US Dollar Outlook: EUR/USD

EUR/USD may continue to trade within the April range as it defends the rebound from the weekly low (1.1210), but the exchange rate may track the positive slope in the 50-Day SMA (1.1196) as it still holds above the moving average.

EUR/USD Defends Rebound from Weekly Low to Hold Above 50-Day SMA

Keep in mind, EUR/USD registered a fresh monthly high (1.1419) at the start of the week as US President Donald Trump pushed back the 50% tariff for Europe until July 9, and the US Dollar may face additional headwinds ahead of the next Federal Reserve meeting in June as the US Court of International Trade rules against the tariffs imposed by the Trump administration.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

With that said, EUR/USD may attempt to retrace the decline from the April high (1.1573) as it bounces back ahead of the 50-Day SMA (1.1196), but failure to hold above the moving average may indicate a potential change in trend as the ongoing shift in US fiscal policy continues to influence financial markets.

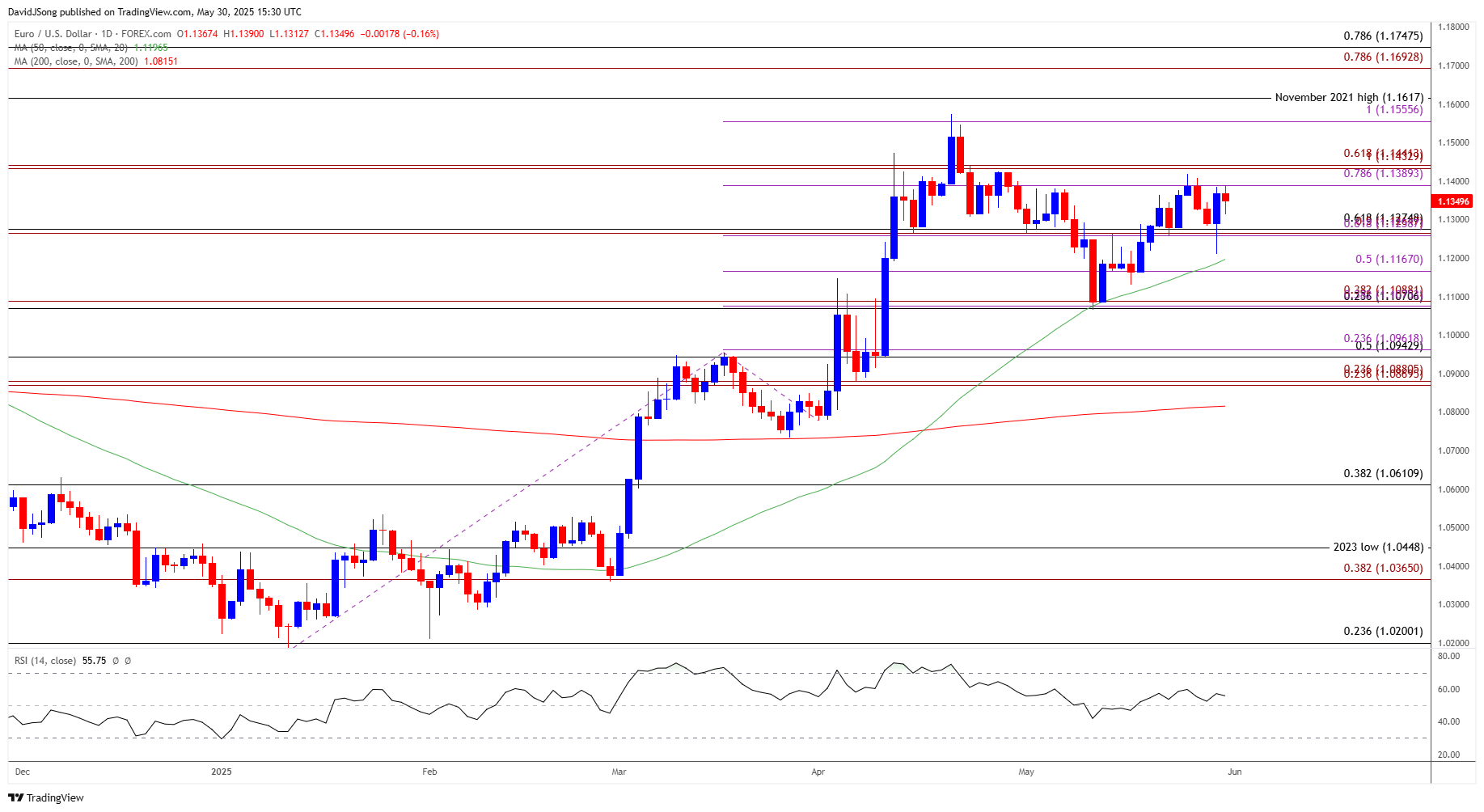

EUR/USD Chart – Daily

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

- EUR/USD seems to be stuck in a narrow range amid the failed attempt to close below the 1.1260 (61.8% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement) zone, but a break/close above the 1.1390 (78/6% Fibonacci extension) to 1.1440 (61.8% Fibonacci extension) region may push the exchange rate toward 1.1560 (100% Fibonacci extension).

- A breach above the April high (1.1573) brings the November 2021 high (1.1617) on the radar, with the next area of interest coming in around 1.1690 (78.6% Fibonacci extension) to 1.1750 (78.6% Fibonacci retracement).

- At the same time, a close below the 1.1260 (61.8% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement) zone may push EUR/USD toward 1.1170 (50% Fibonacci retracement), with the next area of interest coming in around 1.1070 (23.6% Fibonacci retracement) to 1.1090 (38.2% Fibonacci extension).

Additional Market Outlooks

Australian Dollar Forecast: AUD/USD Halts Bearish Price Series

Canadian Dollar Forecast: USD/CAD Snaps Rebound from May Low

GBP/USD Holds Below February 2022 High for Now

USD/JPY Approaches Monthly Low as Trump Plans 50% Tariff for Europe

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong