EUR/USD, Euro, ECB Talking Points:

- Tomorrow brings a rate decision from the European Central Bank with the wide expectation for a 25 bp cut.

- Despite that expectation EUR/USD has been breaking out over the past two months, setting a fresh three-year high just last Friday.

- The weekly EUR/USD chart is overbought and sellers had an open door to run a pullback at the start of this week – but they could not get below the 1.1275 Fibonacci level and bulls have since used that price as a springboard from higher-low support.

There seems to be little suspense around what the ECB might do at tomorrow’s rate decision. The bank is widely expected to cut rates by 25 bps, but you might not know that by looking at the chart as the pair has just flexed up to a fresh three-year high as of last Friday.

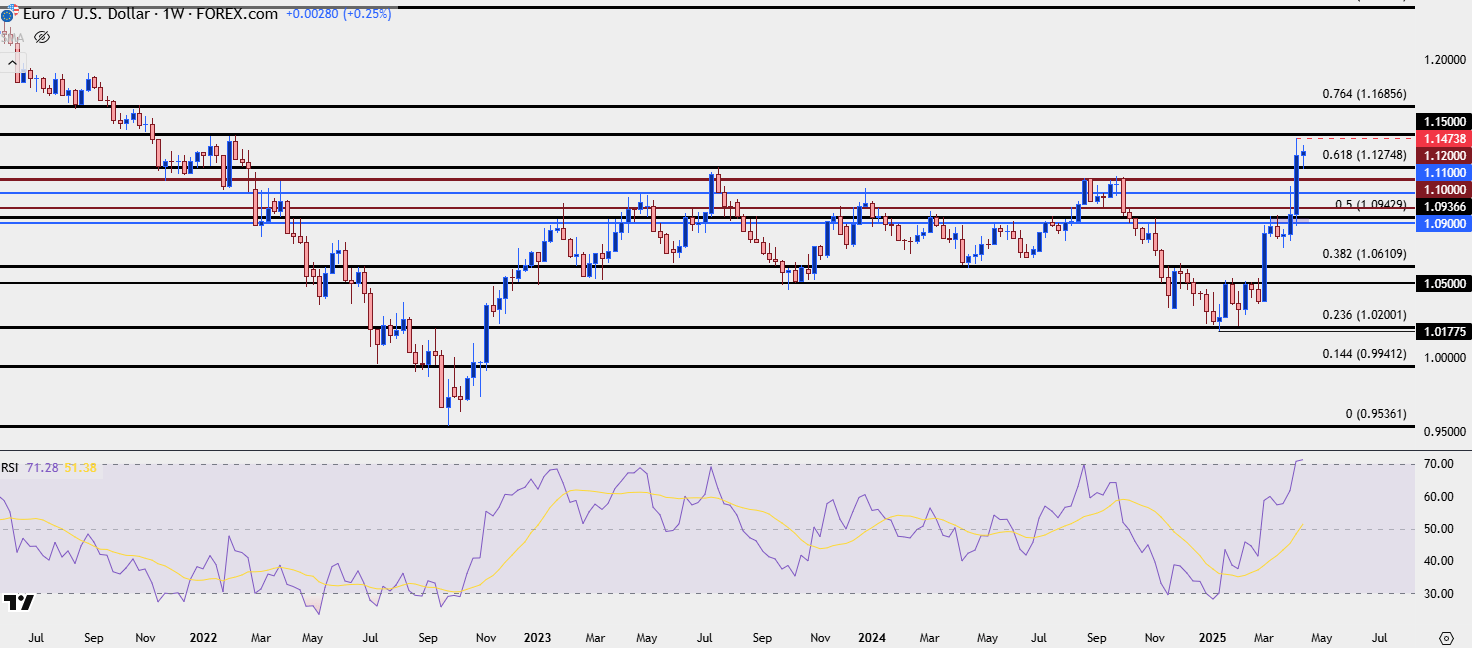

Adding some context to the mix is the fact that RSI is now overbought on the weekly chart and that’s not a very common occurrence. That doesn’t denote an automatic reversal, but it can make it more difficult for bulls to chase trends higher given just how one-sided the move has been.

So far buyers have jumped at the first relevant spot of support, the 1.1275 level looked at in yesterday’s webinar and that rally today erases the losses from both Monday and Tuesday. It also begs the question as to what happens in breakout scenarios – as the weekly RSI reading is still overbought and the 1.1500 psychological level looms overhead. And there’s also the matter of the U.S. Dollar to consider, which is oversold on the weekly and sitting very near key Fibonacci support.

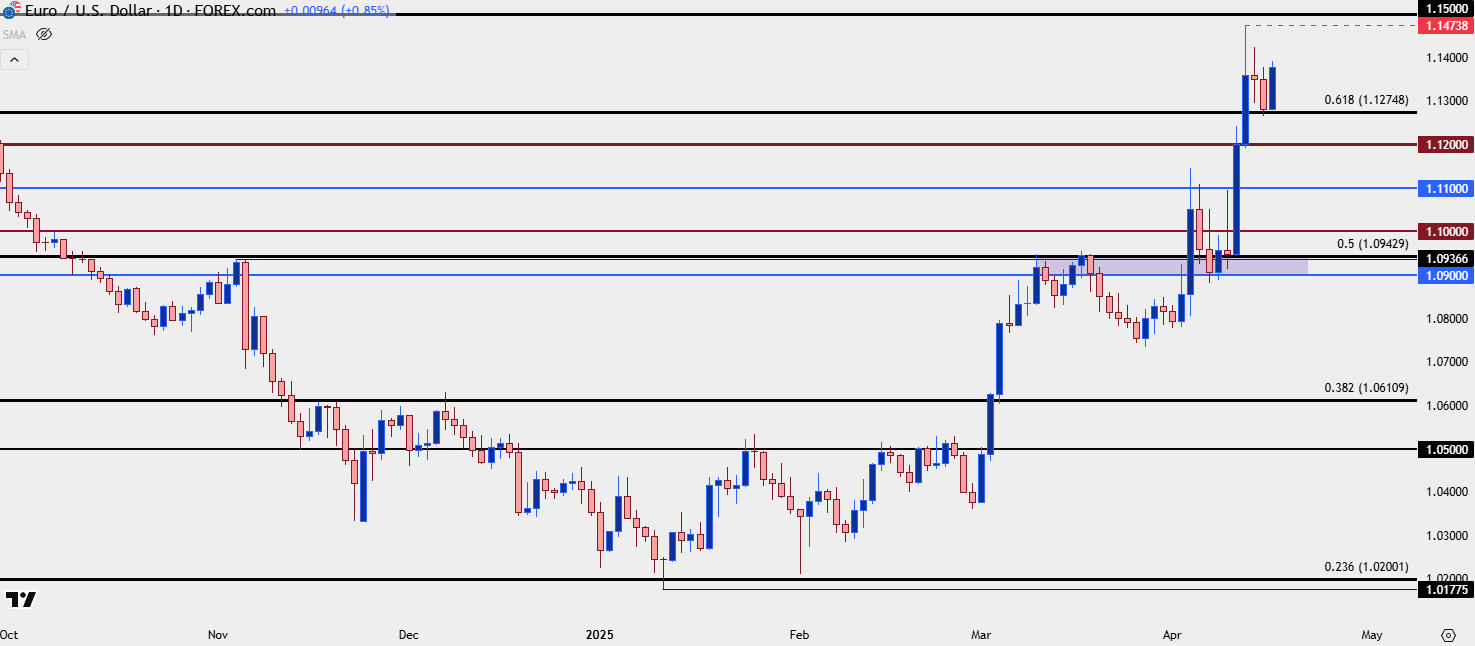

EUR/USD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

The Weekly Chart

At this point both EUR/USD and USD remain in extremes via RSI on the weekly chart, and there’s still some time left for that to change. If we do see a pullback in EUR/USD and USD, there could be a return from oversold in USD and overbought in EUR/USD. But also of consideration is the fact that if we do see that top-side trend in EUR/USD extend up to fresh highs, there’s another possible area of resistance for bulls to contend with at the 1.1500 level.

That’s a price that hasn’t been in-play since early-2022, and when it was in-play, it held the highs on three occasions before a larger reversal developed.

If we do see the breakout extend for a test there tomorrow or Friday – will buyers actually be able to continue to push through, even with an overbought backdrop in the equation?

EUR/USD Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

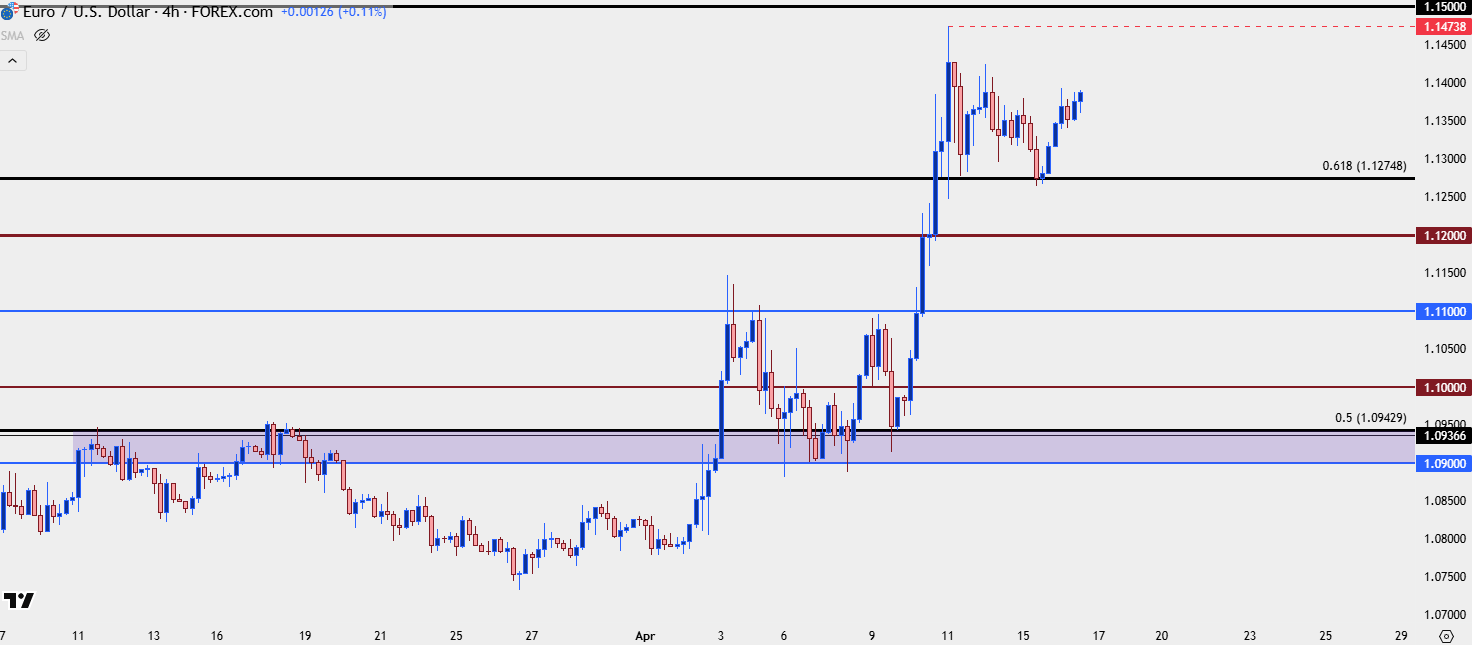

EUR/USD Shorter-Term Strategy, Structure

At this point the response to support at 1.1275 has been clean, as that price helped to hold yesterday’s low and that was followed by a bounce of more than 100 pips. That could keep the level as attractive for support plays if it does come back into the equation again, but the fact that it’s already drawn buyers in must be taken into account – and if we do see bulls fail to press up to a higher-high, then the door should open for a short-term lower-low which can lead to another key test.

In EUR/USD, the 1.1200 level stands out as that was the swing-high from last year on multiple occasions. And then the 1.1100 level is of interest as this was resistance in early-April and, to date, hasn’t yet shown as support. Even 1.1000 could be construed as higher-low support given last week’s bounce from the 1.0943 Fibonacci level.

For invalidation, or as indication that bears are taking back over, it’s that 1.0900-1.0943 zone that I would like to see a closed body on a daily candlestick to illustrate that possibility.

EUR/USD Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist