Following Trump’s announcement of new tariffs on Wednesday, the EUR/USD sold off initially, before bouncing back on Thursday. But the downward pressure has resumed once more, with the EUR/USD staying below the 1.08 handle, as investors assess the damage the threat of looming tariffs would cause the Eurozone economy, and in particular its major carmakers, while weaker inflation data from France and Spain, and stronger PCE data from the US, also weighed on the single currency. Underscoring uncertainty, safe haven gold has hit yet another record high today, with the situation also creating volatility in stock markets. The trade war has escalated and there is going to be a lot of back and forth from now until the “Liberation Day” of April 2. Against this backdrop, the near-term EUR/USD outlook is highly uncertain at this stage. In the very short-term outlook, we can’t rule out the possibility of further declines as the trade uncertainty could see more support levels break down in the coming days, which could accelerate the selling pressure. But in the slightly longer-term outlook, our forecast remains positive following Germany’s approval of a massive stimulus package last week, and with investors potentially losing faith in US policies. The €500 billion stimulus is aimed at revitalizing the eurozone’s largest economy and increasing defence spending, potentially boosting not only German but Eurozone GDP and introduce mild inflationary pressures.

Core PCE stronger, NFP next Friday

This week’s US macro releases have been mixed, with Durable Goods Orders, Final Q4 GDP estimate, and Pending Home Sales all topping expectations, while New Home Sales, CB Consumer Confidence and Flash Manufacturing PMI were among the weaker reports. But from a data point of view, it is today’s release of Core PCE index was always going to be the main event, even if Trade War uncertainty means the focus is not on the macro calendar much right now. This is the Fed’s preferred inflation gauge. Markets were expecting another +0.3% m/m reading. But it came in at +0.4% m/m instead, pushing the y/y rate to 2.8% from 2.6%, vs. 2.7% expected. With the impact of tariffs yet to show in data, Powell’s stance that inflationary pressures remain contained will be tested in the coming months. So, this is a bit of a blow for him.

Next Friday, on April 4, at 13:30 BST, we will get the latest US non-farm payroll report for the month of March, in addition to several other key data released throughout the week. Last month’s US jobs report surprised to the downside, coming in at 151K instead of 160K expected. Worryingly, the household survey showed job losses of 588K, and the unemployment rate ticked higher to 4.1% from 4.0%. The US dollar has since only found mild support amid haven flows, but under pressure as weakening US survey-based data has raised the prospects of a sooner-than-expected rate cut by the Fed. Another poor jobs report could further undermine the dollar and raise recession alarm bells.

Trade war enters a critical phase

It feels like the whole world is on pause with as US president Donald Trump is gearing up to announce a sweeping new round of trade tariffs on 2nd April. It doesn’t stop there. Counter measures by countries impacted by these tariffs could further increase uncertainty and create all sorts of volatility across financial markets.

Central to Trump’s plan are so-called “reciprocal tariffs,” designed to mirror or surpass the duties imposed by other nations on US exports. The administration maintains that America has tolerated one-sided trade arrangements for too long, leading to persistent deficits and an uneven competitive landscape. While Trump insists the strategy will “level the playing field,” some analysts warn it could provoke retaliatory measures and add to global economic uncertainty.

These new tariffs build on existing levies introduced earlier this year on steel, aluminium, and key imports from China, Mexico, and Canada, as well as the imposition on Wednesday of imposing a 25% tariff on auto imports. The forthcoming announcement is expected to target countries running substantial trade surpluses with the US and restricting American exports, with potential duties ranging from 10% to 50% or more across hundreds of products.

The president has also hinted at further tariffs on the European Union and Canada, should they engage in practices he deems economically harmful to the US. Meanwhile, he has suggested a possible easing of tariffs on China—though only if Beijing facilitates the sale of TikTok’s US operations to an American company. Investors are watching developments with caution. Fears over the wider economic fallout from the trade dispute could continue to dampen confidence and keep markets on edge for some time yet.

Read more on reciprocal tariffs on 2nd April as the trade war escalates.

French and Spanish CPI undershoot forecasts

The euro also came under pressure because fresh data this morning showed inflation in France and Spain came in lower than expected, bolstering calls for further interest rate cuts from the European Central Bank. In France, consumer price growth remained steady at 0.9% this month, defying analyst expectations for an increase. Spain saw a sharper-than-anticipated slowdown, with inflation easing to 2.2%, edging closer to the ECB’s 2% target.

Today’s data offer an early glimpse into inflation trends across Europe ahead of next week’s releases from other major member states and the eurozone itself, which is expected to slow to 2.1%. As things stand, traders are pricing in around 60 basis points in total for ECB rate cuts this year, equivalent to two quarter-point reductions, with a 40% chance of a third.

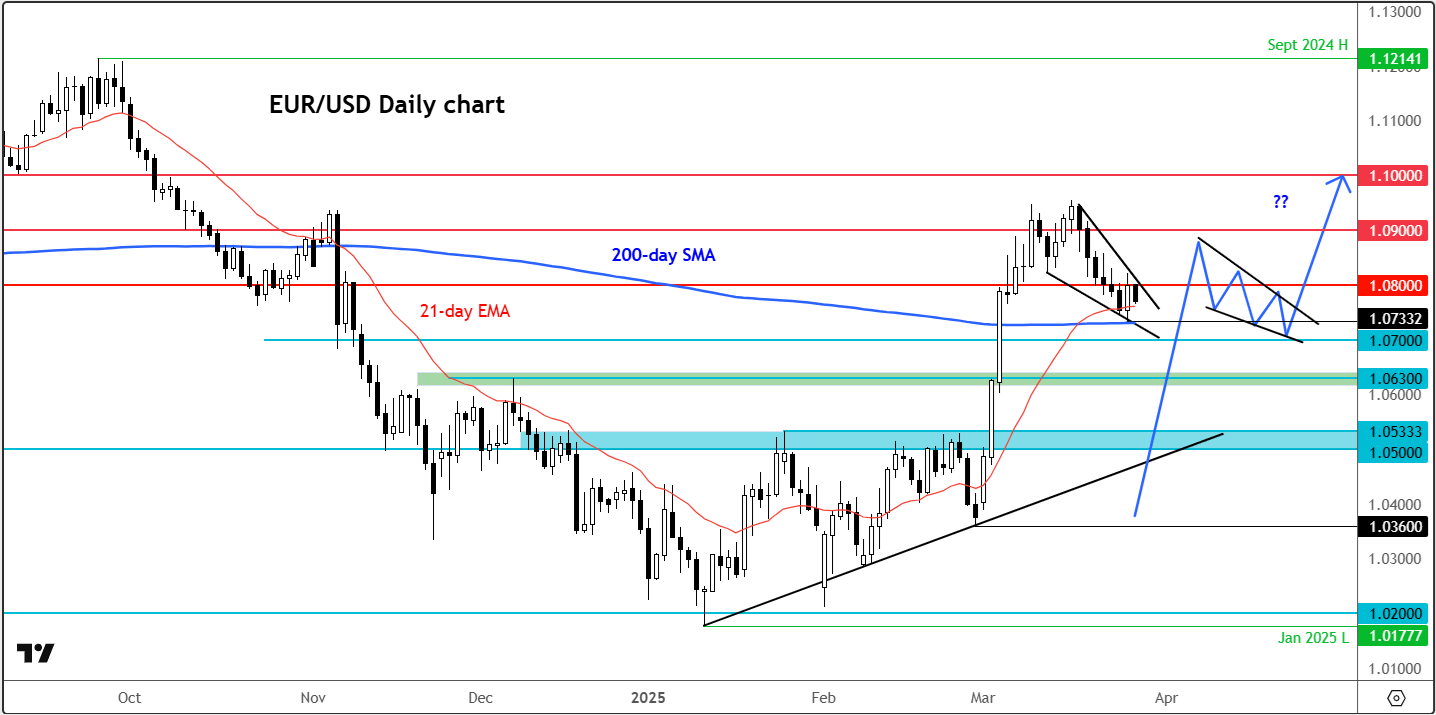

Technical EUR/USD outlook: Key levels to watch

Source: TradingView.com

From a technical standpoint, the EUR/USD outlook remains mildly positive, everything considered. While it has surrendered some ground in the last couple of weeks, the pair still maintains much of the gains from earlier this month when news of German stimulus caused a rally. The EUR/USD continues to hover near the crucial 1.0800 mark, leaving a push towards 1.10 still within reach. Below here, the next key support levels that come into play, start with 1.0730, which corresponds with the 200-day moving average. Below this level, 1.0700 looks like an interesting level to watch, with 1.0630 also likely to attract some activity. The long-term support now comes in around 1.0500-1.0530 area (shaded in blue on the chart).

On the upside, resistance lies at 1.0800, 1.0850 and then 1.0900 standing as the last major barrier until the 1.10 handle. The next few sessions could prove decisive, determining whether the pair resumes its rally or faces a deeper correction as price action continues to coil within what appears to be a bullish continuation pattern—a descending triangle.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R