Euro Outlook: EUR/USD

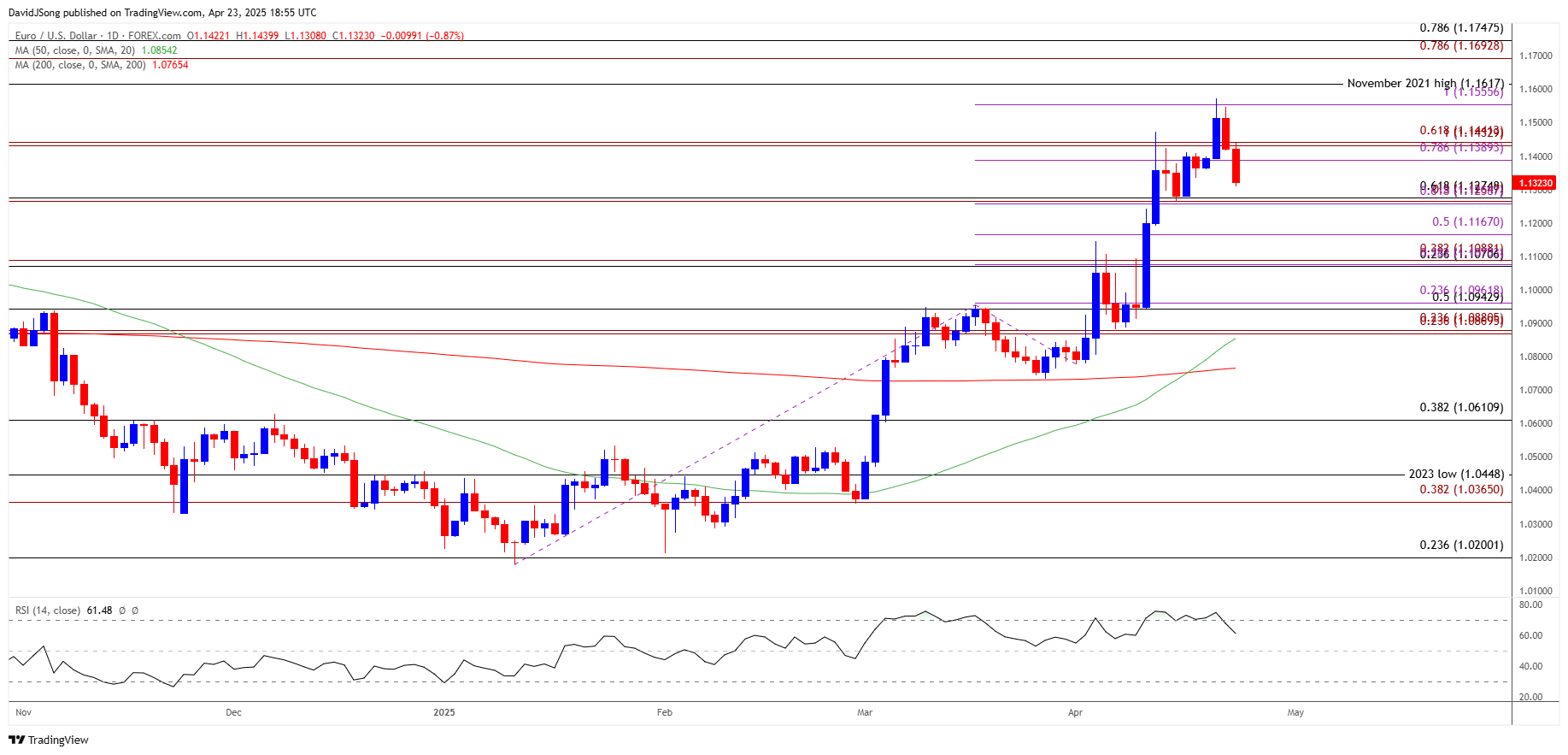

EUR/USD reverses ahead of the November 2021 high (1.1617) to register a fresh weekly low (1.1308), with the recent weakness in the exchange rate pulling the Relative Strength Index (RSI) back from overbought territory.

Euro Forecast: EUR/USD Reverses Ahead of November 2021 High

EUR/USD gives back the advance from the start of the week as it continues to fall from a fresh yearly high (1.1573), and the move below 70 in the RSI is likely to be paired with a larger pullback in the exchange rate like the price action from earlier this year.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, EUR/USD may depreciate over the remainder of the week as there appears to be a broad-based recovery in the US Dollar, but the exchange rate may continue to track the positive slope in the 50-Day SMA (1.0855) as it still holds above the moving average.

With that said, the weakness in EUR/USD may turn out to be temporary as it fulfilled a cup-and-handle formation earlier this month, and the exchange rate may search for support going into the final days of April as it seems to be establishing a bullish trend.

EUR/USD Chart – Daily

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

- EUR/USD falls to a fresh weekly low (1.1308) after struggling to close above 1.1560 (100% Fibonacci extension), and a breach below the 1.1260 (61.8% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement) region may push the exchange rate towards 1.1170 (50% Fibonacci retracement).

- Next area of interest comes in around 1.1070 (23.6% Fibonacci retracement) to 1.1090 (38.2% Fibonacci extension), but EUR/USD may consolidate over the remainder of the week should it defend the 1.1260 (61.8% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement) region.

- Need a move/close above 1.1560 (100% Fibonacci extension) to bring the November 2021 high (1.1617) back on the radar, with the next area of interest coming in around 1.1690 (78.6% Fibonacci extension) to 1.1750 (78.6% Fibonacci retracement).

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Cracks November Low Ahead of Election

GBP/USD Falls Ahead of 2024 High to Threaten Ten-Day Rally

AUD/USD Extends V-Shape Recovery to Push Above February High

USD/JPY Falls Toward 2024 Low to Push RSI into Oversold Zone

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong