View related analysis:

- USD/CHF Hurled Overboard, Swiss Franc, Gold Remain Supreme

- CHF Beats Yen for Safety as Tariffs Take Second Quarter to the Slaughter

- AUD/USD, Nasdaq Soar as Trump Blinks First, Sparking Epic Market U-Turn

- AUD/USD Analysis: Eyes on China and the yuan Amid Trump’s 104% Tariff

Anyone expecting a quiet Asian session heading into the weekend was caught off guard as the US dollar continued to unravel at breakneck speed.

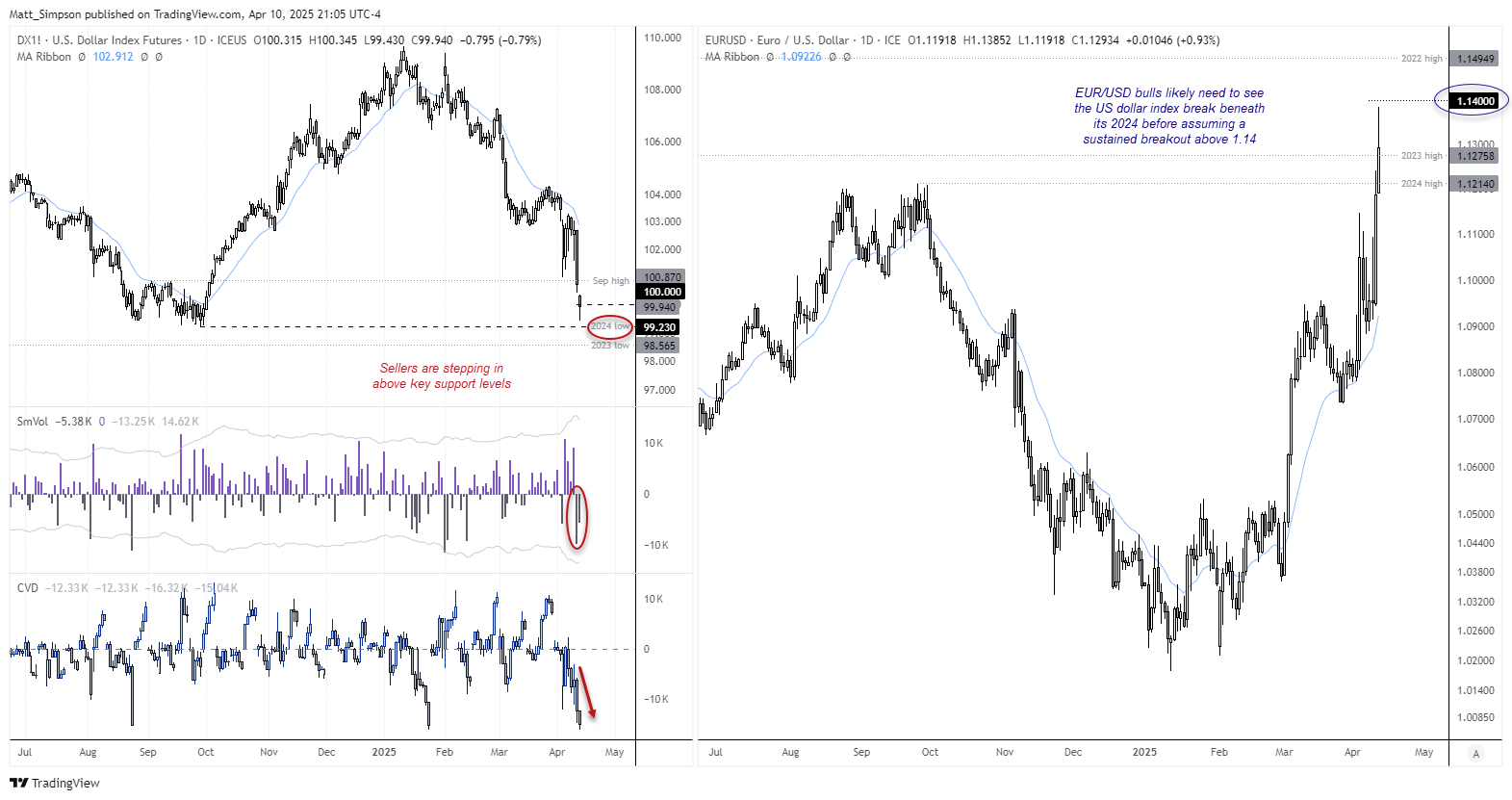

US dollar index futures gapped lower at Friday’s open and swiftly fell below the 100 handle, a key level it remains beneath as of writing. Volatility in the British pound was also elevated, leading to EUR/USD and EUR/GBP exceeding their daily ranges early in the Asian session—a rare occurrence indeed.

EUR/USD, US Dollar Index Analysis

How the US dollar index behaves around the 100 handle and the 2024 low is crucial in determining whether we will see a sustained move above 1.14 for EUR/USD. My sense at the moment is that, given the large moves in lower liquidity conditions, the US dollar index may be prone to a bounce after a shakeout. This would leave EUR/USD vulnerable to a pullback beneath its 2023 and 2024 highs.

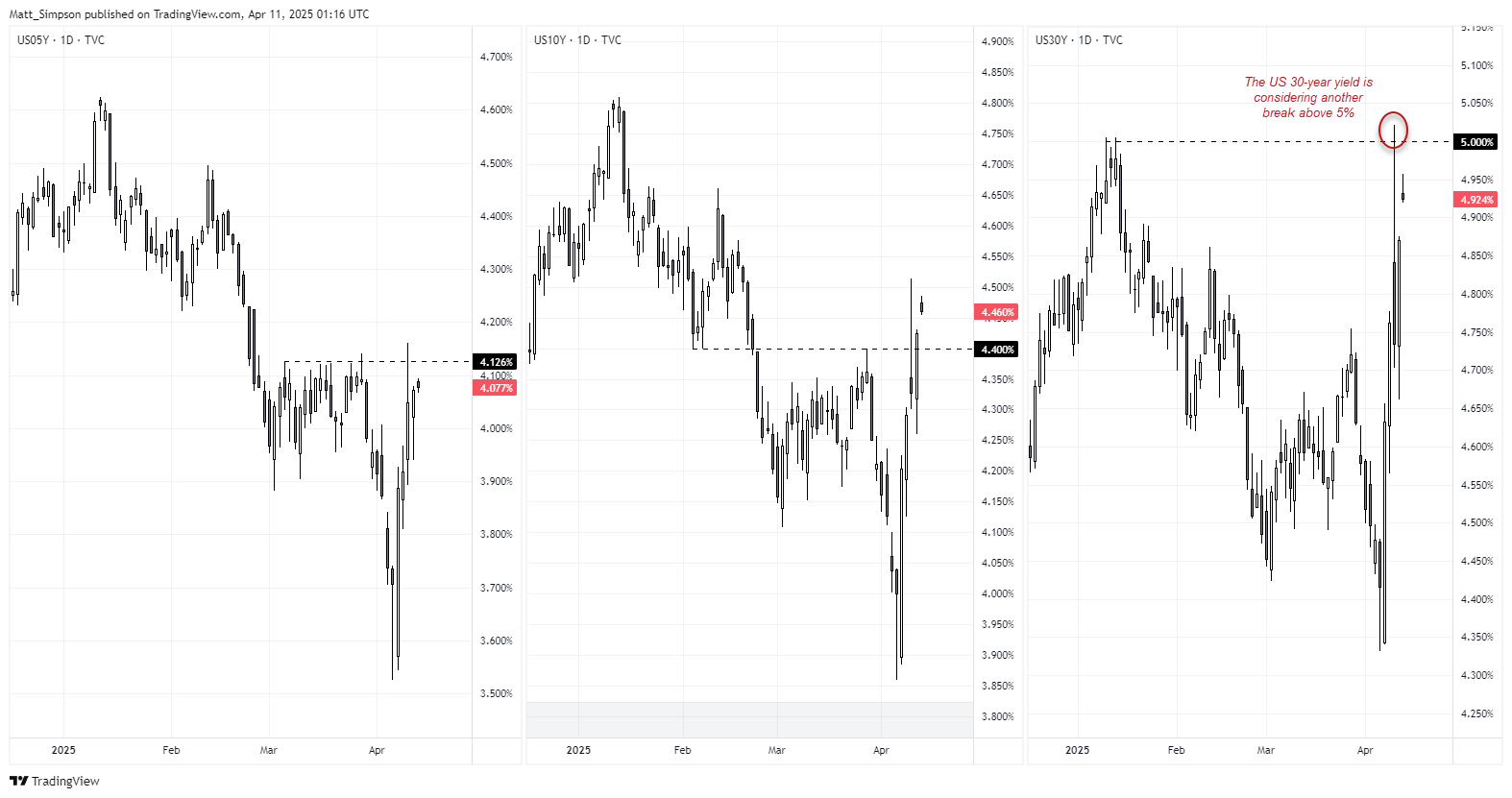

Keep an Eye on US Bond Yields

Another key market to monitor is, of course, the bond market. Bond prices are under pressure as investors stampede for the exit, pushing US bond yields higher as they demand a larger premium for holding the supposed safe haven. The US 10-year has surged to 4.5%, but if there’s a level likely to break the camel's back, it’s 5% on the US 30-year.

On Wednesday, we saw the 30-year briefly spike above 5% in the Asian session, and within 15 hours, President Trump had caved, providing a 90-day pause for his aggressive tariffs. But with the pause already in motion and bond yields rising once more in the Asian session, it seems the effect of the pause is quickly fading.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge