Key Events

- Fed Member speeches

- US-China Trade Developments

- IMF Spring Meetings – Ongoing throughout the week

- EUR, US, and US Flash PMIs - Thursday

- Tokyo Core CPI - Friday

Market Outlook

Between escalating trade tensions and Trump pressures on the Fed to decrease interest rates, global markets are losing confidence in the US Dollar. The greenback is pushing towards levels last seen four years ago, while gold surges to record highs, recently testing the $3,500 mark and eyeing further upside towards $4,000 if no sense of certainty settles in the market.

As for currencies, the Euro is trading at its highest levels in four years above 1.15. GBPUSD is challenging its September 2024 high at 1.34, while USDJPY is testing the September 2024 low near 139. These key levels remain pivotal—either confirming trend continuation into 2025 or signaling at least a short-term reversal for a momentum reset.

Volatility may be sparked this week by a series of key developments:

- Fed commentary amid political pressure from Trump to lower interest rates despite inflation concerns.

- Flash manufacturing and services PMIs across the Eurozone, UK, and US on Thursday

- Friday's Tokyo Core CPI, where a notable rise in inflation could increase pressure on USDJPY—especially if the BOJ adjusts its forecasts in favor of a rate hike, in response to additional tariff risks.

Technical Analysis

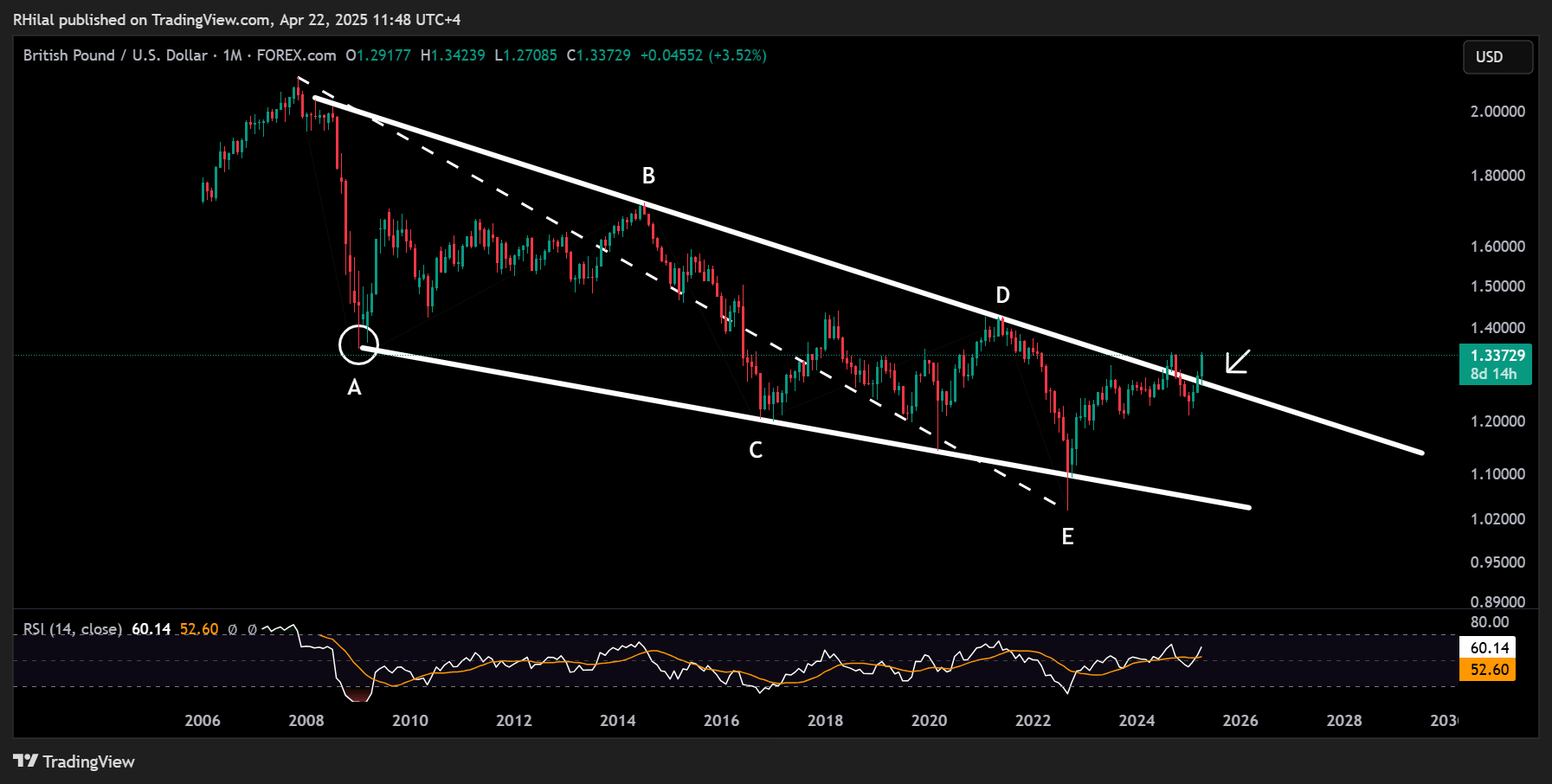

GBPUSD Outlook: Monthly Time Frame – Log Scale

Source: Tradingview

Similar to EURUSD, GBPUSD remains strongly positioned above the long-term consolidation zone extending from the 2008 highs. Currently, it is testing the 2024 high at 1.3434, underpinned by strong momentum.

A confirmed breakout above 1.3434 could open the way for accelerated gains toward a resistance cluster that includes the 2022 highs between 1.3750–1.3780, followed by 1.4240 and 1.4840. Downside scenarios are outlined in the following chart.

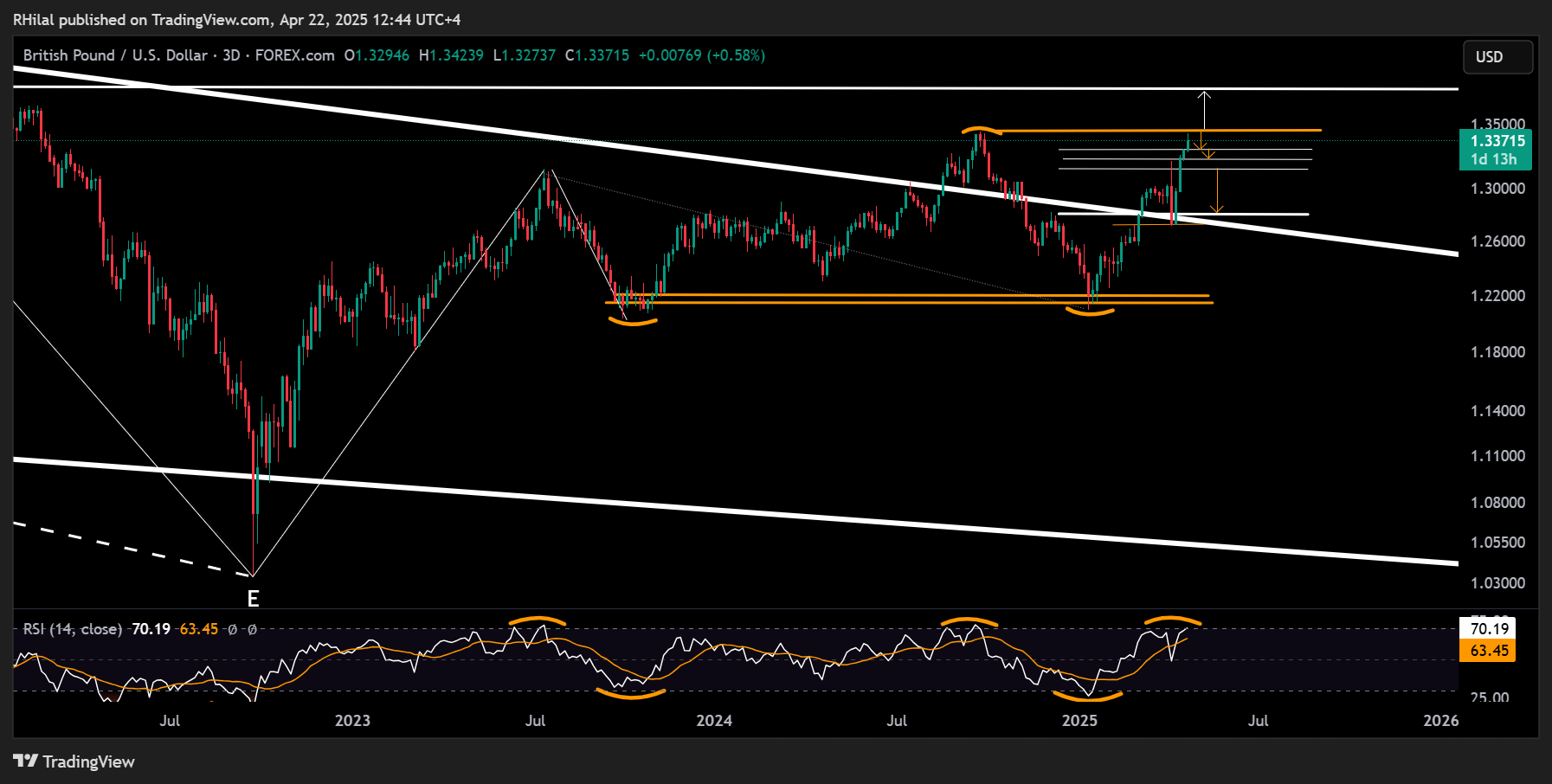

GBPUSD Outlook: 3-Day Time Frame – Log Scale

Source: Tradingview

On the 3-day chart, potential downside risks may bring the pair back toward the upper boundary of the 2008 consolidation zone. Key support levels are noted at 1.33, 1.32, 1.3140, and—under more extreme conditions—1.28.

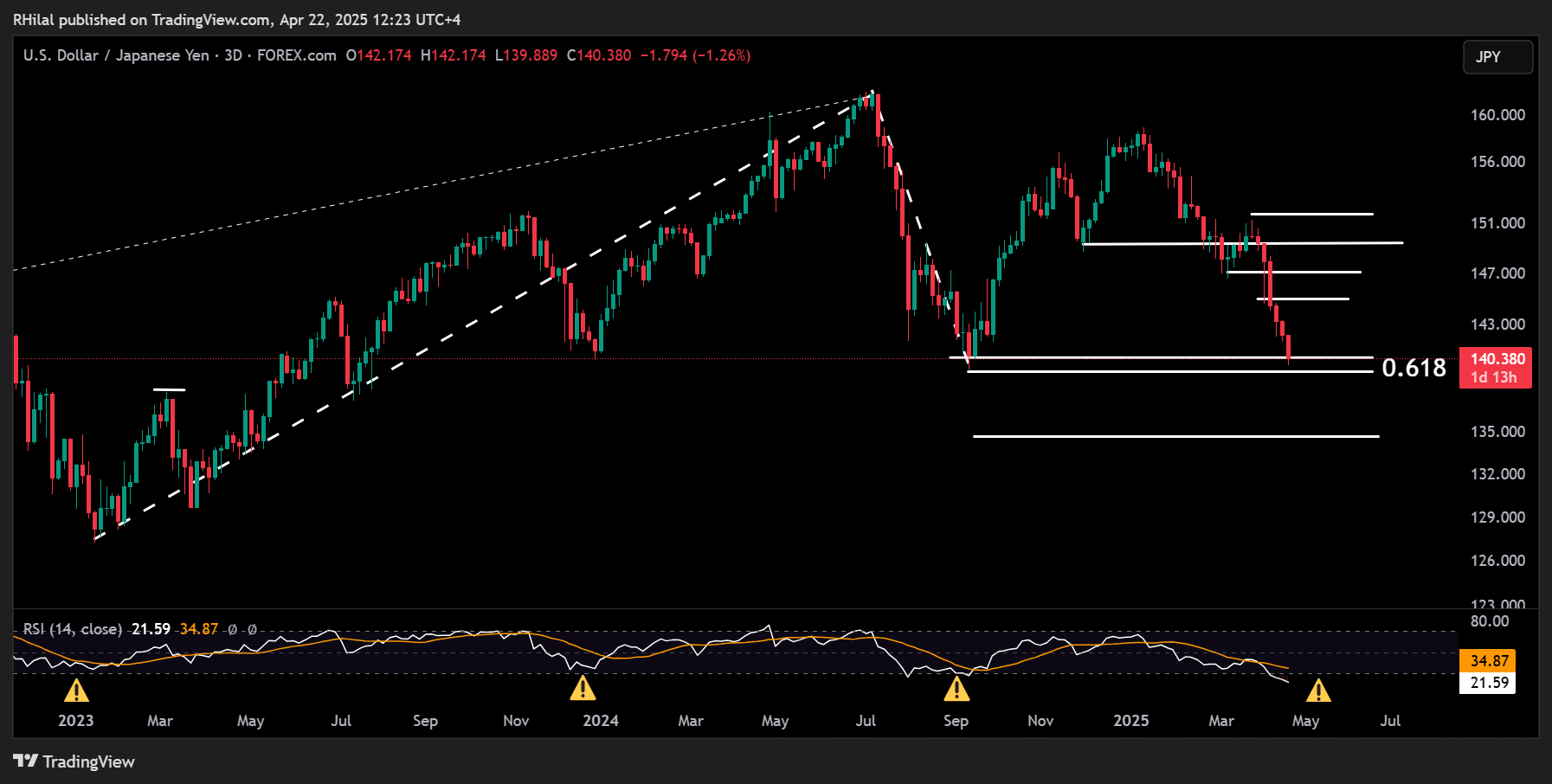

USDJPY Outlook: 3-Day Time Frame – Log Scale

Source: Tradingview

USDJPY is currently retesting its 2024 lows and the 0.618 Fibonacci retracement level of the uptrend from January 2023 to July 2024, near the critical 139 zone. The daily Relative Strength Index (RSI) is now in oversold territory—levels that have previously marked key reversals for USDJPY in both 2023 and 2024.

If a reversal takes hold, potential resistance targets include 142, 145, 147, and 151. However, if the support around 139 fails to hold, the pair may extend losses toward 138 and potentially 134, which aligns with the 0.786 Fibonacci retracement.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves