Euro, EUR/USD Talking Points:

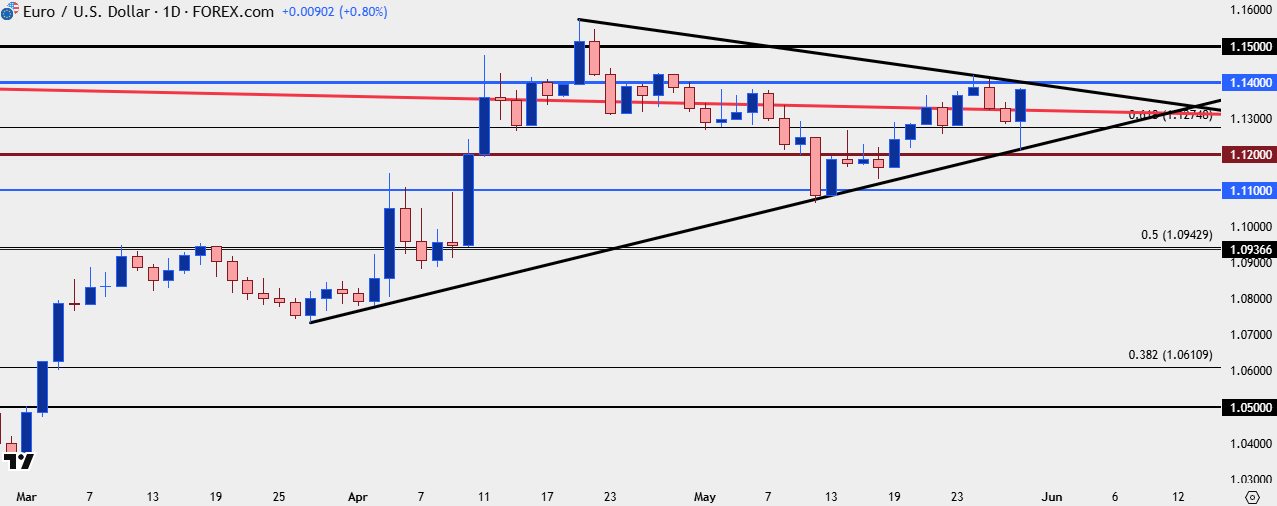

- EUR/USD is posting a strong day after support held above 1.1200 and price now nears a re-test of resistance at 1.1400.

- Tomorrow is the final trading day of May and it’s a big one, as there’s a batch of German data due for release ahead of the U.S. Core PCE release at 8:30 AM ET.

- The monthly bar for EUR/USD is showing 50 pips of range which has increased from what I looked at in the Tuesday webinar. But if that narrows and we close the month with a doji that can make for interesting turn potential in EUR/USD and, in-turn, the US Dollar.

The U.S. Dollar is taking a hit as we approach the final trading day of May, but there’s still some data for the headlines that can push the USD monthly bar and, in-turn, the EUR/USD monthly bar closer to the doji-like showing that I had looked at in the Tuesday webinar.

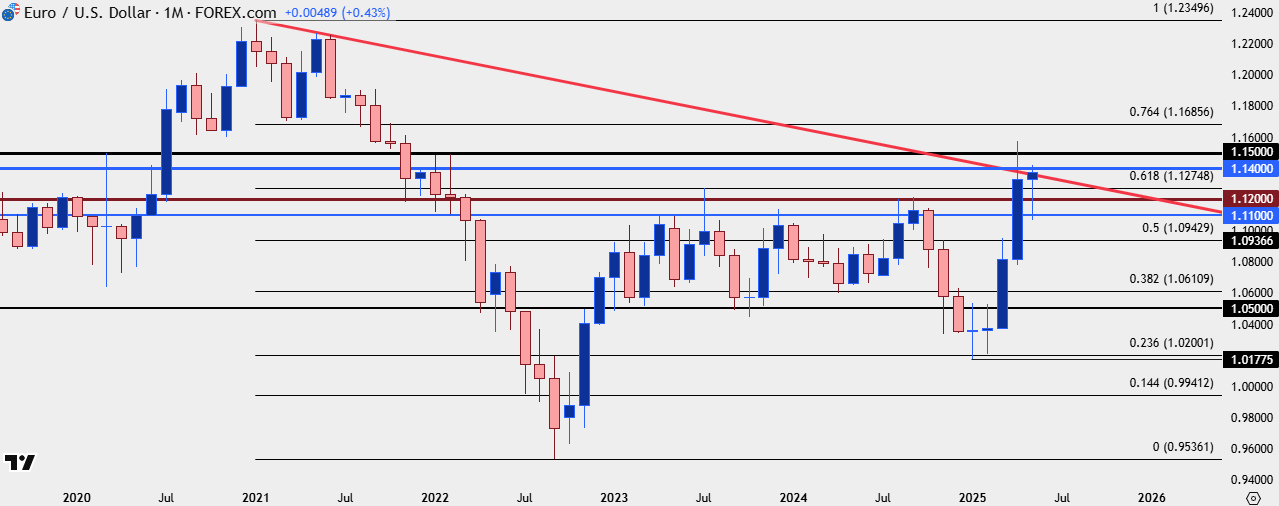

The beauty of long-term charts is that they can modulate through the ebb and flow of day to day headlines and as a case in point, as we came into the month of January it seemed like it was doom-and-gloom for the Euro, with EUR/USD parity forecasts widespread. But, despite a blistering sell-off in Q4 of last year, indecision showed in January, and then again in February. By the time March had rolled around, the pair was ready to reverse, and it reversed in a very big way as EUR/USD showed one of its strongest rallies ever.

That strength continued through April and suddenly, the same bearish backdrop that was commonplace amongst the headlines in January was seemingly nowhere to be found just a few months later.

The 1.1500 level has been a showstopper for EUR/USD bulls, however, and that price came into play around Easter Monday and since then, buyers haven’t been able to push for a re-test. Bears haven’t exactly been able to capitalize though, as a breakdown into last week quicky snapped back. And then another short-side move this week has so far fallen short.

Collectively, the EUR/USD monthly bar sits at a big spot as taken from a trendline projection, with the monthly high at the 1.1400 handle and the low at 1.1100. At current, there’s a little less than 50 pips of range for the monthly candle, and if that whittles down closer to zero, a doji following that failure at highs would suggest the possibility of retracement into the month of June.

EUR/USD Monthly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD Shorter-Term

From the daily chart we can see both a lower-high from the 1.1400 hold earlier in the week and, so far, a higher-low after the overnight rally from above the 1.1200 handle. This sets up a shorter-term symmetrical triangle in EUR/USD and this further emphasizes the importance of that 1.1400 level for bears, as a failure to defend that would not only lead to a higher-high but also a breach of the upper trendline from the formation. That would then point to a 1.1500 re-test.

As I’ve been saying in webinars, I still believe there could be more attractive venues for USD-weakness scenarios such as USD/CAD or GBP/USD; but in EUR/USD bears would need to break below 1.1200 to start taking greater control of near-term price action in the pair.

Given the monthly outlay, a quite finish to the month with the monthly bar moving closer to a doji would seem to favor bears, as that larger turn potential would get more attractive in both the USD and EUR/USD. To that point, EUR/USD remains as one of the more attractive major pairs for scenarios of USD-strength, in my opinion.

EUR/USD Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist