Euro Technical Forecast: EUR/USD Weekly Trade Levels

- Euro breakout extends to fresh multi-year highs- bulls attempt fifth weekly advance

- EUR/USD rally stalling at technical resistance- threat for topside exhaustion / price inflection

- Resistance 1.1497-1.1510 (key), 1.1748, 1.1917- Support 1.1228/75, 1.1108, 1.1038

Euro surged to multi-year highs this week with EUR/USD attempting to mark a fifth consecutive weekly advance. The bulls are struggling near technical resistance and while the broader outlook remains constructive, the immediate rally may be vulnerable in the weeks ahead. Battle lines drawn into the close of the month on the Euro weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this EUR/USD technical setup and more. Join live on Monday’s at 8:30am EST.Euro Price Chart – EUR/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Technical Outlook: In my last Euro Technical Forecast we noted that a, “rebound off downtrend support is now within striking distance of trend resistance with the focus remains on a breakout of this multi-week range. From a trading standpoint, losses should be limited to the yearly open IF price is heading higher on this stretch with a close above 1.0587 needed to suggest a larger turn is underway.” EUR/USD ripped higher two-weeks later with the subsequent rallying extending more than 13.7% off the yearly low.

The bulls are attempting to mark a five-week advance here with EUR/USD exhausting near technical resistance yesterday at 1.1497-1.1510- a region defined by the March 2020 high and the 100% extension of the January advance. Weely momentum remains overbought for now with RSI stretching to extremes not seen since the 2018 high was registered. Looking for possible price inflection off this zone with the immediate advance vulnerable while below this week’s high.

Initial weekly support now rests with the 2023 high-close / 61.8% retracement of the 2021 decline at 1.1228/75 and is backed by the 2023 high-week close (HWC) at 1.1108. Broader bullish invalidation is now raised to the December HWC / 2024 yearly open at 1.1038.

A topside breach / close above this resistance hurdle exposes subsequent objectives at the 78.6% retracement / upper parallel near 1.1748 and the 100% extension of the 2022 advance at 1.1917. The next major resistance hurdle is eyed with the 2018 yearly open / 38.2% retracement of the 2008 decline at 1.2001/20.

Bottom line: A breakout to multi-year highs is now testing technical resistance near the 1.15-handle and the focus is on possible price inflection off this mark. From a trading standpoint, losses should be limited to 1.1038 IF Euro is heading higher on this stretch with a close above 1.1510 needed to mark uptrend resumption.

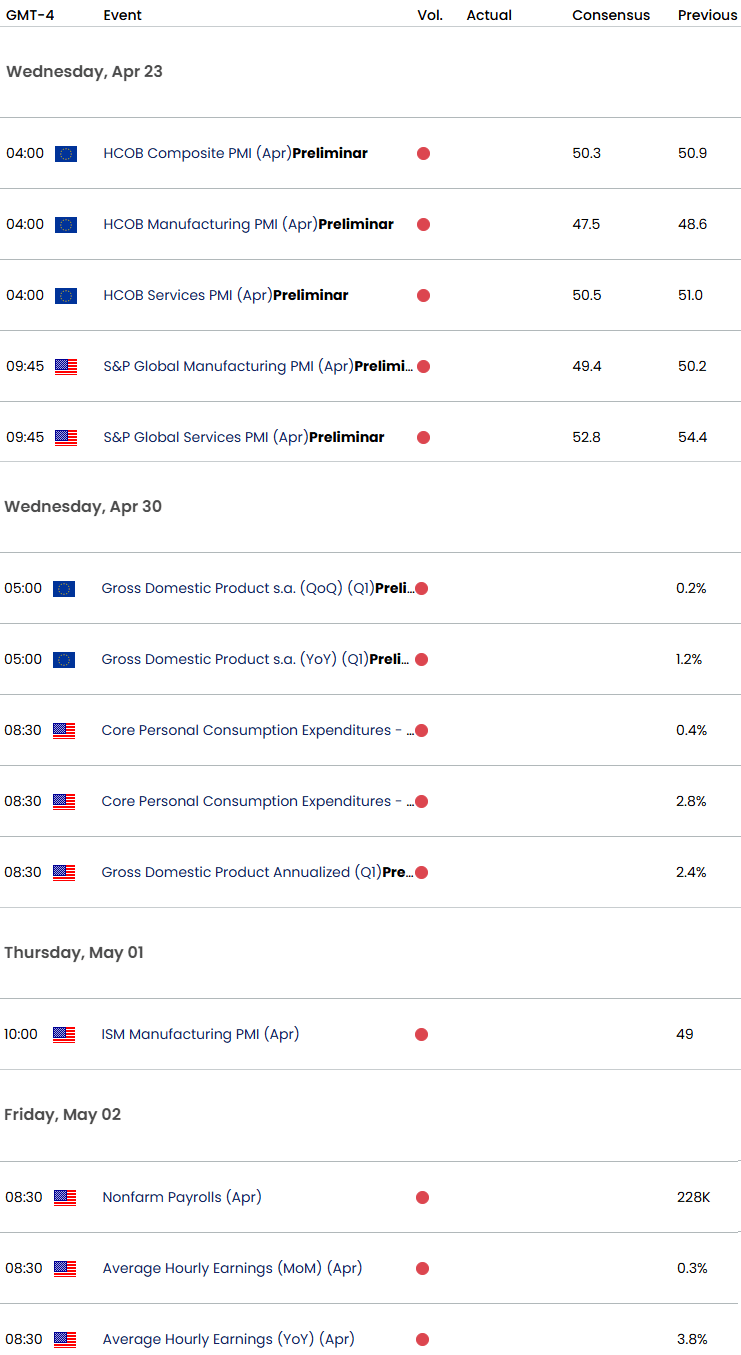

Keep in mind we are heading into the close of the month with U.S. Core Personal Consumption Expenditures (PCE) and Non-Farm Payrolls on tap next week. Stay nimble into the release and watch the weekly closes here for guidance. I’ll publish an updated Euro Short-term Outlook once we get further clarity on the near-term EUR/USD technical trade levels.

Key Euro / US Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- US Dollar Index (DXY)

- Australian Dollar (AUD/USD)

- British Pound (GBP/USD)

- Canadian Dollar (USD/CAD)

- Japanese Yen (USD/JPY)

- Gold (XAU/USD)

- S&P 500, Nasdaq, Dow

- Crude Oil (WTI)

--- Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex