- GBP/USD forecast hinges partly on central bank double-header

- Mixed US jobs data left markets largely unfazed as trade uncertainty dominates

- GBP/USD approaching major long-term resistance

The GBP/USD forecast remains delicately balanced, ahead of key central bank decisions from both sides of the pond. The Federal Reserve and the Bank of England are on the docket, with traders preparing for possible policy divergence. The Fed is expected to hold firm today, while the BoE might deliver a rate cut tomorrow, possibly signalling more to follow. The dollar has started this week lower, but that follows two weeks of small gains. Whether the dollar's recent bounce has real substance may also depend on how global trade talks, particularly with China, unfold. The Trump admiration has announced there will be trade deals with other partners coming end of this week or start of next. Meanwhile, Friday’s release of US nonfarm payrolls or the ISM services PMI on Monday didn’t stir much excitement. Despite decent headline numbers, markets gave a muted reaction with the focus firmly fixated on the trade situation. But could the BoE or FOMC bring back the focus on the macroeconomics this week?

Dollar could come back thanks if trade deals agreed

The dollar index has so far been weaker on the week, after making two consecutive weekly gains. Those modest gains stems from a gradual unwinding of earlier “Sell America” trades, as equity markets continued their impressive recovery last week. The catch? No one truly knows where the US-China trade drama is headed. What’s certain is that equity traders have priced in some sort of deal—however ambiguous. The dollar, meanwhile, has lagged, with political pressure on the Fed muddying the waters. President Trump’s continued calls for rate cuts have not gone unnoticed, raising concerns about the central bank’s independence and complicating the greenback’s path forward. But a deal with China should ease the pressure on the greenback, if and when that happens.

Key events to watch in the GBP/USD forecast

Both the UK and US central banks are meeting in the next 24 hours or so to decide on monetary policy, putting the GBP/USD forecast in sharp focus.

FOMC Rate Decision – Wednesday, 7 May at 19:00 BST

No one expects the Fed to move on rates just yet. The benchmark will likely stay at 4.25–4.50%. With political noise in the background, Powell and team may focus on projecting stability and independence. The market will be watching the statement closely for any tilt ahead of June’s meeting.

Bank of England Rate Decision – Thursday, 8 May at 12:00 BST

This is the main event for the pound. A 25bps cut is widely expected, with a possible 8-1 vote split. The BoE is likely to stick to a cautious tone, stressing that any further easing will be gradual. Watch for tweaks to the inflation forecast—lower energy prices could see the 2025 projection trimmed, though stronger Q1 growth might see GDP revised slightly higher. Any hawkish surprises could see the GBP/USD forecast take a boost and the cable could rises to 1.3500.

Technical GBP/USD forecast: Long-term charts enter key resistance areas

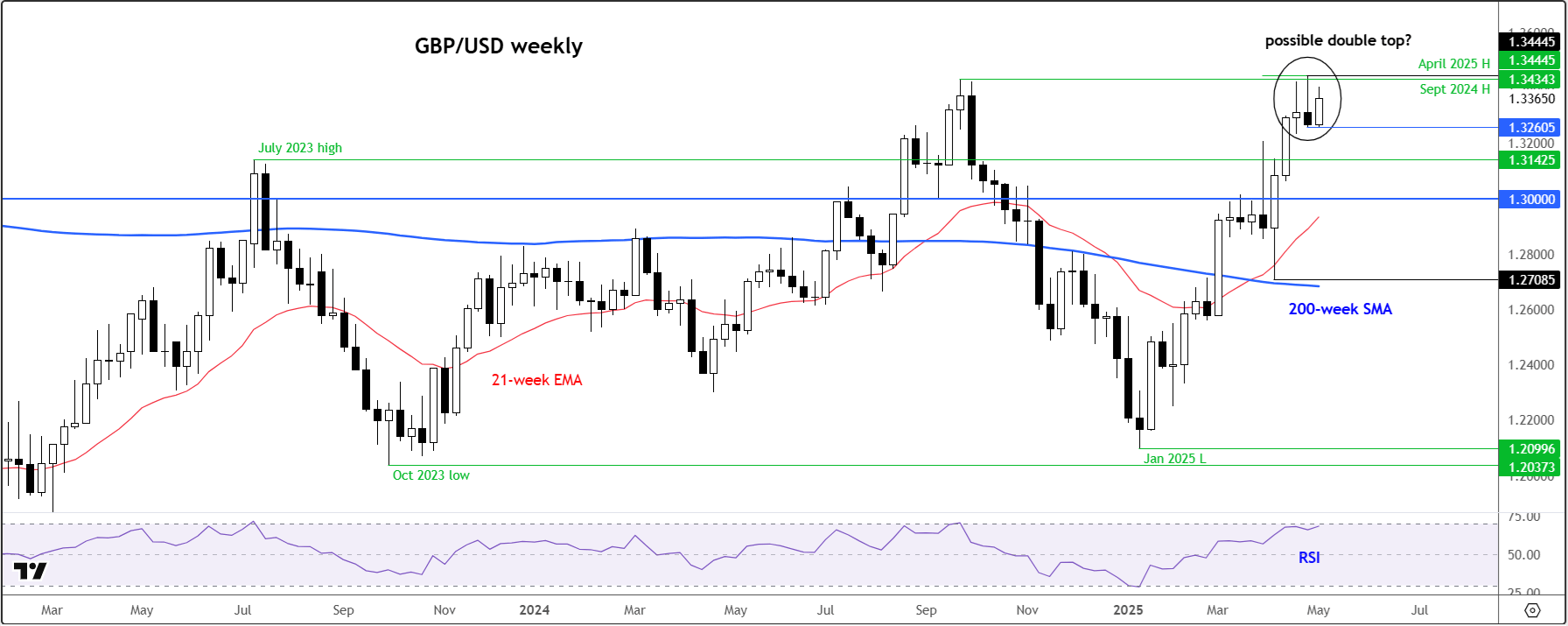

From a technical perspective, the GBP/USD pair is beginning to look a bit stretched, although there are no obvious signs of a trend reversal just yet. Last week’s inverted hammer on the weekly chart hints at a potential reversal, but so far there has been no downside follow-through:

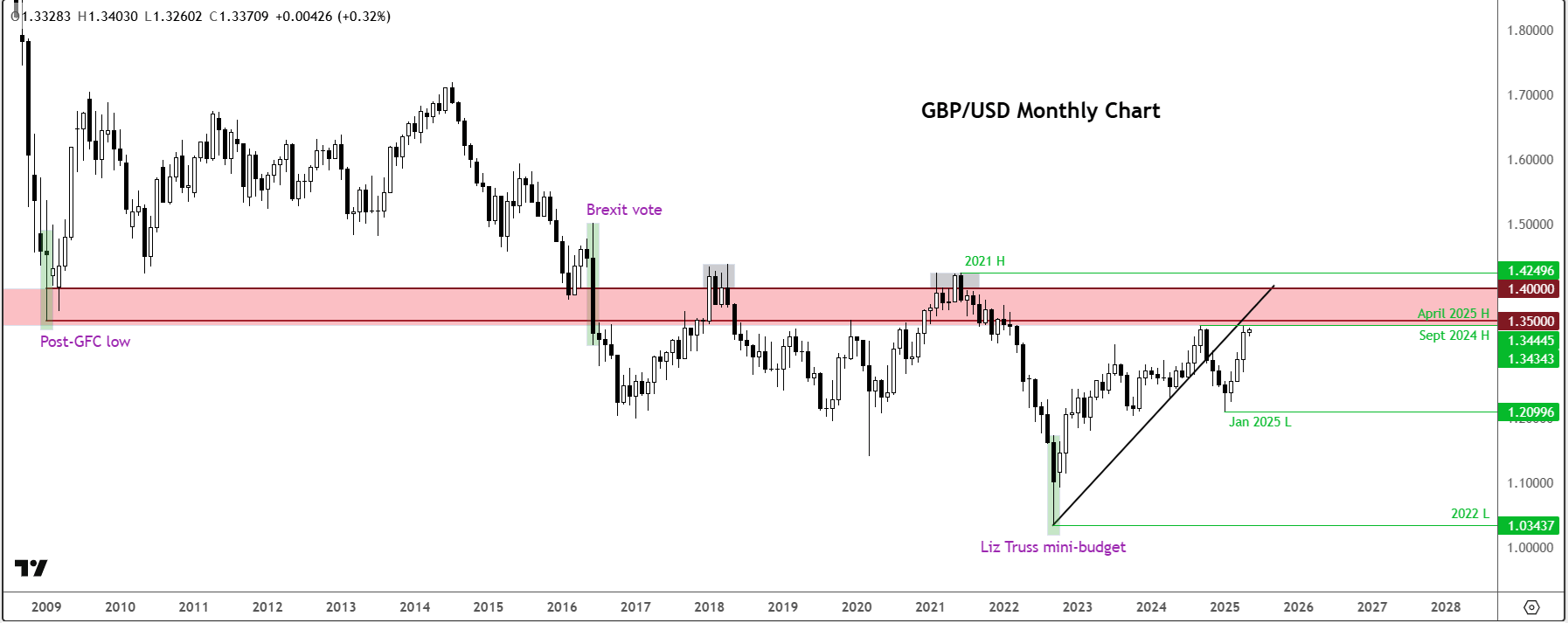

Still, rates are testing key long-term levels. Last week, the GBP/USD tested the September 2024 high at 1.3434, before pulling back. But stronger resistance looms around the 1.35-1.40 region for the cable, where, as the monthly chart shows, the cable has struggled to rise back above ever since Brexit.

In any case, bearish traders should keep a close eye on whether we see any follow-through to the downside this week.

Key support is marked at 1.3200, then again at the psychological 1.3000 level.

Final word

In short, this week could prove pivotal for the GBP/USD forecast. The NFP or trade optimism have so far been unable to lift the dollar from its gloom, but with both the BoE and Fed in play—and ongoing US-China trade developments—there’s plenty that could spark movement. For now, we lean cautiously bearish on sterling, but that view may shift quickly depending on how policymakers steer the narrative.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R