The ECB are expected to cut their interest rate by 25bp to 2.5% today, which could mark its lowest rate since February 2023. It would also mark its fourth consecutive cut, and fifth cut of its easing cycle. Yet you wouldn’t think this was the case given EUR/USD surged to a 4-month high on Wednesday, helped by a combination of dwindling US growth expectations, Germany’s infrastructure and defence package and the relaxation of some of Trump’s tariffs.

EUR/USD has rallied over 1% for the past three days, a statistic that has not been achieved since March 2015. Furthermore, EUR/USD had risen 4% over the past three days, which marks its best 3-day run since August 2015. These milestones simply underscore how few were positioned for such a move, as it is the element of surprise which triggers the larger bouts of volatility. Still, there was growing evidence of a change in sentiment towards the euro in the futures markets.

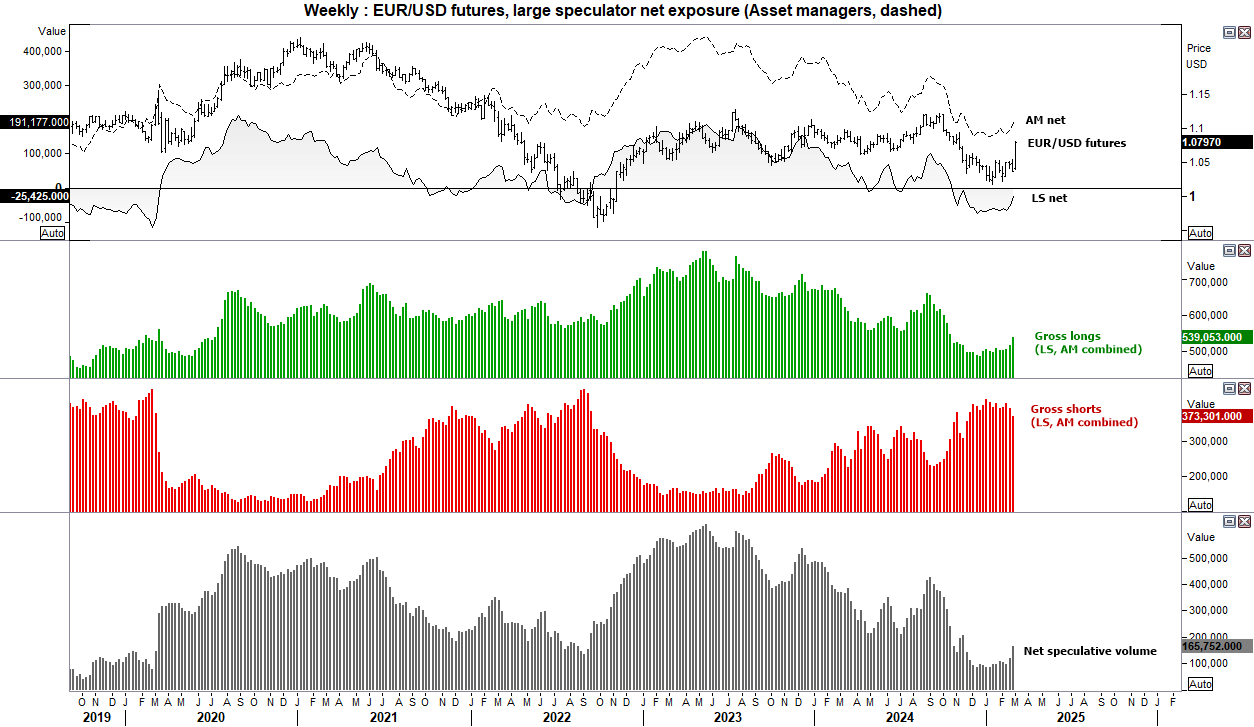

EUR/USD market positioning – COT report

We can see that some futures traders were positioning themselves for a bullish breakout against the consensus. Net-short exposure among large speculators fell to a 16-week low and asset managers increased their net-long exposure to a 17-week high.

More importantly, we’ve seen a notable rise of long bets from both sets of traders while they also closed shorts. This is exactly what you want to see supporting a bullish move, and the fact that prices have since exploded to the upside strongly suggests to me that the next COT report will shows a solid increase of fresh longs being initiated.

From that perspective, 1.10 seems feasible given the potential for a less-dovish ECB meeting, better growth-prospects for European growth and increased odds of a more dovish Fed.

Economic events in focus (AEDT)

- 10:50 – JP bond, stock purchases

- 11:30 – AU building approvals

- 19:30 – DE construction PMI (final)

- 21:00 – EU retail sales

- 23:30 – US job cuts

- 00:15 – ECB interest rate decision (-25bp cut expected)

- 00:30 – US jobless claims

- 00:45 – FOMC Member Harker Speaks

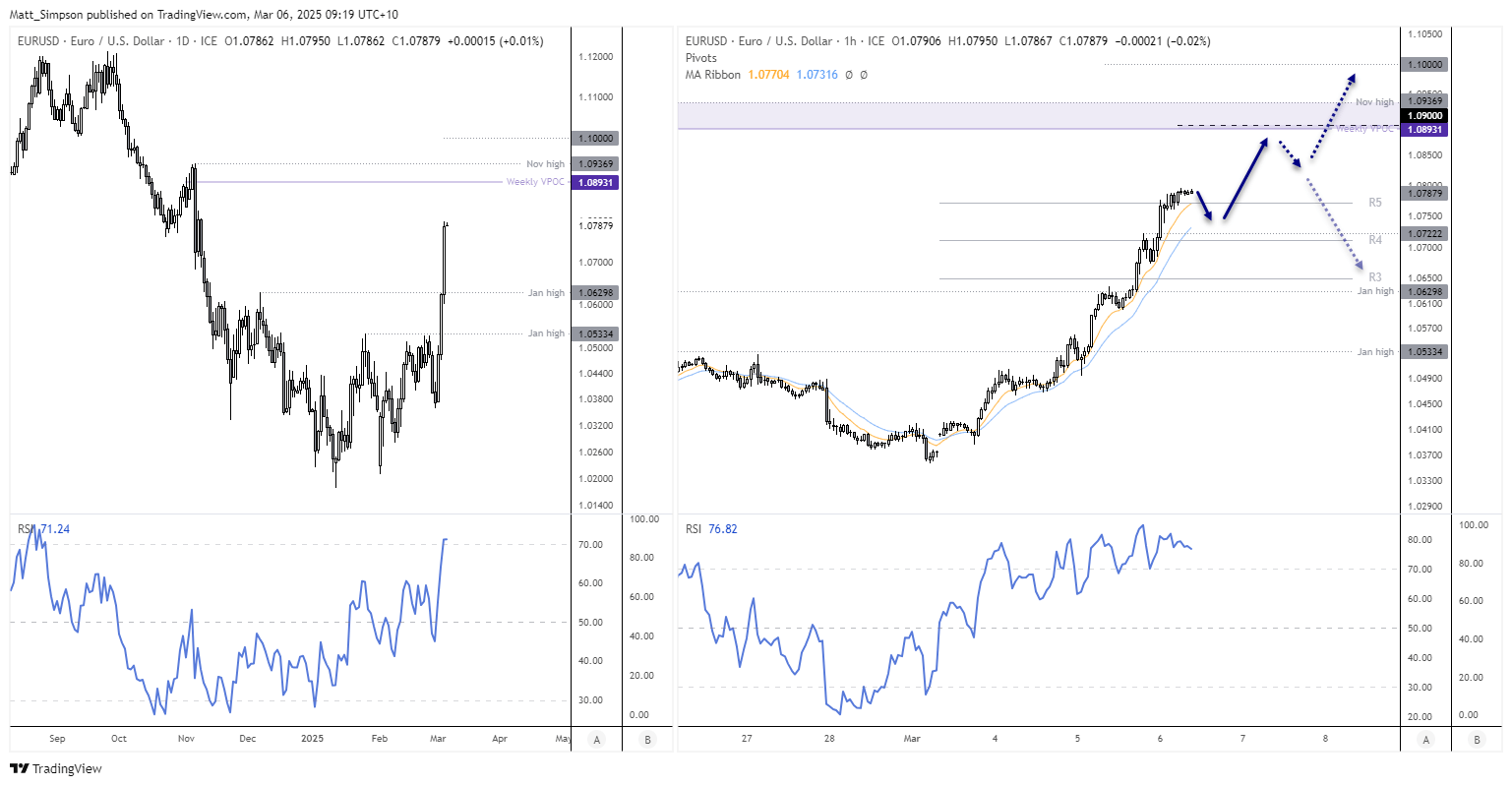

EUR/USD technical analysis

While a move to 1.10 remains favoured, there is also the risk that the current rally may become exhausted along the way. We may also find that the ECB retain a cautious approach and keep the door open for rate cuts, which could at least take the wind out of some bullish sales, if not prompt a retracement lower on EUR/USD.

The daily RSI (14) has reached overbought, although there is no bearish divergence yet. There is a slight bearish divergence on the RSI (14) on the 1-hour chart, and the fact that prices are now above their weekly R5 pivot signals overextension. But the strength of the move and underlying drivers behind could simply point to minor pullbacks, which could favour bulls seeking dips.

Note the VPOC (volume point of control) and November high either side of the 1.09 handle which could provide a potential resistance area ahead of the anticipated move to 1.10.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge