Key Events:

- US Dollar Index (DXY) drops to 98 amid reports Trump plans to restructure the Fed

- EURUSD surges above 1.15, Gold nears 3,400, and GBPUSD approaches 1.34

- China threatens with retaliatory tariffs to nations aligning with US trade policy

- IMF Spring Meetings kick off amid heightened trade negotiations and global economic uncertainty

Markets stumbled in early Monday trading following news that Trump may attempt to overhaul the Federal Reserve. Although it is illegal for a sitting president to fire the Fed Chair, the attacks have raised concerns about the independence and stability of US monetary policy, driving the Dollar Index (DXY) lower toward the 98-support, while global markets reacted sharply:

- EURUSD climbs beyond 1.15

- Gold rallies toward 3,400

- GBPUSD challenges 1.34

- USDJPY slides into the 140 zone

- US indices fall by 1%

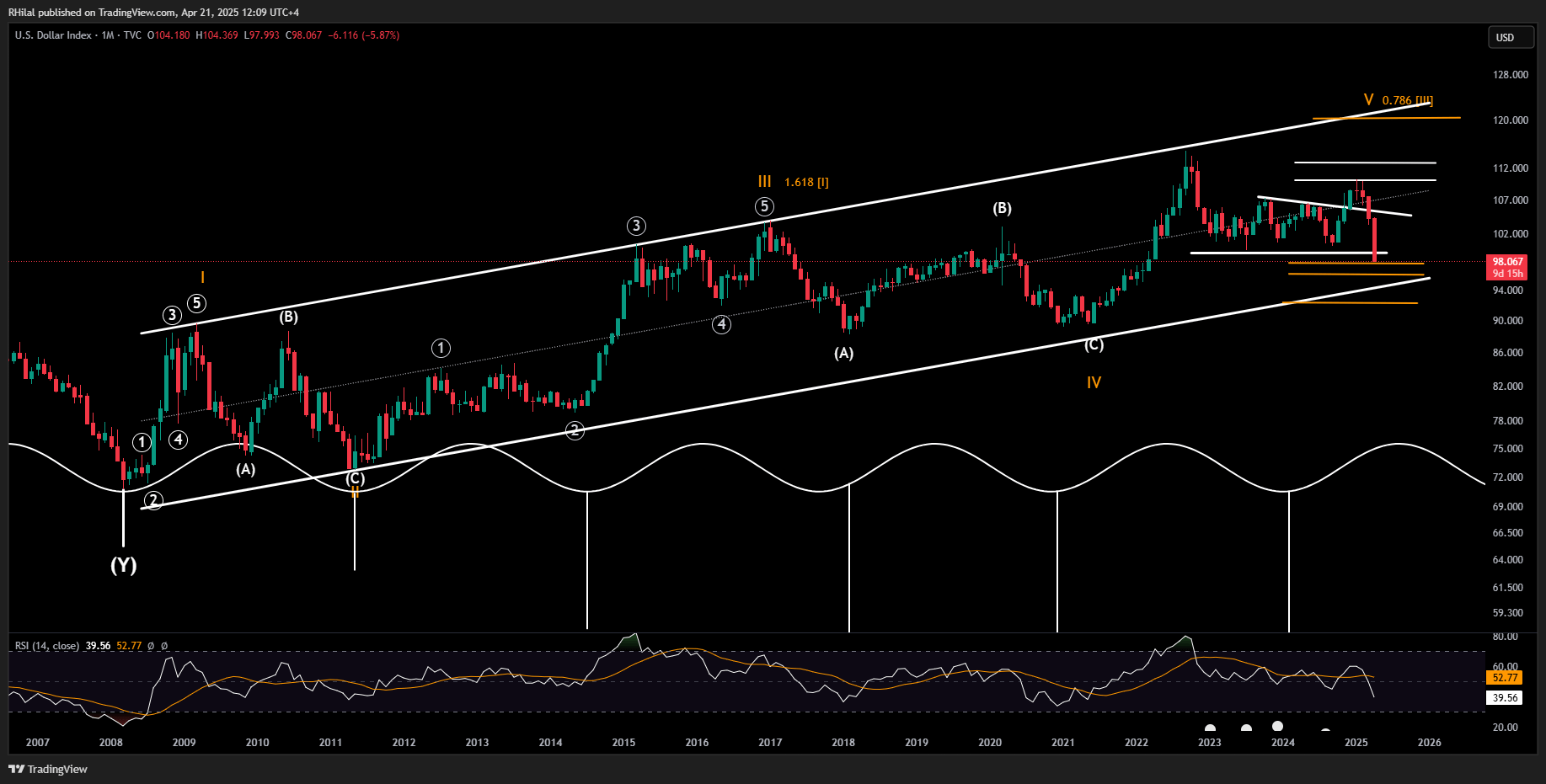

DXY Weekly Time Frame - Log Scale

Source: Tradingview

The DXY is losing momentum, sinking below the 98 threshold and eyeing further support at 97.70, 96, and 92.30—levels aligning with the lower bound of a channel originating from the 2008 lows. A reversal above 99 or 101 could reignite bullish sentiment amid ongoing volatility.

While GBPUSD and USDJPY test levels last seen in September 2024, EURUSD and DXY hover around 3-year extremes, near critical technical levels that may define the next major trend. The Dollar’s weakness is further exacerbated by deepening US–China trade tensions, which continue to erode global market confidence. Recent actions from China include:

- Cutting US commodity imports—including liquefied natural gas and wheat—to near zero as per March reports

- Issuing warnings to other nations against aligning with US trade policy, under threat of retaliatory tariffs

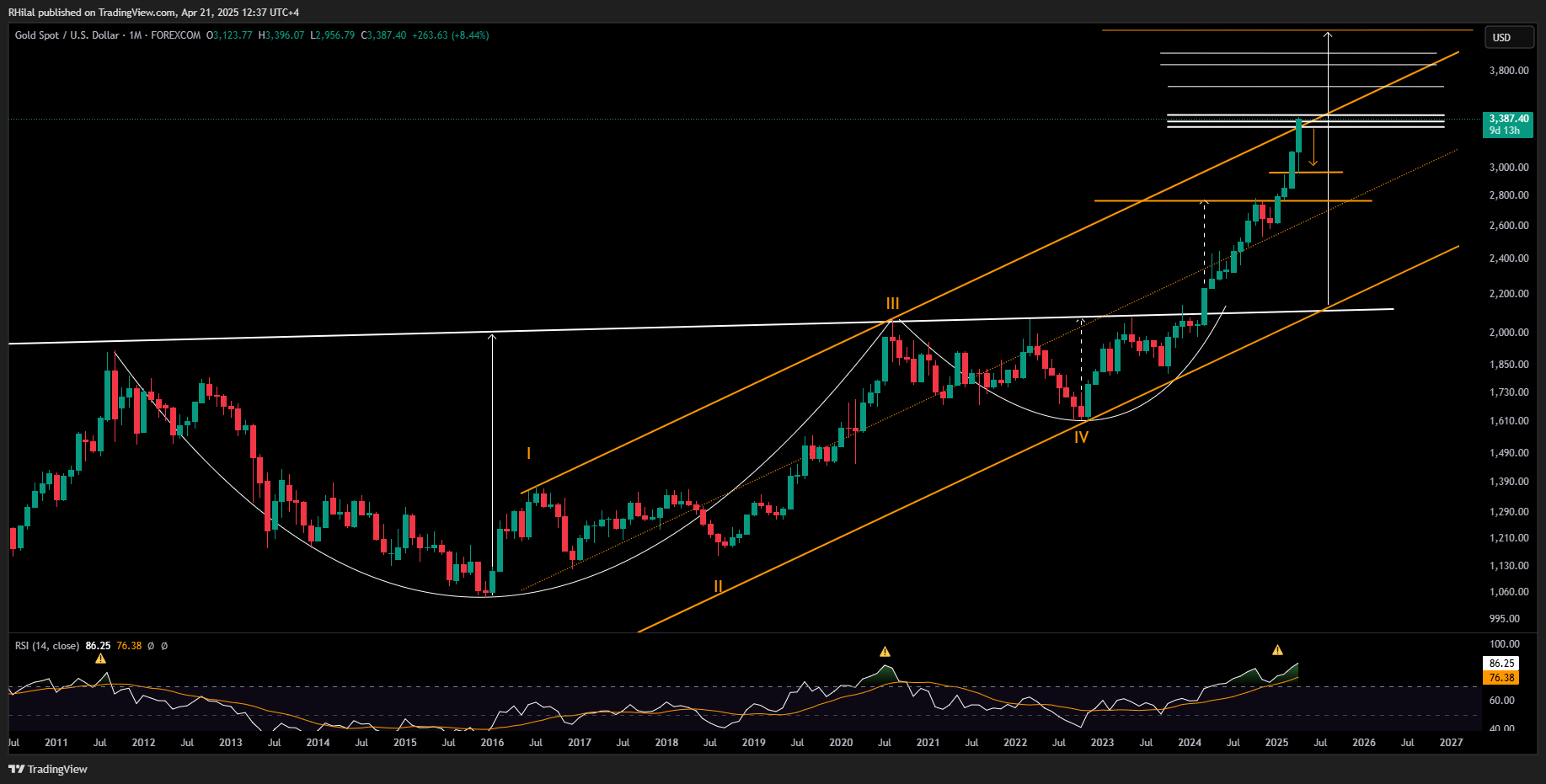

In addition, unresolved geopolitical conflicts in the Middle East and Eastern Europe (Russia–Ukraine) are sustaining upward pressure on gold prices, which are now approaching $3,400 per ounce.

On a monthly chart, gold’s overbought momentum echoes historic crisis periods such as 2020 and 2008. Despite this, the metal remains supported by its safe-haven appeal, especially as macro risks persist. Meanwhile, DXY's weekly momentum reflects oversold territory akin to 2020 levels, though further downside is visible on its monthly time frame.

Quantifying Uncertainties: Technical Analysis

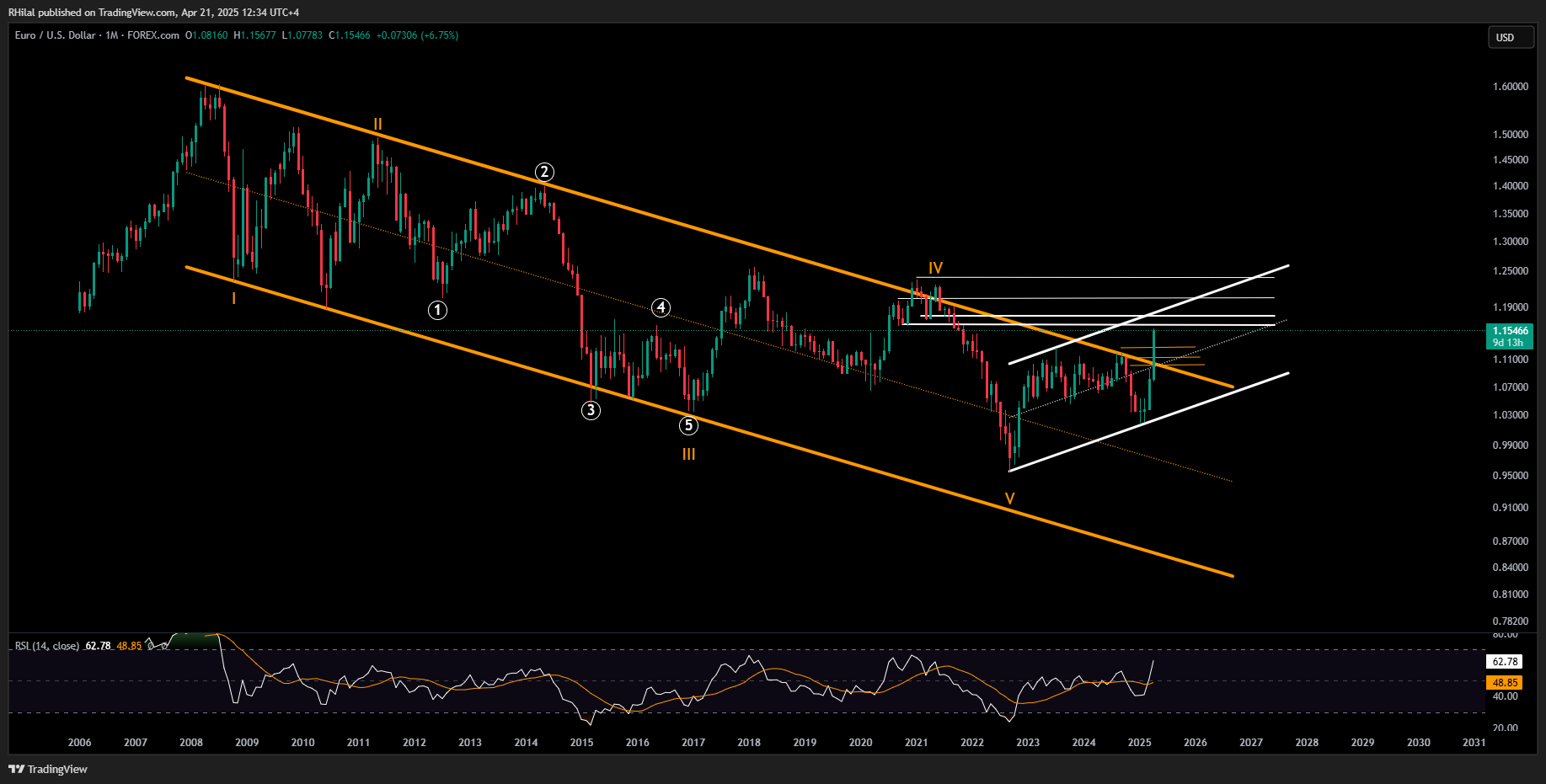

EURUSD Outlook: Monthly Time Frame – Log Scale

Source: Tradingview

EURUSD is trading near its November 2021 highs, reaching 1.1567 today. While weekly momentum shows overbought conditions similar to 2020, monthly indicators suggest further upside potential—possibly short-lived—toward 1.1620, 1.1750, 1.2050, and 1.2360.

Should market confidence recover and momentum reverse, key support zones to watch include 1.1280, 1.1140, 1.1000, and 1.0920. These levels could either recharge bullish momentum into 2025 or signal a deeper pullback toward 1.08 and below.

Gold Outlook: 3-Day Time Frame – Log Scale

Source: Tradingview

Gold is rallying on a combination of safe haven flows and Dollar weakness, approaching the $3,420 resistance. While momentum is elevated—resembling crisis-era extremes—further gains are possible amid continued uncertainty. f $3,420-$3450 zone holds, aligning with key Fibonacci extensions (drawn from the 2018 lows, 2020 highs, and 2022 lows), and trendline connecting 2016 and 2020 peaks, gold could follow through on its cup and handle breakout pattern toward $3,700 and $4,000.

However, any geopolitical resolution or easing of trade tensions could trigger a sharp reversal, with potential downside levels at $3,000, $2,960, $2,900, and $2,800.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves