US Dollar Forecast: EUR/USD

EUR/USD seems to be consolidating after pushing above the opening range for June, but the Federal Reserve interest rate decision may sway the exchange rate as the central bank is slated to update its Summary of Economic Projections (SEP).

EUR/USD Outlook Hinges on Federal Reserve Forward Guidance

Keep in mind, EUR/USD broke out of the April range earlier this month to register a fresh yearly high (1.1632), and the recent pullback in the exchange rate may turn out to be temporary should it continue to track the positive slope in the 50-Day SMA (1.1332).

US Economic Calendar

Looking ahead, the Fed rate decision may sway EUR/USD even though the central bank is expected to retain the current policy should the Federal Open Market Committee (FOMC) stay on track to further unwind its restrictive policy.

The update to the SEP may continue to indicate lower interest rates for 2025 as higher tariffs appear to be having a limited impact on inflation, and expectations for a looming Fed rate-cut is likely to drag on the US Dollar as the ‘median participant projects that the appropriate level of the federal funds rate will be 3.9 percent at the end of this year.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

At the same time, the Fed may adjust the forward guidance for monetary policy as the ongoing shift in fiscal policy clouds the outlook for the US economy, and the developments coming out of the FOMC meeting may prop up the Dollar if the central bank shows a greater willingness to keep US interest rates higher for longer.

With that said, fading expectations for a Fed rate-cut may curb the recent rebound in EUR/USD, but the exchange rate may break out of the range bound price action should it extend the advance from the start of the month.

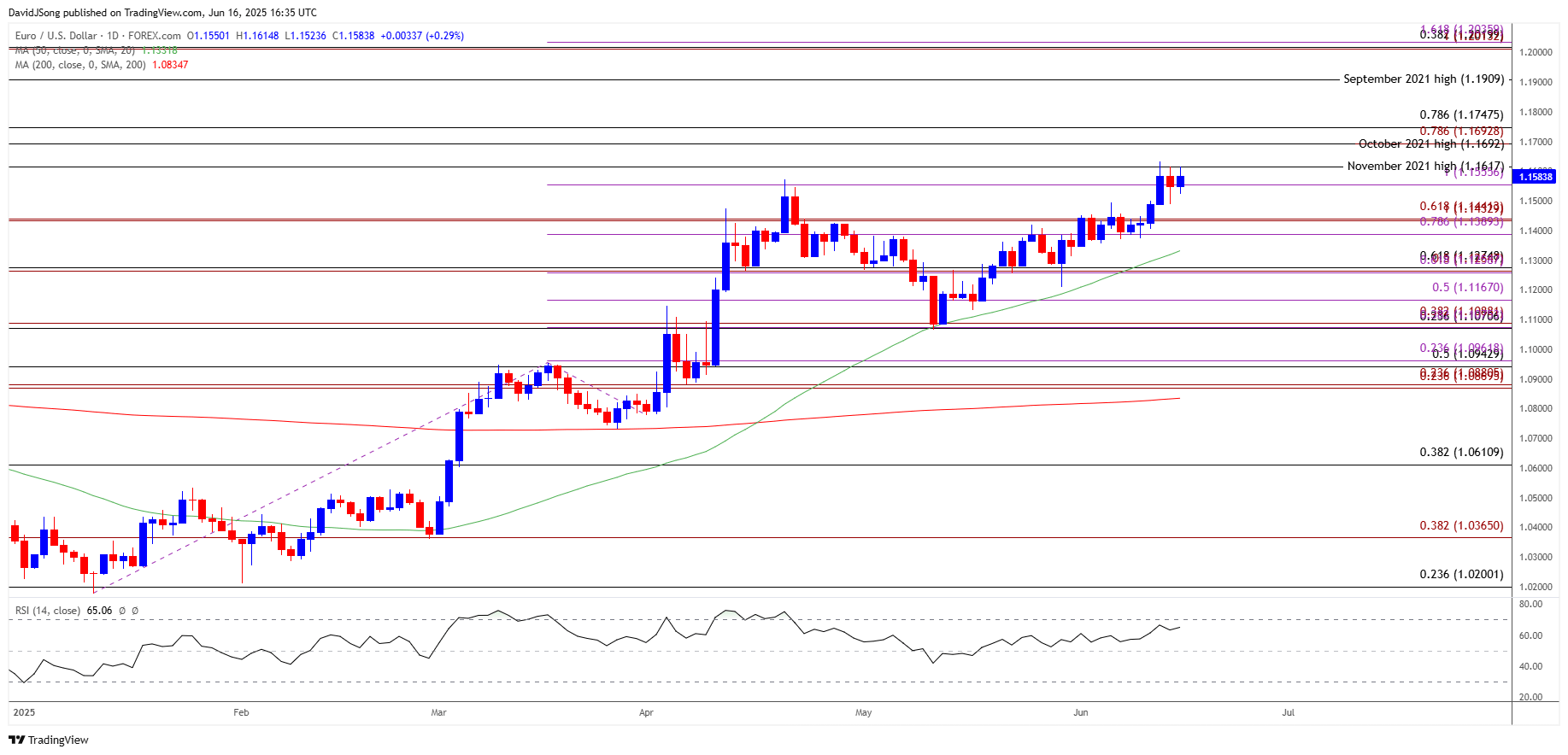

EUR/USD Chart – Daily

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

- EUR/USD no longer carves a series of higher highs and lows after briefly trading above the November 2021 high (1.1617), and lack of momentum to hold above 1.1560 (100% Fibonacci extension) may push the exchange rate back toward the 1.1390 (78/6% Fibonacci extension) to 1.1440 (61.8% Fibonacci extension) region.

- Next area of interest comes in around 1.1260 (61.8% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement), but EUR/USD may continue to track the positive slope in the 50-Day SMA (1.1332) as it still holds above the moving average.

- A move above the monthly high (1.1632) may lead to a test of the October 2021 high (1.1692), with a break/close above the 1.1690 (78.6% Fibonacci extension) to 1.1750 (78.6% Fibonacci retracement) zone opening u the September 2021 high (1.1909).

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Slump Pushes RSI into Oversold Zone

Gold Price Bounces Back Ahead of 50-Day SMA

USD/JPY Weakness Persists with US PPI Unfazed by Higher Tariffs

US Dollar Forecast: USD/CHF Falls Toward Monthly Low amid Soft US CPI

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong