EUR/USD holds above 1.14 ahead of the ECB rate decision

- ECB is expected to cut rates by 25 bps

- Inflation & growth forecasts will also be released

- EUR/USD holds above 1.14

EUR/USD is trading cautiously around 1.14 ahead of the ECB rate decision AT 13:15 BST today.

The ECB is expected to cut interest rates by 25 basis points, which is almost completely priced in following eurozone CPI data earlier this week.

Eurozone inflation dropped to 1.9% YoY in May, below the ECB’s 2% target, and growth remains stagnant.

The ECB will also provide updated inflation and growth forecasts. However, given the uncertainty surrounding Trump’s trade tariffs, the ECB could provide a range of projections. It is still unknown whether Trump will apply 50% on EU imports in July or whether the 50% steel and aluminium tariffs will remain. Trade talks between the EU and the US are ongoing.

The market expects another rate cut this year, but given the tariff uncertainty, ECB President Lagarde could signal a pause in July and another cut in September. There should be more clarity regarding tariffs, inflation, and growth by this time.

The USD remains depressed after yesterday's weak ADP payroll and ISM services data. ADP payrolls. Today, attention is on jobless claims and Fed speakers for direction.

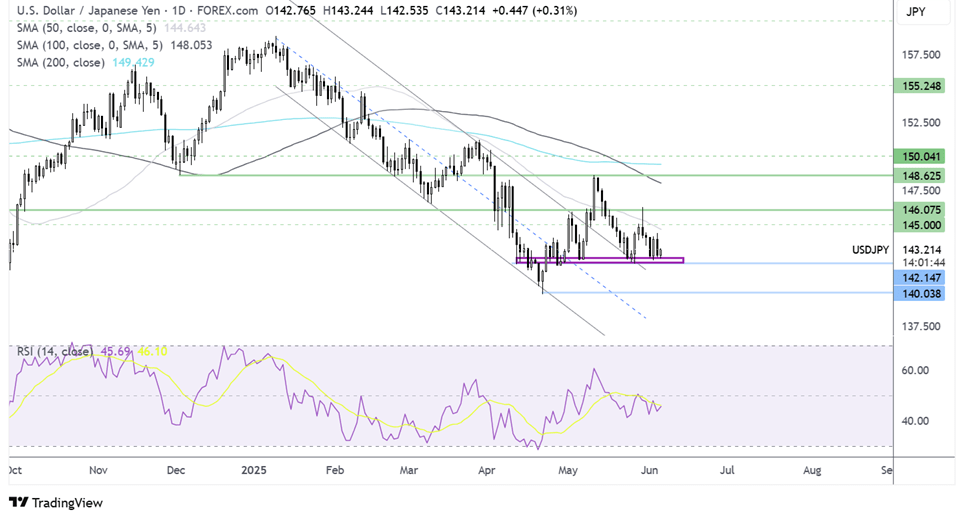

EUR/USD forecast – technical analysis

EUR/USD rebounded from the 50 SMA, recovering to 1.14. Should the bullish momentum continue, buyers will look towards the 1.15 round number and 1.1575, the 2025 high. A rise above here brings 1.16 and multi-year highs into focus.

Failure to rise meaningfully above 1.14 could see the price fall back towards 1.1280 horizontal support and the 50 SMA at 1.1350, a dynamic support which has been guiding the price higher. Should sellers take up 1.12 support, this creates a lower low, changing the chart's structure.

USD/JPY hovers around 143 after yesterday’s losses

- USD/JPY fell 1% yesterday after weak US data

- US ADP payrolls rose just 37k, and ISM services contracted

- USD/JPY hovering around its weekly low

USD/JPY is hovering around 143.00, a weekly low following a 1% decline yesterday after weaker-than-expected US data raised concerns over the impact of Trump’s trade tariffs on the US economy.

ADP payrolls rose just 37,000, the lowest level in over two years, and the ISM services PMI showed the dominant sector slipped into some traction in May. Meanwhile, prices paid surged, raising concerns of slowing growth and sticky inflation as tariffs weigh on the broader economy.

Meanwhile, the yen has benefited from safe-haven flows and amid growing acceptance that the Bank of Japan will continue hiking interest rates. Data showing Japan's real wages fell for a fourth consecutive month in April amid stubborn inflation reaffirmed these expectations. As a result, any losses in the yen could be limited.

Looking ahead, attention will be on US jobless claims and Fed speakers. Jobless claims are expected to be5K from 240K llast week. Softer-than-expected data could pull the USD lower.

Meanwhile, President Trump and China's xi Jinping are expected to speak at some point this week after trade talks between the two economic powers stalled. Any sense of progress towards a trade deal could help boost USD JPY higher.

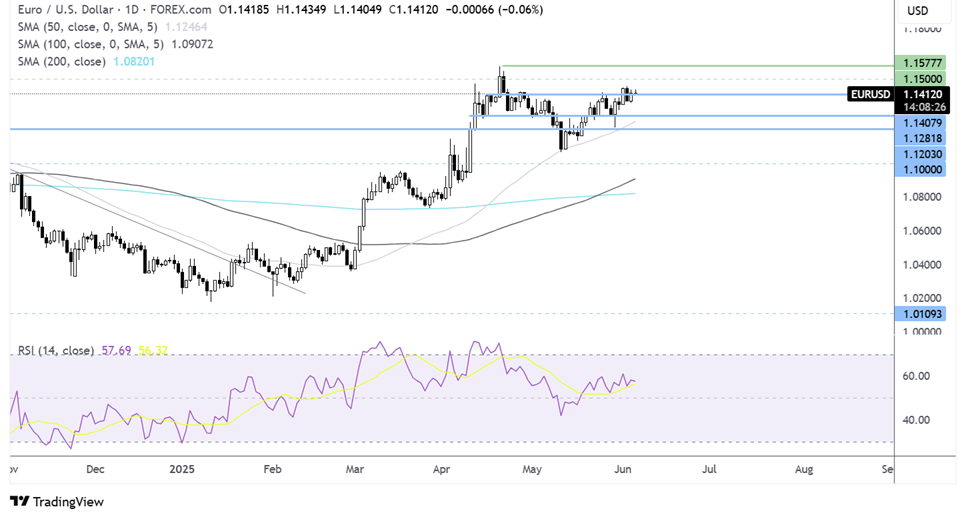

USD/JPY forecast – technical analysis

After hitting resistance at 148.65, USD/JPY rebounded lower, dropping below the 50 SMA but holding above the 142.50 support zone.

Sellers supported by the RSI below 50 will look to take out the 142.50-1.42 support zone, opening the door to a deeper selloff towards 140.00

Should this support zone hold, any recovery would need to rise above the 145 round number and the 50 SMA. Meanwhile, a rise above 146.30 creates a higher high.