Over the past two sessions, EUR/USD has dropped more than 1.5% in favor of the U.S. dollar, and recent price action now reflects a neutral bias that has held steady amid the pair’s latest short-term movements. It’s likely that recent commentary surrounding the trade war, along with growing expectations around interest rate policies from both central banks, is increasing uncertainty in euro demand—a key factor behind the dollar’s short-term recovery.

Is Confidence Returning?

Today, President Trump expressed optimism regarding renewed negotiations with China, even stating he would be willing to reduce tariffs from 145% to 80% if talks go well. This announcement comes ahead of a key meeting between the U.S. Treasury Secretary and the Chinese delegation in Geneva this weekend, aimed at achieving a diplomatic resolution to the conflict.

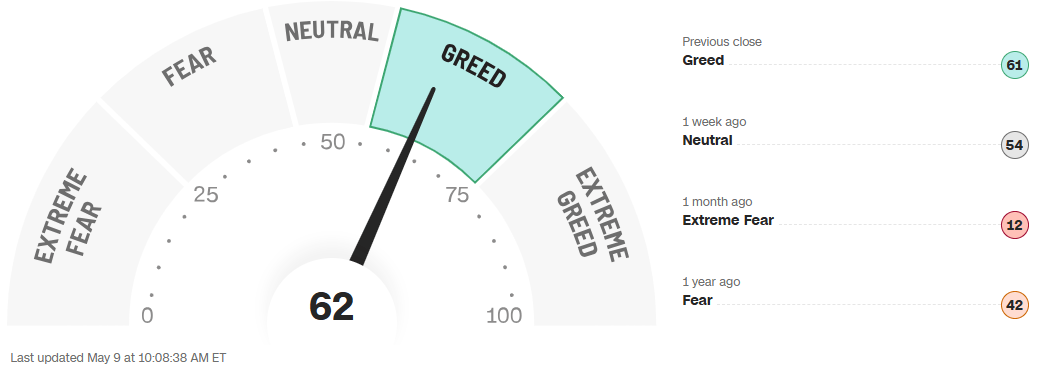

For now, market sentiment has begun to recover, partly due to Trump’s positive comments. The CNN Fear and Greed Index has moved into positive territory, reaching 62 points, landing in the “greed” zone. The index has been steadily recovering after hovering in “neutral” territory last week.

Source: CNN

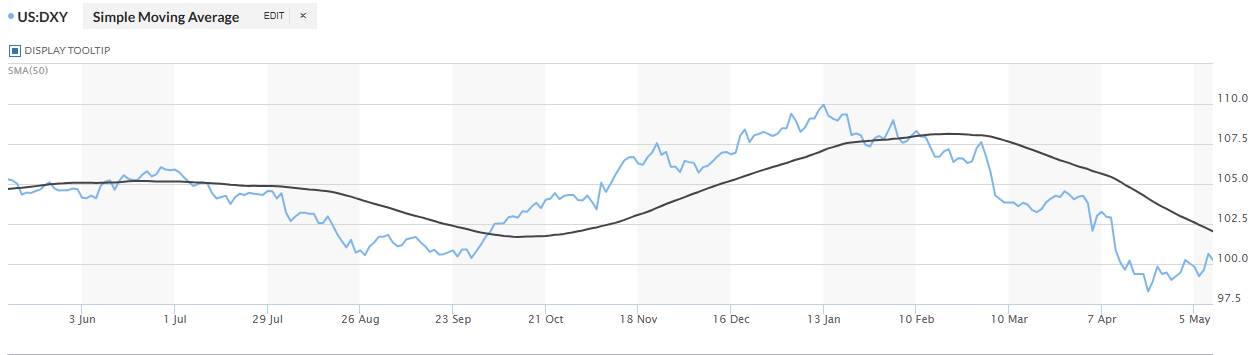

This recent boost in market confidence also appears to have benefited the U.S. dollar, as an eventual easing of trade tensions could help restore investor sentiment toward the U.S. economy. The dollar has experienced notable declines since the onset of trade tensions, largely due to concerns over domestic impact. Currently, the DXY index continues to climb, recently surpassing the 100-point mark, signaling a solid rebound against its major counterparts.

Source: Market Watch

As a result, the recent rebound in market confidence has begun to generate a bullish bias for the dollar, which in turn has contributed to the neutral tone in EUR/USD. If this renewed confidence in the greenback persists, we could see stronger buying pressure on the dollar in the short term.

What to Expect from the ECB?

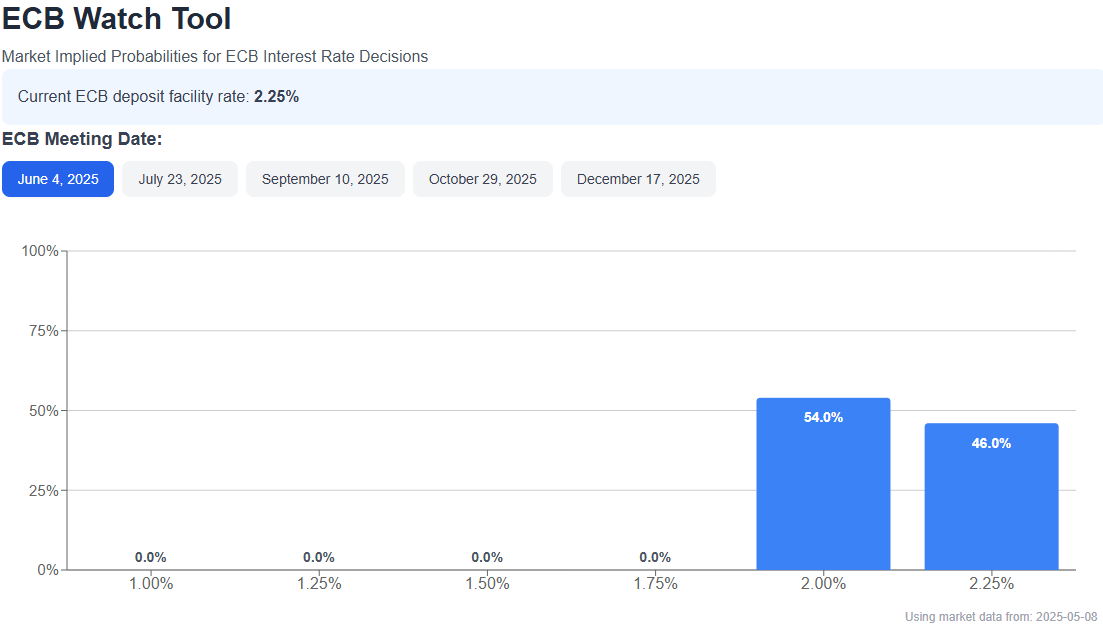

In its recent decisions, the European Central Bank (ECB) has shown a clear intention to lower rates, and for now, that outlook remains intact. According to the ECB Watch Tool, there is a 54% probability that the deposit rate will be cut to 2%, down from the current 2.25%, aligning with the dovish trend the ECB has held in recent months.

Source: ECB Watch

Meanwhile, the U.S. Federal Reserve recently held its rate steady at 4.5%, reaffirming a neutral stance by the U.S. central bank. This highlights a growing divergence in both interest rate levels and outlooks, with the ECB leaning toward cuts while the Fed remains stable.

This rate differential could play a key role in driving both currencies. Higher U.S. rates, combined with recovering confidence, may make U.S. bonds more attractive to investors, increasing demand for dollars and applying downward pressure on EUR/USD as long as the divergence persists.

EUR/USD Technical Outlook

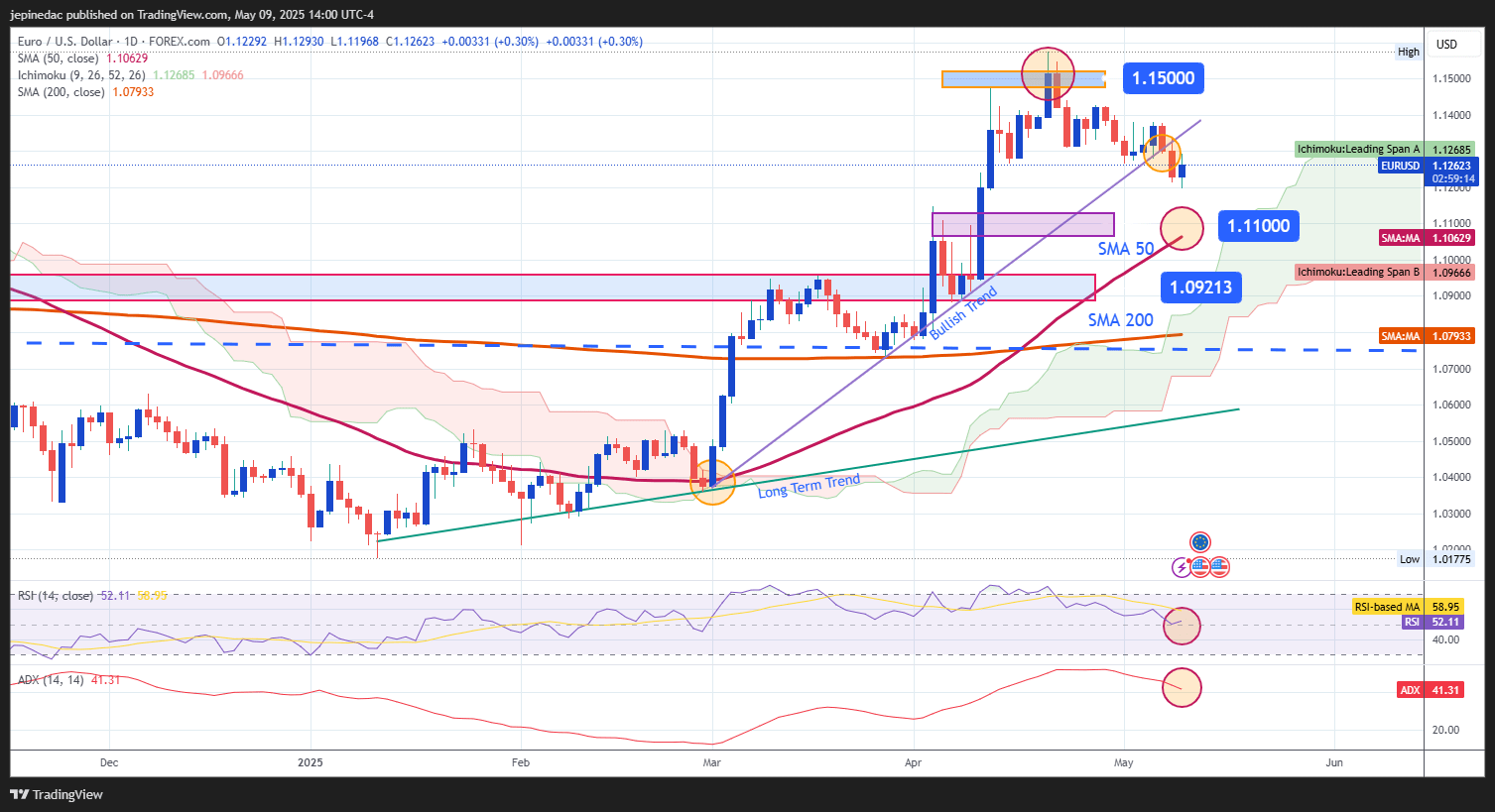

Source: StoneX, Tradingview

- Neutrality Takes Hold: In recent sessions, bearish pressure was strong enough to break a short-term ascending trendline. This has ushered in a consolidated neutral sentiment, which may persist if the dollar continues its recovery, limiting near-term demand for euros. If price movements continue to show a lack of clear direction, this may signal the development of a short-term sideways range.

- RSI: The RSI currently confirms a neutral sentiment, with values hovering around the 50 level, indicating a balance between buying and selling pressure. This could reinforce market indecision in the coming sessions.

- ADX: Although the ADX line remains above 20, its downward slope suggests a weakening trend in recent price action, potentially pointing to a lack of clear directional momentum.

Key Levels:

- 1.15000 – Tentative Resistance: A psychological key level. A sustained breakout above this area could reaffirm a bullish bias and set the stage for a more structured uptrend.

- 1.10000 – Nearby Support: A major psychological level aligned with the 50-period moving average. Price action around this area could threaten the previous bullish outlook and give way to a more bearish bias.

- 1.09213 – Major Support: A level where previous consolidation zones were observed. A drop to this point could initiate a new bearish trend in EUR/USD.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25