The GBP/USD bounced back along with most other dollar pairs as risk appetite improved after the events in the last few days involving Israel and Iran. The cable went back north of the $1.36 handle where the rally stalled ahead of the big events this week. With both the BoE and FOMC rate decisions to come, the GBP/USD forecast is subject to increased volatility, making the cable the currency pair of the week for us.

GBP/USD shrugs off weak UK data as US dollar remains on the backfoot

Last week was a bruising one for UK data. April GDP shrank by 0.3% – worse than expected – and the outlook isn’t getting any rosier. Payrolls took a hit in May, and the government’s spending review did little to dispel the prospect of tax hikes come autumn.

However, the GBP/USD didn’t drop much thanks to ongoing weakness in US dollar, although the EUR/GBP pushed above the key 0.8500 handle, pointing to weakness for the pound. Most other GBP crosses also fell somewhat.

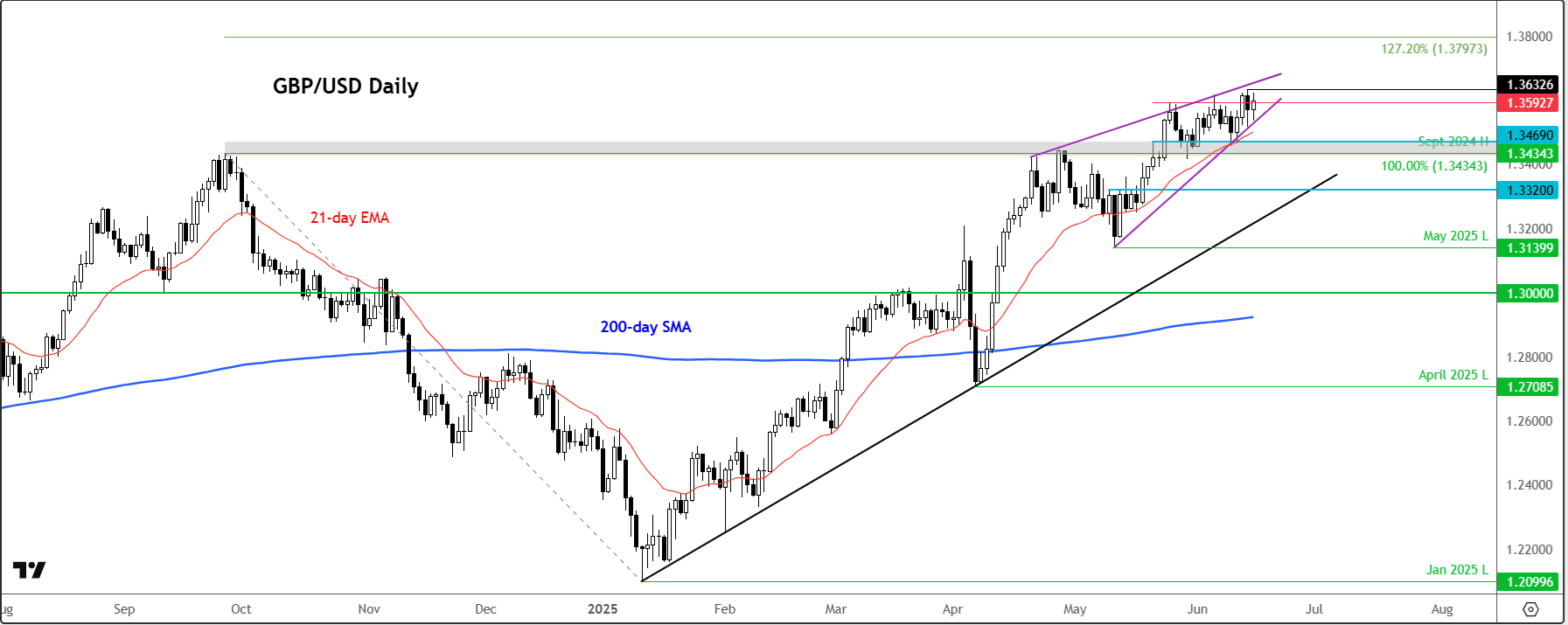

While the softness in UK data suggests the cable is looking ripe for a correction, we need to see strength for the US dollar to change the current trajectory. It’s pricey relative to rate differentials, but bearish USD positioning continues to limit dollar strength. That makes us a touch more cautious on the downside for the GBP/USD. But could this week’s events turn the GBP/USD forecast and trend a little more bearish? For confirmation, a break below the rising wedge pattern is a prerequisite.

Source: TradingView.com

Bank of England won’t cut rates

Well, they are highly unlikely to anyway. Nearly all forecasters suggest the BoE will keep policy unchanged at 4.25%. But it will be interesting to see whether voting composition will change this time, after the committee voted 7-2 in favour of no change last time. If we see a dovish tilt in the voting composition, then that will be the clearest sign yet that the central bank will most likely cut at its next meeting.

The issue for the BoE all this time has been the sticky nature of services inflation, and with oil prices spiking amid the middle East tensions, this is adding another layer of complexity. But the UK jobs data is certainly looking grim. Employment has fallen in 9 of the past 10 months, and the pace of decline is quickening. Wage growth, the hawks’ go-to reason for caution, is finally easing too. Private sector pay has dipped from 6% to just under 5% – still high, but below the Bank’s May forecast.

Inflation, meanwhile, remains sticky on the surface. Headline CPI sits at 3.5% and is likely to stay elevated for a while. However, analysts expect the May CPI to have eased to 3.3%. We will have this inflation data on Wednesday, a day before the BoE rate decision.

Markets now price 50bp of cuts this year, with August and November looking more likely for those potential cuts. This week, the BoE will almost certainly hold – though the watch out for a dovish split in the vote.

FOMC could set the tone for GBP/USD forecast

Trump has been demanding 1% interest rate cut from the Fed, pointing to weaker than expected inflation and rising borrowing costs for the government. His warnings have fallen on deaf ears, with Chairman Powell keen to maintain confidence in monetary policy by holding firm amid potential inflationary risks stemming from tariffs, and defend the central bank’s independence.

While the Fed is also expected to hold firm, any clear hints of a policy shift could further weaken the US dollar in the near-term, potentially giving the GBP/USD forecast another boost. However, if Powell and co stay tight lipped about potential rate cuts, then this may alleviate some pressure off the dollar, allowing the GBP/USD to weaken.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R