Following Israel’s strikes on Iran, the dollar bounced back as it took a boost from oil prices spiking, while also benefitting from increased haven demand. The euro and other risk sensitive currencies fell. But it is far too early to declare an end to the bullish EUR/USD outlook.

Geopolitical shock gives dollar brief lift

The dollar’s firmer this morning, following Israel’s strike on Iranian nuclear sites. Oil jumped before easing back from its highs, although it remained well in the positive territory as investors awaiting Iran’s inevitable response. This isn’t the usual Israel-Iran flare-up, because this time nuclear sites were hit, and while production’s untouched for now, markets are rightly pricing in a bigger geopolitical risk premium. Any disruption to the Strait of Hormuz would be the real game-changer.

With Israel promising more action and Iran already retaliating, this could be more than just a short-lived escalation in the tensions. Iran is vowing to avenge the attack, saying it would respond forcefully and that the “end of this story will be written by Iran’s hand”. The country’s supreme leader, Ayatollah Ali Khamenei, warned of “severe punishment” and claimed residential areas had been targeted and women and children were among those killed in the attacks.

If oil prices remain elevated, this will put further upward pressure on inflation, just as US tariffs start to bite. It also hands the Fed cover to keep policy tight, making last week’s post-CPI dollar selloff look overdone. But once the focus returns to the US, where fears of policy mismanagement from the Trump administration have hurt the dollar and bond markets, we could see fresh selling in the dollar. So, the EUR/USD might be down now, but it is far from out.

EUR/USD outlook: EUR down but not out

The euro has clearly not liked the oil price spike, which is hardly a surprise given the Eurozone is an energy importer. The single currency has decoupled from fellow safe havens like the Swiss franc and gold. But oil volatility will also play into the ECB’s hands, reinforcing a cautious stance on rate cuts. With the tariffs situation still unresolved, any sustained oil price gains could push any final 25bp move to Q4 rather than Q3. For now, EUR/USD is likely to track developments in the Middle East via oil markets. But unless the US dollar manages to turn its fortunes around, the path of least resistance remains to the upside for the pair.

Looking ahead: Iran’s potential retaliation and central bank meetings

The week ahead features no less than four major central bank announcements, from the likes of the Bank of Japan, Bank of England, Swiss National Bank, and the Federal Reserve. Out of these central bank meetings, the Fed’s rate decision is the most important one for the EUR/USD outlook. The two-day FOMC meeting will conclude on Wednesday, June 18, with the rate decision set to be announced at 19:00 BST. Now Trump has been demanding a 1% interest rate cut from the Fed, pointing to weaker than expected inflation and rising borrowing costs for the government. His warnings have fallen on deaf ears, with Chairman Powell keen to maintain confidence in monetary policy by holding firm amid potential inflationary risks stemming from tariffs, and defend the central bank’s independence. No rate change is expected. But if Powell hints at a policy shift sooner than expected, then this could potentially provide fresh impetus for the EUR/USD, as the dollar could take a hit.

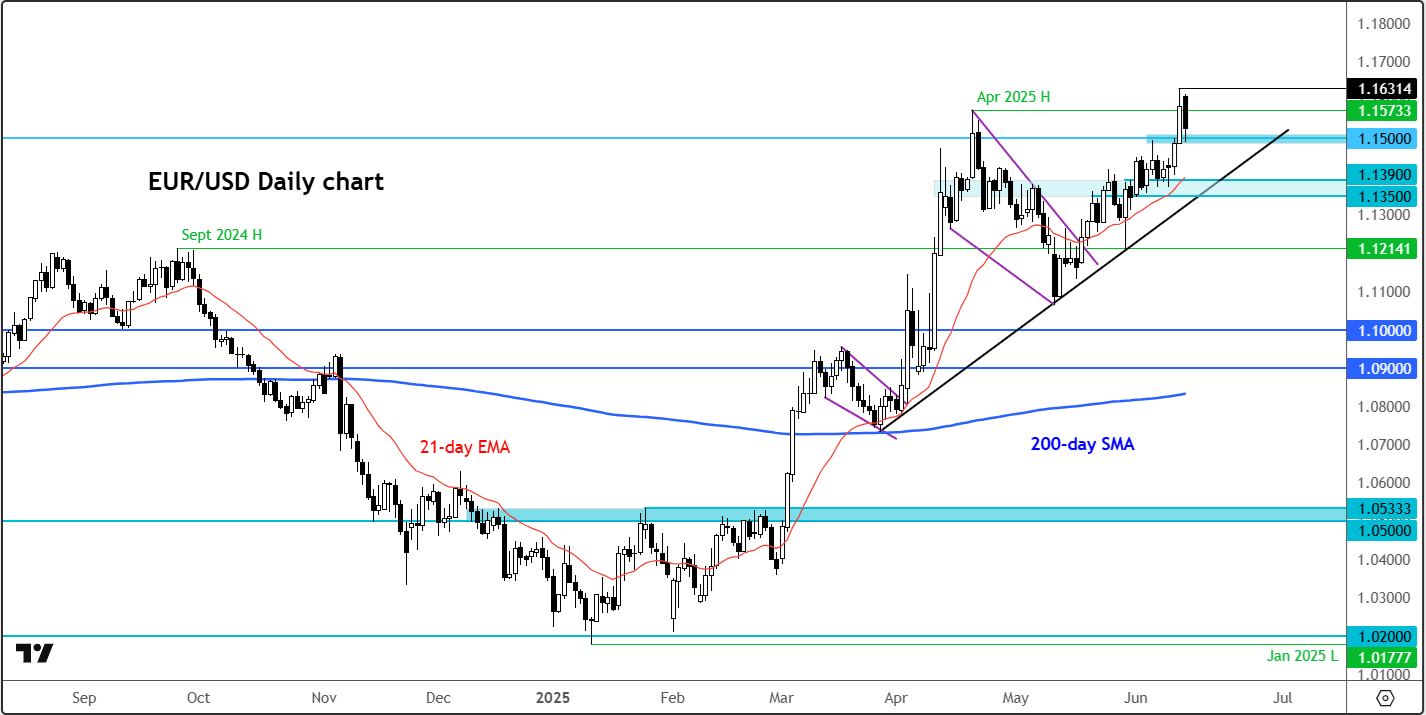

EUR/USD technical outlook: Key levels to watch

Source: TradingView.com

The technical EUR/USD outlook remains bullish thanks to higher highs, higher lows and the fact that price continues to make new 2025 highs. Any pullbacks we have seen have been bought. Today’s one could prove to be another such scenario. The EUR/USD fell sharply from yesterday’s inflation driven high of 1.1631. But at 1.1500, it is now testing a major support level. Below here, the bullish trend line and prior support in the 1.1350-1.1390 range is the next key support area to watch. On the upside, 1.1573 was the high from April, which was taken out earlier this week, but rates couldn’t hold above it. So, this will now be the first bullish objective. Above it, we have the 1.1600 handle and then the 1.1631 high from earlier this week, before the bulls potentially eye 1.17 and beyond.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R