- GBP/USD outlook clouded by oil-driven dollar strength ahead of FOMC decision today

- Middle East crisis revives demand for the US dollar as a safe haven

- UK inflation cools – BoE under pressure to adopt a more dovish stance

The GBP/USD outlook has become increasingly murky as geopolitical tensions in the Middle East concerns Iran, Israel, and now, the US, have helped to fuel a bit of a dollar recovery this week, while weakness in UK data has raises the probability of a BoE rate cut come August. Making things more interesting, both the Federal Reserve and Bank of England will be making their rate decisions within the next 24 hours or so. But while the market usually zeroes in on policy updates from the Fed, it’s the unfolding drama in the Middle East that’s stealing the show right now. Thus, the risks to the short-term GBP/USD outlook remains tilted to the downside.

Trump: I may do it, I may not

Trump has made his most explicit comments yet about possible military action against Iran. He said: "I may do it. I may not do it. Nobody knows what I’m going to do." The US president also revealed that he told Israel PM Netanyahu to keep going, but has not given an indication that the US will provide more help. Meanwhile, Iran has issued an evacuation warning for residents of Haifa, Israel. This suggests that the conflict is far from over. Btu for now at least, the US is not getting involved, if one can believe Trump.

Earlier, fears over US intervention in Iran had reignited oil prices, with Brent rising above the $76 mark. That, in turn, had handed the dollar a boost via its safe-haven appeal, putting the squeeze on cable and risk-sensitive assets. That changed after Trump spoke and we saw a sharp drop in oil prices, and that caused a bit of a recovery in stock prices while the US dollar hardly reacted as investors await the Fed meeting.

GBP/USD outlook hinges more on the Fed and geopolitical risk than BoE

While the Fed is expected to keep rates unchanged later today, it’s the broader backdrop—not monetary policy—that’s pushing the dollar. With Israel stepping up airstrikes on Tehran and whispers of American military involvement growing louder, oil prices have surged in recent days. As a result, the greenback is benefiting more from geopolitical unease than anything the Fed might say or do.

Still, one must be cautious. Unless oil’s gains are backed by real-world supply shocks, this dollar rally could be transitory. Soft US retail sales numbers, which once shook markets, barely raised an eyebrow yesterday. In this cycle, it’s headlines—not fundamentals—that are driving sentiment.

Markets will still be watching the Fed’s updated dot plot closely. Traders anticipate the FOMC to reaffirm expectations for 50 basis points of cuts by year-end. However, if policymakers adopt a more hawkish tilt—perhaps reflecting higher energy prices or tariff-related risks—it could offer the dollar additional legs in the near term, reinforcing a bearish GBP/USD outlook.

BoE faces pressure for a dovish pivot

The domestic picture isn’t looking much brighter for the pound. This morning’s CPI data showed UK inflation easing to 3.4% in May, albeit this was still just above expectations. Core CPI came in at 3.5%, while services inflation—a key gauge for the BoE—dropped to 4.7%, below forecasts.

While no one expects the BoE to cut rates tomorrow, the pressure for a softer tone is mounting. Economic data has been trending softer—from employment to output—making it increasingly difficult for policymakers to justify their hawkish stance unless inflation picks up again soon.

In the immediate term, the GBP/USD outlook suggests heightened volatility with downside risks in focus. Between risk-off flows favouring the dollar and a potentially dovish turn from the BoE, the cable may struggle to find sustained upside traction.

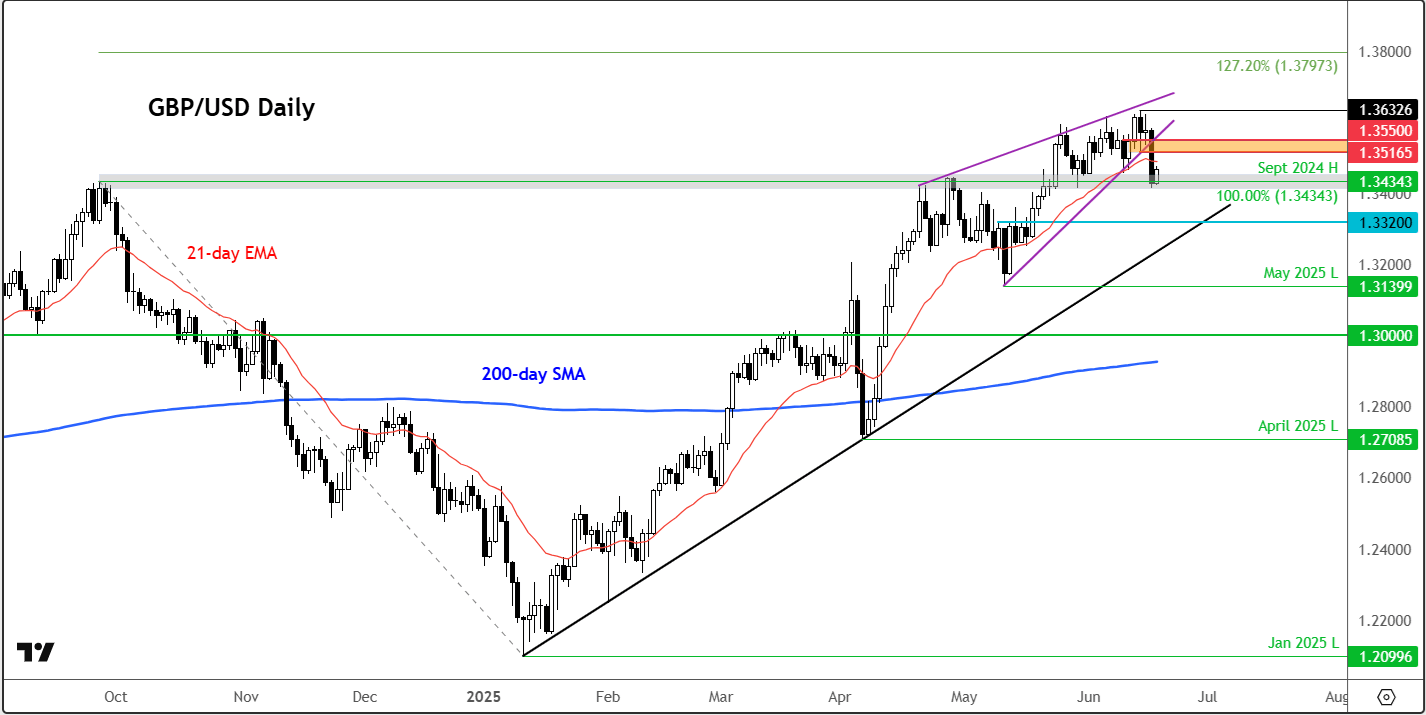

GBP/USD outlook: Technical analysis and levels to watch

Source: TradingView.com

From a technical standpoint, the GBP/USD exchange rate has now broken beneath its rising wedge formation— a precursor to potentially bearish momentum. All eyes are on the 1.3430–1.3435 region, a pivotal level that has acted as both resistance and support over the past year. Bulls have managed to defend it on recent tests, but a break below could trigger long-liquidation and push GBP/USD towards the 1.3400 zone. Further down, support comes in near 1.3350 where a bullish trendline sits waiting.

On the topside, resistance is stacked between 1.3515 and 1.3550—a former support area now flipped to resistance. Should buyers regain control, 1.3632 (the recent swing high) would come back into view. IF we get there, the near-term bearish bias will become invalidated.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R