Key Takeaways:

- EUR/USD forecast buoyed by dollar weakness, not just euro resilience

- Diverging policy paths for the ECB and Fed ignored by traders focused on trade war

- Volatility likely to persist as markets wrestle with tariff and inflation risks

Dollar and bonds tumble amid stagflation concerns

Last week witnessed a dramatic shift across global markets. US 10-year Treasury yields leapt by over 40 basis points, the S&P 500 posted a big rally, and the US dollar saw a near 4% decline against the euro. The common denominator behind all the market movement was Washington’s approach to trade policy. A 90-day reprieve on reciprocal tariffs provided relief for stocks, but not much for the dollar, which fell across the board after a brief rally in mid-week, as stagflation concerns mounted due to the impact of the import duty burden.

Crucially, while tariffs for some countries were trimmed, China’s rate soared to 145%, which is a big worry. For US consumers and businesses, the economic impact remains unrelenting. Many firms will be forced to shift away from Chinese imports, if tariffs remain in place for a long time. If not, companies must now contend with escalating costs, further fuelling inflation expectations.

Although March’s CPI reading appeared benign, the consensus is that inflationary pressures are far from behind us. Analysts are increasingly of the view that the Federal Reserve may be forced to respond with a series of rate cuts—potentially three or four—before year’s end to ease the pressure on both households and corporates. But there is a worry that inflation might get so high that the Fed won’t be able to cut rates.

EUR/USD Forecast: All about the US dollar and trade war

The EUR/USD forecast may well remain positive unless there is a fundamental shift in the current macro environment. The pair surged on Friday, briefly touching 1.1474, before pulling back to 1.1360 at the close of play. It didn’t quite get to that 1.1500 mark but could do in the week ahead. It’s important to note, however, that this movement is less a vote of confidence in the euro and more a reflection of deepening scepticism surrounding the greenback.

From a fundamental standpoint, the euro appears somewhat stretched. The two-year EUR-USD swap spread now favours the dollar by 155 basis points—a level more in line with EUR/USD trading closer to 1.09 handle. That said, such dislocations are hardly unprecedented, and this time is driven by falling confidence in the US government’s trade policy. If US yields rise because of stagflation and other economic risks rather than expectations of solid growth, then we could see EUR/USD testing and surpassing the 1.15 handle in the weeks ahead. Only if confidence in US fiscal and trade policy stops eroding may we see the EUR/USD forecast turn negative.

What to expect this week?

The coming days may provide something of a reprieve. With Easter looming, markets could experience a temporary lull. Nonetheless, underlying fragilities remain firmly in place. Tariff pressure, inflation risks, and job insecurity continue to weigh on consumer sentiment. The EUR/USD may climb to 1.1500, after all, but we are expecting the pace of the dollar selling to wane somewhat.

Wednesday’s US retail sales data may offer a momentary lift. Many economists would argue that it is likely that consumers brought forward spending—particularly on vehicles and electronics—in anticipation of tariff-related price increases. This might point to a bigger retail sales print than expected, but markets will be aware of this logic.

Meanwhile, attention will also turn to corporate earnings, with businesses remaining on edge over the potential for retaliatory trade measures and flagging global demand.

The European Central Bank, for its part, will meet on Thursday, 17 April. A quarter-point rate cut appears all but assured, with a second expected in June. Thereafter, the ECB is widely forecast to pause well into 2026. However, the trajectory of US monetary policy may yet upend these expectations—particularly if the Fed accelerates its rate-cutting cycle. Indeed, current market pricing implies around 90 basis points of Fed cuts for 2025, aligning with the growing belief that three to four reductions may be necessary to combat flagging growth.

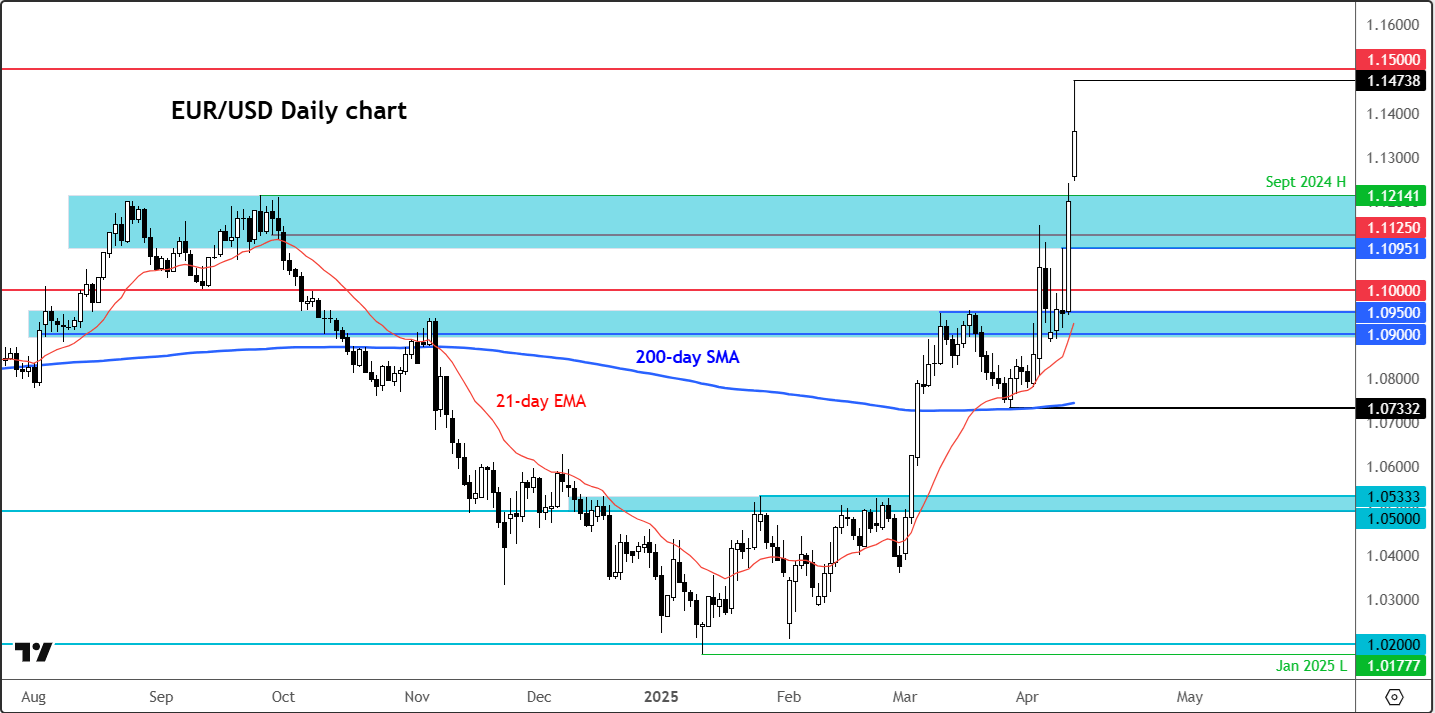

Technical EUR/USD forecast: Key levels to watch

There are no obvious levels of resistance on the EUR/USD except round handles like 1.1500 now. On the downside, there are plenty of potential support levels, most of which being former resistance levels. In particular, the area between 1.1095 to 1.1210 is now very important to watch, with this zone being a major resistance hurdle between August to September 2024, and again in the last several days or so, before we finally cleared this area on Thursday. Once strong resistance, could the EUR/USD bounce from this area? Below this zone, we have 1.1000 handle and then 1.0935-45 as the last significant short-term support to watch. A potential break below the latter would tip the balance back in the bears’ favour.

Source: TradingView.com

To conclude, the present EUR/USD forecast remains driven by a deteriorating outlook for the US dollar, rather than renewed optimism for the eurozone. With geopolitical tensions, trade uncertainty, and inflation still unresolved, FX markets are likely to remain highly sensitive to news flow. For traders and investors alike, prudence and agility are advised as we navigate the unpredictable waters of monetary divergence and fiscal ambiguity.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R