June Forex Seasonality Key Points

- June has historically been a relatively strong month for EUR/USD and AUD/USD going back to the Bretton Woods Agreement in 1971.

- In contrast, USD/JPY and USD/CAD have seen more mixed performance in June.

- With Trump’s trade war in flux as we go to press, it’s worth watching the headlines to determine

The beginning of a new month marks a good opportunity to review the seasonal patterns that have influenced the forex market over the 50+ years since the Bretton Woods system was dismantled in 1971, ushering in the modern foreign exchange market.

As always, these seasonal tendencies are just historical averages, and any individual month or year may vary from the historic average, so it’s important to complement these seasonal leans with alternative forms of analysis to create a long-term successful trading strategy. In other words, past performance is not necessarily indicative of future results.

Euro Forex Seasonality – EUR/USD Chart

Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

Historically, June has been the third-strongest month for EUR/USD, with the world’s most widely-traded currency pair sporting an average return of +0.52% over the last 50+ years. In May, EUR/USD fell then rallied back, ultimately finishing the month near unchanged after unusually strong months in March and April. With the pair holding near 3-year highs, bulls have the upper hand and will be watching for a confirmed break above resistance at April’s high in the mid-1.15s to open the door for an extended rally in the coming month.

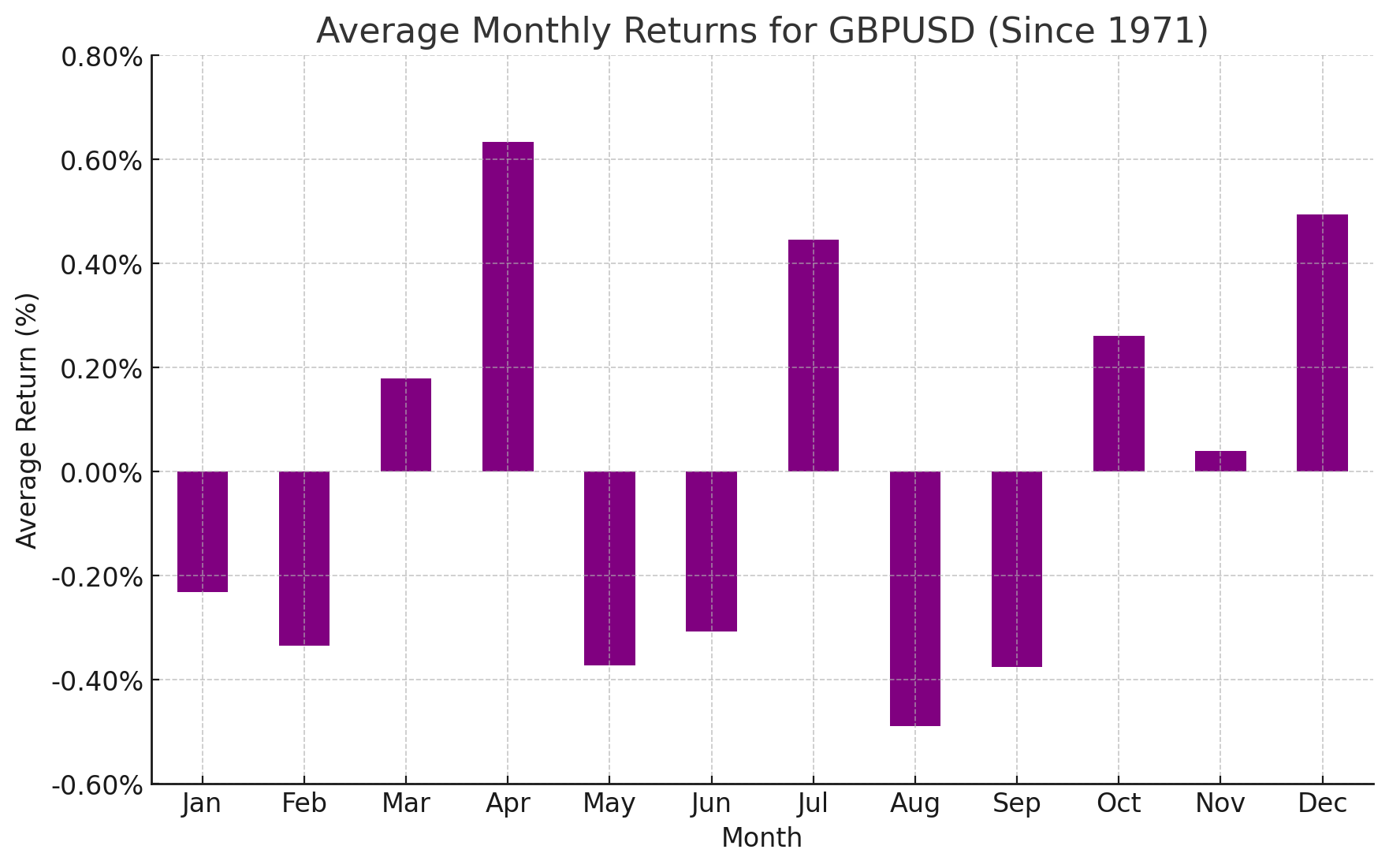

British Pound Forex Seasonality – GBP/USD Chart

Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

Looking at the above chart, GBP/USD has historically seen relative weakness in June, with average returns of around -0.31% since 1971. Like the euro, the British pound also edged higher in May after an early-month dip, hitting a 3+ year high near 1.3600. As long as cable holds above its 50-day EMA (currently around 1.3225), the path of least resistance should remain to the topside as we head through June.

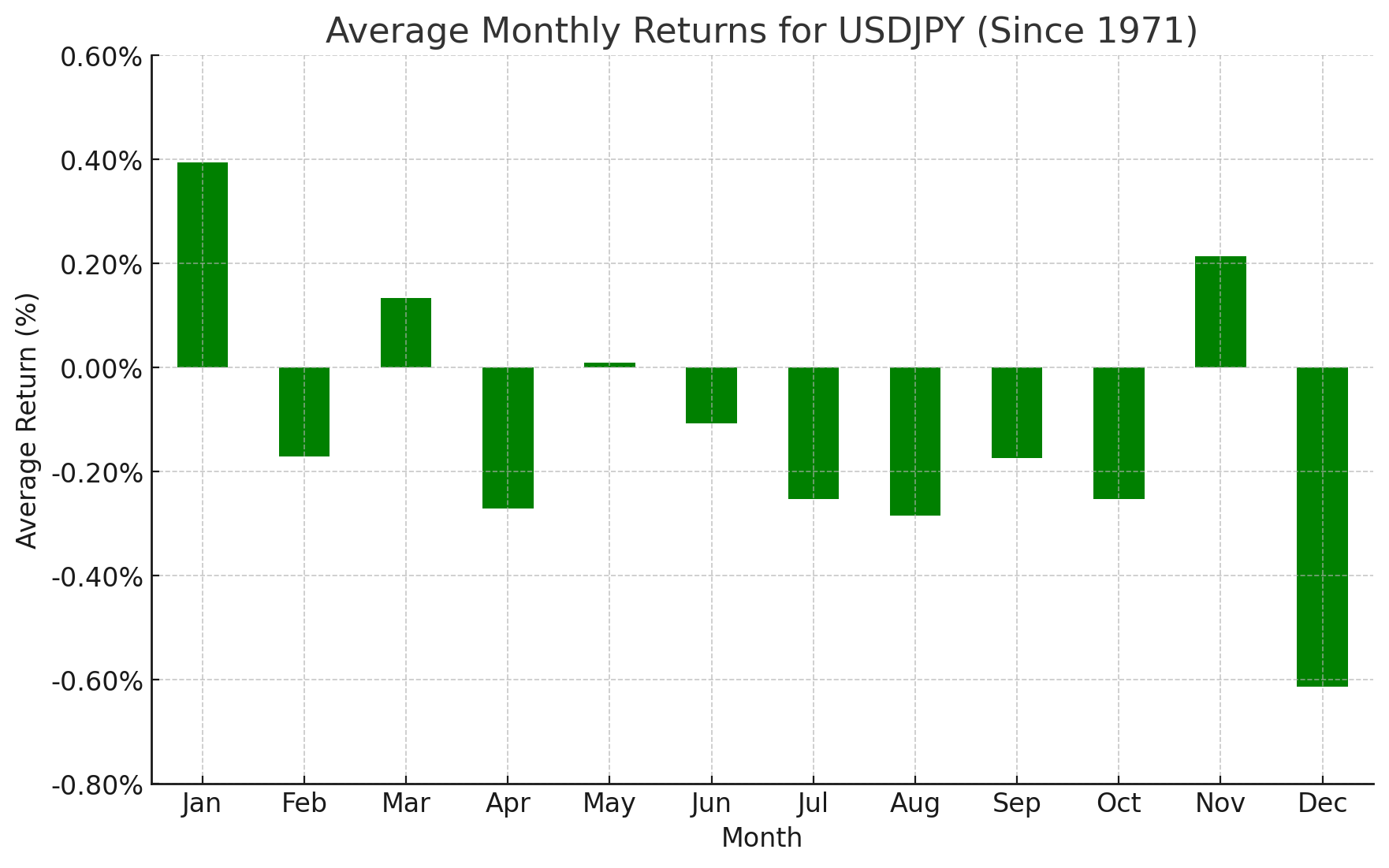

Japanese Yen Forex Seasonality – USD/JPY Chart

Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

June has historically been a modestly bearish month for USD/JPY, with the pair falling by an average of -0.10% since the Bretton Woods agreement. In line with its long-term seasonal trend, USD/JPY saw relatively quiet trade in May as trade negotiations between the US and Japan continued to tick along with little in the way of substantial progress or setbacks. Traders will be watching the 2-year lows at 1.3950 for a potential breakdown if the seasonal trend asserts itself again this month.

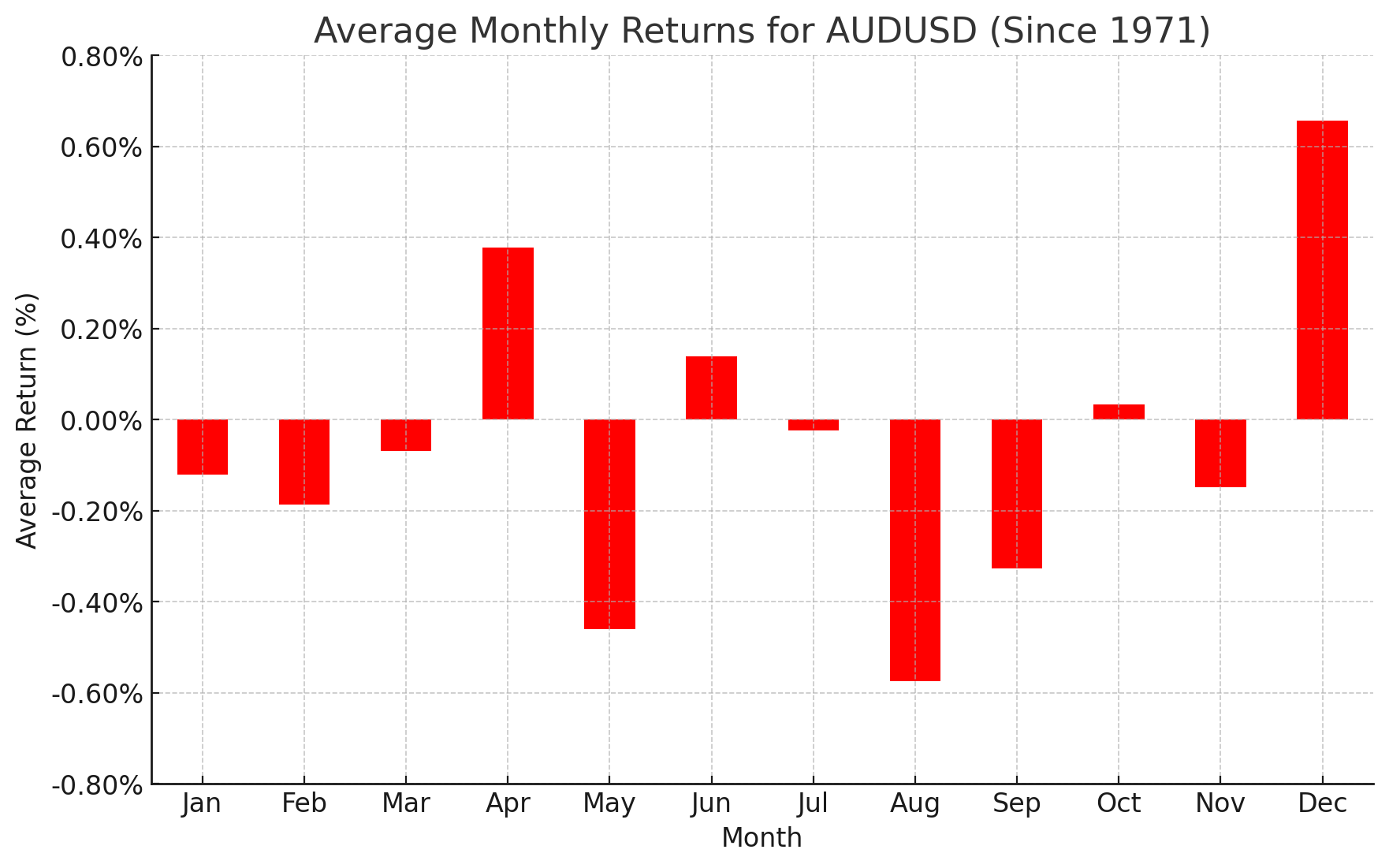

Australian Dollar Forex Seasonality – AUD/USD Chart

Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

Turning our attention Down Under, AUD/USD has its third-strongest performance in June, with an average gain of +0.14% going back to 1971. Last month, AUD/USD edged higher in relatively quiet trade, bucking the bearish seasonal trend. For June, readers should watch the 61.8% Fibonacci retracement of the September 2024 to April 2025 drop at 0.6550 as a key resistance level that may cap the pair unless we see a substantial bullish catalyst.

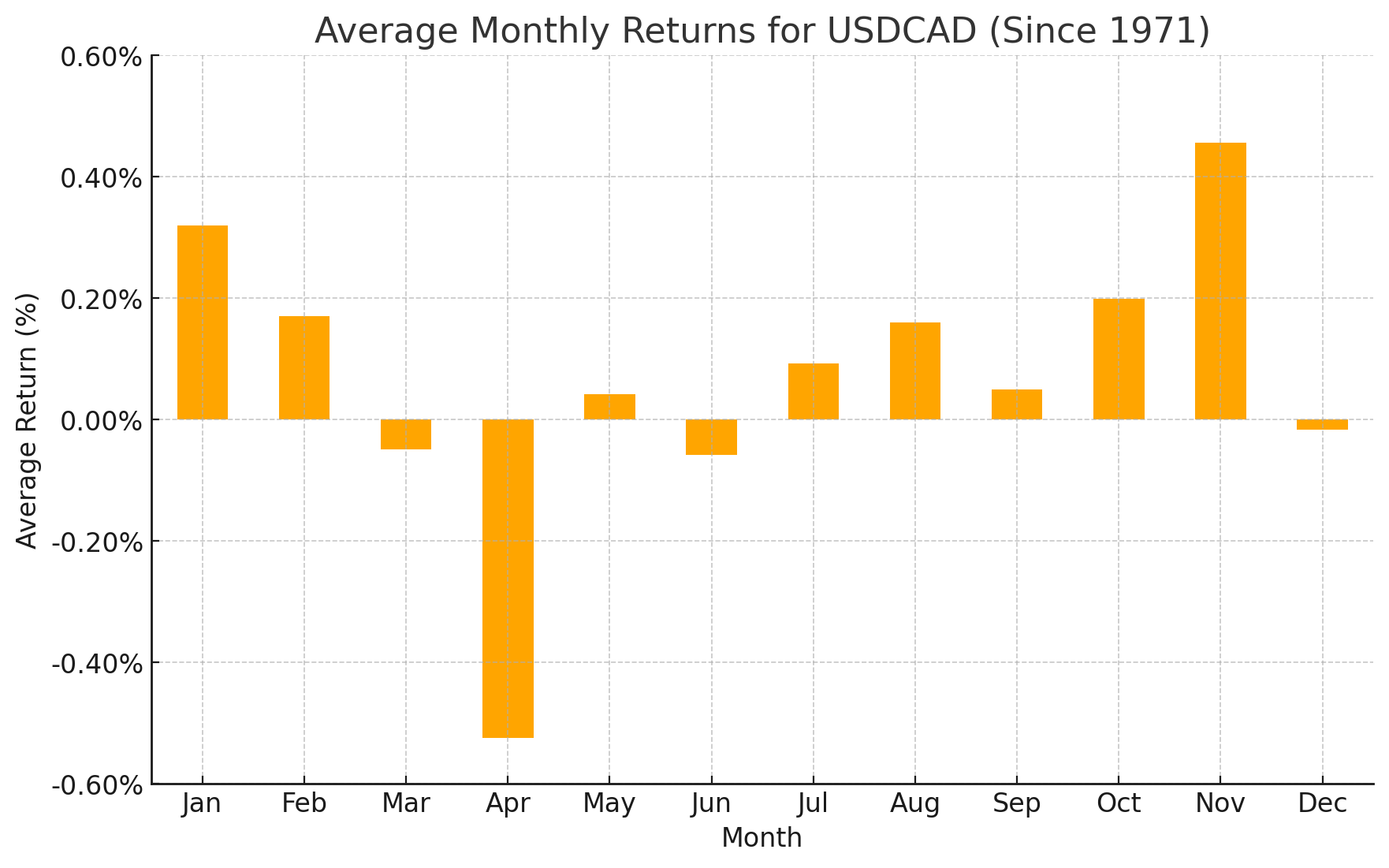

Canadian Dollar Forex Seasonality – USD/CAD Chart

Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

Last but not least, June has been a mixed month for USD/CAD, with an average historical return of -0.06%. While it can be useful to understand the historical seasonal tendencies in certain environments, the North American pair faces much more significant pressure from the health of its trading relationship with the US and the new minority government under Prime Minister Mark Carney, and those headlines may once again be a bigger driver for USD/CAD this month than the bearish seasonal trend.

As always, we want to close this article by reminding readers that seasonal tendencies are not gospel – even if they’ve tracked relatively closely so far this year – so it’s important to complement this analysis with an examination of the current fundamental and technical backdrops for the major currency pairs.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX