British Pound Outlook: GBP/USD

GBP/USD gives back the advance following the Bank of England (BoE) rate decision as US President Donald Trump announces that ‘together with our strong ally, the United Kingdom, we have reached the first, historic trade deal since Liberation Day.’

GBP/USD Post-BoE Rebound Unravels amid US-UK Trade Deal

GBP/USD bounced back from a fresh monthly low (1.3242) as the BoE voted 5-4 to implement a 25bp rate cut, with the policy statement revealing that ‘two members preferred to maintain Bank Rate at 4.5%.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

It seems as though the Monetary Policy Committee (MPC) will move to the sidelines as its next meeting in June as ‘a gradual and careful approach to the further withdrawal of monetary policy restraint remains appropriate, and GBP/USD may continue to reflect the bullish trend from earlier this year as the dissent within the BoE curbs speculation for back-to-back rate cuts.

In turn, the British Pound may continue to outperform against the Greenback even though the ongoing shift in US trade policy keeps the Federal Reserve on the sidelines, and GBP/USD may continue to track the positive slope in the 50-Day SMA (1.3061) as it still holds above the moving average.

With that said, GBP/USD may attempt to retrace the decline from the yearly high (1.3445) should it defend the rebound following the BoE rate decision, but the exchange rate may struggle to retain the rally from the April low (1.2709) as the US-UK trade deal seems to be spurring a change in US Dollar sentiment.

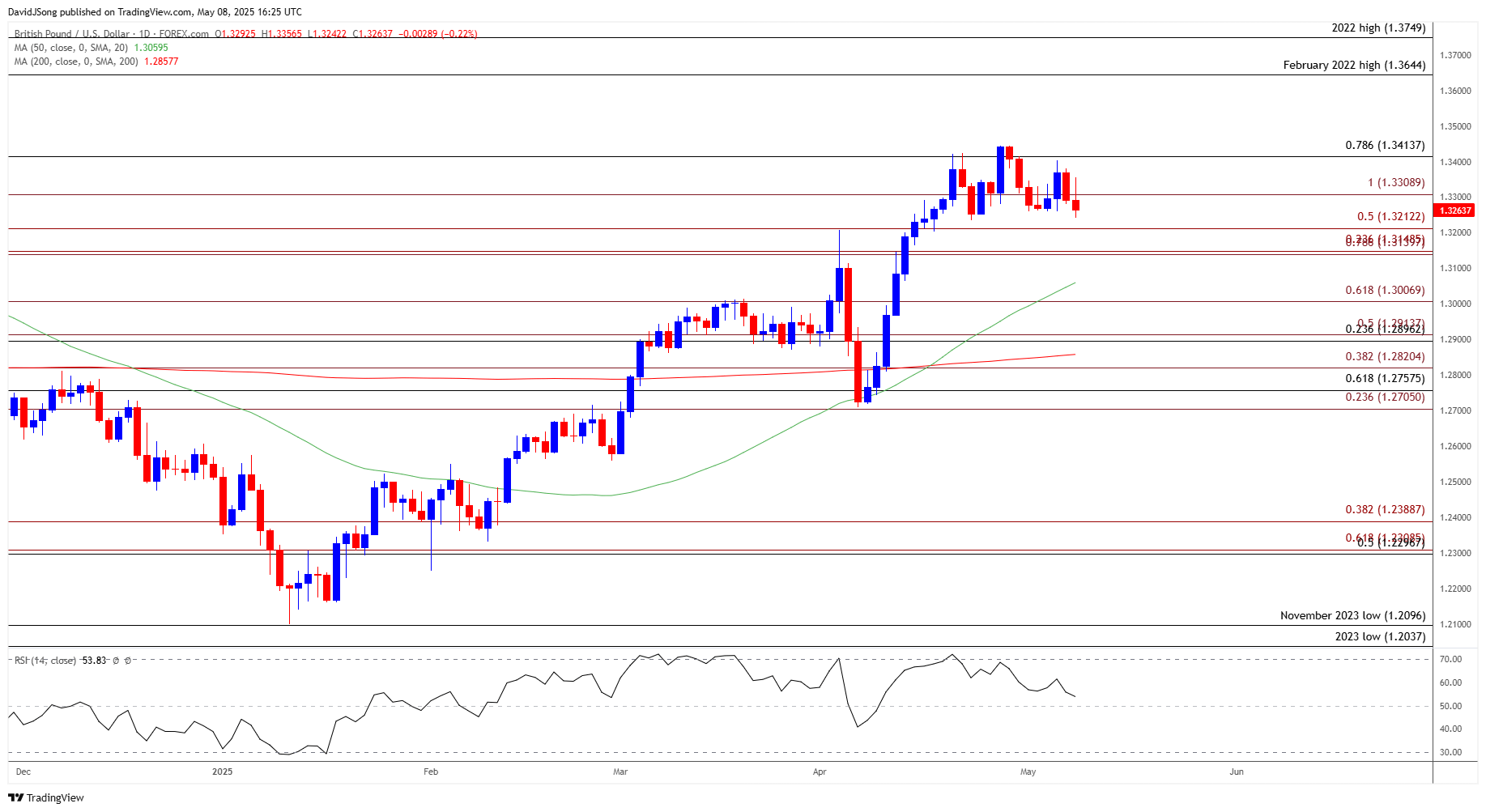

GBP/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; GBP/USD on TradingView

- GBP/USD registers a fresh monthly low (1.3242) as it gives back the advance from the start of the week, and lack of momentum to hold above 1.3210 (50% Fibonacci extension) may push the exchange rate towards the 1.3140 (78.6% Fibonacci extension) to 1.3150 (23.6% Fibonacci extension) region.

- Failure to hold above the 50-Day SMA (1.3061) may lead to a test of 1.3010 (61.8% Fibonacci extension), but the weakness in GBP/USD may turn out to be temporary should it continue to hold above the moving average.

- Need a move back above 1.3310 (100% Fibonacci extension) to bring the monthly high (1.3403) on the radar, with a break/close above 1.3410 (78.6% Fibonacci retracement) raising the scope for a test of the April high (1.3445).

Additional Market Outlooks

Australian Dollar Forecast: AUD/USD Threatens December High

Canadian Dollar Forecast: USD/CAD Reverses Ahead of Monthly High

EUR/USD Defends Rebound from Monthly Low Ahead of Fed Rate Decision

USD/JPY Rebound Unravels with Fed Rate Decision on Tap

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong