Key Developments

- U.S. debate over striking Iran continues to paralyze global market momentum.

- EURUSD and the U.S. Dollar Index (DXY) sit near three-year extremes, poised for potential breakout as we move into H2 2025.

- Gold lags behind silver and conflict-driven momentum, holding below the $3,400 mark.

While Middle Eastern equity markets suffer losses amid the Israel–Iran escalation, speculation around potential U.S. military involvement has deepened global risk aversion. The MSCI UAE Index has fallen over 8% this month, raising concerns of a broader contagion that could spill over into global indices.

Despite this, demand for safe havens like gold and the U.S. dollar remains muted, with traders seemingly expecting a swift resolution—though real-world developments continue to signal escalation. Markets remain paralyzed post–Juneteenth holiday, as summer momentum collides with headline risk.

Still, key levels in EURUSD and gold will remain critical markers for directional conviction through the remainder of H2.

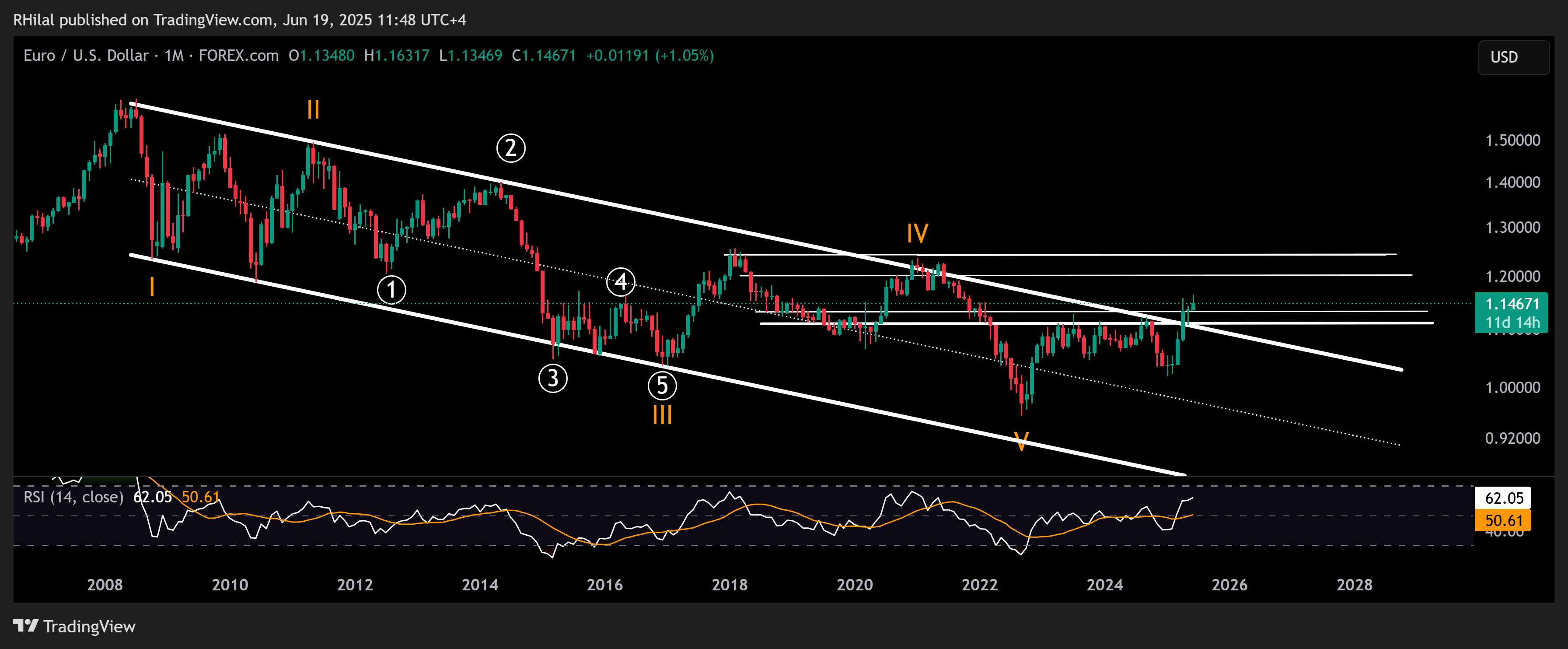

EURUSD Outlook: Monthly Time Frame – Log Scale

Source: Tradingview

From a monthly chart perspective, EURUSD maintains upside potential into the second half of 2025, trading solidly above a 17-year channel. However, renewed haven flows into the U.S. dollar amid geopolitical tensions are anchoring the pair at three-year extremes.

Key resistance stands at 1.1640, and a sustained break above it could open the path toward 1.1740 and 1.20, aligning with 2021 highs. On the downside, if a pullback intensifies and breaks below 1.1400, subsequent support levels to watch are 1.1320 and 1.1270. A deeper correction could push the pair toward the upper border of the long-term channel near 1.1070, serving as a major support zone.

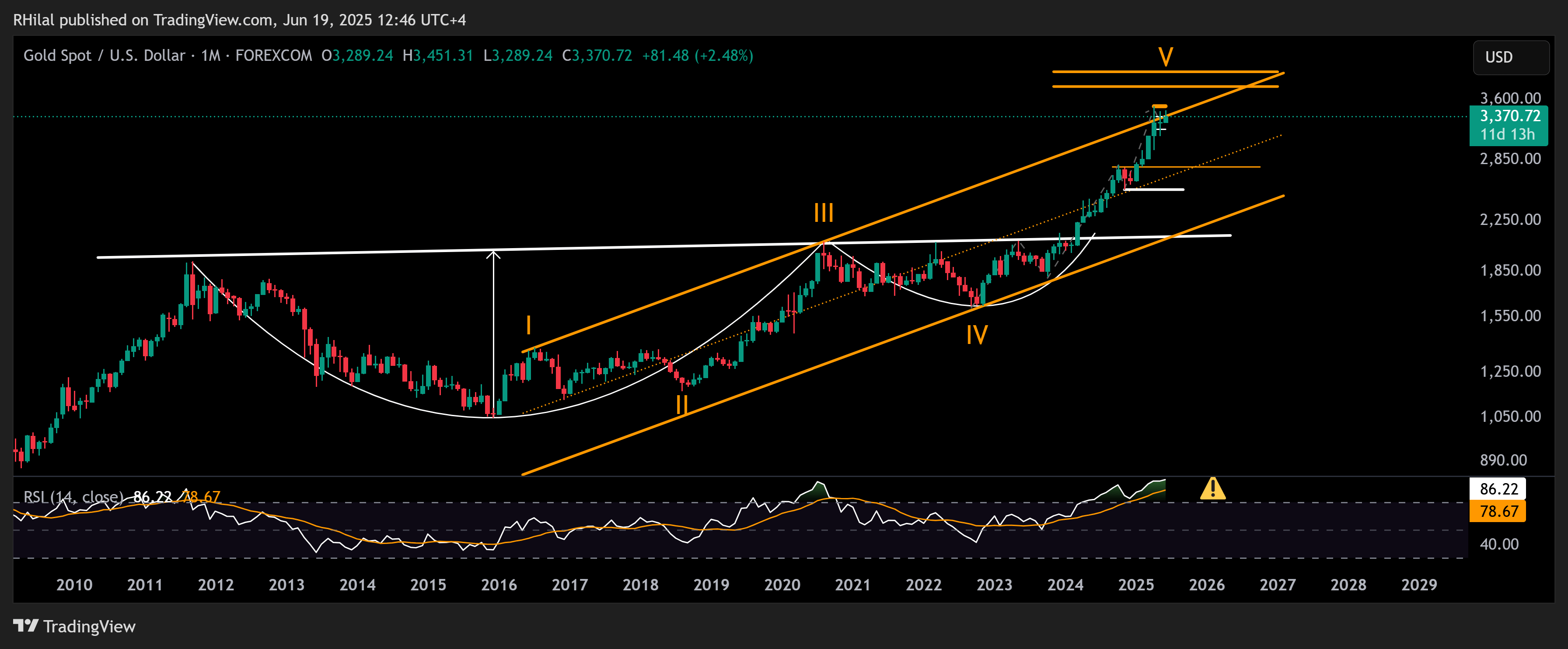

Gold Outlook: Monthly Time Frame – Log Scale

Source: Tradingview

Unlike silver—which recently reached new yearly highs near the 2012 peak of $37.40—gold continues to consolidate below the $3,400 level, awaiting a catalyst. Technically, gold remains at the upper boundary of a long-term ascending channel, anchored by the 2016 and 2020 highs.

It also sits just beneath the projected breakout zone of a large cup-and-handle pattern, with a potential target near $4,000. If gold manages a firm close above $3,500 and clears the upper boundary of the channel, bullish momentum could lift prices toward $3,700, and possibly $4,000, during the second half of 2025.

Conversely, sustained weakness below the $3,300 level would open the door to near-term support zones at $3,290, $3,240, $3,100, and $2,800, which may offer "buy-the-dip" opportunities along its primary uptrend.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves