US Dollar Outlook: EUR/USD

EUR/USD continues to fall from the monthly high (1.0955) to pull the Relative Strength Index (RSI) back from overbought territory, and the move below 70 in the oscillator is likely to be accompanied by a further decline in the exchange rate like the price action from last year.

EUR/USD Post-Fed Weakness Pulls RSI Back from Overbought Zone

EUR/USD trades to a fresh weekly low (1.0815) even as Federal Reserve officials continue to forecast lower interest rates for 2025, and the exchange rate may continue to give back the advance from the monthly low (1.0504) as it carves a series of lower highs and lows.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Nevertheless, the recent weakness in EUR/USD may turn out to be temporary as lawmakers in Europe plan to boost government spending, and the shift in fiscal policy may push the European Central Bank (ECB) to the sidelines as it instills an improved outlook for the Euro Area.

As a result, the ECB may adopt a wait-and-see approach at its next meeting in April after delivering a string of rate-cuts, but the threat of a trade war may push the Governing Council to implement lower interest rates as ‘the disinflation process is well on track.’

With that said, the recent series of lower highs and lows may lead to a further decline in EUR/USD, but the exchange rate may defend the rally from earlier this month should it track the positive slope in the 50-Day SMA (1.0516).

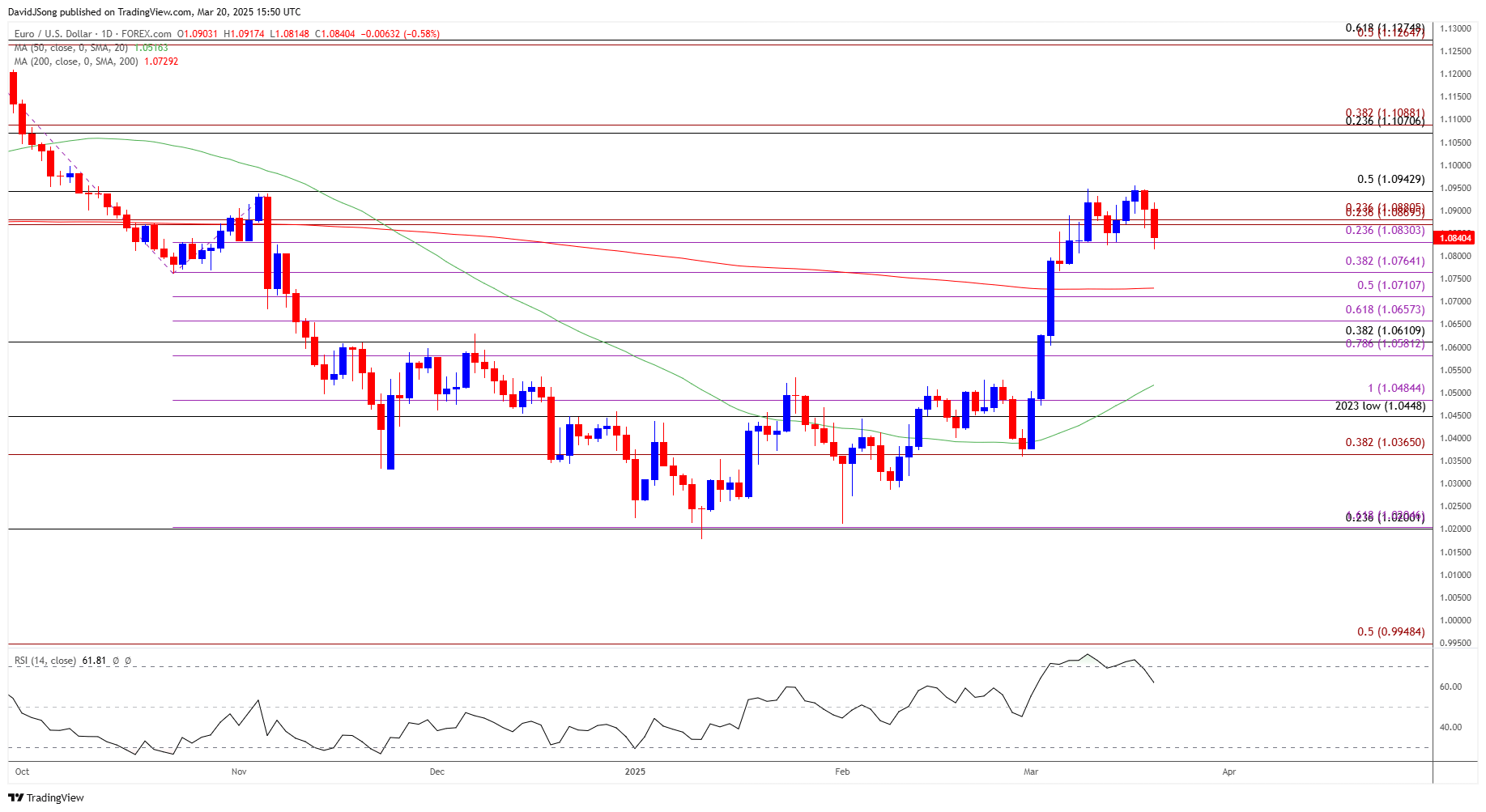

EUR/USD Chart – Daily

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

- EUR/USD extends the decline from the monthly high (1.0955)

- With a close below the 1.0830 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension) region raising the scope for a move towards 1.0760 (38.2% Fibonacci extension),

- Next area of interest comes in around 1.0660 (61.8% Fibonacci extension) to 1.0710 (50% Fibonacci extension), but EUR/USD may search for support as it no longer trades within the January range.

- Lack of momentum to close below the 1.0830 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension) region may keep EUR/USD within a narrow range, but a breach above the monthly high (1.0955) brings the 1.1070 (23.6% Fibonacci retracement) to 1.1090 (38.2% Fibonacci extension) zone back on the radar.

Additional Market Outlooks

Gold Price Rally Pushes RSI Back into Overbought Territory

AUD/USD Fails to Test February High Ahead of Fed Rate Decision

British Pound Forecast: GBP/USD Vulnerable to Dovish Bank of England (BoE)

Canadian Dollar Forecast: USD/CAD Coils Ahead of Reciprocal Trump Tariffs

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong