Over the past five trading sessions, EUR/USD has shown consistent strength, climbing more than 2% and successfully breaking through the psychological 1.15000 level, while the U.S. dollar continues to weaken in the short term. This bullish momentum remains solid following the recent European Central Bank (ECB) rate decision, which has not been sufficient to slow down the market's upward move.

ECB Rate Decision

On April 17, the ECB announced a 25-basis point rate cut, lowering the benchmark rate to 2.25%. This move continues the central bank's policy shift toward a more accommodative monetary stance, reflecting its commitment to supporting economic activity in the eurozone.

During her speech, ECB President Christine Lagarde stated that inflation remains under control, highlighting that the March reading came in at 2.2%, which aligns closely with the ECB’s 2% target. She also noted that growing uncertainty surrounding trade tensions, particularly those stemming from White House tariff policies, could put additional pressure on the European economy. In this context, lower interest rates are seen as crucial for maintaining regional stability.

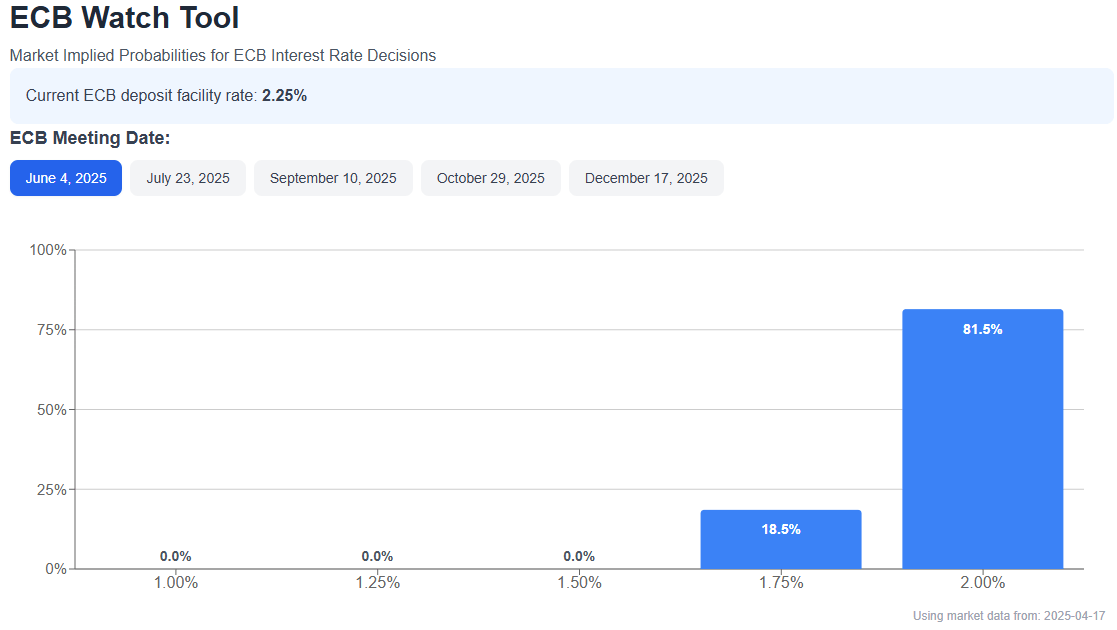

The ECB has also indicated that future policy decisions will depend on how global trade dynamics evolve. According to the ECB Watch Tool, there is currently an 81.5% probability that the central bank will cut rates again to 2.0% at its next meeting on June 4, reaffirming its short-term dovish outlook.

Source: ECB-WATCH

Under normal conditions, a steady path of rate cuts would typically weigh on the euro, as lower yields tend to reduce demand for euro-denominated assets. However, the market appears to have already priced in the rate cut, limiting the downside reaction. On the contrary, some investors are viewing the ECB’s decision as a strategic move in response to potential economic slowdown, particularly amid rising trade tensions. This has positioned the euro as a relatively resilient currency, which may continue to support bullish pressure on EUR/USD in the coming weeks.

How Is the U.S. Dollar Reacting?

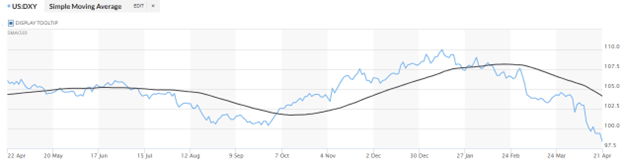

The U.S. dollar has shown clear weakness in recent sessions, as evidenced by the DXY index, which is currently trading near 98 points, its lowest level in the past year.

Source: Marketwatch

This decline is largely driven by growing political uncertainty in the United States, not only due to the ongoing trade war, but also following statements by President Donald Trump, who has even threatened to remove Jerome Powell as Chair of the Federal Reserve. These remarks have raised concerns about central bank independence, adding to investor unease.

As a result, the market has witnessed capital outflows from the U.S., leading to increased dollar selling and strengthening demand for the euro. If this negative sentiment toward U.S. political risk persists, the dollar may remain under pressure, further supporting upward momentum in EUR/USD.

EUR/USD Technical Outlook

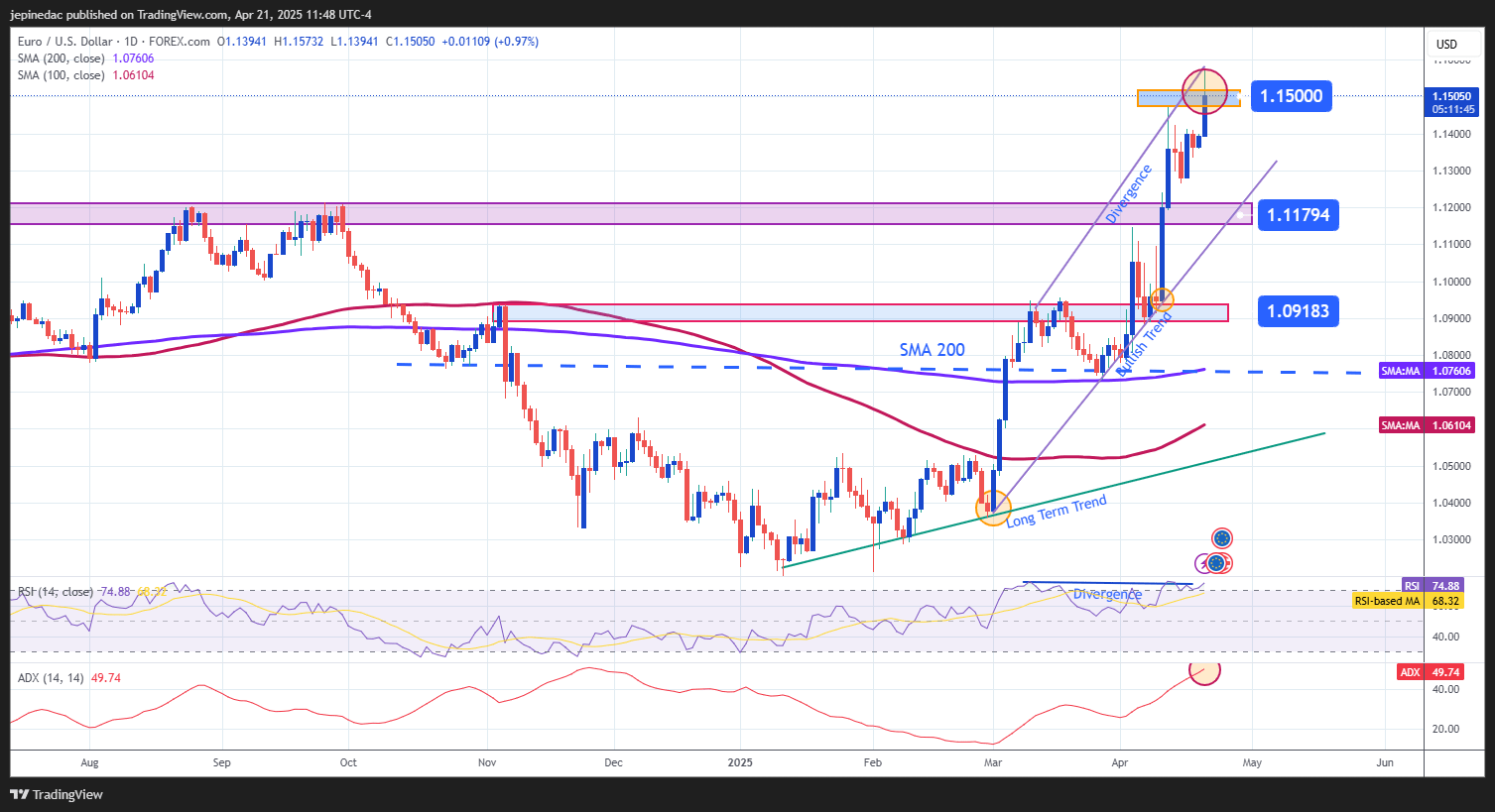

Source: StoneX, Tradingview

- Bullish Trend Holds: Since March 3, EUR/USD has followed a steepening upward trendline, confirming the strong bullish momentum in recent weeks. The pair has now cleared the psychological resistance at 1.15000, and if it remains above this level, the bullish bias is likely to strengthen further in the coming sessions.

- ADX: The ADX line has risen significantly and is now approaching 50, a level not seen since November 2024. This indicates that the current uptrend is gaining strength, and future price movements could become even more aggressive.

- RSI: The RSI is currently trading above the 70 level, placing EUR/USD in overbought territory. Additionally, a technical divergence has emerged, with higher highs in price but flat RSI readings, which may suggest an imbalance in buying pressure. This could lead to a short-term pullback if market forces begin to correct.

Key Levels:

- 1.15000 – Current Barrier: A key psychological level in the short term. A sustained breakout above this zone could reinforce the bullish trend and set the stage for a longer-lasting rally.

- 1.11794 – Near-Term Support: This level aligns with previous consolidation zones from October 2024 and could act as a support area if price retreats.

- 1.09183 – Major Support: A key technical zone where previous price consolidations occurred. A break below this level could threaten the existing bullish structure on the chart.

Written by Julian Pineda, CFA – Market Analyst