British Pound Outlook: GBP/USD

GBP/USD gives back the advance from the start of the week to hold below the May high (1.3593), but the pullback in the exchange rate may turn out to be temporary should it continue to track the positive slope in the 50-Day SMA (1.3241).

GBP/USD Stuck in Narrow Range amid Failure to Test February 2022 High

GBP/USD seems to be stuck in a narrow range following the failed attempt to test the February 2022 high (1.3644), and the exchange rate may struggle to retain the rebound from the May low (1.3140) as Bank of England (BoE) Governor Andrew Bailey pledges to adjust monetary policy ‘gradual and careful’ while testifying in front of the Treasury Select Committee.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

It seems as though the BoE will stay on track to implement lower interest rates as Governor Bailey states that ‘the path remains downwards,’ but the Monetary Policy Committee (MPC) may move to the sidelines at its next meeting on June 19 after voting 5-4 to deliver at 25bp rate-cut in May.

With that said, the dissent within the BoE may keep GBP/USD afloat as its curbs speculation for back-to-back rate cuts, and the exchange rate may break out of the range bound price action should it continue to track the positive slope in the 50-Day SMA (1.3241).

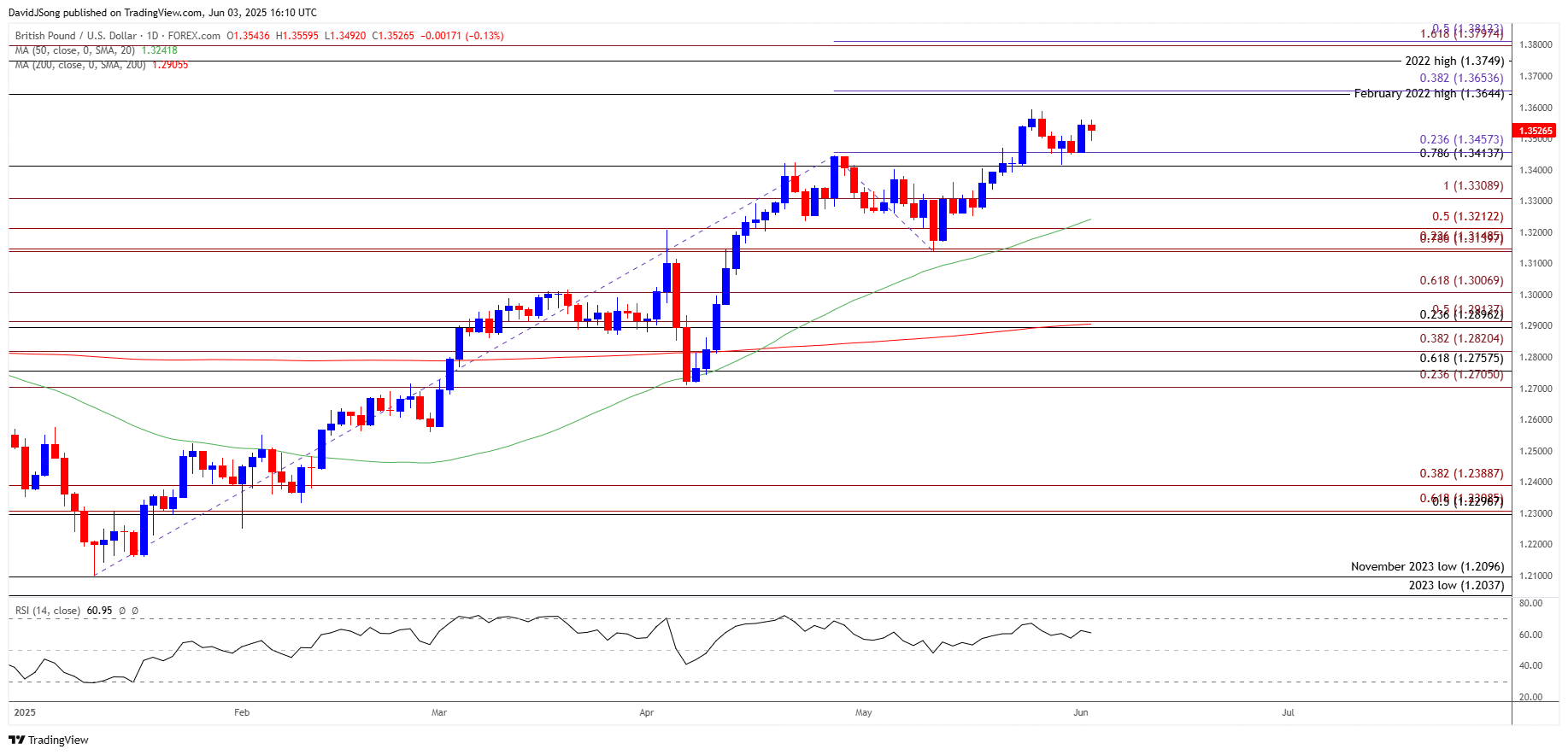

GBP/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; GBP/USD on TradingView

- GBP/USD may trade within the May range as it gives back the advance from the start of the week, with a break/close below the 1.3410 (78.6% Fibonacci retracement) to 1.3460 (23.6% Fibonacci extension) region raising the scope for a move toward 1.3310 (100% Fibonacci extension).

- Next area of interest comes in around 1.3210 (50% Fibonacci extension), but GBP/USD may continue to track the positive slope in the 50-Day SMA (1.3242) as it appears to be defending the 1.3410 (78.6% Fibonacci retracement) to 1.3460 (23.6% Fibonacci extension) region.

- A breach above the May high (1.3593) may lead to a test of the February 2022 high (1.3644), with a move/close above 1.3650 (38.2% Fibonacci extension) bringing the 2022 high (1.3749) on the radar.

Additional Market Outlooks

US Dollar Forecast: USD/CHF Clears May Low

Canadian Dollar Forecast: USD/CAD Selloff Persists Ahead of BoC Meeting

EUR/USD Defends Rebound from Weekly Low to Hold Above 50-Day SMA

Australian Dollar Forecast: AUD/USD Halts Bearish Price Series

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong