Key Events to Watch:

- EU Plans to Fast-Track U.S. Tariff Negotiations

- Nasdaq Holds Above 21,000 Ahead of NVIDIA Earnings

- EUR/USD Holds Above 16-Year Channel amid Dollar Weakness

Trump’s Negotiation Tactics: Raise the Bar, Extend the Deadline

Following the 50% tariff threat toward the EU, we’re seeing a familiar pattern unfold in 2025: Trump initially raises tariff barriers, only to later extend deadlines, creating space for negotiations. This tactic, now playing out again with the EU, appears geared toward cushioning the economic impact as July approaches.

Despite Risk-Off Headlines, Nasdaq Remains Resilient

AI remains embedded in long-term national strategies across 2030 and beyond, which is keeping tech resilient even amid trade uncertainty and weaker economic data. Renewed AI-related projects between the U.S. and Gulf countries have supported risk appetite in tech, with markets now eyeing NVIDIA’s earnings on Wednesday. Expectations are high, but the announcement could raise volatility risks, particularly heading into Wednesday evening and Thursday's U.S. market open.

EUR/USD Eyes Historical Bullish Breakout as DXY Tests Key Support

The U.S. dollar, pressured by debt concerns, has declined toward critical 2025 lows near the 98 level. Meanwhile, the euro has stabilized near 1.1380, now trading above the upper boundary of a 16-year descending channel originating from the 2008 peak and extending through 2024.

This breakout positions EUR/USD for a potential long-term bullish move—provided the DXY confirms further downside. The dollar index appears to have room to test the lower bound of its own extended channel from the 2008 lows.

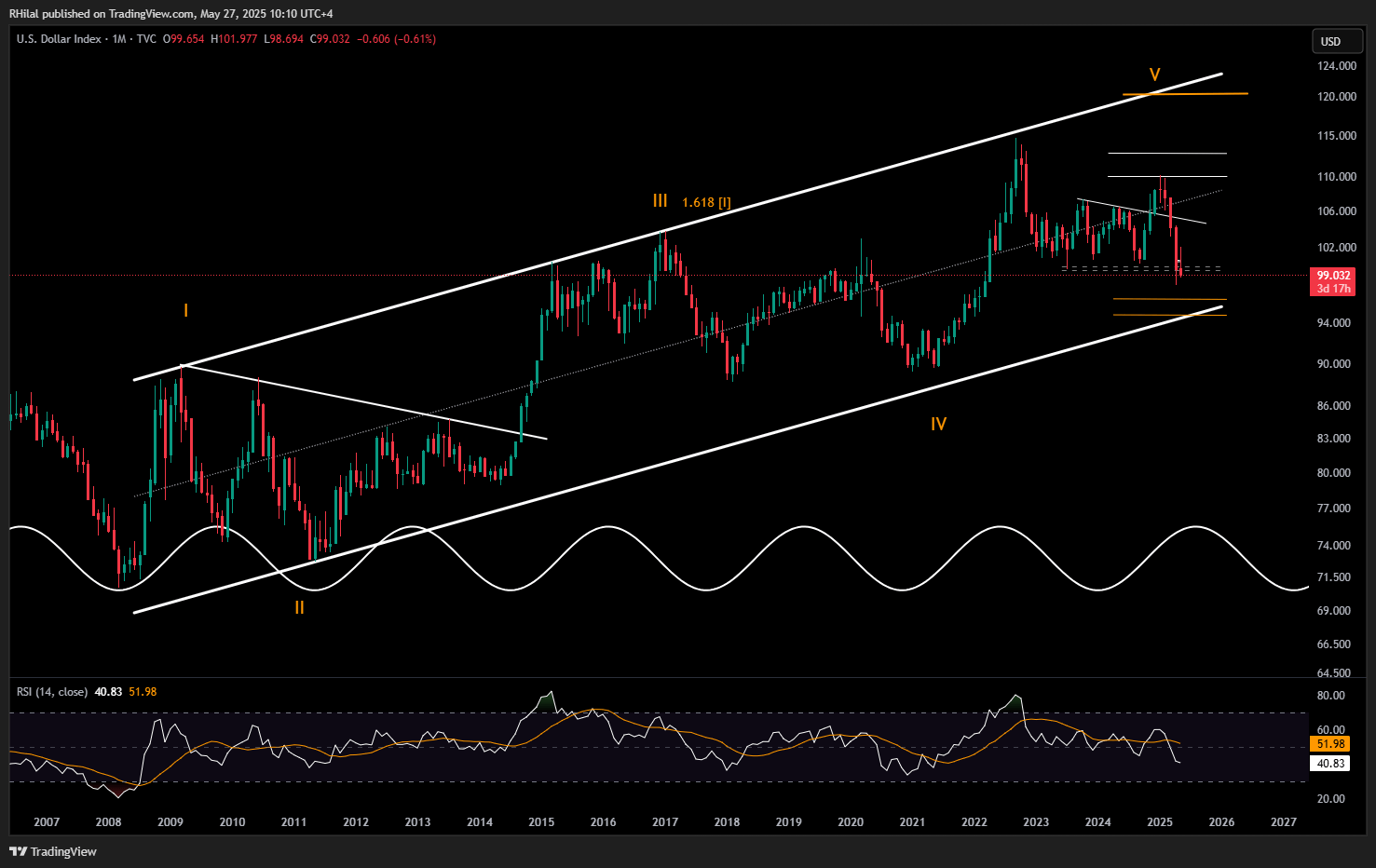

US Dollar Index (DXY) – Monthly Time Frame – Log Scale

Source: Tradingview

The DXY continues to lean lower, with key support levels at 97.80, 96.00, and 94.00. A rebound above 98 and a breakthrough 102 could shift momentum back to the upside, targeting 105 and 107—pulling EUR/USD back within its dominant downtrend channel.

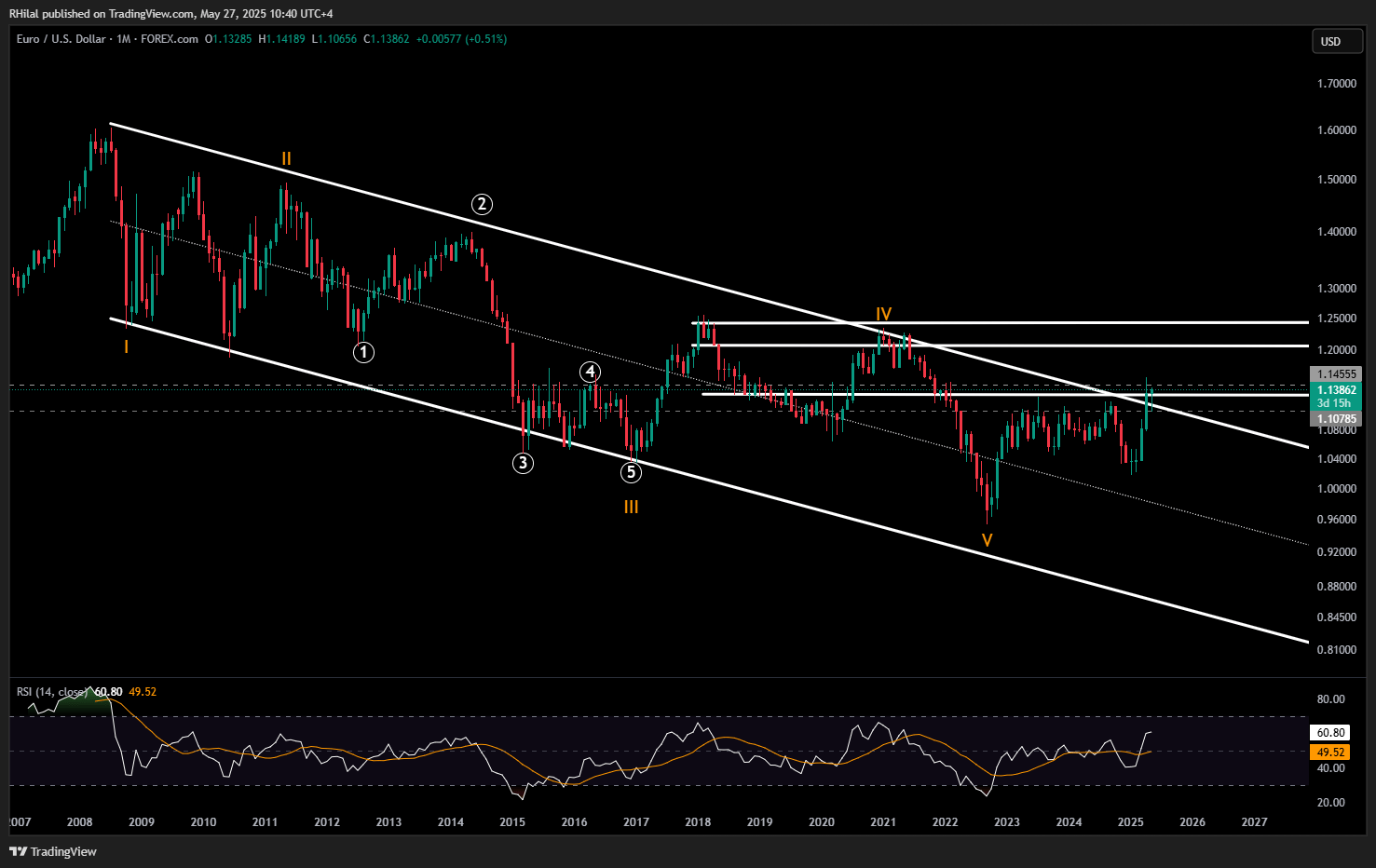

EUR/USD Outlook: Monthly Time Frame – Log Scale

Source: Tradingview

DXY’s recent lows have lifted EUR/USD above the top of its 16-year descending channel—first via an un-sustained wick, and now with a potentially stable hold. A firm monthly close above 1.16 would confirm the breakout, setting sights on highs from 2018 and 2021, between 1.20 and 1.24.

However, a close back below 1.10 would invalidate the breakout and restore the historical bearish structure.

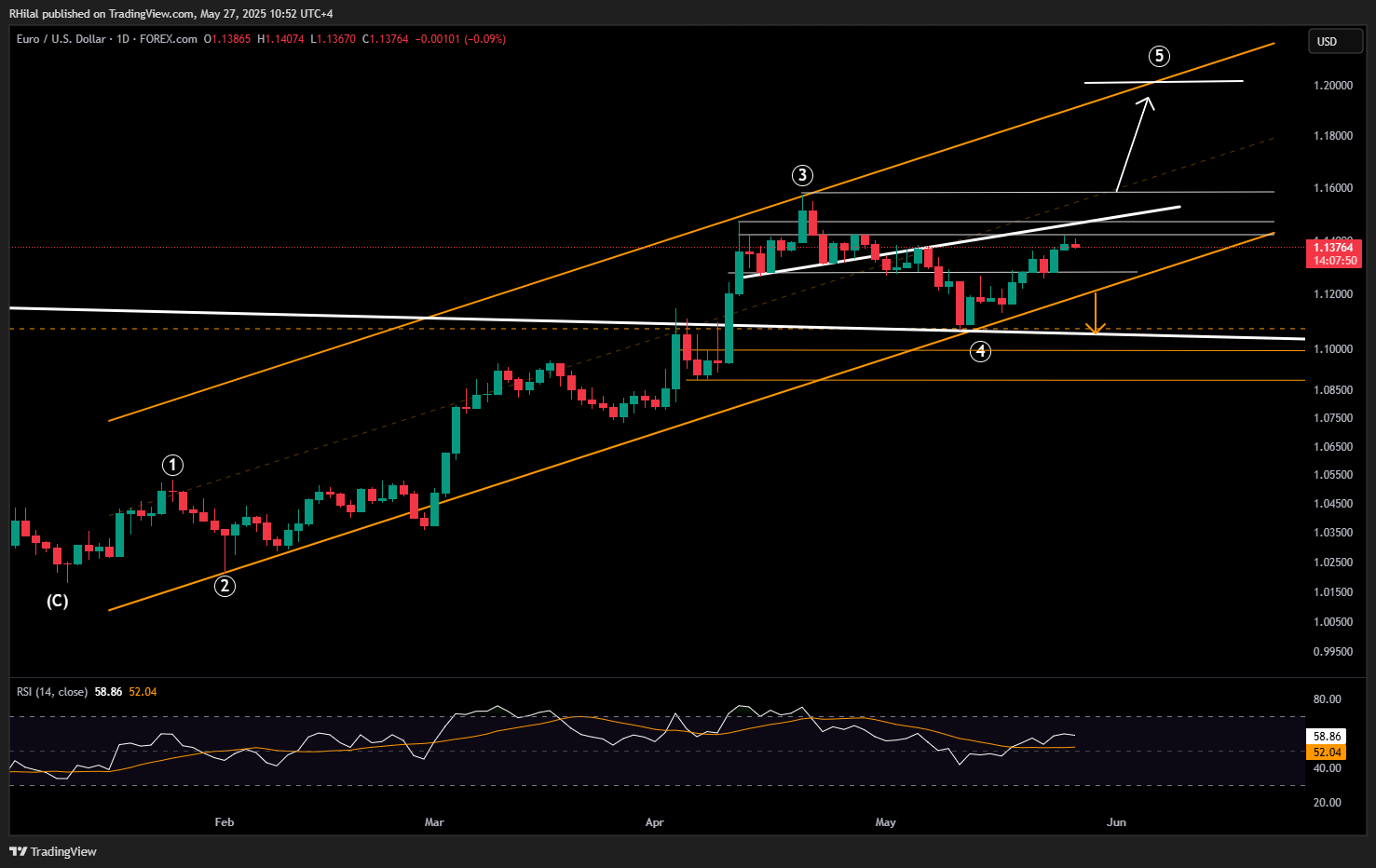

EUR/USD Outlook: Daily Time Frame – Log Scale

Source: Tradingview

EUR/USD continues to follow its 2025 uptrend channel. Near-term resistance is at 1.1380, 1.1430, and 1.1570. A break above these would confirm a bullish breakout heading into H2. On the downside, key pullback levels are 1.1270, 1.1140, and 1.1070. A break below those could extend pressure toward 1.0990 and 1.0890.

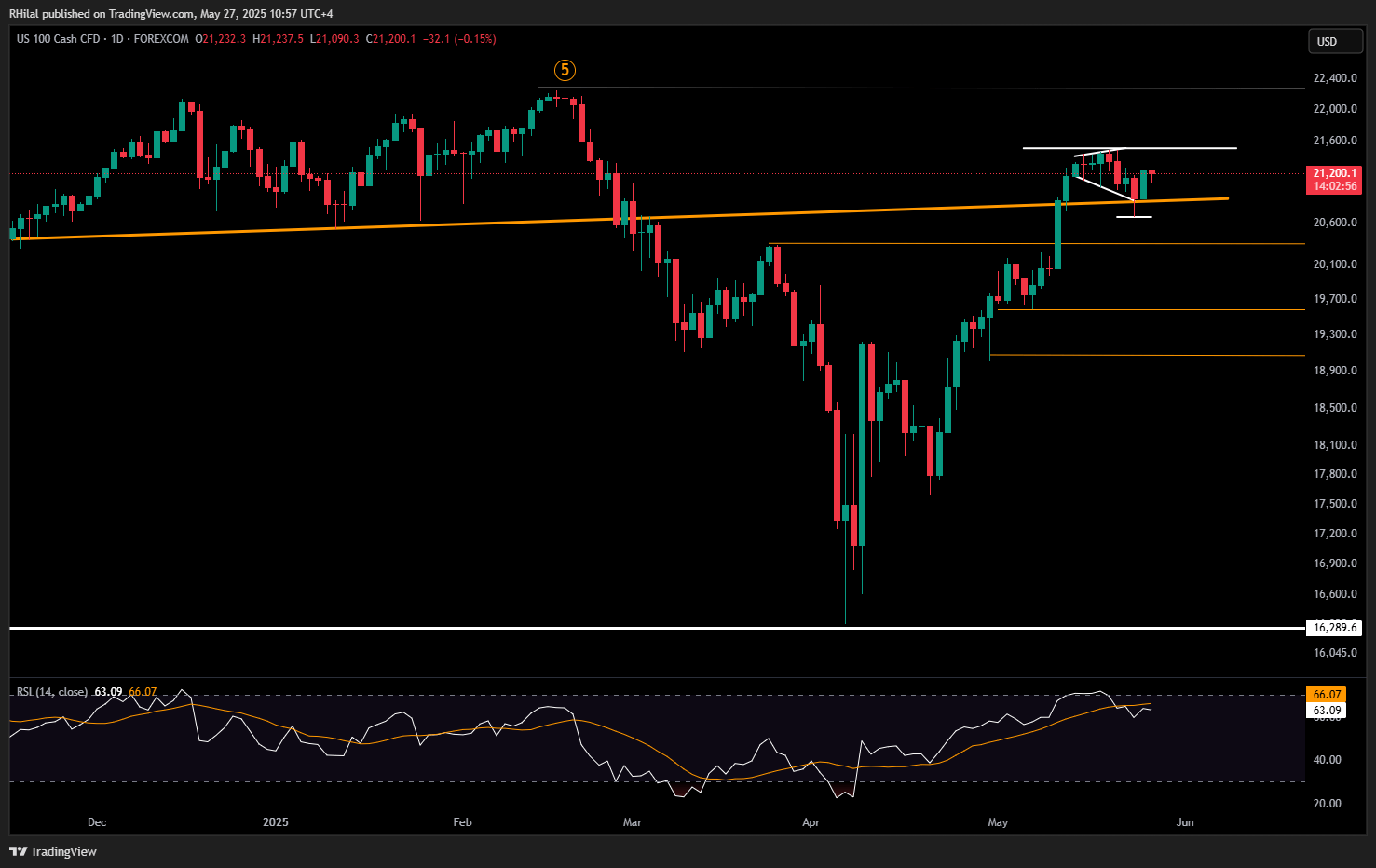

Nasdaq Outlook: Daily Time Frame – Log Scale

Source: Tradingview

The Nasdaq remains in a bullish zone above the neckline of a double top pattern that formed between December 2024 and February 2025. Price action is currently consolidating between the 21,500 resistance and the 20,800 support. A clear breakout above 21,500 could push the index toward 22,200 and potentially the next major high near 23,700. Conversely, a decisive close below 20,800–20,600 would signal increased selling pressure, targeting 19,600 and 19,100.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves