Gold has experienced two sessions of strong bullish pressure that have pushed the price back toward the $3,400 per troy ounce zone. However, during the current session, selling pressure has reemerged, with a drop of just over 1.5%, as the price remains near historical highs. The bullish trend in gold has remained intact amid persistent political and economic uncertainty, while the market also awaits the Federal Reserve decision.

Factors That May Influence Gold Prices

According to data published through April, for the fifth consecutive month, the People’s Bank of China has continued to increase its gold reserves, reaching 73.7 million troy ounces as of the end of March. This trend has boosted demand expectations and suggests that China remains committed to consistent purchases amid ongoing economic and political uncertainty worldwide.

Additionally, recent reports of military strikes by India on Pakistani territory have heightened geopolitical tensions. Pakistan’s government has stated its intention to respond with counterattacks and has called on the international community to condemn the incidents. This conflict has further intensified regional political instability, reinforcing the role of gold as a global safe-haven asset.

Finally, it’s important to note that the trade war remains unresolved. Although the U.S. Treasury Secretary has mentioned the possibility of official talks with the Chinese government, there is still no clear timeline or solution in sight. This prolonged uncertainty could continue to drive demand for safe-haven assets, as investors avoid higher-risk markets.

Currently, there are three main catalysts driving gold movements: sustained demand from China, global economic uncertainty, and geopolitical instability. Given that gold has already demonstrated its role as a safe-haven asset during recent periods of volatility, if these conditions persist, buying pressure on XAU/USD could remain relevant in upcoming sessions.

What Is the Role of the U.S. Dollar?

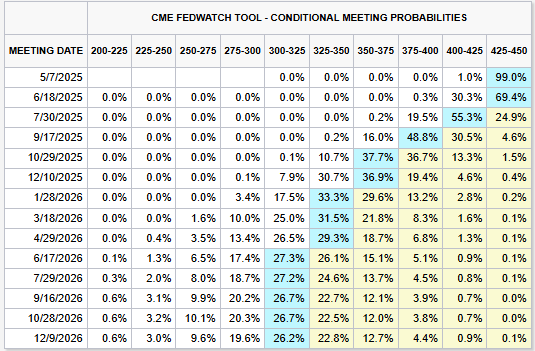

Today, the market awaits the release of the Federal Reserve's interest rate decision, which could have a direct short-term impact on the U.S. dollar. According to CME Group’s FedWatch Tool, there is a 99% probability that the Fed will keep the interest rate at 4.5% during today’s meeting. There is also a 69.4% probability that this rate will remain unchanged at the June 18 meeting.

Source: CME Group

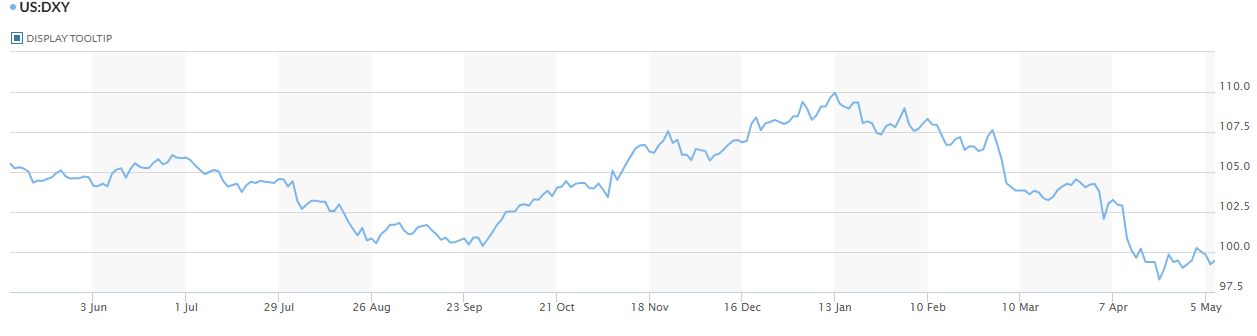

In this context, the behavior of the U.S. dollar could be crucial. A sustained strengthening of the currency could threaten the bullish momentum gold has built in recent weeks. The DXY index, which measures the dollar’s strength against a basket of currencies, has shown a steady short-term recovery, approaching the 100-point zone after reaching recent lows.

Source: MarketWatch

Therefore, if the Federal Reserve maintains its hawkish tone, and Jerome Powell confirms that the current policy stance will continue, this could keep Treasury yields elevated, boosting demand for dollars. Such a scenario could put gold’s recent rally at risk and potentially increase selling pressure on XAU/USD.

Gold Technical Outlook

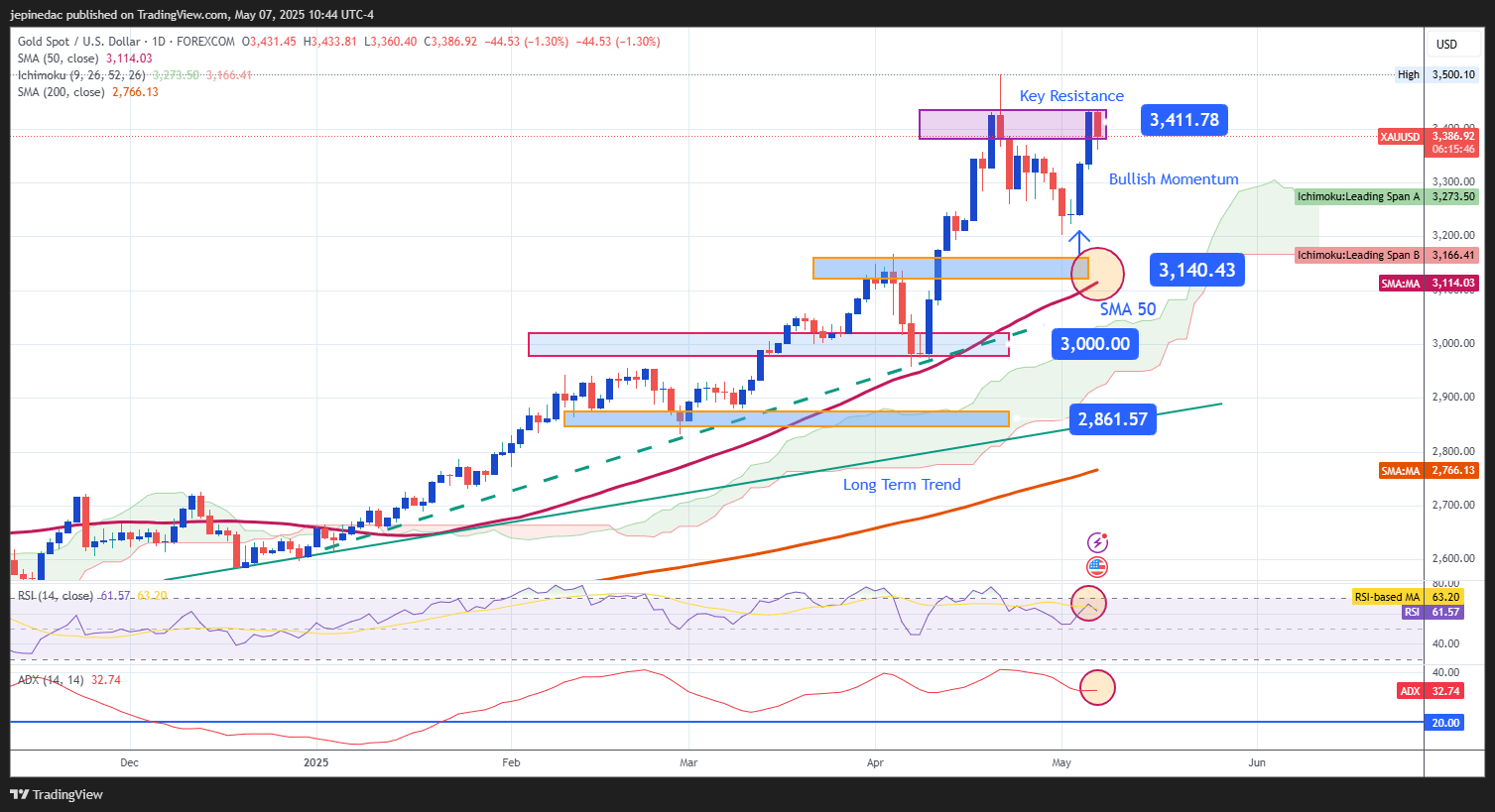

Source: StoneX, Tradingview

- Bullish Trend: Gold’s technical structure has remained largely bullish in recent months. Since early 2025, the price has followed a steep ascending trendline, surpassing the psychological barrier of $3,000 per ounce. Although some bearish moves have occurred recently, they haven’t been strong enough to break key support levels, and now the price is again testing historical highs. If buying pressure persists, the bullish formation could strengthen even further.

- ADX: The ADX line remains above the neutral level of 20, though it has started to flatten around 30, which may suggest a decline in market volatility and directional strength. If this flattening continues, it could indicate a consolidation or neutral phase in the short term.

- RSI: The RSI line remains just below the overbought threshold (70). As long as fluctuations near this level remain moderate, there are no clear signs of significant bearish corrections in the short term.

Key Levels to Watch:

- $3,400 – Major Resistance: This level corresponds to recent historical highs. A sustained breakout above this point could confirm the bullish bias and extend the ongoing upward trend.

- $3,140 – Relevant Support: A technical level that has provided support during recent periods of indecision. It also coincides with the 50-period simple moving average, and its preservation could be key to preventing further downside corrections.

- $3,000 – Critical Support: A psychological threshold and now a more distant support level. If breached, the current bullish structure could come under pressure.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25