EUR/USD falls ahead of inflation data, Trump’s tariffs

- Eurozone inflation is expected to cool to 2.2%

- Trump’s trade tariffs worries keep USD gains limited

- EUR/USD holds above the 200 SMA

EUR/USD is edging lower after failing to rise above 1.0850 yesterday. The euro is out of favour as traders look ahead to eurozone inflation data and US reciprocal tariff announcements on Wednesday while also digesting news that French far-right leader Marine Le Pen has been found guilty of embezzling European parliamentary funds.

Eurozone inflation data will be released at 9:00 GMT and is expected to show that inflation ticked lower to 2.2% down from 2.3%. The figures follow German inflation data from yesterday, which is at 2.2%. Cooling inflation indicators suggest that the ECB will cut rates by 25 basis points again at the April meeting.

The markets are also bracing themselves for President Trump's announcement of reciprocal tariffs tomorrow, although details remain scarce. High tariffs on Europe could raise concerns for the growth outlook.

Meanwhile, the USD has struggled amid concerns that Trump's tariffs could slow the US economy, creating a tailwind for the pair in the near term. Should Trump's adopt a softer stance on tariffs this could soothe investors worries, which could help limit USD losses.

Yesterday, Richmond Fed president Thomas Barkin said the Fed would need to have greater confidence that inflation is cooling before cutting rates again. The market continues to price in two quarter-point rate cuts this year, the first of which is expected to come in July.

On the data front, ISM manufacturing PMI figures are expected to be released later today and are anticipated to show that manufacturing activity contracted in March to 49.5, down from 50.3 in February. Meanwhile, prices paid are expected to rise to 65 from 62.4, indicating persistent inflationary pressures.

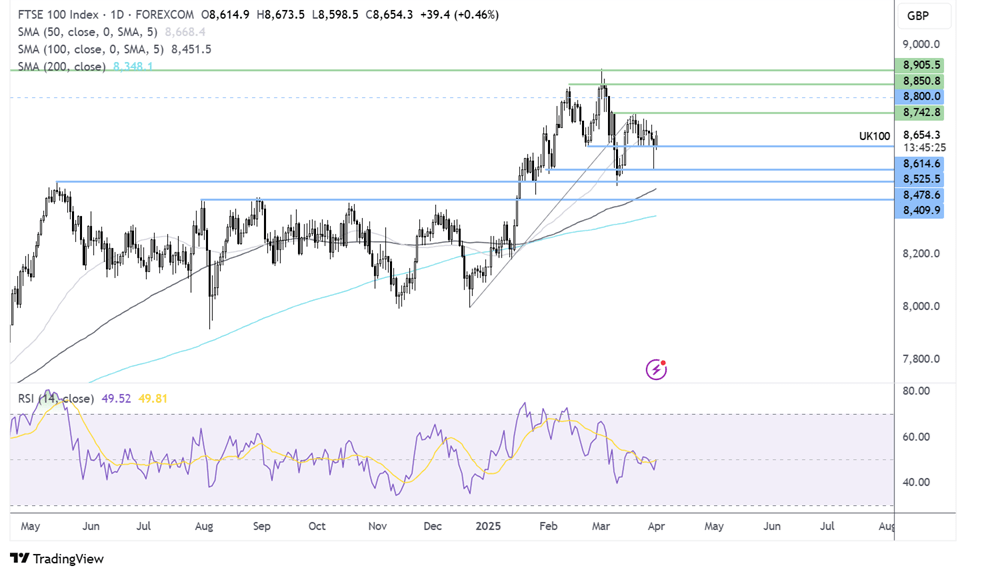

EUR/USD forecast technical analysis

After running into resistance at 1.0940, EUR/USD rebounded lower, finding support at the 200 SMA and recovering to 1.08. The price is caught between these levels, where buyers lack the drive to create a higher high above 1.0940 and sellers are too limited to push below the 200 SMA around 1.07.

The limited recovery from the 200 SMA could favour sellers. A break below 1.07 is needed to create a lower low.

FTSE rises after gaining 5% in Q1

- UK hopeful any tariffs could be reversed quickly

- UK grocery inflation rises 3.5%

- FTSE trades in a holding pattern

The FTSE is pushing higher on Monday, recouping losses from the previous day as the market mood stabilises ahead of Trump's trade tariff announcements tomorrow. While the UK index fell yesterday, it has booked gains of 5% in Q1, the largest quarterly gain since Q4 2022.

The UK remains hopeful that the tariffs imposed by President Trump will be reversed shortly, provided the two sides can agree on an economic partnership. The UK has been keen to avoid Trump's tariff plan by offering to work more closely with Washington in areas including technology.

Banks miners and airlines are helping to drive the FTSE higher. Housebuilders More broadly unchanged after data showed UK house prices were flat in March and the market could stay soft after a tax increase on property transactions.

On the downside retailers are under pressure after data showed that UK grocery inflation edged higher in March putting pressure on consumers at a time when they're facing other cost increases. Kantar data showed annual grocery inflation was 3.5% in the four weeks to March UK grocery sales rose 1.8% over the same. The slowest pace of growth since June last year.

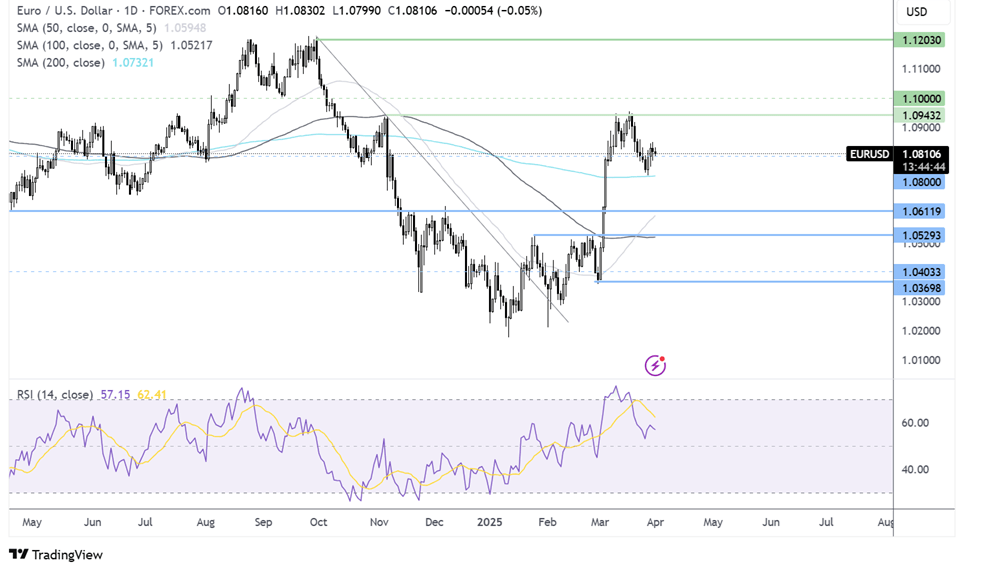

FTSE forecast- technical analysis

The FTSE trades in a holding pattern, capped on the upside by 8740 and by 8615 on the downside. The RSI is neutral.

A breakout trade setup sees buyers looking to enter a buy position above 8740 to bring 8800 and 8850 into focus.

Sellers could look to enter a sell position below 8615, with support seen at 8530 and 8480.