Although the bullish bias in XAU/USD movements has remained strong, the price closed the week pulling back toward the $3,000 per troy ounce support zone, posting a short-term decline of just over 1%. Nevertheless, the long-term trend remains broadly bullish, and buying pressure could continue after a week dominated by major central bank decisions.

Central Bank Week

This week, several key monetary policy decisions from central banks reflected the overall sentiment amid persistent uncertainty in financial markets.

The most notable announcement came from the Federal Reserve, which decided to keep its interest rate unchanged at 4.5%. The Fed also noted that inflation remains above its 2% target, and that it is not yet the right time to adjust its monetary policy, favoring a neutral stance in the short term.

A similar tone was reflected in the statements from the Bank of Japan and the Bank of England, which also kept their rates unchanged, at 0.5% and 4.5%, respectively. Both institutions highlighted that inflation still poses risks, and that, given the current uncertainty, the best course of action is to maintain a cautious outlook.

The neutral posture adopted by the major central banks reflects shared concerns about the economic outlook for the year. This cautious approach has coincided with growing market anxiety, creating a more defensive investor environment. As a result, demand for safe-haven assets like gold has increased, as it typically benefits during times of uncertainty.

Additionally, the current high-interest rate environment has boosted the appeal of fixed-income instruments, which offer stable returns. This could be undermining interest in risk assets and encouraging a shift of capital toward safer instruments such as Treasury bonds and gold.

Market Sentiment

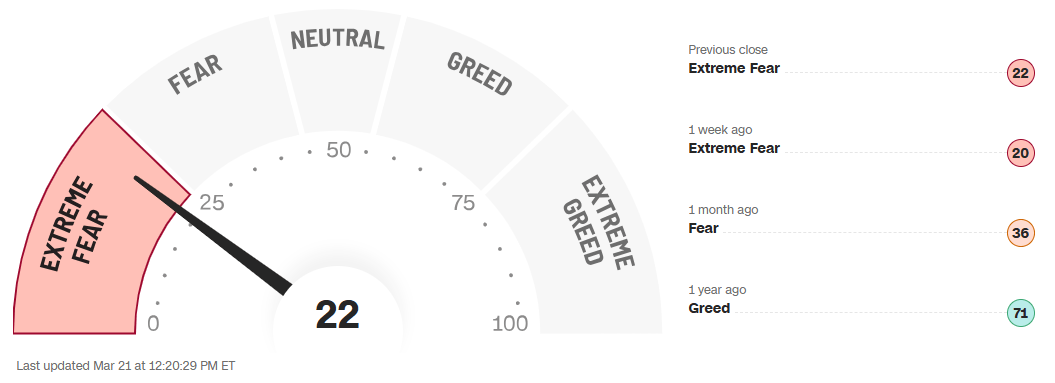

The Fear & Greed Index, published by CNN, currently stands at 22, within the extreme fear zone. This level has held since last week, reflecting deep mistrust across the markets. The possibility of a trade war has further fueled investor caution toward risk assets.

Source: CNN

As long as the index remains below 25, demand for gold is likely to increase. In this environment, the upward pressure on XAU/USD, which has prevailed in recent weeks, could extend into future sessions as interest in safe-haven assets continues to grow.

Technical Outlook for Gold

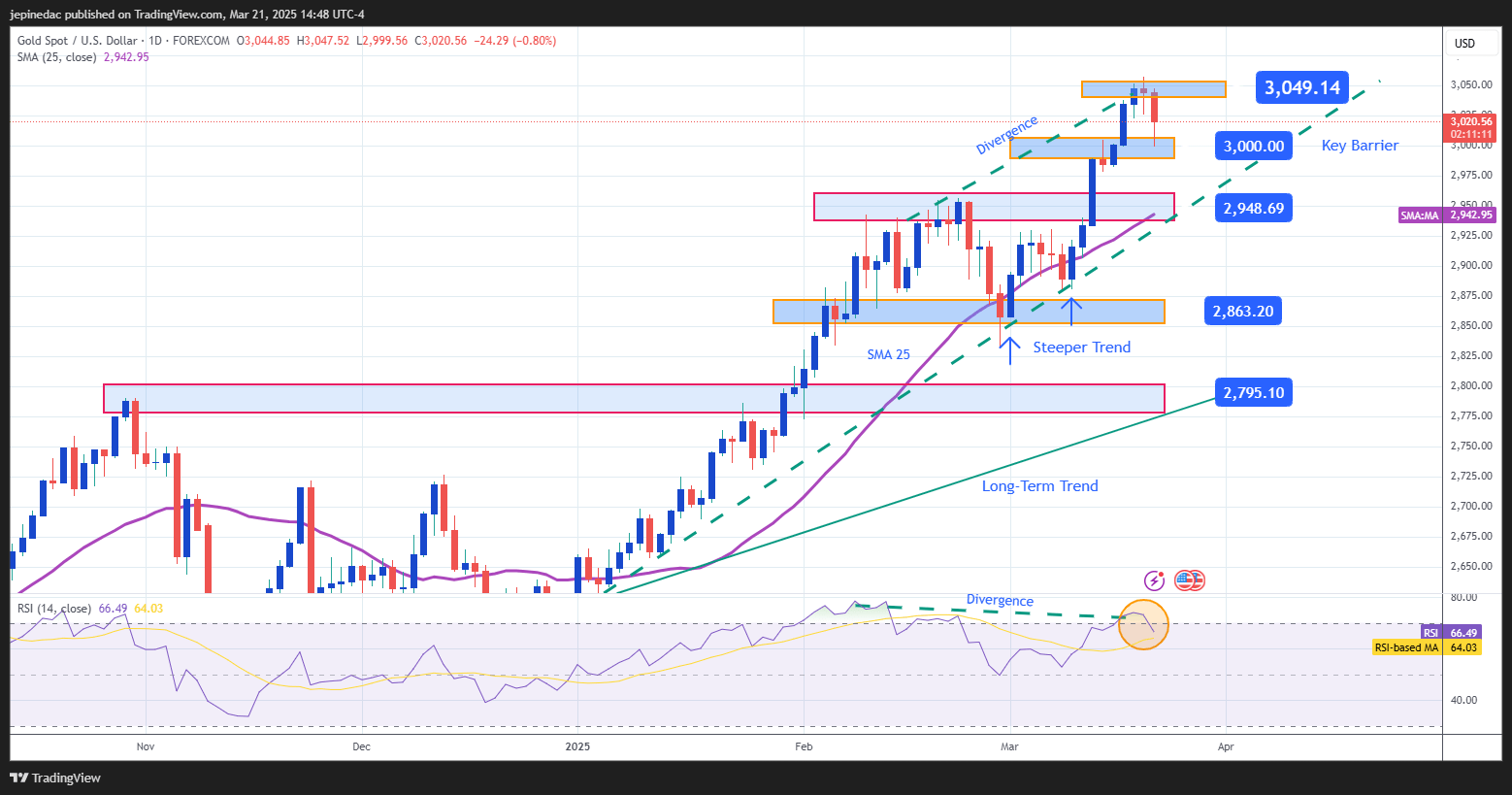

Source: StoneX, Tradingview

- Bullish Trend: Gold has maintained a steady uptrend in recent months. Since early 2025, the bullish movement has steepened, surpassing the psychological barrier of $3,000 per ounce. However, after reaching that level, the price appears to have entered a consolidation phase, closing the week with a neutral bias.

So far, there have been no significant selling movements that pose a real threat to the current bullish structure.

- RSI: The RSI line has recently dropped after exiting the overbought zone at 70. Additionally, the divergence between higher highs in gold prices and lower highs in the RSI suggests a possible imbalance in recent momentum, which could pave the way for short-term bearish corrections.

Key Levels to Watch:

- $3,050 – Tentative Resistance: This is the area of recent highs and the closest resistance at the moment. A breakout above this level could further strengthen the current bullish trend.

- $3,000 – Key Support: This is the most important short-term barrier and could serve as the base for upcoming bearish corrections.

- $2,950 – Distant Support: This level aligns with the current bullish trendline and the 25-period simple moving average. A drop below this point could weaken the bullish formation and trigger a sharper bearish bias.

Written by Julian Pineda, CFA – Market Analyst