EUR/USD holds above 1.14 ahead of EZ inflation data

- EZ HICP is expected to fall to 2%

- The USD is rising but the outlook remains weak

- EUR/USD has recovered above 1.1400

EUR/USD is modestly lower, giving back some of yesterday's gains, but remains above the 114 level as the USD recovers some ground on a technical correction and despite ongoing concerns over the outlook for the US economy amid Trump's erratic trade policies.

The U.S. dollar is recovering slightly after weakness in recent sessions as Trump ramped up rhetoric against China, raising concerns of escalating trade tensions. Meanwhile, data from yesterday suggests that ISN manufacturing PMI declined for a third straight month. The manufacturing PMI file saved 48.5 in May, down from 48.7 in April, which was weaker than the 49.5 forecast.

Looking ahead, US factory orders are expected to fall 3% in April, while Jolts job openings are also expected to show that the labour market is slowing modestly, with 7.1 million openings down from 7.2 million in May.

The row has been a key benefactor of USD weakness amid Trump's trade policies, with the recent rally in the euro reflecting the dollar's vulnerabilities even though the ECB is expected to cut interest rates again this week,

today attention will be on eurozone inflation data which is expected to show that H sip inflation is to 2% the central bank's target supporting the view the ECB will cut rates by 25 basis points on Thursday. Weaker-than-expected inflation data could add 2 dovish ECB bets, pulling the euro lower.

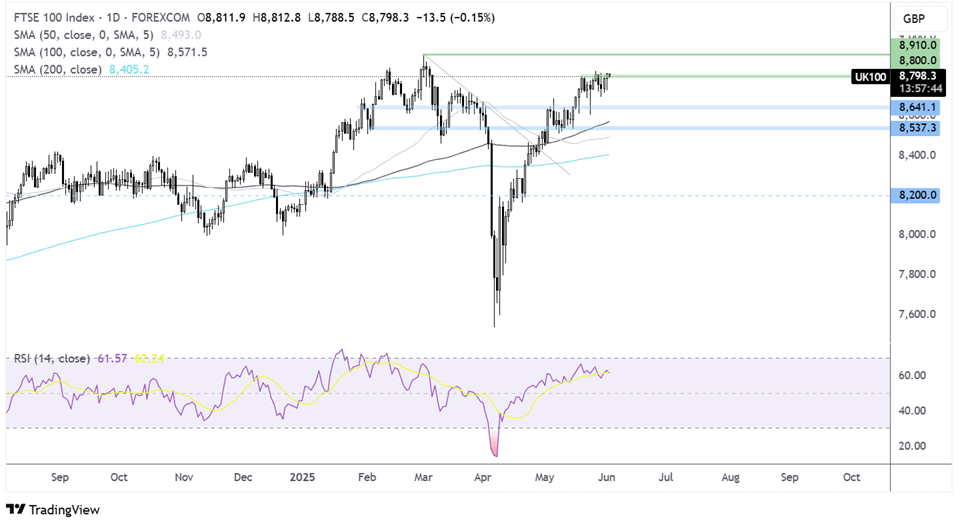

EUR/USD forecast technical analysis

EUR/USD has extended its recovery from the 1.1065 May low, rising above 1.14. The price is being guided higher by the 50 SMA as it looks towards 1.1450. A rise above here could open the door to 1.15 and fresh YTD highs.

Should the price weaken below 1.14, the next support is seen at 1.1285 ahead o 1.12, last week’s low and the 50 SMA.

FTSE 100 struggles as miners drop after weak Chinese data

- Chinese manufacturing PMI falls into contraction

- Miners put pressure on the index

- FTSE’s recovery runs into resistance at 8800

The FTSE 100 is under pressure, pulled down by miners as Chinese manufacturing activity tumbles into contraction.

China's manufacturing sector experienced its worst slump since September 2020 according to the Caixin manufacturing PMI, which fell to 48.3 in May, down from 50.4 in the prior month. The figure 50 separates expansion from contraction.

The results were far weaker than expectations of a rise to 50.7. They were also significantly weaker than the official National Bureau of Statistics manufacturing PMI, which could be attributed to the two surveys covering different pool sizes and business types.

The weak data comes as President Trump ramped up rhetorically against China and as the impact of trade tariffs is felt across industries in Asia, Vietnam, Indonesia, Thailand, Japan, and South Korea. All suffered construction and manufacturing activity last month.

The data raises concerns over the outlook for the Chinese economy, which is affecting metal prices and dragging miners lower. Antofagasta trades 2 lower.

The UK economic calendar is quiet today. Attention will be on US factory orders, JOLTS jobs openings, and several Fed speakers, for further fears over the outlook of the US economy, which could impact broader market sentiment.

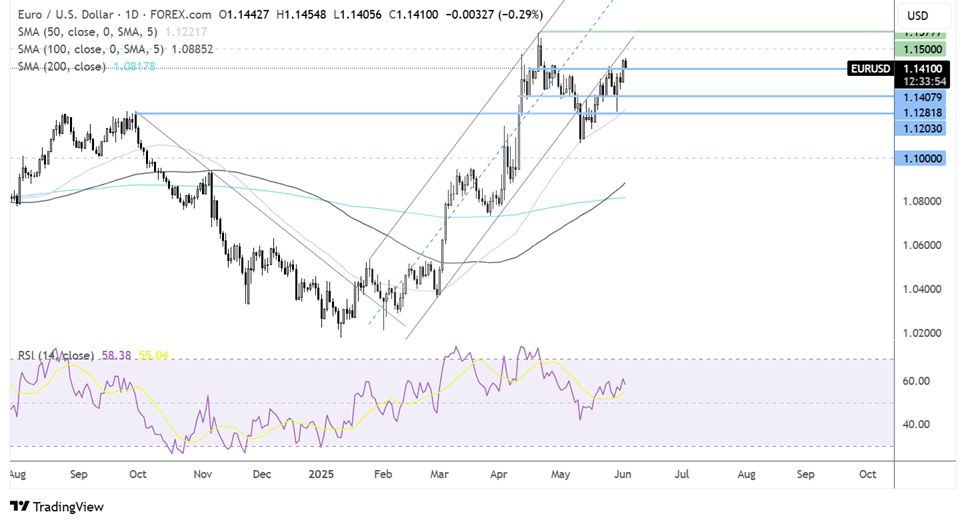

FTSE 100 forecast - technical analysis

The FTSE 100’s recovery from the 7535 low has run into resistance at 8800. Buyers will need to rise above this level to extend gains towards 8910 and fresh record levels.

Immediate support can be seen at 8725, and below here, 8650 comes into play.