GBP/USD holds steady amid trade deal hopes & ahead of the BoE rate decision

- The BoE is expected to cut rates by 25 bps to 4.25%

- The central bank could signal a June cut

- GBP/USD consolidates at 1.33

GBP USD is holding onto yesterday’s losses ahead of the Bank of England's interest rate decision and despite optimism surrounding a UK—U.S. trade deal.

At 12:00 BST, the BoE is expected to cut rates by 25 basis points to 4.25% and could signal towards another rate cut in June. This would put the central bank on track for its first back-to-back rate cut since 2009 amid concerns that the US trade war has darkened the growth outlook.

Up until now, the Bank of England has adopted a careful and gradual approach to rate cuts despite still-above-target inflation and solid wage growth.

However, President Trump's steep tariffs have threatened to slow the global economy, leaving the market predicting that the BoE will cut rates to 3.5% by the end of this year.

Today’s vote is expected to be unanimous, with even more hawkish members such as Meghan Greene expected to vote for a rate reduction.

Attention will be on guidance as the Bank of England told investors to expect gradual and careful rate cuts. Removing the word gradual or careful would be a more dovish stance from the central bank as it shifts its focus away from inflation and towards the slowdown in growth. Overall, there's a growing consensus that US tariffs will slow growth and ease inflationary pressures, particularly if declining sales to the US prompt Chinese companies to target the UK market.

The market expects four rate cuts throughout the remainder of this year. A dovish BoE could pull GBP lower.

This comes after the Federal Reserve left interest rates unchanged in yesterday's meeting and warned of higher inflation and unemployment due to trade tariffs.

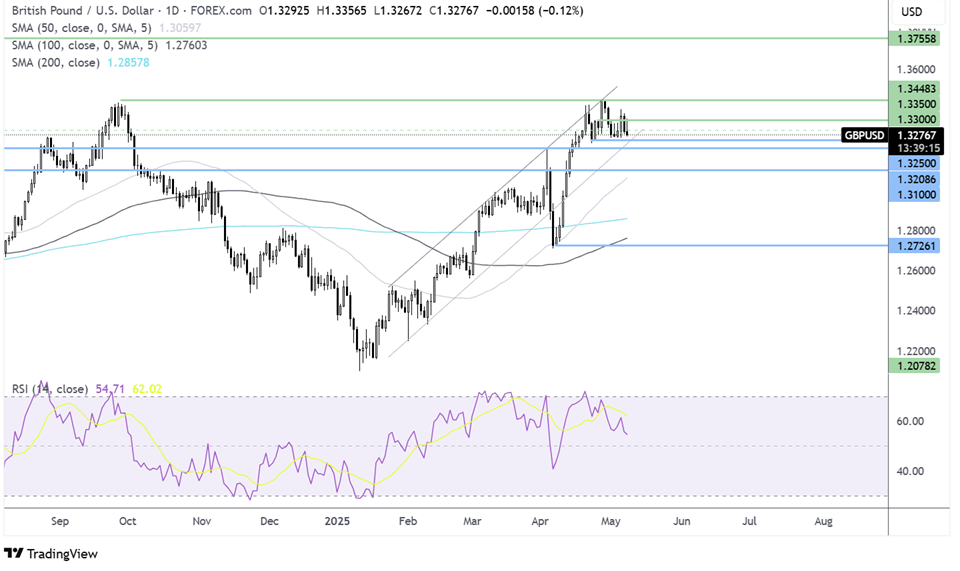

GBP/USD Forecast- technical analysis

GBP/USD has eased back from its 3-year high of 1.3450. consolidating around 1.33. So far, the pair has found support around 1.3260, the May low. The RSI is pointing lower, indicating slowing momentum.

Sellers will look to break below 1.3260 and 1.32, the April 3 high, to bring 1.30 into focus.

Buyers would need to rise above 1.34 to bring 1.3450 and fresh multi-year highs into play.

EUR/USD slips as USD rebounds on trade deal hopes

- A trade deal framework between the UK and the US could be announced today

- The Fed left rates unchanged

- EUR/USD consolidates around 1.13

EUR/USD is falling amid renewed USD strength as optimism builds surrounding trade.

The USD is extending gains after Trump teased a trade deal announcement for later today. The announcement is expected to be a framework for a trade deal between the US and the UK, marking a solid first step in reaching a fully fledged trade deal.

This latest announcement comes as trade talks between the US and China are set to take place this weekend. Whilst it's important to remain realistic about the potential outcome of these trade talks, the US is saying this is a starting point for negotiations.

While investors sold out of the USD aggressively on trade war fears, any sense that trade deals are coming through and an improved situation is helping to boost the USD.

This comes after yesterday's Federal Reserve interest rate decision, where the Fed, as expected, left rates on hold at 4.25%- 4.5%. Policymakers are in no rush to further reduce rates until there is more clarity on Trump's trade tariffs and their potential economic impact.

Federal Reserve Chair Jerome Powell warned that trade tariffs could result in higher inflation and higher unemployment, putting the Fed in a difficult spot as each problem requires a different policy action.

Looking ahead, jobless claims will be in focus. So far, the US labour market has been resilient despite deteriorating consumer and business sentiment.

The euro is inching lower amid mixed regional cues. Frederick Mers' election as Germany's chancellor has reduced uncertainty in the outlook for the eurozone's economic powerhouse, lending some support to the shared currency.

Meanwhile, today's data was also encouraging, with German industrial production rising 3% month over month in March after falling 1.3% in February. However, these figures should be considered with caution. The erratic performance in the German industry came ahead of expected trade escalations.

Meanwhile, eurozone retail sales yesterday came in below forecasts amid deteriorating consumer confidence but above inflation wage growth.

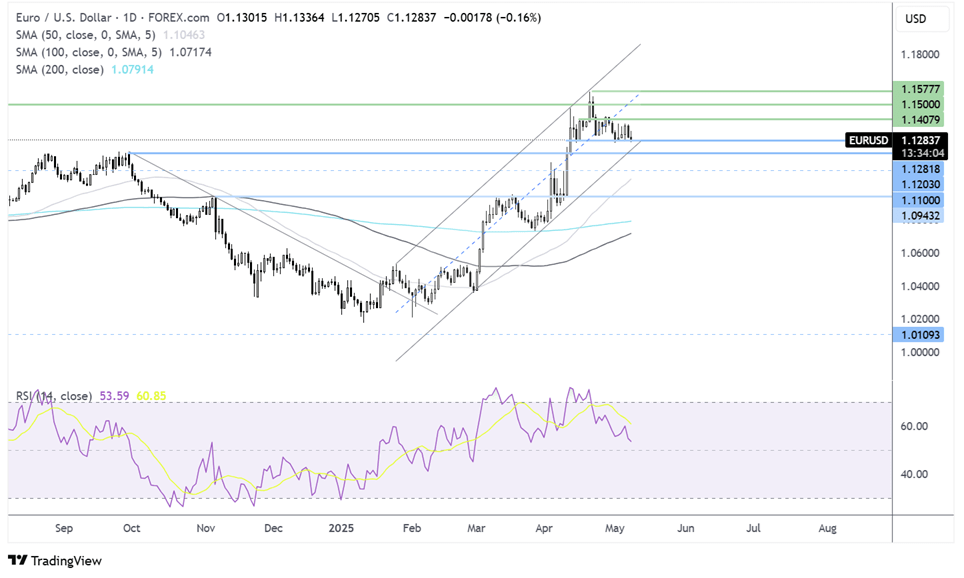

EUR/USD forecast – technical analysis

EUR/USD has eased back from its multi-year high of 1.1575 and is consolidating around 1.13. The pair has found decent support at around 1.1260, the May low.

Sellers will look to break below this level towards 1.12, the September high, and 1.11, the round number.

Buyers would need to rise above 1.14 to bring 1.15 into focus. A rise above 1.1575 opens the door to a fresh multi-year high.