The EUR/USD recovered from early weakness to turn higher on the session by mid-morning London trade, before pushing a little further higher ahead of the US open. started the session on the front foot but later turned lower as the US market rebounded sharply. Risk sentiment remained positive a day after Wall Street had one of its best days of the year. The positive risk appetite kept the commodity dollars on the front-foot. Yesterday, markets rallied following reports that Trump’s tariffs would be more targeted than initially feared, dampening demand for safe haven assets. Today Trump announced new tariffs on automobile imports will be revealed in the coming days but hinted that nations will receive breaks from next week’s “reciprocal” tariffs. The confusion regarding tariffs means the near-term EUR/USD outlook remains murky, but we maintain a bullish view on the pair in light of Germany’s historic fiscal shift approved last week and the recent mixed US data. Today’ focus will be on CB Consumer Confidence, which showed a 6 point drop last time.

EUR/USD Outlook: Key US data on the radar

This week’s US calendar contains a few important highlights. Earlier we have the Philly Fed non-manufacturing index which plunged to -32.5 vs -13.1 expected. Soon, we will have today’s other key US economic releases which include the Richmond Manufacturing Index, New Home Sales and more to the point, CB Consumer Confidence.

The latter fell 6 points last time, down for the fourth month in a row. Let’s see if consumers have grown even less confident about the relative level of current and future economic conditions including labour availability, business conditions, and overall economic situation. It is, in fact, expected by economists to reveal another drop to 94.2 from 98.3 last time.

Looking ahead, tomorrow’s highlights include Durable Goods Orders, while Thursday will bring Unemployment Claims, the Final Q4 GDP estimate, and Pending Home Sales. However, Friday’s Core PCE release will be the main event. As the Fed’s preferred inflation gauge, a steady +0.3% m/m reading would push the annual rate to 2.7% from 2.6%, testing Powell’s stance that inflationary pressures remain contained.

The dollar ended last week consolidating after an uninspiring performance, marked by mixed data and a slightly dovish Federal Reserve. While Chair Jerome Powell reassured markets by downplaying inflation risks from tariffs, the University of Michigan’s inflation expectations survey raised some concerns. However, Powell dismissed these as temporary fluctuations, suggesting that tariff-driven inflation might not be sustained.

EUR/USD caught between Germany’s fiscal stimulus and US tariffs uncertainty

The uncertainty surrounding the April 2 tariffs is holding back the euro for now. Trump announced that new tariffs on automobile imports will be revealed in the coming days, adding to the uncertainty surrounding the sweeping levies set to take effect on April 2. While some nations are expected to receive exemptions from the “reciprocal” tariffs, markets remain in wait-and-see mode. If Trump follows through with broad tariffs, you’d think it would weigh on the euro in the short term at least.

That said, the euro is likely to find buyers on any short-term dips, thanks to Germany’s landmark spending package approved last week. The €500 billion stimulus, a major departure from Berlin’s traditionally conservative fiscal policy, is aimed at revitalizing the economy and increasing defence spending. This historic move could boost German GDP and introduce mild inflationary pressures, both of which are supportive of the medium-term EUR/USD outlook.

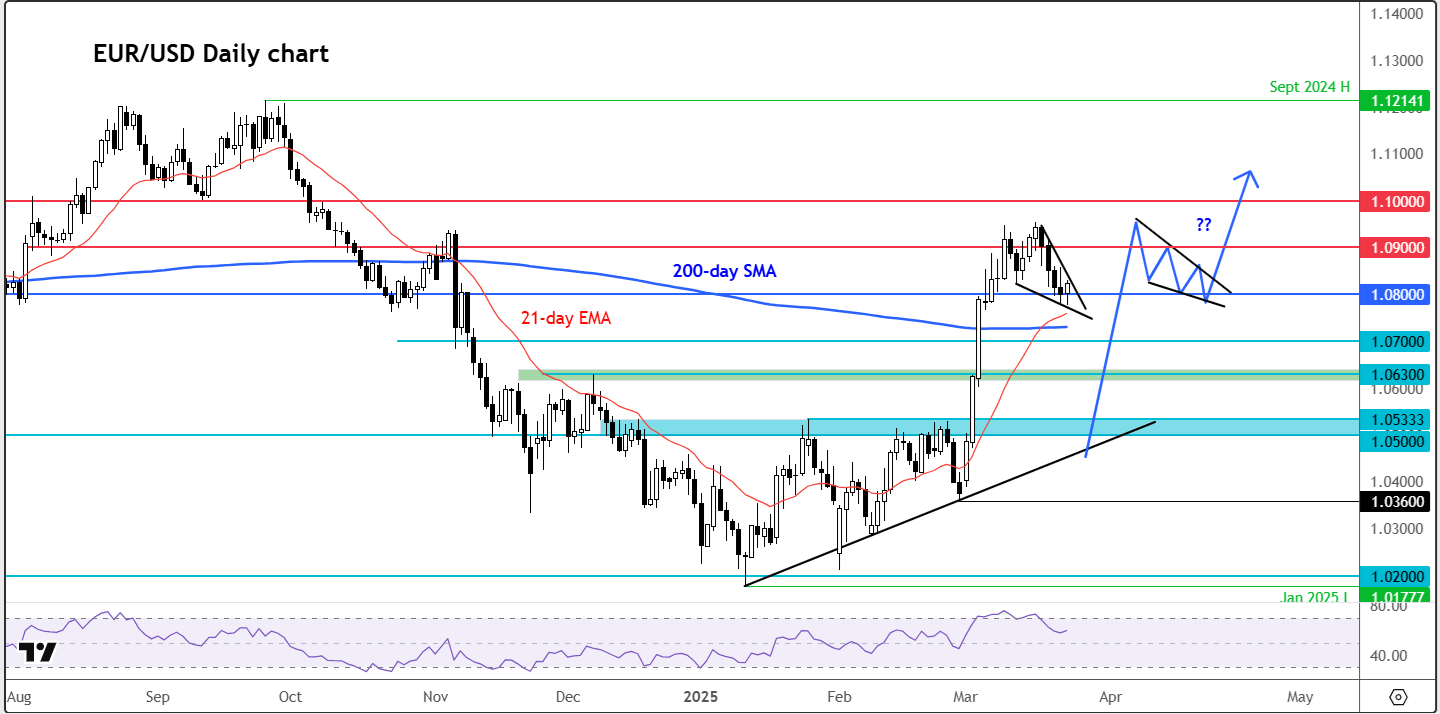

Technical EUR/USD outlook: Path to 1.10 remains open

Source: TradingView.com

From a technical perspective, the EUR/USD gave up some ground last week but remains near the key 1.0800 level, keeping a push toward 1.10 within reach. The bulls must continue to defend this region to maintain upward momentum. A break lower, however, could bring into focus support levels at 1.0730 (the 200-day moving average), followed by 1.0700 and 1.0630. On the upside, resistance sits at 1.0900 and 1.0950, with the critical psychological level of 1.1000 looming as the key hurdle. The coming sessions could determine whether the pair resumes its rally or experiences a deeper correction as rates continue to coil inside what looks to be a bullish continuation pattern (descending triangle).

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R