- GBP/USD forecast hinges on pivotal BoE and Fed rate decisions this week

- Mixed US jobs data failed to ruffle markets—risk appetite still in charge

- All roads now lead to the ISM PMI, Fed, and BoE

The GBP/USD forecast remains largely rangebound heading into a pivotal week for the pair, with both the Federal Reserve and Bank of England set to make policy decisions. While the Fed is expected to hold steady, the BoE could cut rates and signal more easing in the months ahead. Whether the dollar recovery has any legs will also depend on the progress and outcome of trade negotiations between the US and its large trade partners, not least China. Meanwhile, the market’s verdict to the mixed NFP report on Friday was a shrug and a nod. The dollar briefly flickered higher before settling back, while the GBP/USD pair barely moved. Commodity currencies rallied, equities found a spring in their step, and gold slipped slightly—suggesting investors are still firmly in "risk-on" mode. Frankly, no one expected this NFP to rock the boat, and it didn’t.

US dollar index ended second week higher on trade optimism

Friday saw the US dollar index inch lower following a rather muddled US Nonfarm Payrolls (NFP) report. The greenback rose against the pound, but fell against most other major currencies, though closed well off its lows. Still, the dollar index managed to cling on a small weekly gain, its second in as many weeks. The greenback’s mild gains were largely driven by continued reversing of the “Sell America” trades, as equity markets extended their impressive comeback, even though no one quite knows where we stand on the trade war — whether fresh tariffs are incoming, existing ones will be rolled back, or retaliatory measures will be the order of the day. The fundamental narrative is in a state of flux. We are, for all intents and purposes, in no man’s land, but stock investors seem to have concluded that trade deals, in whatever form, are coming and soon. Yet, the dollar has been quite slow in making a recovery compared to equity markets, partly because of concerns about the Fed’s independence as Trump continues to apply maximum pressure on Powell and co to cut rates.

NFP was mixed, so too was the dollar’s response

Yes, the headline figure came in better than expected at 177,000 versus the anticipated 138,000, but let’s not get carried away. Previous months saw sharp downward revisions—March was clipped to 185,000 from 228,000, and in total, 58,000 jobs were lopped off prior estimates. Hardly a picture of labour market strength.

Still, there were a few green shoots. Full-time employment rose nicely, and the unemployment rate held at 4.2%. Wage growth was more subdued, with average hourly earnings up just 0.2% month-on-month, undershooting expectations of 0.3%. Not exactly thrilling, but softer wage data paired with a weaker Core PCE earlier in the week might give the Fed a touch more breathing room on inflation.

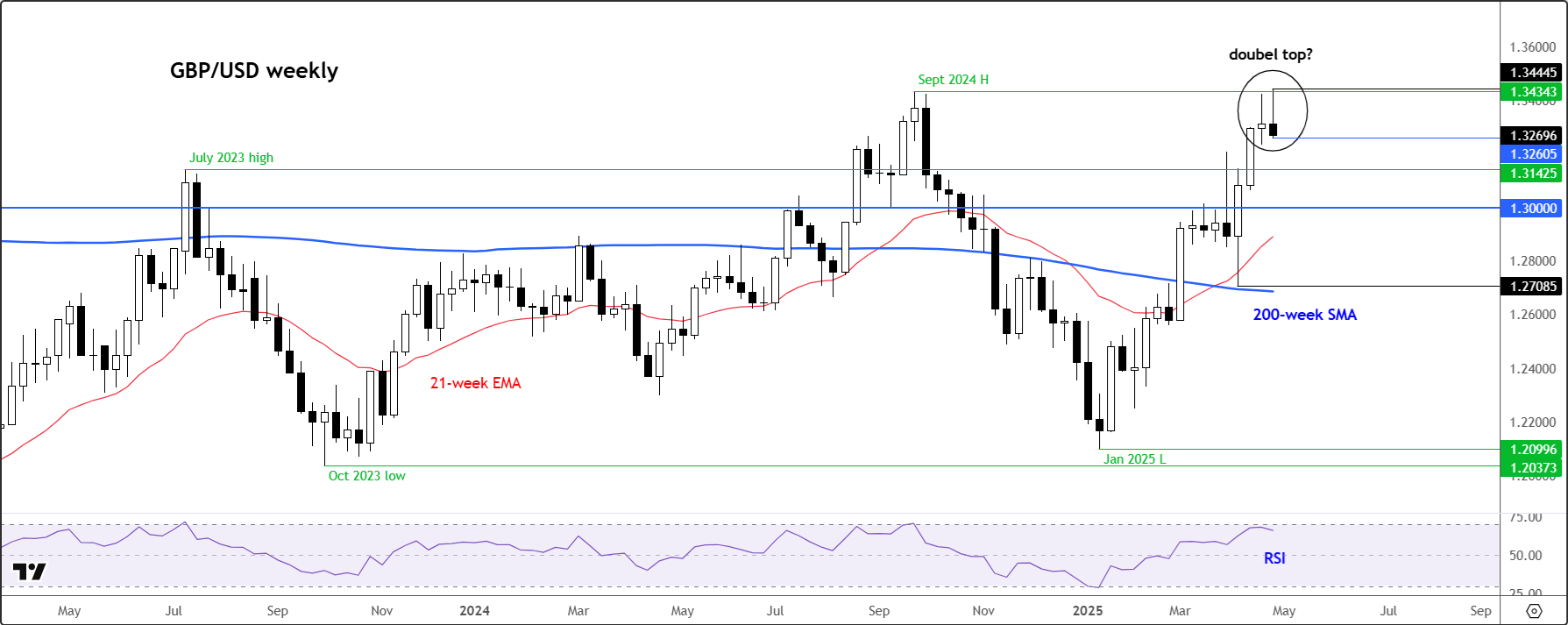

Technical analysis: GBP/USD prints potential double top

Source: TradingView.com

The broader narrative remains intact: global growth concerns, trade tensions, and—in the coming week—what central banks have to say. From a technical point of view, the GBP/USD chart is starting to look a bit bearish after the pair formed an inverted hammer candle on the weekly chart, and a possible double top or false break reversal against the September 2024 high of 1.3434. It is all about downside follow-through now, so let’s see if we will get any in the week ahead. Key support comes in at 1.3200, then 1.3000. Resistance is seen around 1.3300 initially ahead of 1.34ish next.

What to Watch for in the GBP/USD Forecast

- ISM Services PMI – Monday, 5 May at 15:00 BST

A solid read here could ease recession jitters and give risk assets another lift. That said, unless the number comes in wildly off script, we’re not expecting fireworks. For the GBP/USD forecast, this report is more of a supporting act than the main show.

- FOMC Rate Decision – Wednesday, 7 May at 19:00 BST

The Fed is widely expected to hold the line on rates, keeping the benchmark at 4.25–4.50%. While the odd political voice has called for cuts, Chairman Powell and co are unlikely to flinch just yet. More likely, they’ll use this meeting to stress independence and assess recent developments, particularly around tariffs and inflation. Traders will be looking for clues about June’s decision.

- Bank of England Rate Decision – Thursday, 8 May at 12:00 BST

Now here’s the one that truly matters for the GBP/USD forecast. The BoE is set to cut rates by 25bps, with an 8-1 vote expected. The central bank is unlikely to change its cautious tone—expect policymakers to reiterate that any future cuts will be measured. We may also see a slight downgrade to the 2025 inflation outlook, given the recent dip in energy prices. On the flip side, the 2025 GDP forecast could get a lift after a surprisingly solid Q1 showing.

Final Thoughts:

In short, the GBP/USD forecast will come into sharper focus as the week progresses. While the NFP didn’t shift the dial, the week ahead could be pivotal, especially if we also see soe progress in the trade negotiations between the US and China. Between the BoE and Fed, traders should buckle up. Depending on the tone and forward guidance from both, sterling could soon be on the move—one way or the other. Based on last week’s price action, we are leaning slightly to bearish side of the argument.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R