View related analysis:

- AUD/USD weekly outlook: RBA, ISMs and NFP in Focus

- Japanese Yen Weaker Amid Tariffs, Reduced Hawkish-BOJ Bets, CPI Reports in Focus

- Nasdaq 100, S&P 500 Feel the Force of Trump’s Tariffs, ASX to Open Lower

- If Consumers Don’t Consume, a Recession Could be Presumed

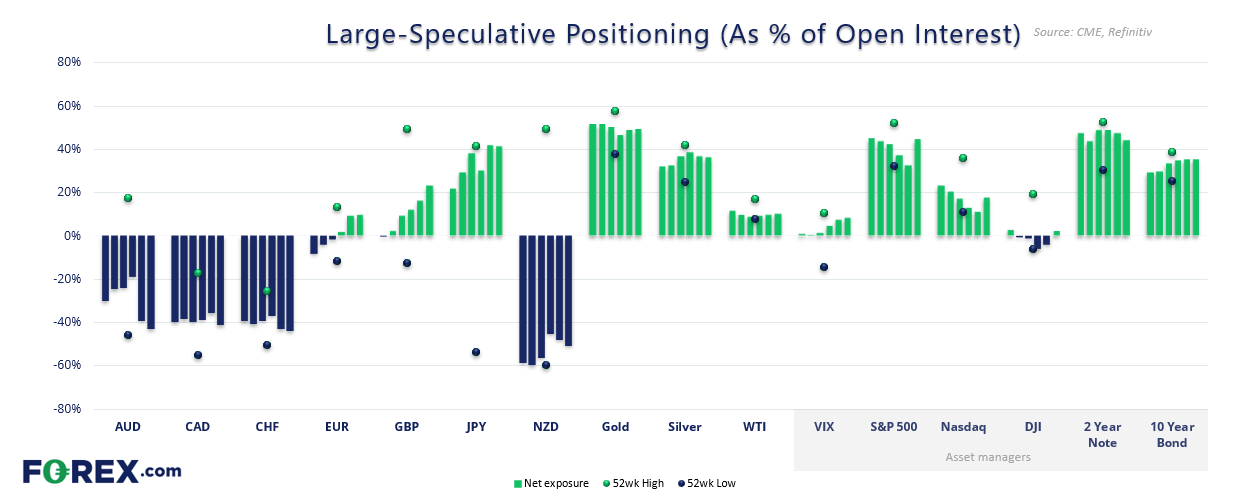

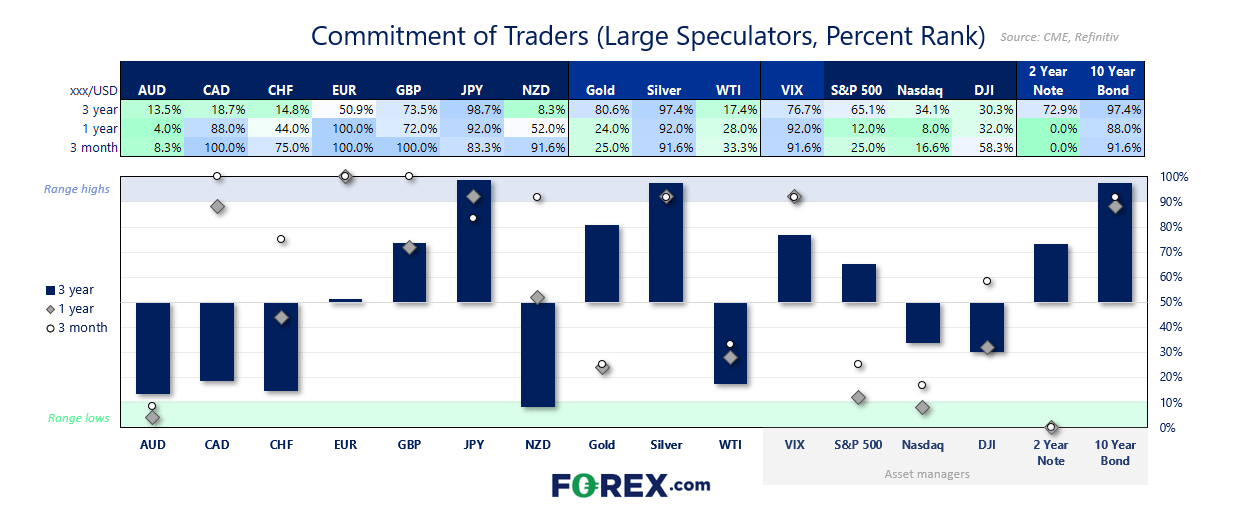

Market positioning from the COT report – 25 March 2025:

- Futures traders were effectively short the US dollar by -$1.2 billion, according to the International Money Market (IMM)

- Large speculators decreased their gross-short exposure to Japanese yen futures by -16% (-6.7k contracts) which saw net-long exposure rise by 2.4k contracts

- They increased their gross-long exposure to GBP/USD futures by 14% (13k contracts), which saw their net-long exposure rise by 14.8k contracts to a 19-week high

- Net-short exposure to AUD/USD futures uncreased by 7k contracts among large speculators, seeing net-short exposure rise by 7k contracts

- Gross-long exposure to NZD/USD futures declined by -16% (-2.5k contracts)

- Net-short exposure to Canadian dollar futures fell to a 23-week low

- Asset managers increased their net-long exposure to S&P 500 futures by 83.5k contracts

- Large speculators reduced their net-long exposure to gold futures by -8.1k contracts

- Net-long exposure to WTI crude oil futures rose for a third week to a five-week high

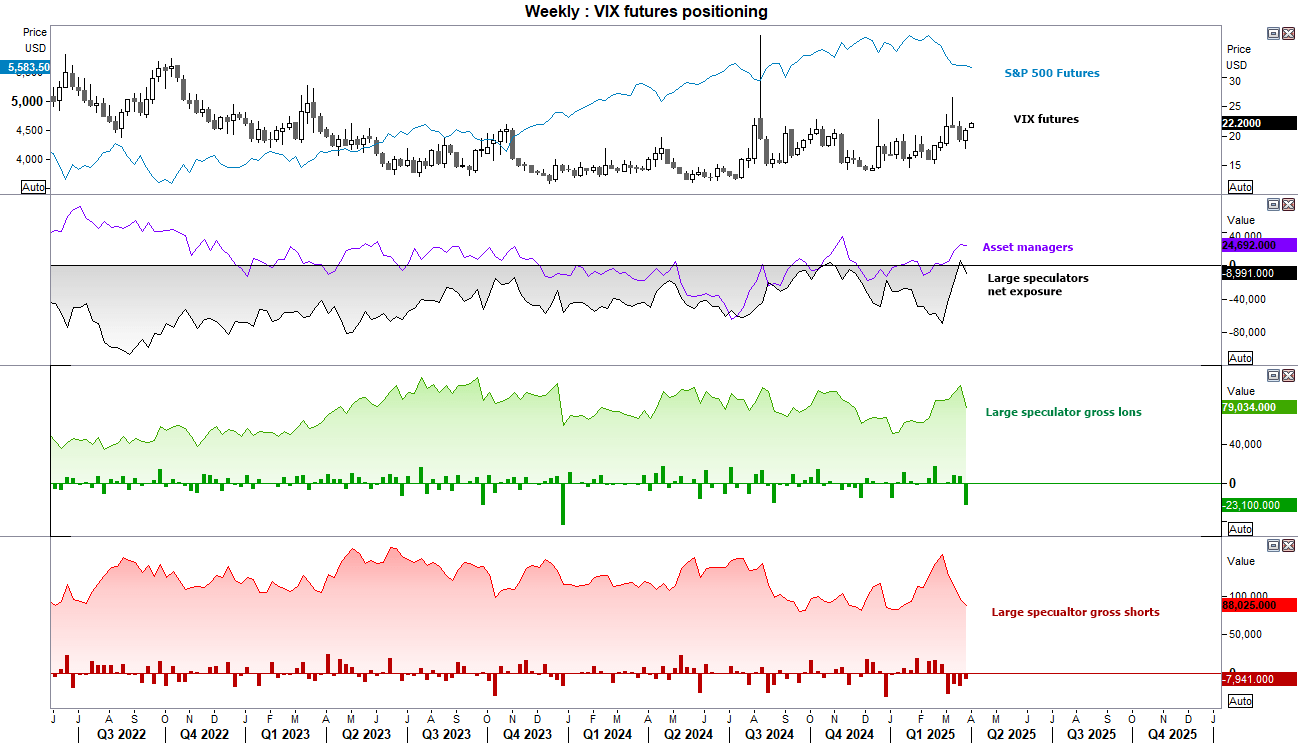

VIX futures (VX) positioning – COT report:

The large speculators that helped flip their net-long VIX exposure back to net-short may have regretted their decision, based on price action so far this week. Wall Street futures have continued lower on Monday after a bearish end to the week, thanks to concerns of stagflation from the PCE inflation and Michigan consumer sentiment reports on Friday.

Large speculators closed 23.1k VIX longs last week, which saw their most bullish exposure in nearly six years revert to net-short exposure after just one week. Asset managers remained net long, and I suspect we’ll see an increase of bullish bets in next week’s report.

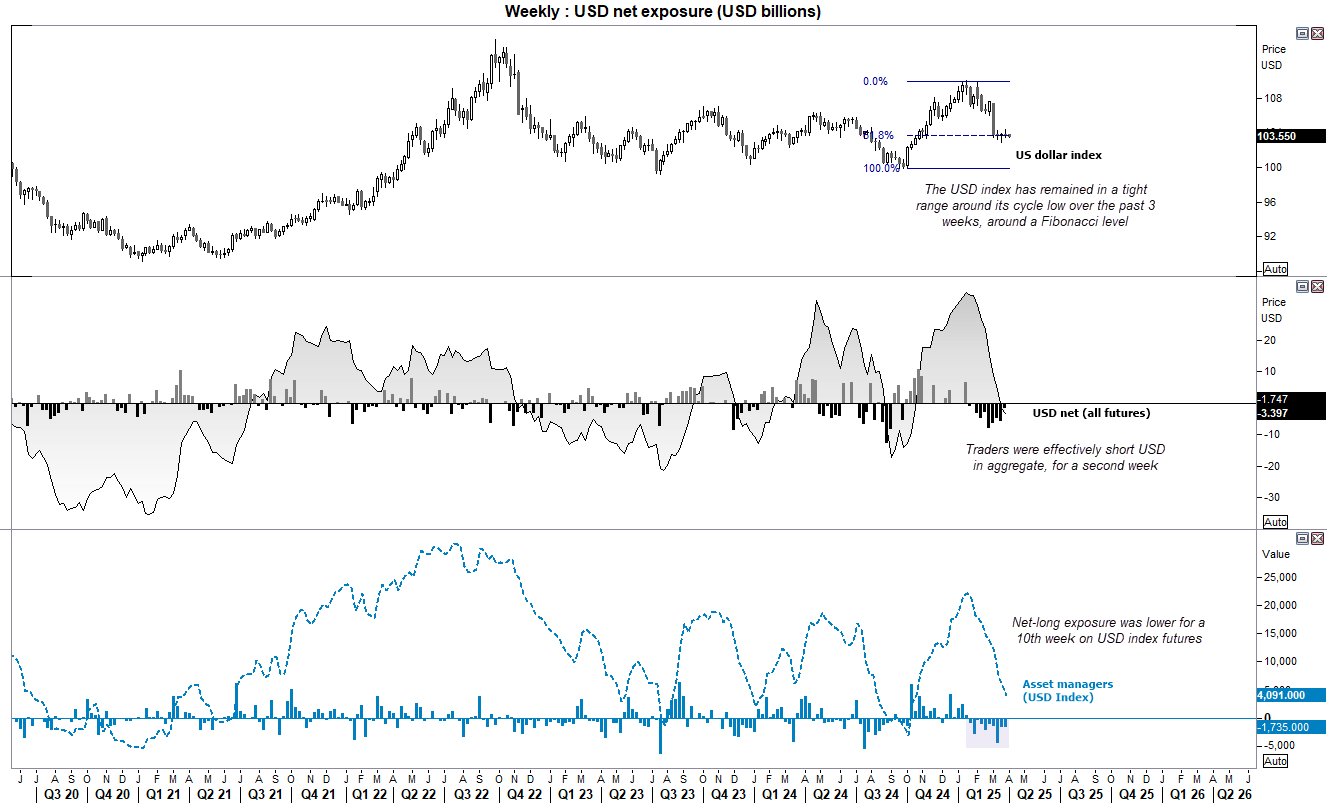

US dollar positioning (IMM data) – COT report:

Asset managers reduced their net-long exposure to the US dollar index for a tenth week, which takes this group of traders to their least bullish level since October. Gross shorts rose for a third week and longs were trimmed for a tenth.

Yet as bearish as this sounds, the US dollar index has effectively moved sideways over the past three weeks, in a tight range around its cycle lows. And this is despite all traders being effectively short the US dollar by -$1.7 billion.

And as the US dollar index is clinging to the 61.8% Fibonacci level after a decent decline in Q1, I continue to suspect a bounce higher is due for the dollar in Q2. Even if only small.

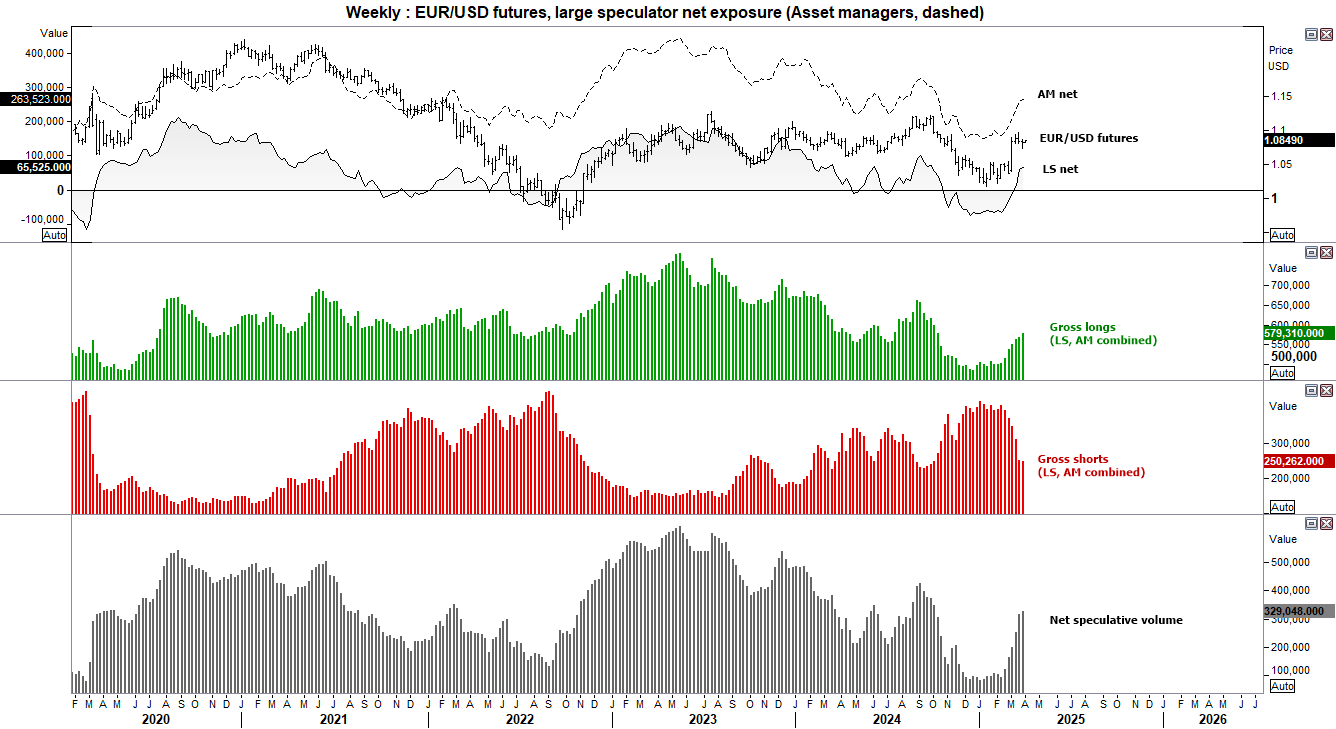

EUR/USD (Euro dollar futures) positioning – COT report:

Speculative volumes have been rising alongside EUR/USD prices, on the idyllic scenario of increased long bets and reduced shorts. However, as noted above, the US dollar remains supported and EUR/USD is not rising despite the increase of bullish euro position.

Furthermore, asset managers increased their gross-short exposure to EUR/USD for the first week in six last week. So unless we see EUR/USD rise soon, I am inclined to suspect a bit more of a pullback before its trend resumes later in Q2.

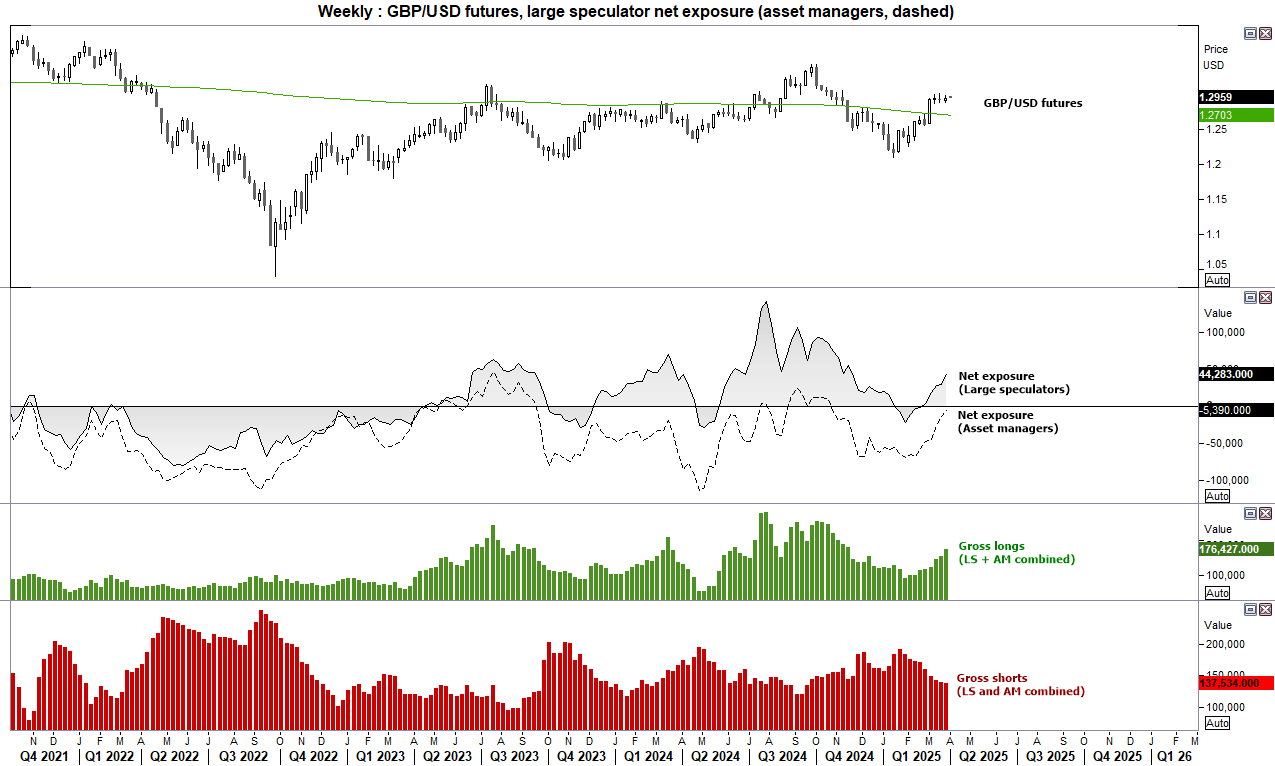

GBP/USD (British pound futures) positioning – COT report:

GBP/USD looks a bit more keen to break to a new cycle higher compared to EUR/USD. So this is a key pair to watch, as it could pave the way for others to follow. Failure for GBP/USD to break to a new cycle high could also provide warning elsewhere, and add weight to the case for a bounce on the US dollar.

Large speculators pushed their net-long exposure to the highest level since November. Asset managers were on the cup of flipping to net-long exposure, with a gross-short exposure of just under -6k contracts. I suspect they will flip to net-long exposure should we see GBP/USD prices continue higher this week.

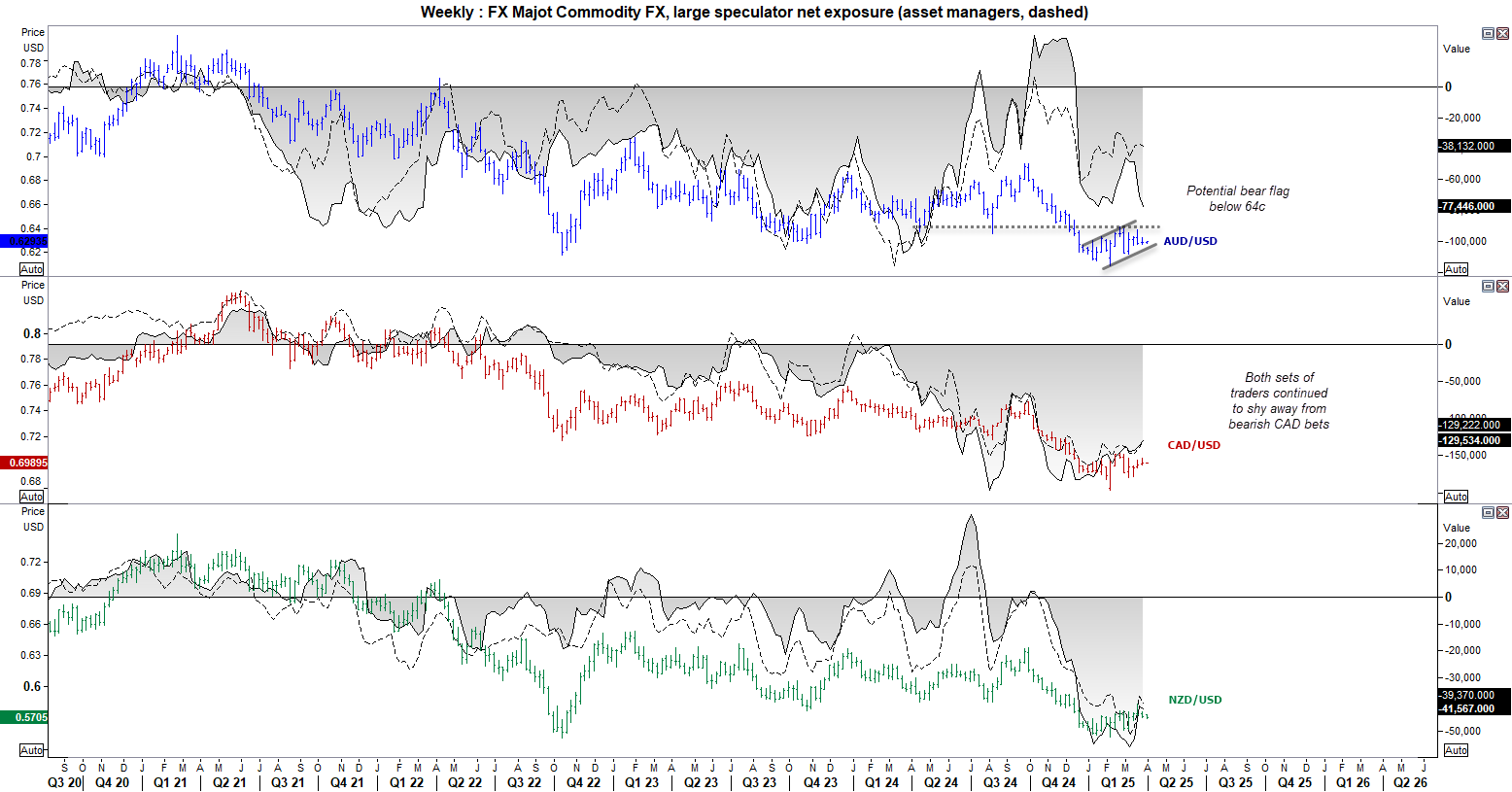

Commodity FX (AUD, CAD, NZD) futures – COT report:

Large speculators increased their net-short exposure to AUD/USD to a 10-week high. A bearish flag is also forming on the weekly chart. However, for it to stand any chance of success, we likely need to see USD/CNH post a strong rally. Otherwise, dip buyers may return the closer AUD/USD get to 60c (and we’ve not spent any real time in the 60s without a financial catastrophe).

Asset managers and large speculators continued to shy away from their bearish bets against the Canadian dollar. While this might not necessarily result in a bullish move for the Canadian dollar (unless tariffs are to be removed or watered down), it does warn against being overly bearish the Canadian dollar given its reluctance to selloff further in recent weeks.

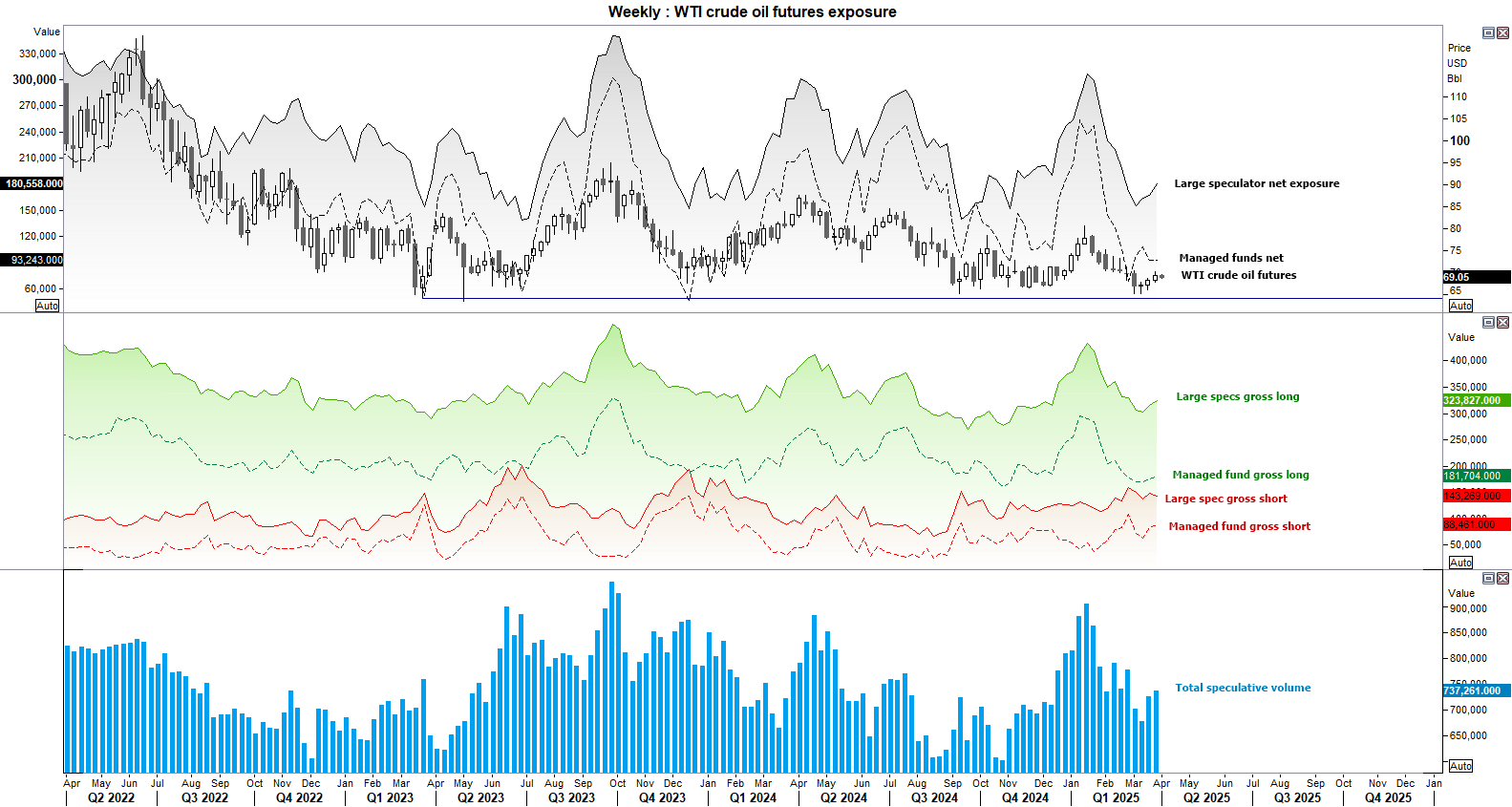

WTI crude oil (CL) positioning – COT report:

Crude oil reached my $70 target, which I originally outlined on March 13th due to the multi-week decline stalling around support. WTI crude oil has now risen for a second week. As for positioning, large speculators and increased their gross-long exposure for a third week, and at 13.7k it was its fastest rise since mid January, significantly higher than the 980 contract rise among managed funds.

As we’ve seen there days of selling since the $70 target was met, I currently have no immediate bias on WTI crude oil. But if I see evidence of a swing low on the daily chart, a near-term bullish bias could be reconsidered.