Key Events

- Chinese PMIs fall below expansion levels, nearing two-year lows

- Ukraine moves closer to a short-term minerals deal, weighing slightly on gold and oil

- Gold is holding within a triangle formation, awaiting a catalyst for breakout

- Fears over the U.S. Dollar standard continue to support gold above the $3,000 level

Gold Forecast: Daily Time Frame – Log Scale

Source: Tradingview

Gold is currently trading within a triangle pattern, bounded by key support and resistance levels between $3,260 and $3,350 — a $100 range. A breakout in either direction could mirror this range in volatility, aligning with the full potential of the triangle formation.

Upside Scenario:

A sustained breakout above $3,370 may extend gains toward $3,460 and $3,500.

Downside Scenario:

A confirmed breakdown below $3,260 could open the way for declines toward $3,160, $3,080, and $3,000.

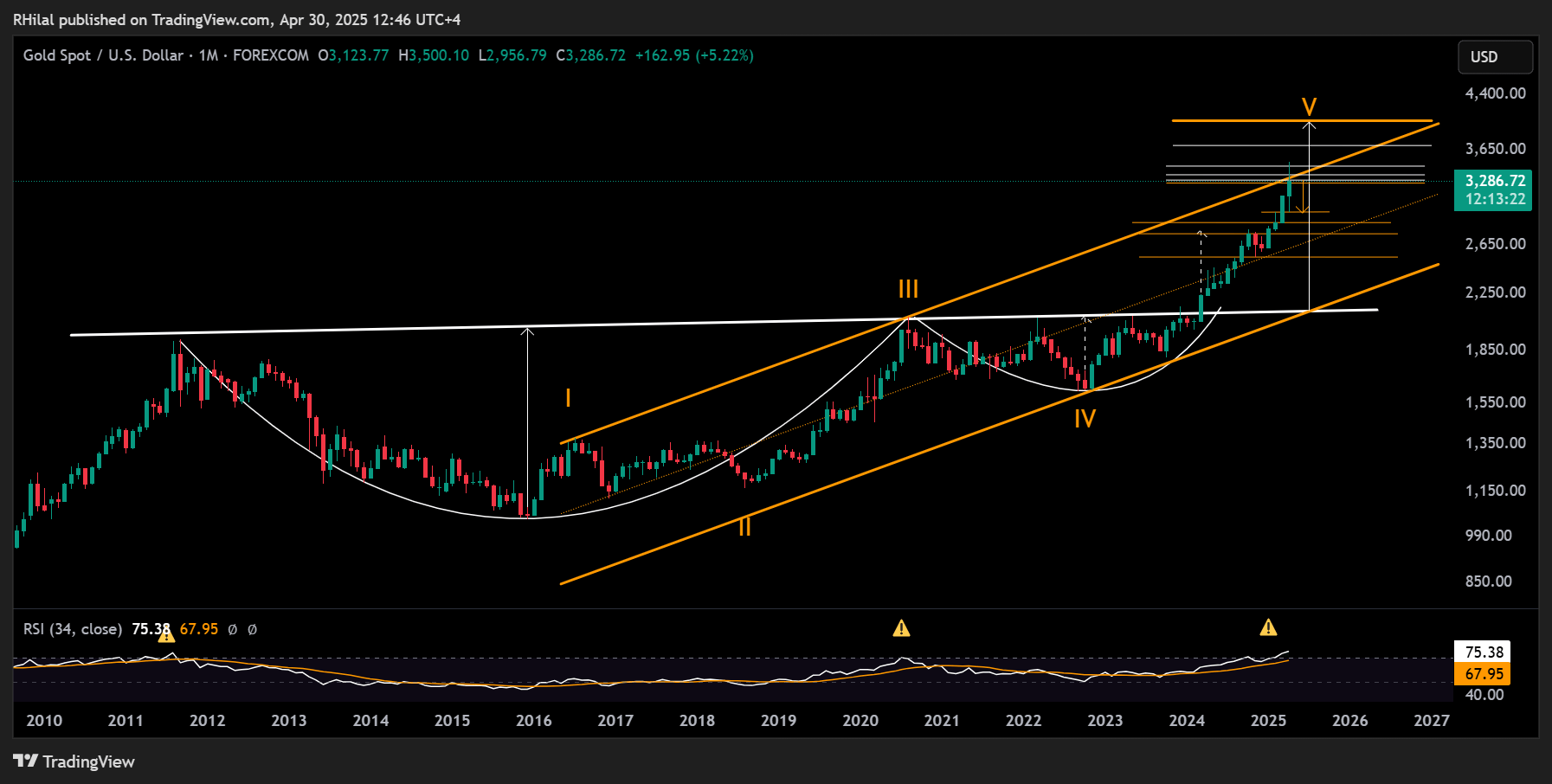

Gold Forecast: Monthly Time Frame – Log Scale

Source: Tradingview

From a long-term perspective, gold’s position near upper channel resistance suggests a possible short-term correction to relieve overbought momentum. However, if tariff tensions escalate, recession fears intensify, and the U.S. dollar weakens further, gold could resume its bullish path — following a potential cup-and-handle formation — targeting $3,700 and eventually $4,000.

On the downside, if peace deals solidify and the dollar strengthens, a deeper correction toward $2,800 is possible before resuming a longer-term bullish trend toward $4,000.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves