Euro Outlook: EUR/USD

EUR/USD gives back the rebound from the weekly low (1.1264) as the European Central Bank (ECB) implements another 25bp rate-cut, and the Relative Strength Index (RSI) may indicate a textbook sell signal as it struggles to hold above 70.

Euro Forecast: EUR/USD Vulnerable to RSI Sell-Signal amid ECB Rate Cut

EUR/USD pulls back ahead of the monthly high (1.1474) as the ECB reiterates that ‘the disinflation process is well on track,’ and the central bank may continue to cut Euro Area interest rates as ‘most measures of underlying inflation suggest that inflation will settle at around our two per cent medium-term target on a sustained basis.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

However, it seems as though the ECB is nearing the end of its rate-cutting cycle as the Governing Council acknowledges that ‘the euro area economy has been building up some resilience against global shocks,’ and President Christine Lagarde and Co. may adopt a wait-and-see approach as the Euro Area plans to boost public spending.

In turn, the shift in fiscal policy may sway the ECB as ‘a boost in defence and infrastructure spending could also raise inflation over the medium term,’ and the recent weakness in EUR/USD may turn out to be temporary as a cup-and-handle formation unfolds.

With that said, EUR/USD may attempt to break out of the range bound price action if the RSI continues to hold above 70, but failure to defend the weekly low (1.1264) may pull the oscillator back from overbought territory.

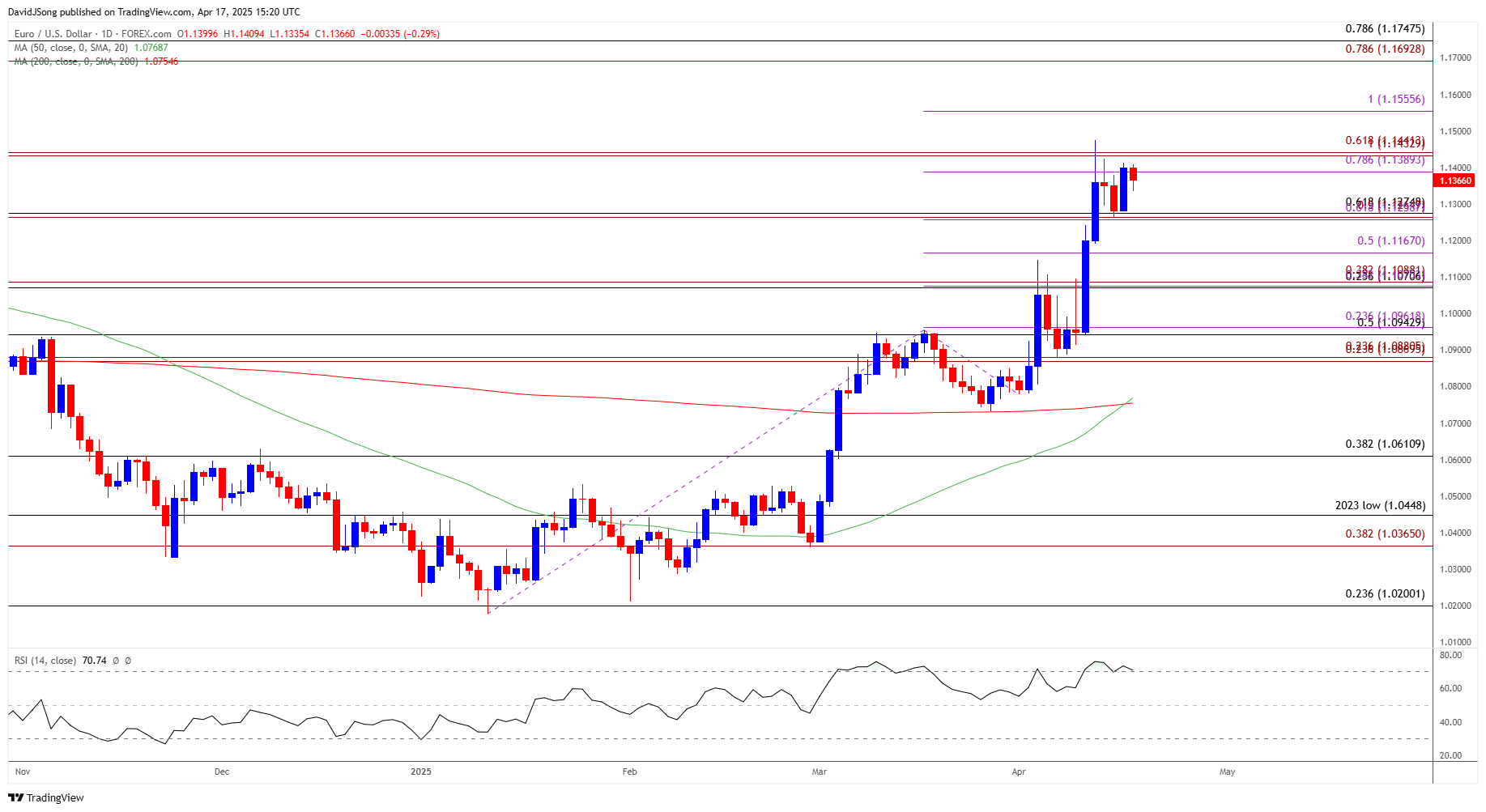

EUR/USD Chart – Daily

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

- EUR/USD appears to be stuck in a narrow range after completing a cup-and-handle formation earlier this month, but lack of momentum to hold above the 1.1260 (61.8% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement) region may push the exchange rate back towards 1.1170 (50% Fibonacci retracement).

- A move/close below the 1.1070 (23.6% Fibonacci retracement) to 1.1090 (38.2% Fibonacci extension) region brings the 1.0940 (50% Fibonacci retracement) to 1.0960 (23.6% Fibonacci extension) zone on the radar, with the next area of interest coming in around 1.0870 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension).

- At the same time, a move/close above the 1.1390 (78.6% Fibonacci extension) to 1.1440 (61.8% Fibonacci extension) zone may push EUR/USD towards 1.1560 (100% Fibonacci extension), with the next area of interest coming in around 1.1690 (78.6% Fibonacci extension) to 1.1750 (78.6% Fibonacci retracement).

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Drops as BoC Holds Interest Rate

US Dollar Forecast: USD/CHF Weakness Keeps RSI in Oversold Territory

GBP/USD Stages Six-Day Rally for First Time in 2025

USD/JPY Defends Monthly Low to Keep RSI Above 30 for Now

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong