GBP/USD rises after UK services PMI returns to growth & ahead of US data

- UK services PMI rose to 50.9 in May vs 49 in April

- US JOLTS job openings unexpectedly rose, ADP payrolls up next

- GBP/USD trades in a rising channel, but momentum is slowing

GBP/USD is increasing, holding above 1.35 after an upward revision to UK PMI data and ahead of key US figures.

UK PMI data showed that the UK services sector returned to growth in May after US President Trump's tariffs caused the sector to contract in April for the first time in a year. The services PMI rose to 50.9 in May, up from 49 in April and above earlier estimates of 50.2. The upward revision lifted the composite PMI back above the 50 level, which separates expansion from contraction.

The data comes after the UK economy grew by a stronger-than-expected 0.7% in the first quarter of this year. However, the Bank of England expects growth to slow. Yesterday, the OECD also downwardly revised UK growth to 1.3% in 2025, down from 1.4% and two 1% in 2026 due to the impact of Trump's trade tariffs.

Meanwhile, the US dollar is under pressure after gaining yesterday. The USD was boosted by stronger-than-expected JOLTS jobs openings data, which saw 7.39 million new positions in April, up from 7.2 million openings in March. The surprising resilience of the US labour market means attention will be on ADP payrolls set to be released later today, and expected to show a rise to 115,000, up from 62,000

Meanwhile, the US ISM services PMI will be scrutinized for any signs of impact from Trump's trade tariffs. The PMI of ISM services is expected to rise from 52 to 51.6. The data comes after the OECD downwardly revised US GDP growth to 1.6% from 2.8% this year, owing to the impact of tariffs.

US trade tensions remain in focus, with President Trump and China's President Xi expected to speak this week as trade talks between the two largest economies stall. Any sense that trade talks are back on track could help lift the US dollar higher.

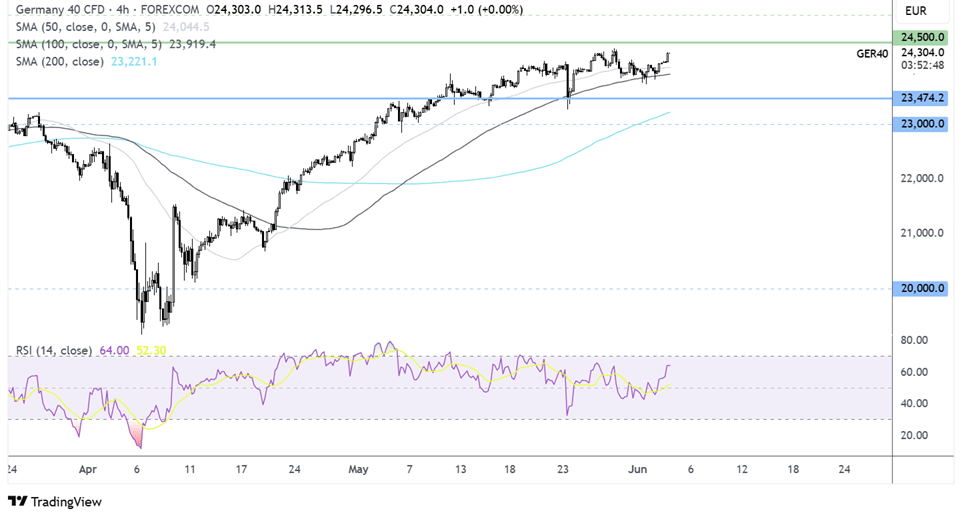

GBP/USD forecast – technical analysis

GBP/USD trades within a rising channel dating back to the start of the year, reaching a peak of almost 1.36 before easing lower. There are signs of slowing momentum amid a bearish RSI divergence. Support can be seen at 1.3450, the April high. Below here 1.3350 the lower band of the rising channel could offer support ahead of 1.33.

Buyers will look to rise above 1.36 to fresh multi-year highs. Above here, 1.3750, a level last seen in 2022, comes into play.

DAX rises on trade talk hopes, PMI data & ECB rate cut expectations.

The DAX rose to a record high on Wednesday, boosted by optimism about US-EU trade negotiations and expectations of further ECB rate cuts.

The US trade representative, Jamieson Greer, and the European commissioner for trade are due to meet today following Trump's tariff increases on steel and aluminium, which went into effect yesterday.

Optimism surrounding trade talks between Trump and Chinese President Xi also keeps global stocks buoyant. The two presidents are expected to speak sometime this week after Chinese-U.S. trade talks stalled. The market will want to see the two leaders on the same page, and that talks can progress for the mood to remain supported.

On the data front, eurozone services PMI showed activity in the sector contracted at a slower pace than initially feared. The services PMI for May came in at 49.7, an upward revision from 48.9 and the initial reading. Meanwhile, the eurozone composite PMI, which is considered a good gauge for business activity, expanded to 50.2, an upward revision from 49.5.

High hopes for a more dovish ECB rate path have also boosted the DAX. Eurozone annual inflation fell to 1.9% in May, down from 2.2% in April, dropping below the central bank's 2% target for the first time in eight months. The data comes ahead of tomorrow's ECB rate decision, where the central bank is expected to reduce rates by 25 basis points.

Looking ahead, US ADP employment data and ISM services PMI will also be in focus, and a resilient US labour market could boost sentiment further.

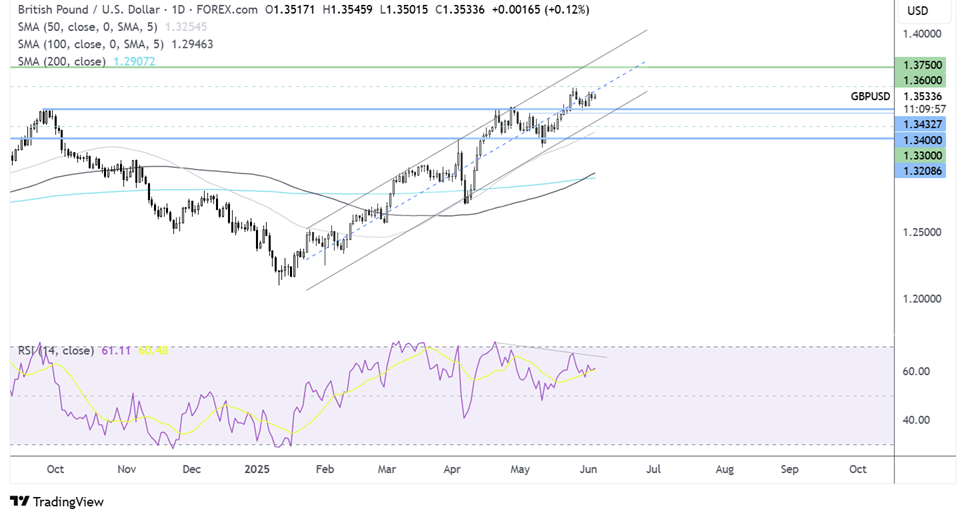

DAX forecast - technical analysis

The DAX is being guided higher by its rising 100 SMA. The price recovered from the 100 SMA, rising above the 24000 level to a peak of 24,326, just shy of the 24,400 record high. Buyers supported by the RSI above 50 will look to rise towards 24,500.

Support can be seen at 23,900, the 100 SMA, below here 23,500 comes into play.