View related analysis:

- Nasdaq 100, S&P 500 Forecast: Bring Your Quarter to the Slaughter?

- If Consumers Don’t Consume, a Recession Could be Presumed

- AUD/USD, USD/CAD Price Action Clues Could Bode Well for AUD/CAD Bears

During an event titled “Make America Wealthy Again”, President Trump worked the crowd during his build up to officially an executive order for his reciprocal tariffs. Saying that “if they do it to us, we will do it to them” regarding import levies, Trump promised to break down trade barriers, lower consumer prices and encourage jobs and factories to come back to America.

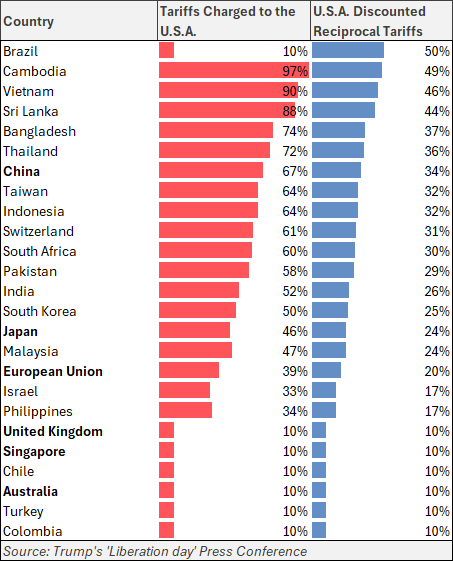

Australia and the UK appear to have got off lightly with 10% tariffs, but China’s tariffs have been upgraded (for want of a better word) to 34%, Japan’s is 24% and the European Union sit somewhere in the middle with 20%. Brazil and Cambodia topped the chart with 50% and 49% tariffs respectively. But Trump provided a clear way out for all by saying “to foreign leaders, I say terminate your own tariffs”.

It is worth noting that I am unclear of the calculations used for ‘tariffs charged to the US’, as the EU do not have a blanker 39% levy on US imports. So there may be some weighting involved for these figures depending on which goods the US deems important for their exports. Regardless, it does show the blanket imports tariffs these countries now face when sending goods to the US.

With pressure now applied, has Trump offered a way out?

Swiss President Karin Keller-Sutter was the first leader to respond, with “The Swiss Federal Council takes note of the US tariff decisions” and promised to determine its next steps. It remains unclear whether they, or any other leader, will move to raise their own tariffs on the US in retaliation or lower them to renegotiate the current terms.

But these current tariffs are surely set to hurt global growth, given US consumers have up until now enjoyed relatively cheaper products from these countries. So it is now down how to each county reacts as to how their local markets can perform in relation to the US.

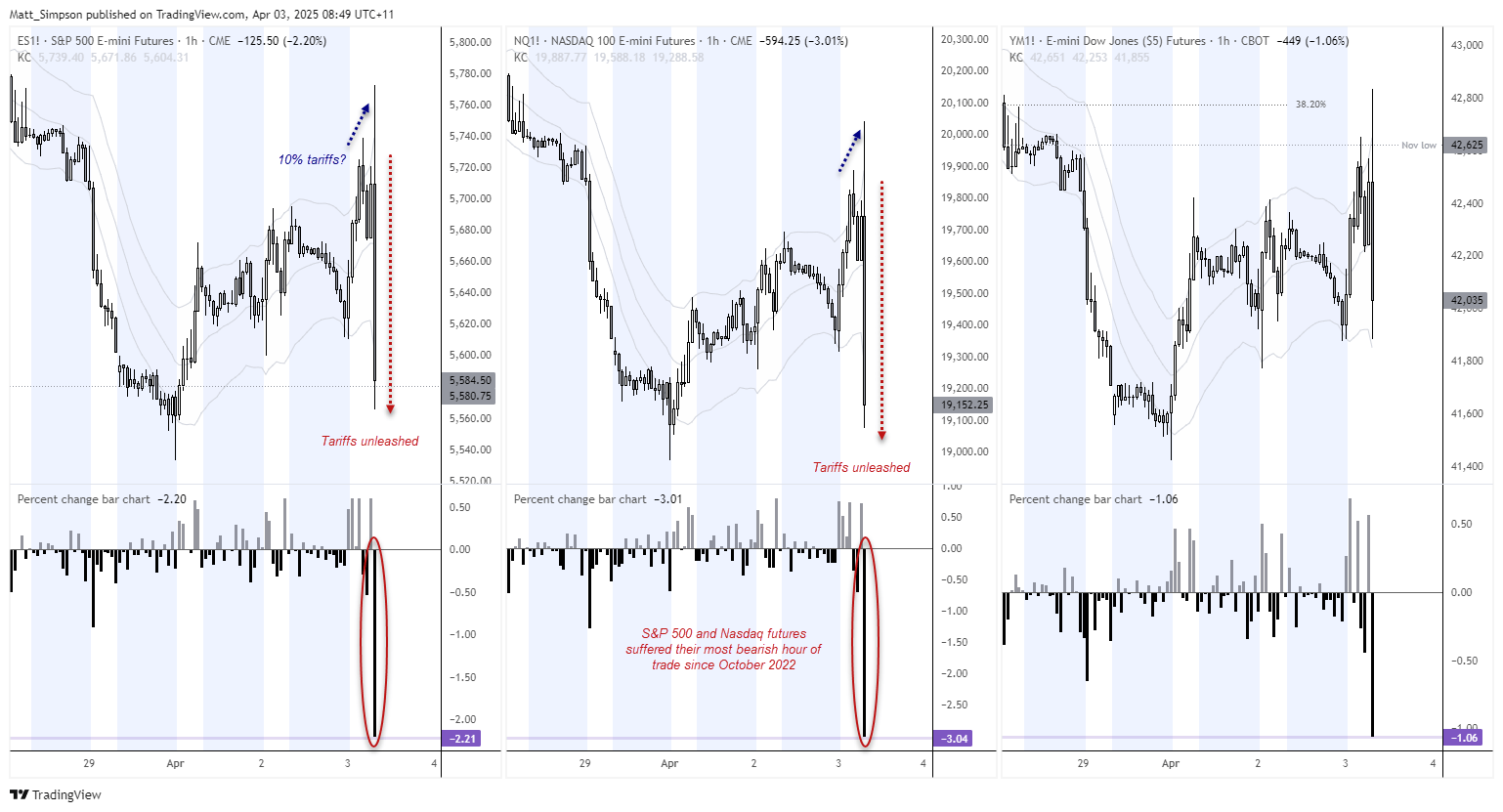

Wall Street futures tumbled into the close

Mixed response from markets, with much of the tariff hype seemingly priced in. Though there were some noteworthy moves on Wall Street futures in closing hour of trade, with the S&P 500 and Nasdaq suffering their most bearish hour since October 2022.

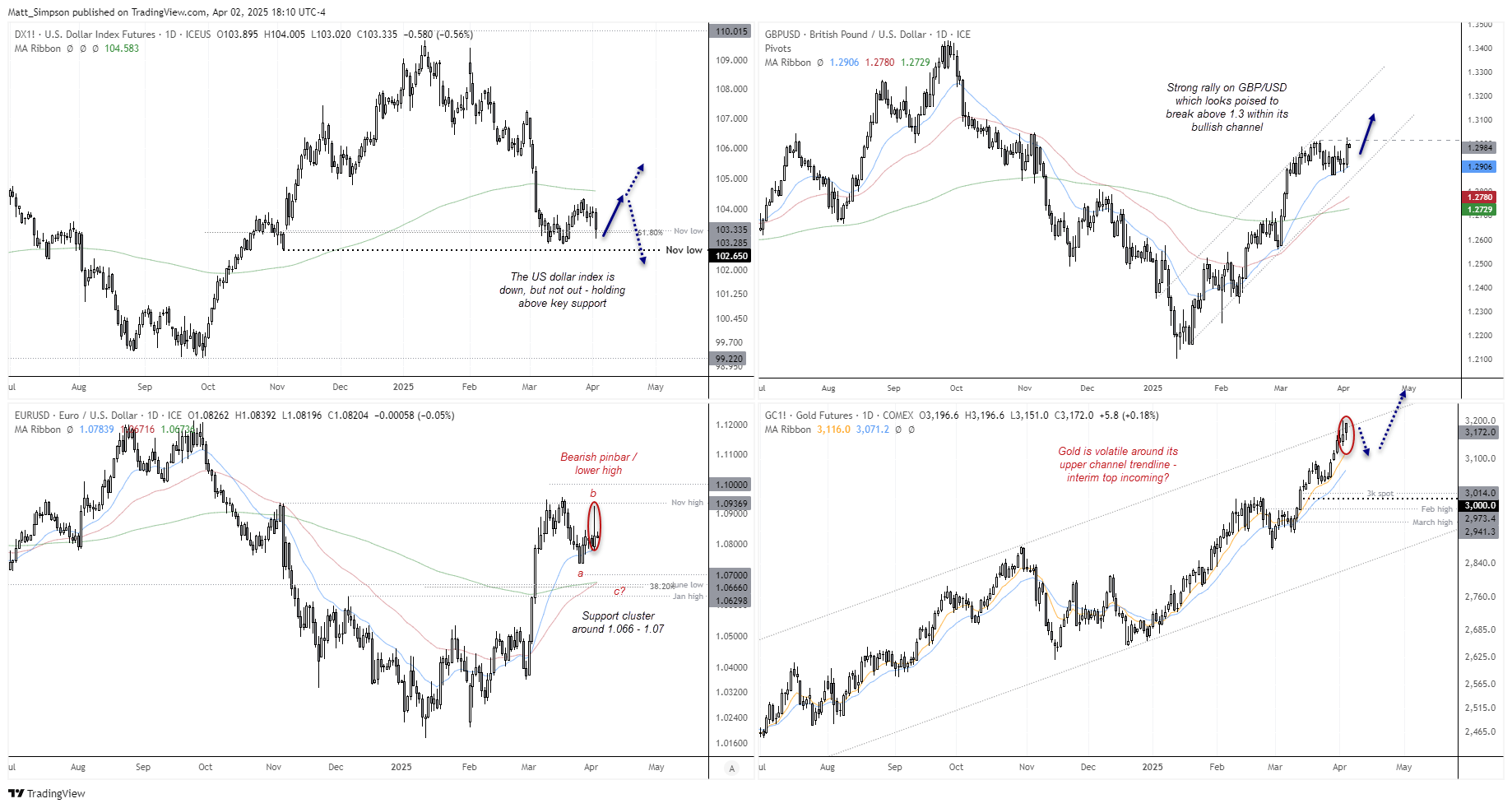

The net result for currencies was one of confusion.

- EUR/USD erased its early-speech gains of 1.3% to now sit slightly up on the day at 0.2%, presenting a potential bearish pinbar

- The Canadian dollar rose against all FX major, in an apparent sigh of relief tariffs were not higher, sending USD/CAD down -0.4% on the day to a 5-week low

- AUD/USD is unsure whether to celebrate or rebuff the 10% tariff on Australia, trading flat for the day after handing back most of its 1.4% early-speech gains

- USD/JPY formed a bearish outside day (against my bullish bias set yesterday) as the Japanese yen takes in mild risk-off flows, though it remains above Monday’s low to suggest limited downside from here

- GBP/USD was the clear winner against the US dollar, with its 0.5% gain and potential to break above 1.3000

The bearish pinbar on EUR/USD is hard to ignore, and it could suggest another leg lower as part of a deeper ABC correction towards at least 1.07, or the 200-day EMA and 38.2% Fibonacci level near the 1.0670 area. While the US dollar index was down on Wednesday, it remains above a key support area around 1.03, and my bias remains for a bounce over the near term to at least the 200-day EMA (104.60). Given the euro accounts for approximately 57% of the US dollar index, this bodes well for my bias of a leg lower for EUR/USD.

GBP/USD remains in a strong uptrend within its bullish channel, and Wednesday’s bullish range expansion suggests a break above 1.03 to be likely. I will keep an open upside target for now, but 1.31 and 1.32 make likely areas of interest for bulls to focus on for now.

Gold futures reached a fresh record high on Wednesday, but we’re seeing bearish volatility in early trade today. Given its extended run and the fact it now trades around the upper trendline of its channel, this is not a move I would like to chase. Perhaps we’ll get a pullback, which could allow side lined traders to get the dip they more than likely want.

Economic events in focus (AEDT)

- 09:00 – Australian Services and Composite PMIs (Final)

- 10:50 – Japan’s Foreigner Stock and Bond Purchases

- 11:30 – Australian Trade Balance, RBA Financial Stability Review

- 11:30 – Japanese Services and Composite PMIs (Final)

- 12:45 – Chinese Services PMI (Caixin)

- 17:30 – Swiss Inflation

- 18:55 – German Services and Composite PMIs (Final)

- 19:00 – EU Services and Composite PMIs (Final)

- 19:30 - Services and Composite PMIs (Final)

- 20:00 – EU Core CPI

- 22:30 – US Challenger Job Cuts, Jobless Claims

- 23:30 – Canadian Trade Balance

- 12:45 – US Services and Composite PMIs (Final)

- 01:00 – US ISM Non-Manufacturing PMIs

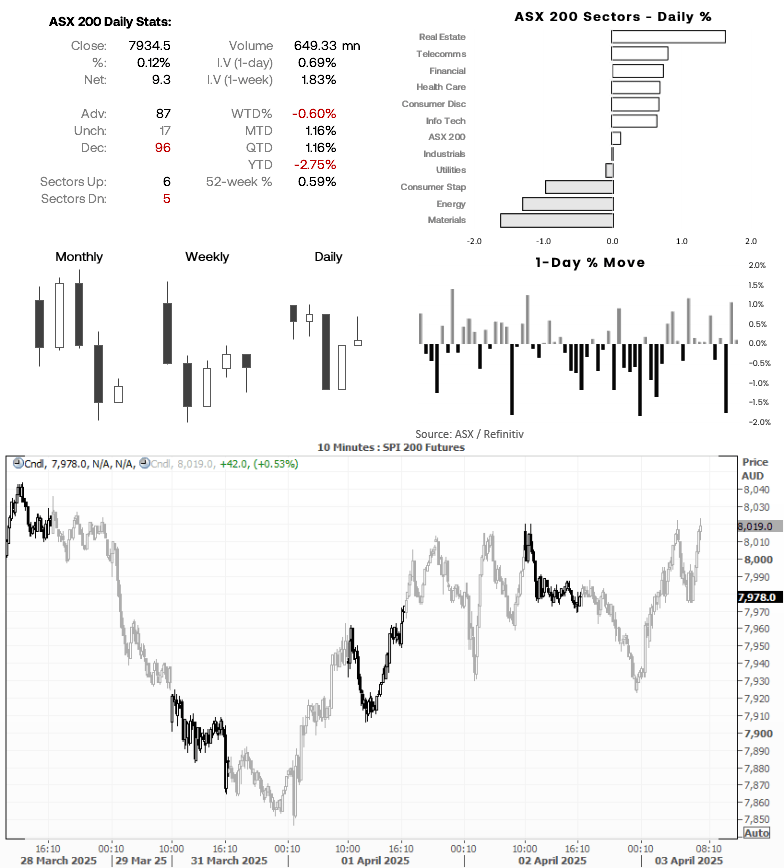

S&P ASX 200 at a glance

- A cautious day’s trade ahead of Trump’s tariffs saw the S&P ASX 200 etch out a minor gain of 0.12% on Wednesday

- Implied volatility remains elevated, though down from its 2-week peak set on Monday

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge