Over the past three trading sessions, EUR/USD has remained in a state of neutral consolidation, with price movement limited to just 0.3%, reducing the bullish momentum that had begun to build earlier in the week. For now, uncertainty prevails, driven by new comments from the European Central Bank (ECB) and the release of key U.S. economic data. As long as major catalysts remain unconfirmed, this neutral bias may persist in the short term.

What’s Next for Central Banks?

On the European side, several ECB members have suggested that the bank may be nearing the end of its rate-cutting cycle, as inflation continues to converge toward the 2% target, and the recent easing of trade tensions no longer justifies further monetary loosening in the near term.

These statements could become important catalysts for the euro, as the ECB’s accommodative policy over the past year has reduced the appeal of euro-denominated assets and limited sustained demand for the currency.

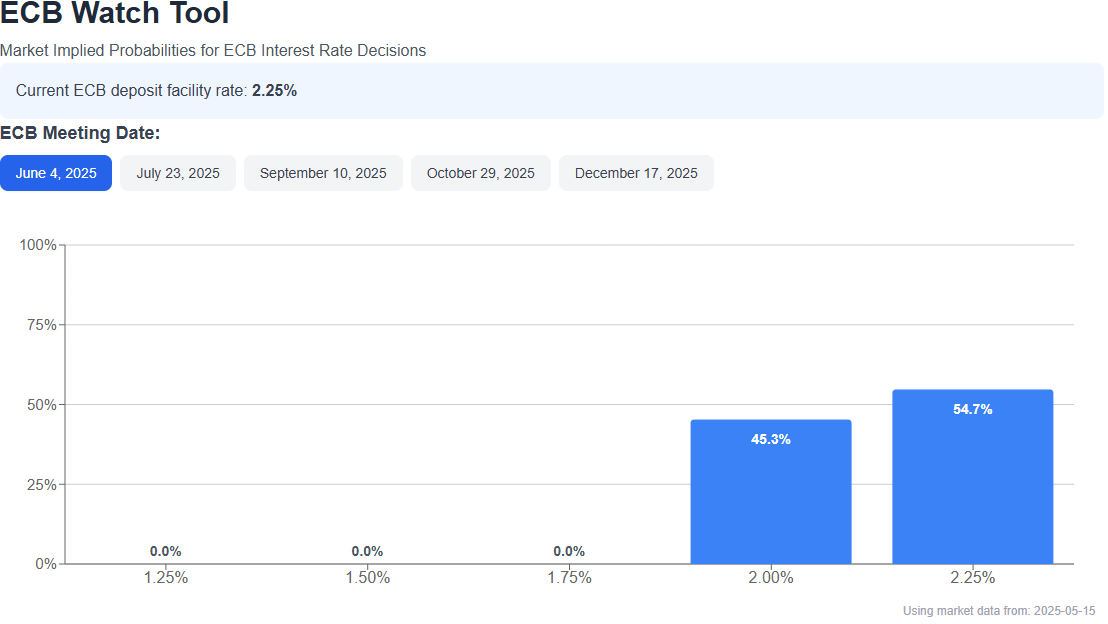

This shift in outlook is already reflected in the ECB Watch Tool, which now shows a 54.7% probability that the ECB will keep the deposit rate unchanged at 2.25% at its June 4 meeting.

Source: ECB Watch

Meanwhile, this week’s release of the U.S. annual CPI showed inflation at 2.3%, slightly below the expected 2.4%. Initially, this led some to believe that the Federal Reserve could soon consider a new rate-cut cycle, especially as inflation nears the central bank’s 2% goal.

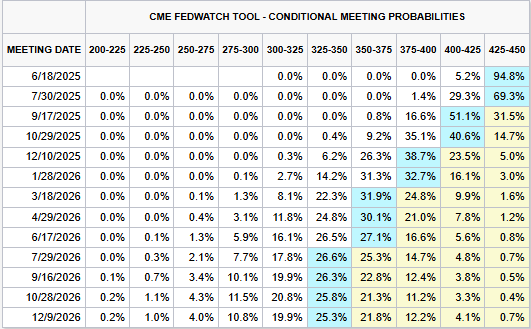

However, that has not been the case so far. According to CME Group's FedWatch Tool, there is still a 94.8% probability that the Fed will leave rates unchanged at 4.5% at its June 18 meeting, and a 69.3% probability of the same outcome at the July 30 meeting.

Source: CME Group

This divergence in monetary policy has likely contributed to the lack of clear direction in EUR/USD. On one hand, Europe is hinting at a potential shift away from easing, while the U.S. maintains a firm stance with elevated rates.

This rate differential, 4.5% in the U.S. vs. 2.25% in the Eurozone, continues to favor dollar-denominated assets, which could increase demand for U.S. fixed income instruments, ultimately boosting demand for the U.S. dollar. In this context, downward pressure on EUR/USD could intensify if this divergence remains in place.

EUR/USD Technical Outlook

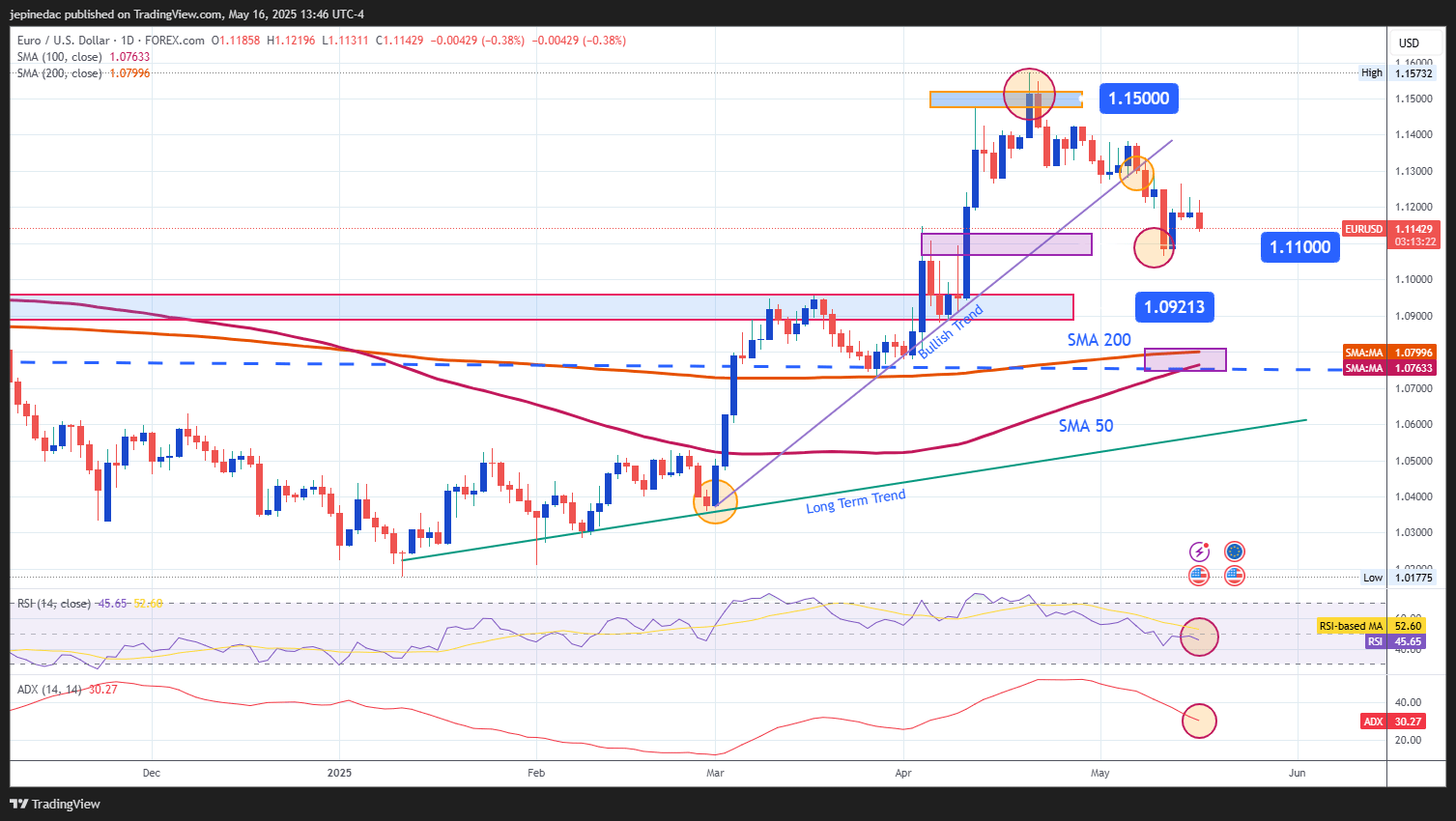

Source: StoneX, Tradingview

- Bullish Trend Break: In recent sessions, selling pressure has been strong enough to break the short-term uptrend that had been in place since early March. While the pullback has not been aggressive enough to confirm a new prolonged downtrend, it has been sufficient to invalidate the bullish bias that had been forming. The pair is now in a zone of indecision near 1.11000, and as long as price continues oscillating around this level, the market may enter a sideways phase in the near term.

- RSI: The RSI line remains close to the 50 level, reflecting a balance between buyers and sellers. If the RSI continues to flatten at this level, the lack of clear direction may persist and weigh on the pair in the short term.

- ADX: Although the ADX line remains above 20, its slope has started to fall below 30, indicating a decline in trend strength. If the ADX continues to drop, it could suggest further indecision in euro price movements.

Key Levels:

- 1.11000 – Crucial Support: A psychological level aligned with recent zones of indecision. A breakdown below this area could trigger a broader bearish bias.

- 1.09213 – Distant Support: A support zone near the 100- and 200-period simple moving averages. A sustained move toward this level could initiate a new downtrend on the chart.

- 1.15000 – Key Resistance: A psychological level and the recent multi-month high. If price returns to this area, it could reactivate the bullish bias and lead to a resumption of the upward trend.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25