Euro Outlook: EUR/USD

EUR/USD rallies to a fresh weekly high (1.1463) even as the European Central Bank (ECB) delivers another 25bp rate-cut, and the exchange rate may further retrace the decline from the April high (1.1573) it extends the advance from the start of the month.

Euro Forecast: EUR/USD Post-ECB Rally Eyes April High

EUR/USD breaks out of the range bound price action from earlier this week as ECB President Christine Lagarde reveals that one member of the Governing Council dissented against the decision to lower Euro Area interest rates, with the official going onto say that ‘I think we are getting to the end of the monetary policy cycle that was responding to compounded shocks.’

The comments suggest the ECB is preparing to alter the course for monetary policy as ‘rising government investment in defence and infrastructure will increasingly support growth over the medium term,’ and an increasing number of the Governing Council may show a greater willingness to keep Euro Area interest rates on hold at the next meeting in July as ‘most measures of underlying inflation suggest that inflation will settle at around the Governing Council’s 2% medium-term target on a sustained basis.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Until then, waning expectations for another ECB rate cut may keep EUR/USD afloat, and the Euro may continue to outperform against its US counterpart especially as US President Donald Trump argues that ‘Powell must now lower the rate.’

With that said, EUR/USD may continue to track the positive slope in the 50-Day SMA (1.1248) as it holds above the moving average, but the exchange rate may consolidate over the coming days should it struggle to test the April high (1.1573).

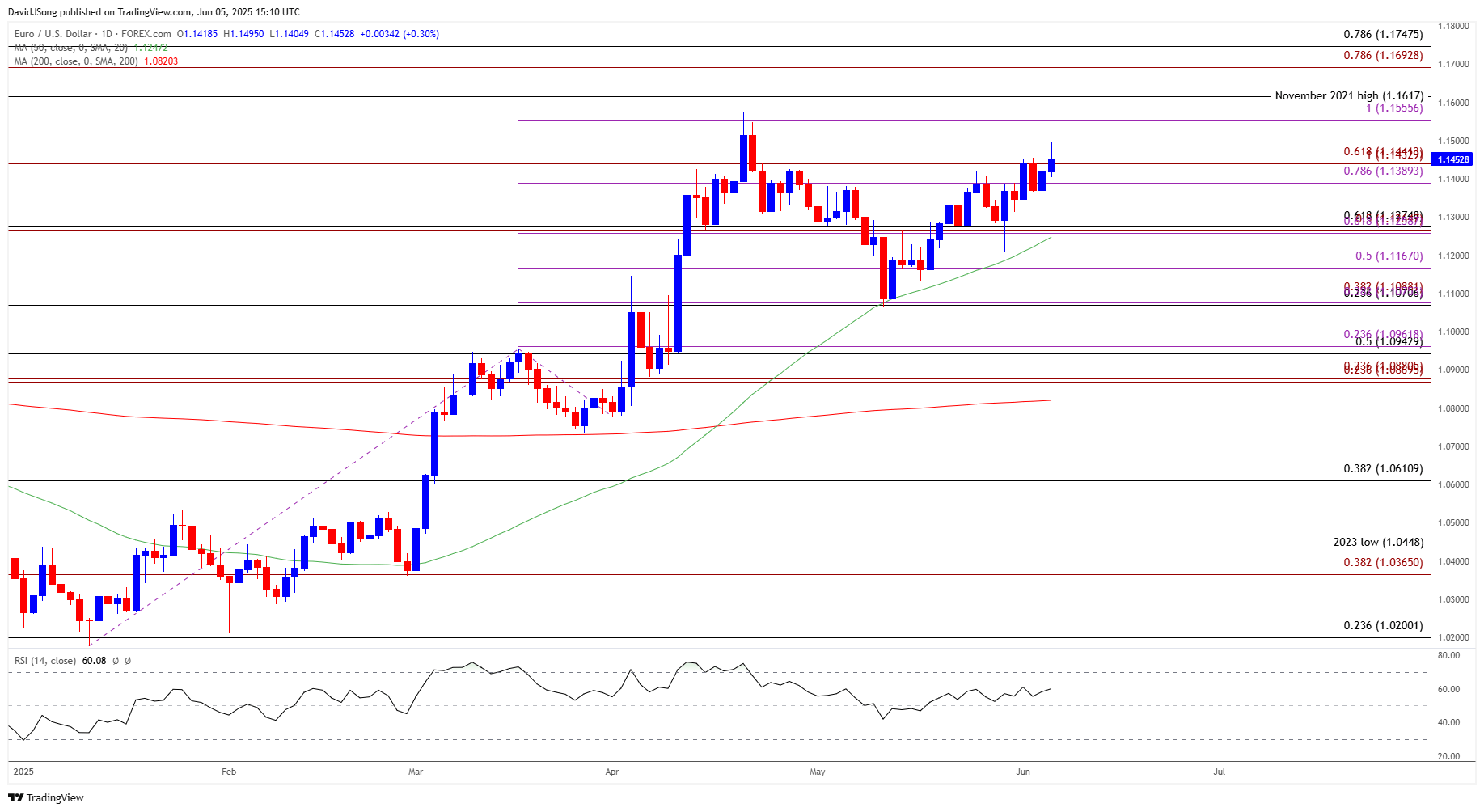

EUR/USD Chart – Daily

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

- EUR/USD appears to be defending the advance from the start of the week as it initiates a series of higher highs and lows, with a move above 1.1560 (100% Fibonacci extension) raising the scope for a test of the April high (1.1573).

- A breach above the November 2021 high (1.1617) opens up the 1.1690 (78.6% Fibonacci extension) to 1.1750 (78.6% Fibonacci retracement) zone, but lack of momentum to close above the 1.1390 (78/6% Fibonacci extension) to 1.1440 (61.8% Fibonacci extension) region may keep EUR/USD within the April range.

- Failure to defend the weekly low (1.1347) may push EUR/USD back towards the 1.1260 (61.8% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement) zone, with the next area of interest coming in around 1.1170 (50% Fibonacci retracement).

Additional Market Outlooks

US Non-Farm Payrolls (NFP) Report Preview (MAY 2025)

Canadian Dollar Forecast: USD/CAD Drops as BoC Stays on Hold

GBP/USD Stuck in Narrow Range amid Failure to Test February 2022 High

US Dollar Forecast: USD/CHF Clears May Low

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong