This remains a major support level for this week too. Below here, the bullish trend line and prior support in the 1.1350-1.1390 range will be the potential support to watch in the event 1.15 handle breaks.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R