In recent hours, the euro has depreciated by nearly 0.5% against the U.S. dollar, and a bearish bias has started to take shape following the release of today’s Non-Farm Payrolls (NFP) report. Additionally, the European Central Bank’s (ECB) rate decision announced yesterday has also weighed on the euro in the short term, contributing to selling pressure on the EUR/USD.

NFP Report Day

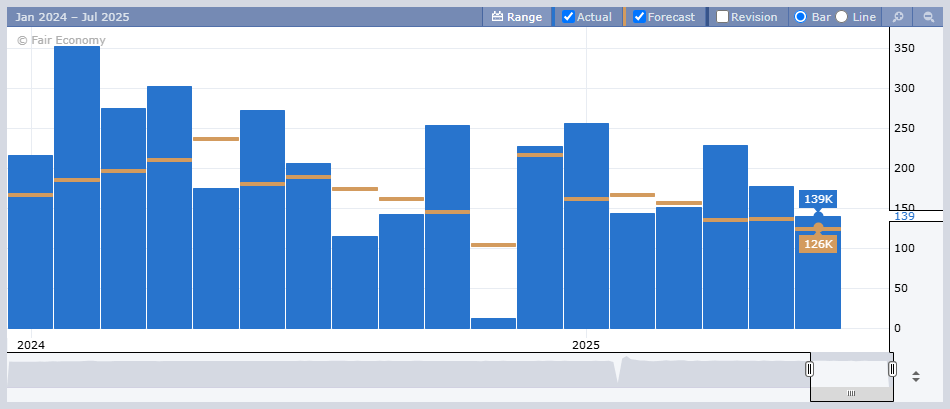

Today, the U.S. NFP employment data was released, showing 139,000 new jobs, compared to an expected 126,000. This indicates that while the labor market continues to slow in 2025, job creation slightly exceeded expectations.

Source: Forex Factory

Although employment growth remains below levels seen in previous reports, wage growth came in higher than expected, signaling that inflationary pressures persist in the U.S. In this scenario, the Federal Reserve may choose to maintain its restrictive monetary policy for longer, resulting in elevated interest rates over an extended period. This could boost demand for dollar-denominated assets, supporting a bullish bias for the greenback in the near term.

This setup is key because a more solid labor market reinforces investor confidence in the U.S. economy. If positive employment expectations continue, selling pressure on the euro may intensify, potentially leading to a more sustained bearish move in EUR/USD.

What to Expect from the ECB?

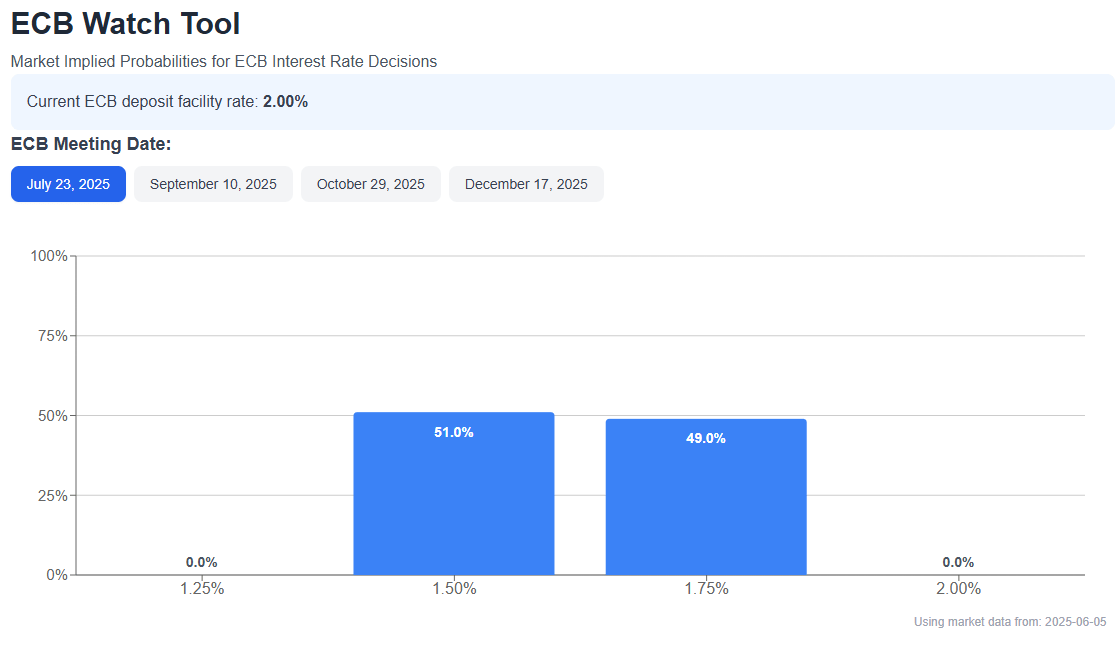

Yesterday, the ECB announced a 25-basis-point rate cut, lowering the deposit rate to 2% and the refinancing rate to 2.15%. The central bank cited inflation being under control, within its 2% target, and weak expected growth for the remainder of 2025 as reasons for maintaining lower interest rates to support the economy.

This rate cut has revived a bearish outlook that was previously thought to be behind us. According to ECB Watch, there is currently a 51% probability that the ECB will issue another rate cut at its July 23 meeting, potentially lowering the rate further to 1.5%.

Source: ECB Watch

This new dovish outlook is raising concerns about the declining appeal of European fixed-income assets, as falling rates could reduce investor interest in euro-denominated instruments. While Europe considers lowering rates to near 1%, the U.S. maintains a stable 4.5% rate, which widens the yield differential and supports increased demand for U.S. assets. This imbalance could strengthen the dollar and exert bearish pressure on the EUR/USD in the short term.

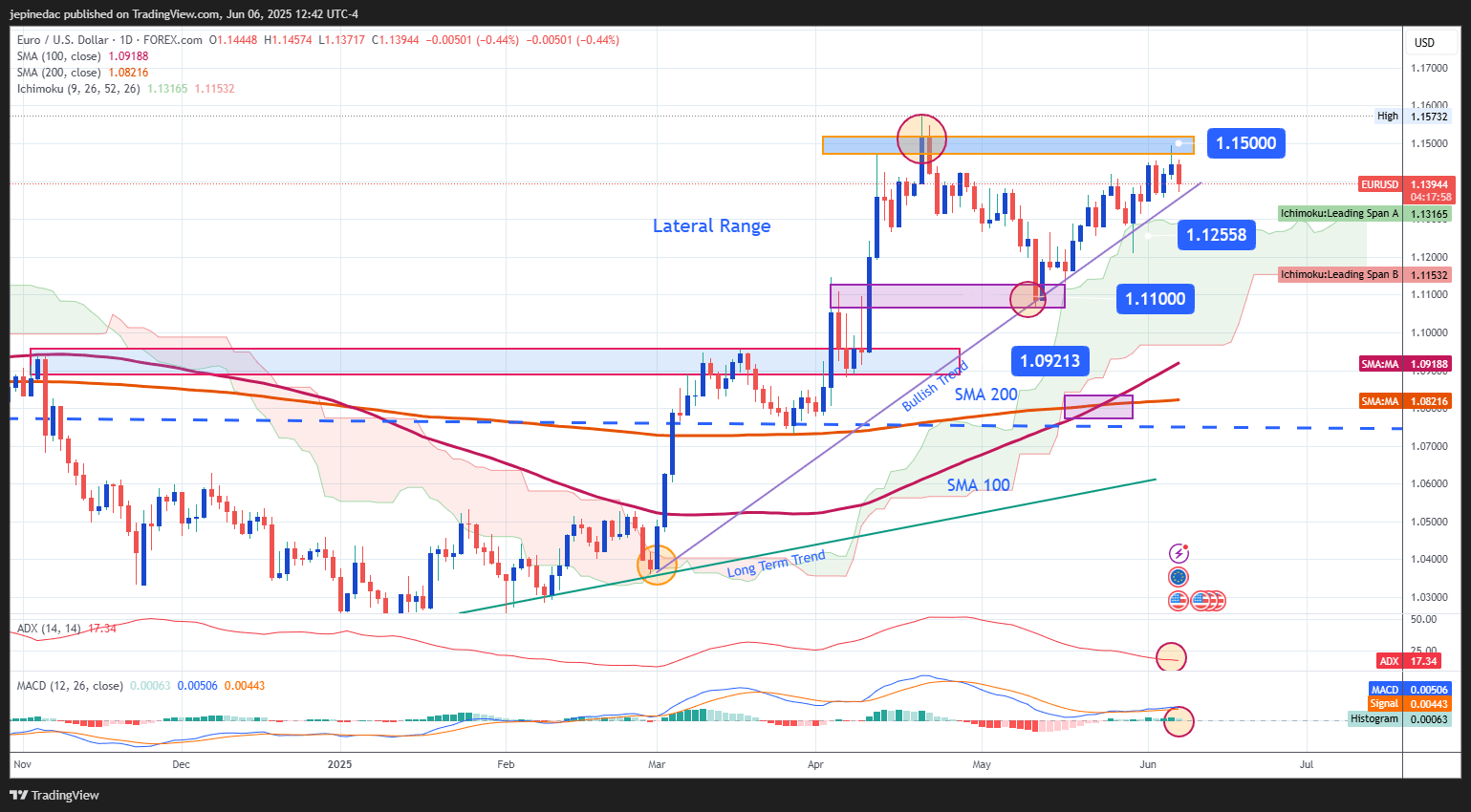

EUR/USD Technical Outlook

Source: StoneX, Tradingview

- Neutrality Sets In: In recent sessions, buying pressure has been insufficient to break through the key 1.15000 resistance, allowing a new bearish bias to emerge in the short term. This suggests that the previous bullish trend has entered a consolidation phase, especially as the price tests recent highs. If this dynamic persists, a lateral trading channel could form in the sessions ahead.

- ADX: The ADX line remains below the neutral level of 20, signaling that average volatility has decreased, and that the market may continue trading in a neutral range. This may limit further upside momentum seen in previous weeks.

- MACD: The MACD histogram shows mild fluctuations around the zero line, indicating weak bullish momentum that is not strong enough to drive a major move. This reinforces the neutral scenario, with no clear direction dominating the chart.

Niveles clave:

- 1.15000 – Tentative Resistance: A key psychological level and recent high. A breakout above this zone could reactivate the bullish trend.

- 1.12558 – Near-Term Support: A recent consolidation zone. A break below this level could strengthen the bearish bias in the short term.

- 1.11000 – Major Support: Aligned with the ascending trendline, this level corresponds to recent multi-week lows. A drop to this zone could put the current bullish structure at risk.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25