The EUR/USD weakened in the first half of Friday’s session as the US dollar made a comeback after yesterday’s drop. The greenback rebound, some would say rather surprisingly, in the face of fresh uncertainty surrounding President Donald Trump’s ever-contentious tariff agenda. This came after a federal appeals court granted the president a temporary reprieve from a ruling that had threatened to unravel much of his economic playbook. White House aides were quick to stress that Mr Trump remains undeterred; tariffs, they say, are here to stay. Adding to the uncertainty, US Treasury Secretary Scott Bessent acknowledged that trade negotiations with China have become, in his words, “a bit stalled.” And just now, we heard from the man himself: Trump, who posted on Truth Social that China has totally violated its trade agreement with the US. In reaction, stock indices and the USD/JPY took a tumble, with the dollar also come under a bit of pressure against the euro. Traders were awaiting the release of US data, ahead of more key macro pointers in the week ahead, when we will also have the ECB rate decision to looking forward to, putting the EUR/USD outlook into sharp focus.

Core PCE among key data coming up shortly

As we transition over to the US session, the focus will turn to some key data from the world’s largest economy, which could very well impact the EUR/USD outlook. Market watchers will turn their attention to the US personal consumption expenditures price index (PCE) — excluding the more volatile food and energy components — which just so happens to be the Federal Reserve’s preferred measure of core inflation. Investors will be scouring the figures for clues about the underlying strength of the American economy and, crucially, what it might mean for the Fed’s stance on future rate cuts.

As for President Trump’s tariffs, their effect on April’s inflation data is expected to be relatively restrained. However, the true weight of these policies is likely to emerge more fully in the months ahead.

Fuelling the dollar slide on Thursday was not only the federal appeals court offering Trump a temporary reprieve from a ruling that had threatened to throw out the bulk of his agenda, but we also had a weaker GDP report too. The latter revealed that the US economy actually contracted at the start of the year, with consumer spending softening and trade taking a sharper toll than initially thought — a worrying sign that the protectionist push by Trump may already be leaving its mark.

Looking ahead: ECB set to trim rates next week, but what comes after?

The European Central Bank looks poised to cut interest rates by 25 basis points next week, with falling inflation taking precedence over anything else. But the key question is whether this is now baked in. The ECB is certainly content to let its June decision quietly land without fuss. Inflation is easing quicker than forecast, aided by a stronger euro and cheaper oil—both by-products of erratic Trump policies.

Still, it’s not all dovish. Some policymakers may argue for a pause, given the eurozone’s Q1 resilience. Yet with inflation likely to dip below 2% sooner than expected, a precautionary cut now seems prudent.

It will be worth watching Lagarde’s press conference, which may raise more eyebrows than usual—expect questions not only on policy, but on Lagarde’s own ‘direction of travel’. The ECB might favour a summer pause, but markets will be listening carefully for clues about what lies beyond that could impact the EUR/USD outlook.

Key US data in the week ahead include the jobs report on Friday

The US jobs report is always important as it could impact the Fed’s future policy decisions. Traders will want to see whether the trade war uncertainty is negatively impacting the jobs market too, after several macro data, including consumption data in GDP report and consumer sentiment surveys, have come out weaker in recent weeks. JOLTS jobs data and ISM PMIs are also due out earlier in the week.

The US dollar has been under pressure in the last three months or so, with the euro performing admirably during this time despite US tariffs.

With the US recently losing its final top-tier credit rating at the hands of Moody’s a couple of weeks ago, investors are worried that debt concerns and government spending will push yields even higher and thus they are shorting Treasuries and the dollar, buying foreign currencies, including the euro. This makes the EUR/USD outlook remain fairly resilient around the 1.12-1.15 range.

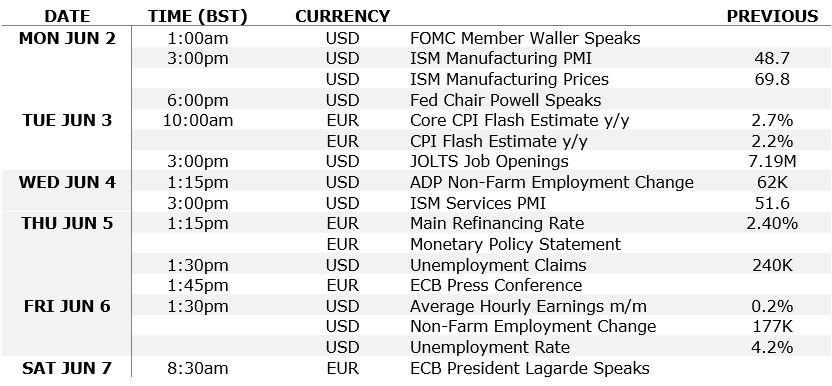

EUR/USD outlook: Key data highlights for the week ahead

Here's the macro calendar for the week ahead, only relevant to the EUR/USD outlook as it only contains data from the Eurozone and the US.

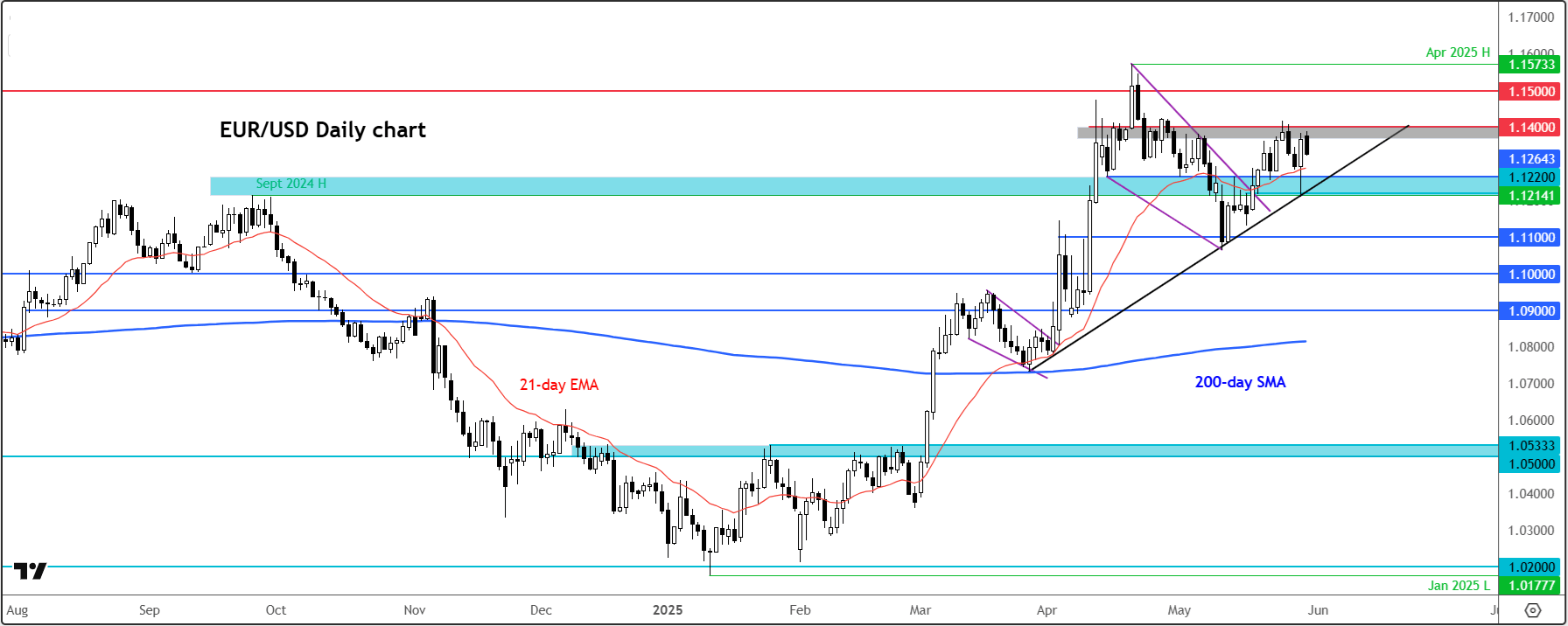

Technical EUR/USD forecast: Key levels to watch

Source: TradingView.com

The EUR/USD chart is continuing to consolidate in a choppy range, but generally holding above the key moving averages and trend lines etc. that still suggests that the path of least resistance is to the upside. The Key support area to watch is around 1.1210-1.1265 zone, as marked in light blue on the chart. Unless the EUR/USD breaks below here, the bulls will remain generally content with current price action and levels. Resistance is now clearly established around 1.1400. A decisive break above here is needed to pave the way for a run towards the April highs of 1.1570s, with 1.1500 handle being the interim stop ahead of that target.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R