Key Events Ahead:

- US Unemployment Claims and Final GDP

- US Core PCE on Friday and the Upcoming NFP Week

- April Tariff Quotas Support a Cautious Market Outlook

Tariffs, reciprocal tariffs, auto tariffs, trade war fears—these themes have dominated headlines ever since Trump’s trade agenda came into focus. We witnessed a pre-tariff market movement marked by a rush in Chinese exports, and now, it feels like we’re in the eye of an uncertain storm. Are we witnessing merely heated negotiations, or is this the beginning of a new economic landscape shaking the markets until all is priced in?

Regardless of the narrative, market momentum has taken the lead. Oversold levels on indices resemble those seen in 2022 and 2023 on weekly timeframes, while overbought levels on gold mirror peaks from 2024, 2020, and 2011 on the monthly scale. This supports potential reversals from a momentum perspective. However, persistent concerns over tariff consequences are keeping these reversals on a cautious edge.

US indices are facing bearish volatility risks as they test resistance zones, while gold exhibits bullish volatility risks as it tests support levels. As for currencies, the US Dollar is experiencing a cautious bullish rebound, mirrored by a tentative bearish rebound in the euro, pound, and yen. These currencies are navigating one key level at a time, leaving longer-term projections quite uncertain.

Technical Analysis: Quantifying Uncertainties

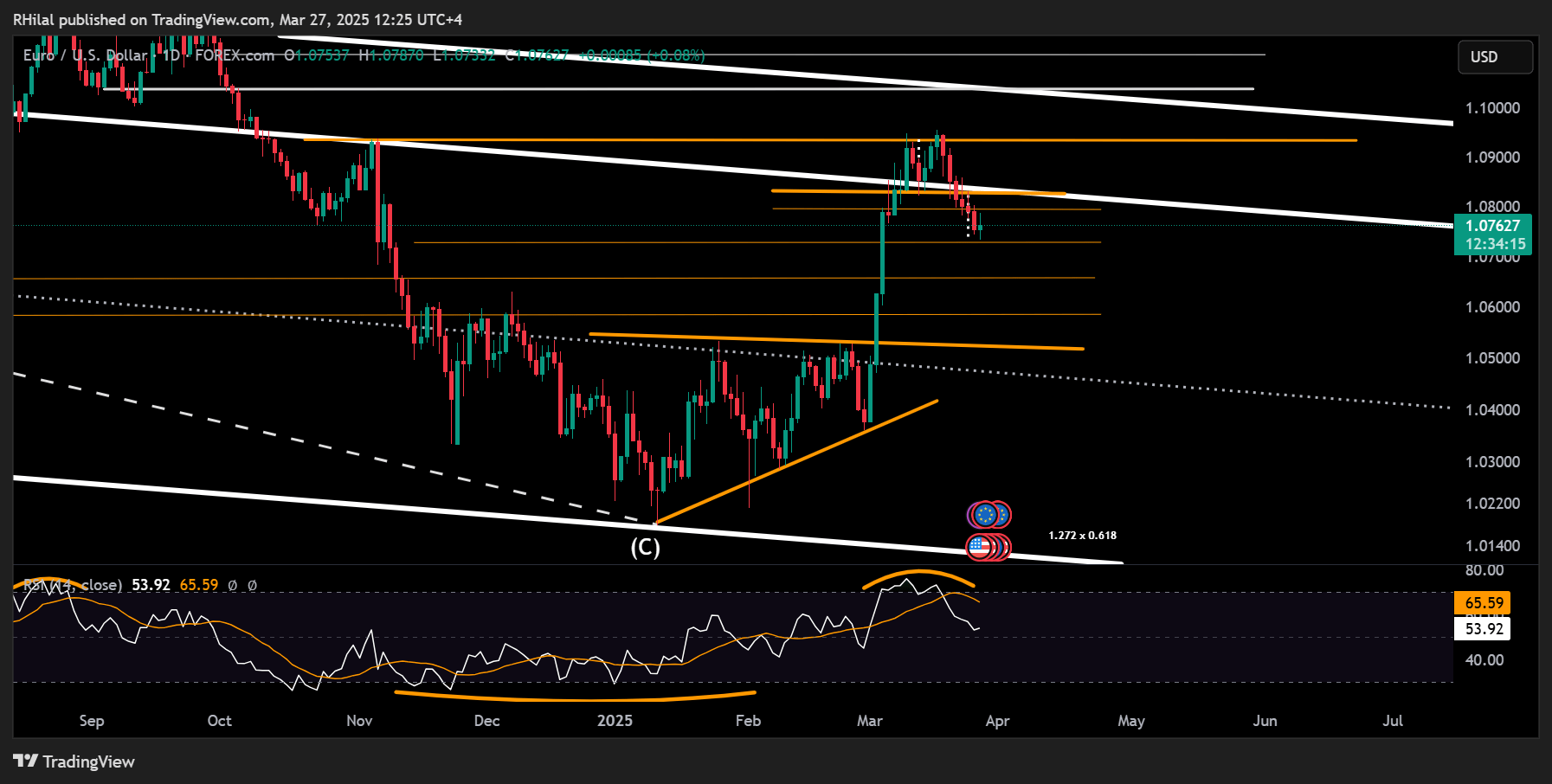

EURUSD Outlook: Daily Time Frame – Log Scale

Source: Tradingview

From a daily perspective, the EURUSD pair has met the projected target of a double top formation, reversing from the 1.0940 resistance zone and touching down at 1.0730. This level aligns with the 0.382 Fibonacci retracement of the March 2025 uptrend from the 1.0370 low to the 1.0955 high. A decisive breach below 1.0730 could expose the next potential support levels at 1.0660 and 1.0590.

On the upside, if the pair holds above 1.0730, former support levels at 1.0790 and 1.0820—now resistance—may limit gains before a confirmed bullish momentum resumes toward the 1.0950 high and potentially higher towards the critical 1.1040 resistance. This latter level aligns with the upper boundary of the euro’s broader downtrend extending from the 2008 highs.

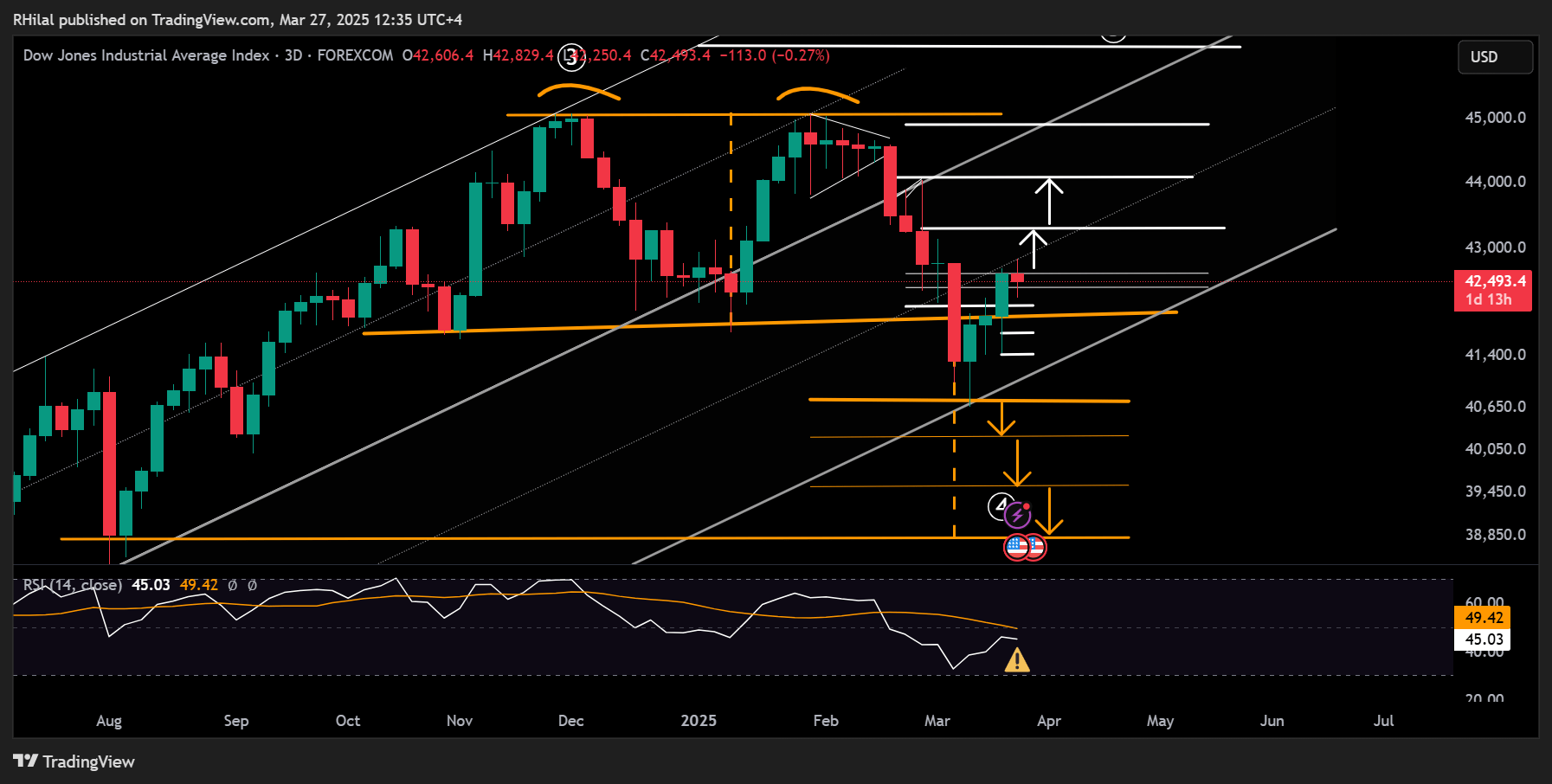

Dow Outlook: 3-Day Time Frame – Log Scale

Source: Tradingview

The Dow’s positive rebound above the 42,000 barrier is currently facing resistance in the 42,600 zone, amid a persistently uncertain outlook shaped by US tariffs. A sustained breakout above 42,600 could extend the rally toward 43,000, then 44,400, and possibly 45,000—reinforcing a more bullish long-term view.

Conversely, failure to hold above 42,600 may trigger downside pressure, with support levels likely near 42,100, 41,900, 41,700, and 41,400. A deeper decline could reinforce bearish sentiment, possibly validating a double top pattern around the 45,000-mark.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves