The last five trading sessions have been fairly neutral for EUR/USD movements, with barely a 0.8% variation. It appears that neutrality has taken hold of the pair below the key 1.15000 zone. This neutral bias is mainly due to investors' expectations ahead of the upcoming FED decision, as well as the longer-term stance the ECB may adopt. As markets await statements from both central banks, it is likely that expectations will continue to prolong this neutrality in the EUR/USD.

The Role of Central Banks

Currently, there remains a notable disparity in interest rates between two of the world's leading central banks. The FED maintains a steady rate of 4.5%, while, after the latest cut, the ECB shows a deposit rate of 2.25% and a refinancing rate of 2.4%, both clearly trending downward. For now, the United States is pursuing a more aggressive monetary policy, favoring fixed-income returns compared to the European market, where rates are significantly lower.

Source: Trading Economics

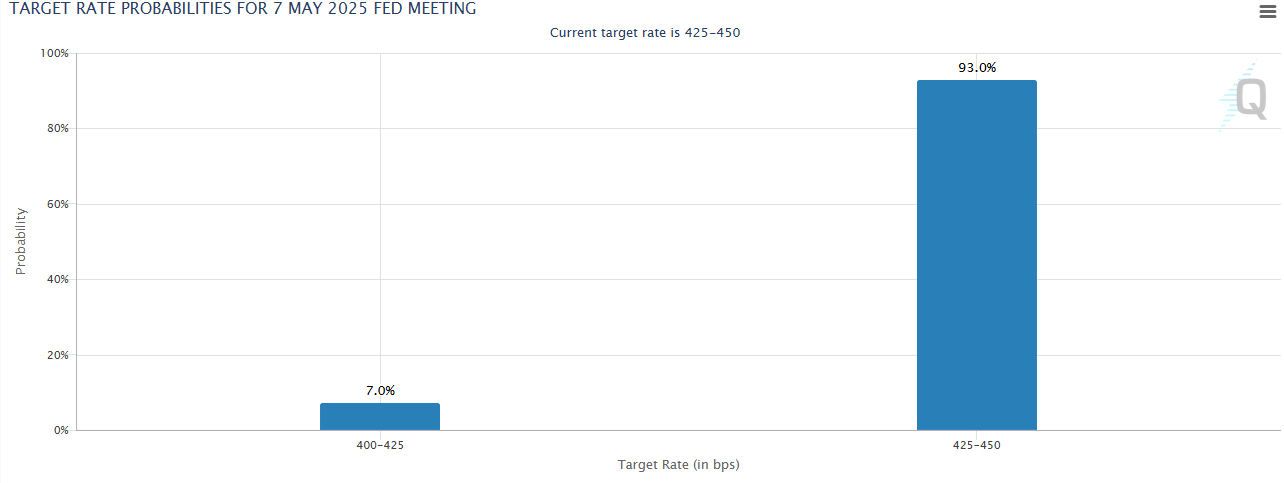

The Federal Reserve's decision is approaching and is scheduled for May 7. According to the CME Group probability chart, there is a 93% chance that the central bank will maintain the interest rate within the current 4.25%–4.5% range, maintaining its recent neutral stance and continuing its efforts to bring inflation down to the 2% target. In the short term, the FED is thus expected to uphold a neutral rate outlook.

Source: CME Group

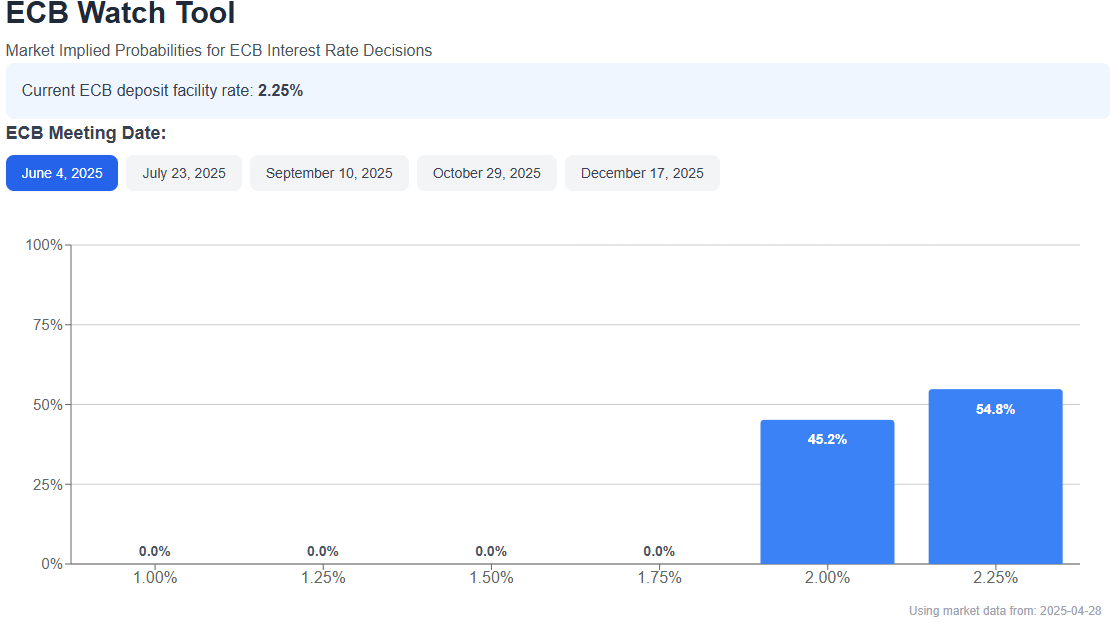

Meanwhile, the situation for the European Central Bank (ECB) remains uncertain. According to the ECB Watch Tool, there is a 54.8% probability that the deposit rate will remain at 2.25%, and a 45.2% probability that it will be lowered to 2% at the meeting scheduled for June 4. This indicates that the ECB is currently slightly neutral but could lean toward further rate cuts in the short term.

Source: ECB Watch Tool

Taking this into account, a significant interest rate gap remains: the United States maintains higher and stable rates, while Europe shows lower rates with a risk of further reductions. This disparity is key, as bond yields in both regions are tied to central bank rates. As long as the FED maintains higher rates, U.S. bonds could remain more attractive, boosting demand for the U.S. dollar. This phenomenon could exert downward pressure on the EUR/USD in the coming weeks if the FED keeps its current course.

Don’t Forget About the U.S. Dollar

Following the turmoil of the trade war, and with President Trump now advocating for a truce with China—facilitating negotiations to resolve the tariff conflict—confidence has gradually returned to the financial markets.

This resurgence in confidence has also supported a recovery in the U.S. dollar, which had been experiencing a prolonged three-month bearish streak. Currently, the DXY index is oscillating near the 100-point zone, reflecting a steady recovery of the greenback against a broad basket of assets.

Source: Market Watch

The U.S. dollar's recovery, driven by improved market confidence, is a crucial factor explaining the recent corrections in the EUR/USD. If dollar strength persists, selling pressure on the pair could intensify in the short term.

EUR/USD Technical Forecast

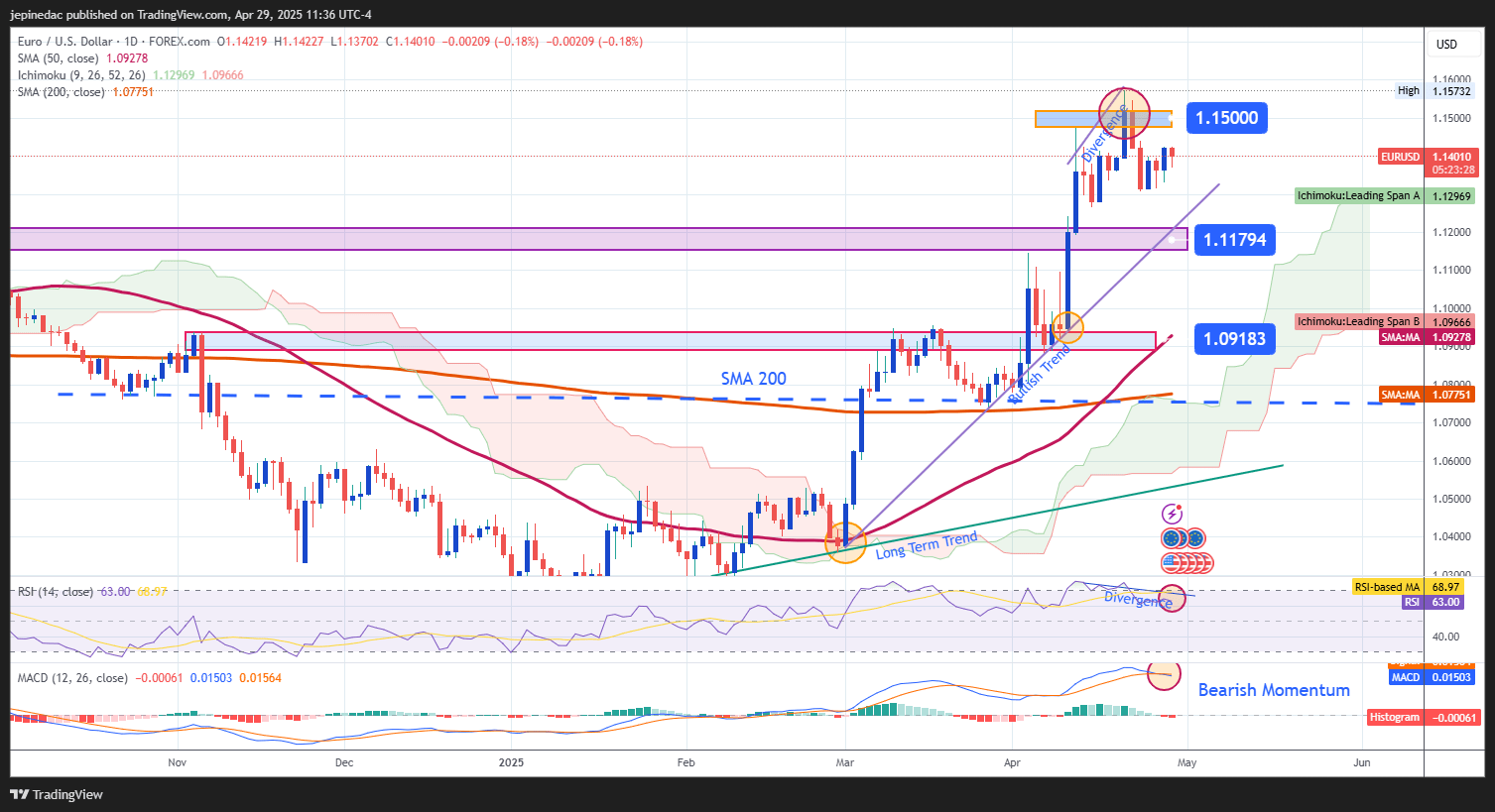

Source: StoneX, Tradingview

- Trend Accelerates: Since March 3, the EUR/USD uptrend has steepened, confirming strong buying momentum over the past few weeks. However, the price has encountered resistance below the key 1.15000 level, entering a neutral phase that has prevented the formation of new highs. This suggests the uptrend is facing a consistent loss of bullish momentum.

- RSI: The RSI remains above the 50 level, indicating buying momentum dominance. However, it is close to the overbought level of 70, and a divergence is also observed: while the price reaches new highs, the RSI's highs are lower. This imbalance could open room for potential bearish correction in the short term.

- MACD: The MACD histogram has crossed below the neutral 0 line, showing bearish oscillations. Additionally, a negative crossover between the MACD line and the signal line has occurred, reinforcing the possibility of emerging selling momentum in the short term. These signals also suggest a possible exhaustion of bullish strength.

Key Levels:

- 1.15000 – Tentative Resistance: A key psychological level in the short term. A sustained breakout above this zone could reinforce the bullish bias and pave the way for a stronger trend.

- 1.11794 – Nearby Support: A neutrality zone observed in October 2024. It could act as a barrier against potential bearish corrections triggered by U.S. dollar strength.

- 1.09183 – Major Support: A level where previous consolidations occurred, aligned with the 50-period simple moving average. A pullback toward this level could put the current bullish structure of the EUR/USD at risk.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25