- EUR/USD forecast: Dollar slips as oil rally cools after Trump holds off Iran strike

- Crude oil down but maintains much of recent gains

- Global PMIs, Powell testimony and Core PCE among next week’s macro highlights

EUR/USD forecast: Dollar makes modest retreat as oil prices ease

In FX circles, the slightly diminished prospect of imminent US involvement in Iran has opened the door for renewed short-dollar positioning, but it remains to be seen whether investors will pile into that trade ahead of the weekend. Oil fell after Reuters reported that a senior official has said Iran is 'ready' to discuss limitations on its uranium enrichment, although "zero enrichment will undoubtedly be rejected" by Tehran "especially now, under Israel's strikes." Meanwhile, the Fed’s more hawkish tone and the potential for inflation to remain elevated for longer are additional factors that could discourage shorting the dollar. All told, energy markets and Middle East developments remain the principal lodestar for FX traders, and unless there’s a material shift, dollar’s losses will likely be limited, and it may even find a floor around current levels. As such, the EUR/USD forecast is still subjective to increased volatility as investors await further developments in the Middle East.

FOMC was more hawkish – and at odds

Meanwhile, it looks the Federal Reserve is leaning ever so slightly to the hawkish side despite constant verbal warnings and name calling by the US President. At their most recent meeting, the FOMC struck a firmer tone than markets had been banking on. What’s more, the rate-setters at the central bank themselves appear to be at odds. While the median forecast still hints at a half-point cut by year-end, there’s a growing faction — now seven strong — who reckon no cut’s needed at all, up from just four in March. A couple even fancy a modest further cut, while a few thinks one cut should suffice. In short, consensus is proving elusive.

Week ahead: Global PMIs, Powell Testimony and Core PCE inflation

- Global PMIs

Monday, June 23: The PMI data provides us with leading indication about the health of the economy, from both the services and manufacturing sectors. Thanks to Trump’s tariffs, input costs have been rising for manufacturers but so far, they have largely absorbed those costs. However, higher tariffs may eventually be passed on to consumers. So, as well as headline data, watch out for any surprises in the “prices paid” sub-indices of these PMIs, especially for the Eurozone, which could impact the EUR/USD forecast.

- Powell Testimony

Tuesday, June 24: The blackout period for Fed talk is over, after the FOMC struck a slightly more hawkish tone last week, with officials split on rate cuts. While the median still points to two cuts this year, a growing number now expect none. Projections show higher inflation and unemployment, with policy uncertainty fuelled by Trump’s tariff moves. Let’s see if the Fed chair will shed more light on future policy path at this two-day testimony.

- US Core PCE Price Index

Friday, June 27: This the FOMC’s favourite inflation gauge, and it is this that they base their inflation forecasts on. Last week, policymakers projected that headline PCE would end this year at 3.0% before dropping to 2.4% next year. As for the core PCE inflation, the FOMC thinks it will be 3.1% by year’s end. A lot of uncertainty to their projections is to do with trade tariffs uncertainty and now Middle East tensions sending oil sharply higher. So far, these factors haven’t showed up in hard data but could that change?

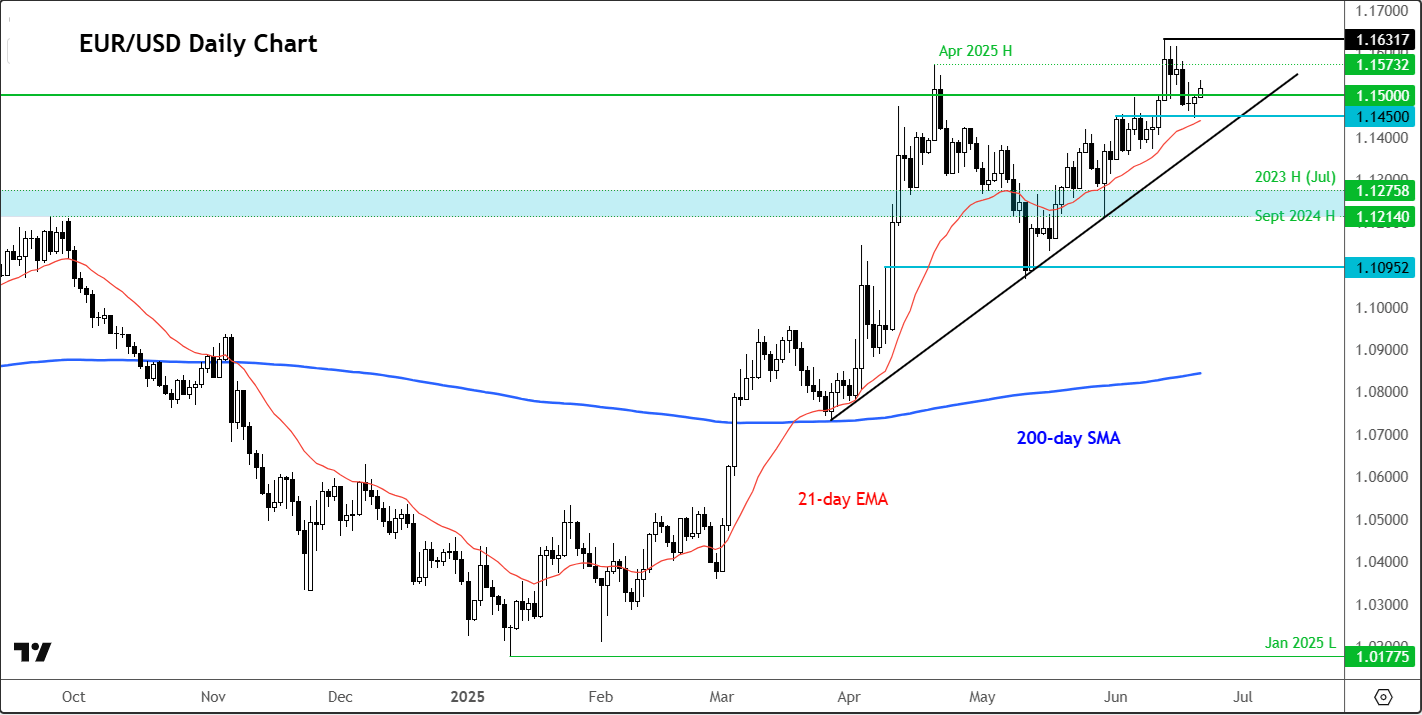

Technical EUR/USD forecast: key levels to watch

Source: TradingView.com

The EUR/USD chart has reclaimed the 1.150 handle, buoyed by a paring back of geopolitical risk pricing. That said, the EUR/USD forecast remains delicately balanced. The persistent uncertainty around potential US involvement in the Middle East continues to cast a shadow, likely limiting any enthusiastic push beyond 1.160 ahead of the weekend. From the Eurozone itself, there is now much in the way of news for directional momentum in the currency pair. But next week is key.

Anyway, in as far as the technicals are concerned, the EUR/USD remains largely supported but with the recent loss of momentum and lack of any major bullish catalysts, the upside could well be capped. The dollar bulls are showing a few signs of life again following the recent oil spike and the Fed’s hawkish tone. For now, though, the EUR/USD has held key support at 1.1450. If it goes on to break this, then that could potentially trigger a sharper decline than we have already seen. The next big support area comes in around 1.1210 to 1.1280, marking the highs from the previous couple of years, which were obviously major resistance points in the past.

On the upside, the April high of 1.1573 has not been decisively taken out, making that a key level to watch. Above it, this month’s high at 1.1631 comes into focus and then onto the next round handles like 1.1700 etc.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R