Euro Technical Outlook: EUR/USD Short-term Trade Levels

- Euro three-month rallies falters at resistance- threat for larger correction

- EUR/USD weekly opening-range intact into monthly cross- U.S. Non-Farm Payrolls on tap

- Resistance 1.1510/14 (key), 1.16, 1.1747- Support 1.1275, 1.1214, 1.1160 (key)

Euro is trading in a tight 0.8% range this week after faltering into technical resistance last week. While the broader outlook is constructive, the immediate advance may be vulnerable here with the weekly opening-range preserved heading into Thursday. Battle lines drawn on the Euro short-term technical charts heading into May / NFP.

Review my latest Weekly Strategy Webinar for an in-depth break down of this EUR/USD technical setup and more. Join live Monday’s at 8:30am EST.Euro Price Chart – EUR/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

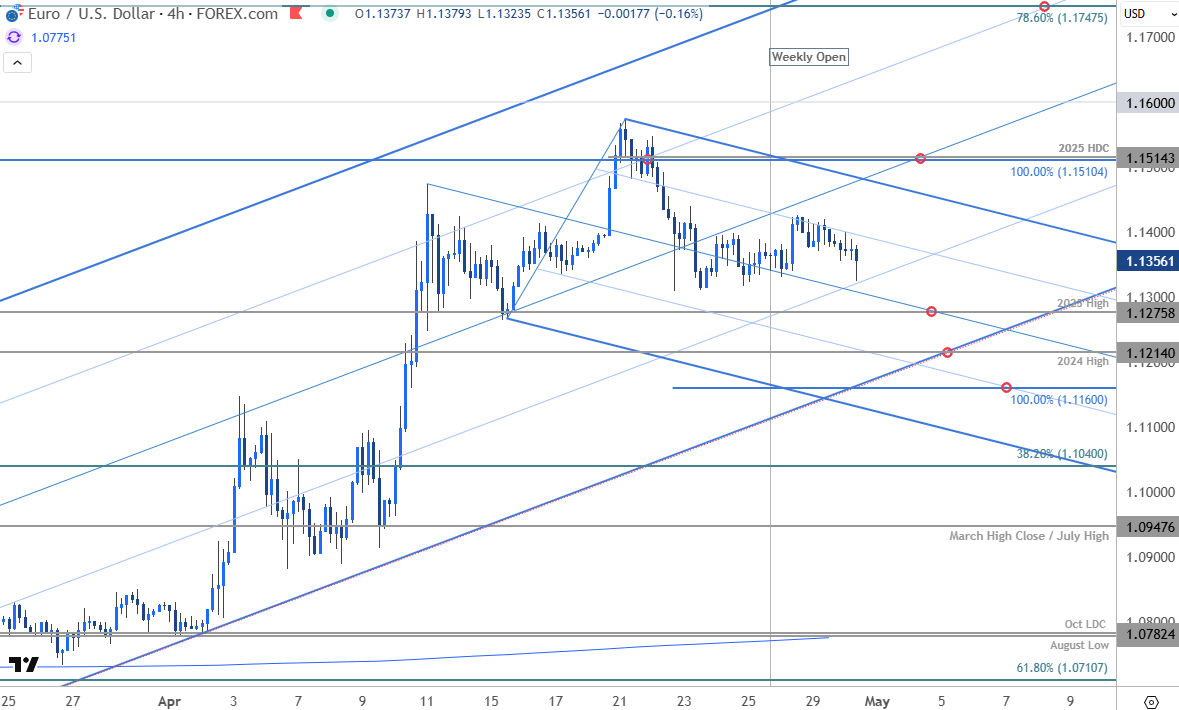

Technical Outlook: Euro rallied more than 13.7% off the yearly low with the advance faltering last week at the 100% extension of the January advance near 1.1510. EUR/USD is off more than 2.2% from the high with a break below the median-line threatening a test of uptrend support. The immediate focus is on a breakout of this week’s opening-range (1.1329-1.1425) for near-term guidance.

Euro Price Chart – EUR/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Notes: A closer look at Euro price action shows EUR/USD trading within the confines of a descending pitchfork extending off the monthly highs with the weekly opening-range preserved just above the median-line. Initial support rests with the 2023 swing high at 1.1275 backed by the 20204 high at 1.1214. Ultimately, a break / close below the 100% extension at 1.1160 would be needed to suggest a more significant high was registered last week / a larger trend reversal is underway.

Topside resistance remains with the 100% extension / yearly high-day close (HDC) at 1.1510/14- a break / close above this threshold is needed to mark uptrend resumption with subsequent resistance eyed at the 1.16-handle and the 78.6% retracement of the 2021 decline at 1.1747- look for a larger reaction there IF reached.

Bottom line: A four-month rally off multi-year lows has responded to resistance at multi-year highs and while the broader outlook remains constructive, the advance may be vulnerable near-term while below trend resistance. From a trading standpoint, the immediate focus is on a breakout of the weekly opening range- losses would need to be limited by 1.1160 IF Euro is heading higher on this stretch with a close above 1.1514 needed to fuel the next leg of the advance.

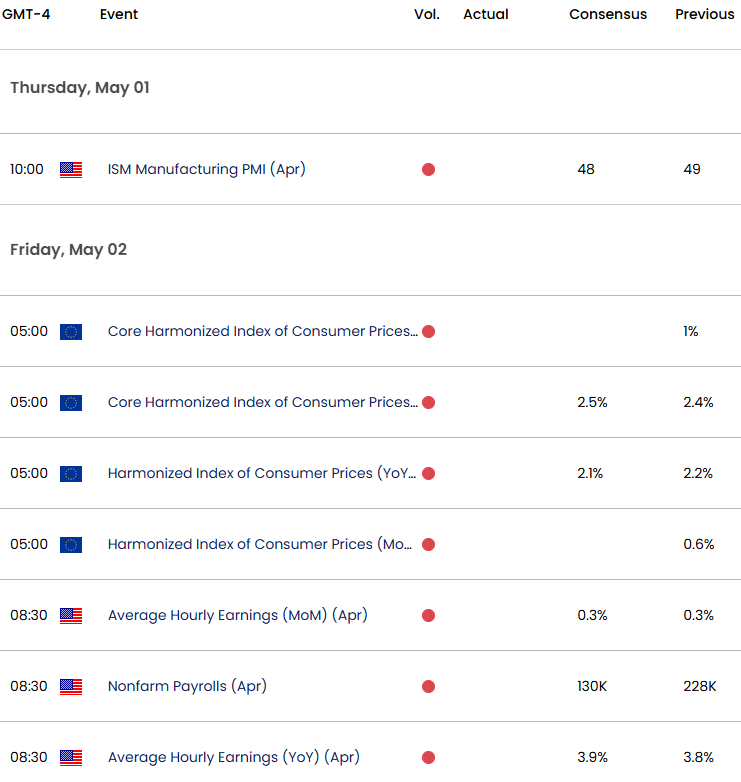

Keep in mind we are heading into the monthly cross with U.S. Non-Farm Payrolls on tap Friday. Stay nimble into the releases and watch the weekly closes here for guidance. Review my latest Euro Weekly Technical Forecast for a closer look at the longer-term EUR/USD trade levels.

Key EUR/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Japanese Yen Short-term Outlook: USD/JPY Coils Ahead of BoJ, NFP

- British Pound Short-term Outlook: GBP/USD Bulls Eye 2024 High

- Australian Dollar Short-term Outlook: AUD/USD Halted at Resistance

- Canadian Dollar Short-term Outlook: USD/CAD Breakout Imminent

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex