Weekly Technical Trade Levels on USD Majors, Commodities & Stocks

- Technical setups we are tracking into the weekly open / FOMC interest rate decision

- Next Weekly Strategy Webinar: Monday, May 12 at 8:30am EST

- Review the latest Video Updates or Stream Live on my YouTube playlist.

In this webinar we take an in-depth look at the technical trade levels for the US Dollar (DXY), Euro (EUR/USD), British Pound (GBP/USD), Australian Dollar (AUD/USD), Canadian Dollar (USD/CAD), Japanese Yen (USD/JPY), Swiss Franc (USD/CHF), Gold (XAU/USD), Silver (XAG/USD), Crude Oil (WTI), S&P 500 (SPX500), Nasdaq (NDX), and the Dow Jones (DJI). These are the levels that matter on the technical charts into the weekly open.

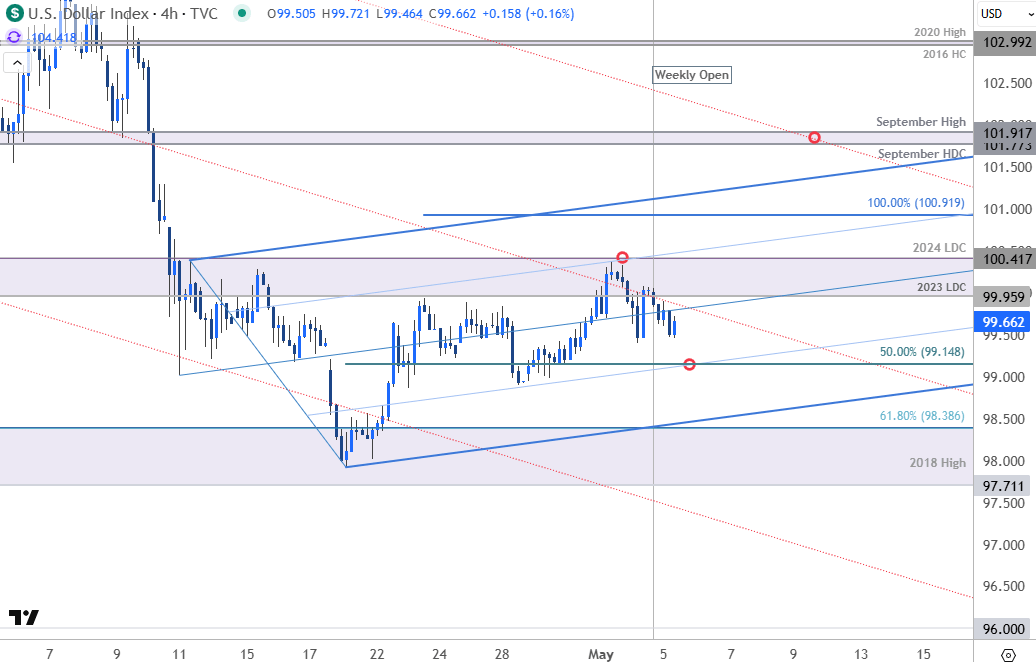

US Dollar Index Price Chart – USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

The US Dollar rallied into resistance last week at 99.95-100.42 with the weekly opening-range taking shape just below. Losses should be limited to the 50% retracement IF price is heading higher on this stretch with a breach above 100.42 needed to fuel the next leg of the recovery. Keep in mind the Fed is on tap Wednesday with markets largely anticipating the central bank to hold rates. Stay nimble into the release and watch the weekly close here. Review my latest US Dollar Weekly Forecast for a closer look at the longer-term DXY technical trade levels.

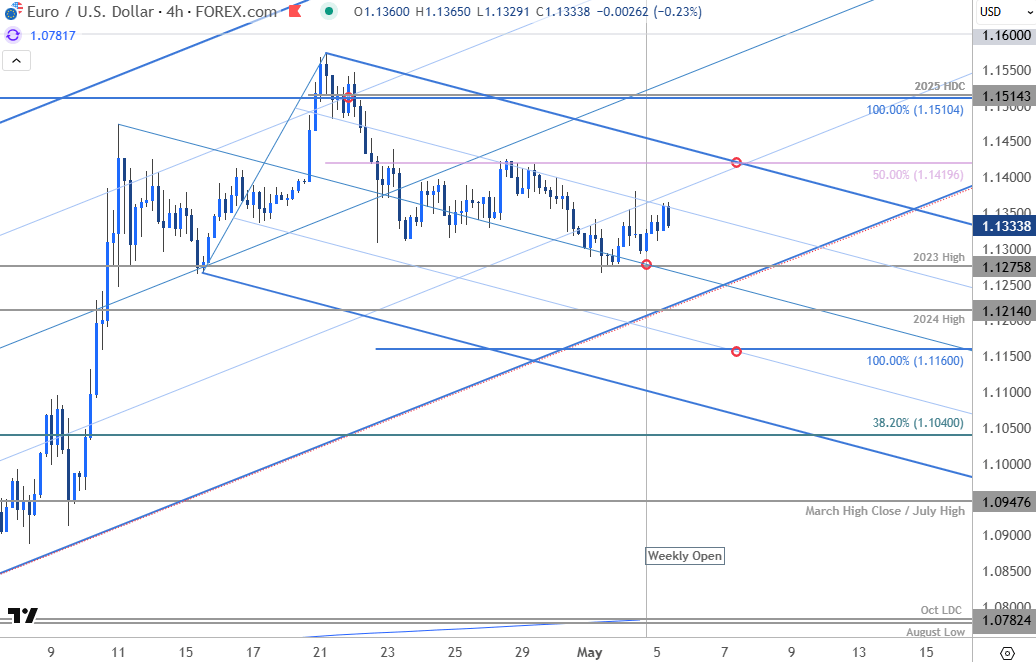

Euro Price Chart – EUR/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Euro is off more than 2% from the yearly high with EUR/USD carving the weekly opening-range just above multi-month uptrend support. From a trading standpoint, rallies would need to be limited to Friday’s high IF price is heading lower on this stretch with a break below the lower parallel exposing the 2024 high at 1.1214 and 1.1160- both levels of interest for possible exhaustion / price inflection IF reached. Ultimately, a breach / close above 1.1420 is needed to threaten uptrend resumption. Review my latest Euro Weekly Forecast for a closer look at the longer-term EUR/USD technical trade levels.

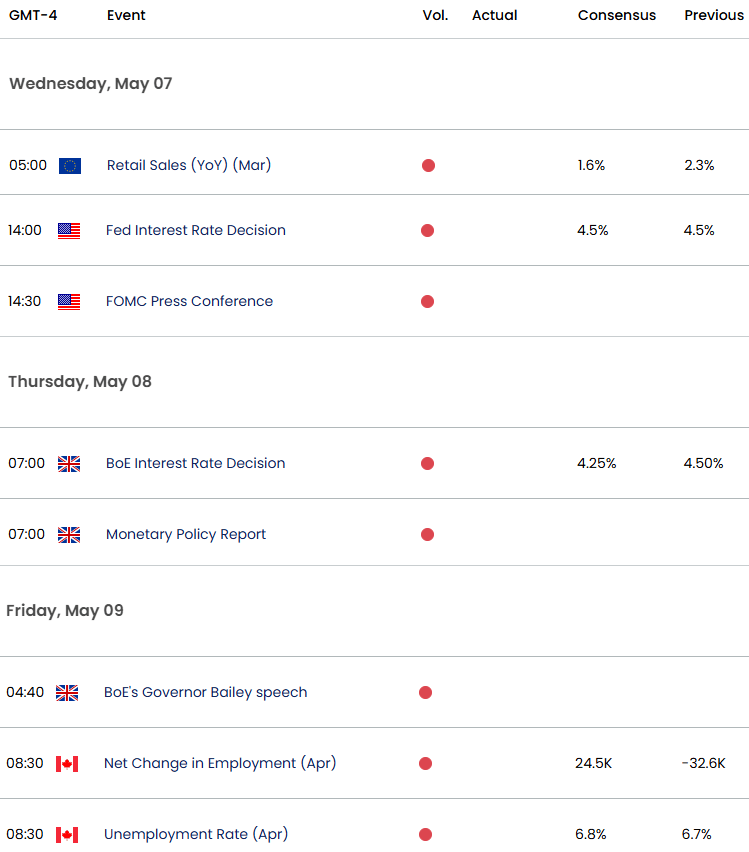

Economic Calendar – Key USD Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

--- Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex