Markets appeared to steady themselves last week, with risk assets such as the S&P 500 pressing higher and haven assets taking a backseat. As a result, gold fell sharply after hitting a record high of $3,500, reaching a weekly low of $3,260, before bouncing into the week’s close to settle at $3,319. That late-day recovery meant gold would finish the week little-changed despite a very good week for stock averages. The gold outlook remains positive until we see lower lows and lower highs and actual trade deals, rather than just promises.

Calmer condition could be disrupted any moment

Despite the calmer conditions in the markets last week, any true sense of confidence remains tentative, with underlying threats — trade tensions, recession worries, and monetary policy jitters — still capable of unsettling the calm. In particular, it is trade worries that could unnerve investors in the event the US refuses to bring down tariffs on China or the two countries fail to reach any sort of agreement on the trade situation.

Could the gold outlook change due to economic data?

With all the focus being on the trade war, economic data has taken a back seat. But that changes in the week ahead, which is brimming with pivotal events: GDP figures from major economies, China’s April PMIs, and a flurry of heavyweight corporate earnings from the so-called ‘Magnificent 7’ group of companies. Trade war repercussions will be scrutinised through US ISM manufacturing data and updates from Canada and Mexico. While first-quarter US GDP figures may prove dated, consumer confidence surveys and tech results should offer a fresher read on sentiment. To close the week, all eyes will be on US labour data for April — a potential flashpoint for market nerves. In short, caution remains the order of the day, keeping the longer term gold outlook positive.

Technical gold outlook: key levels to watch

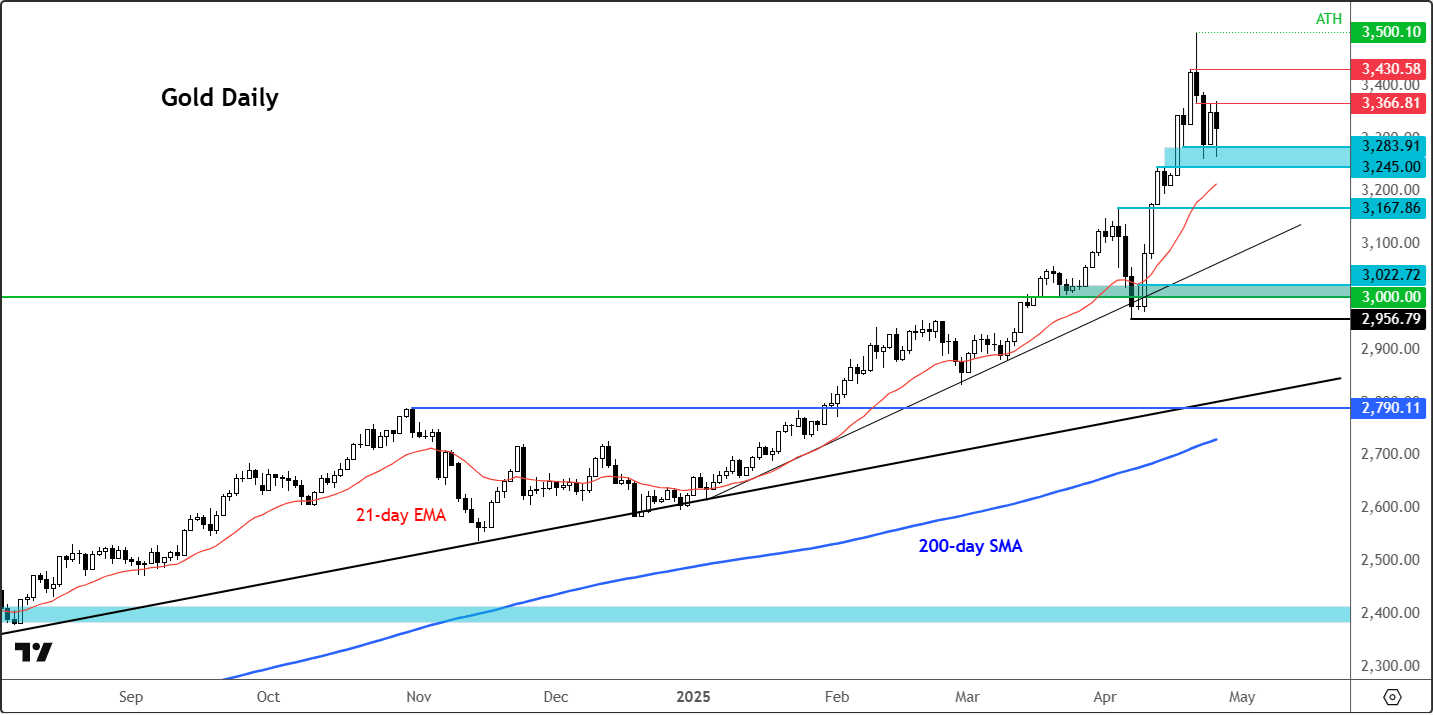

Gold sold off sharply after encountering heavy resistance at the psychologically important $3,500 level (its all-time high). Still, the bigger picture remains firmly bullish.

Source: TradingView.com

The question now is whether dip buyers will return as the price of gold approaches key support zones. The first major support to watch is between $3,245 and $3,283 — an area where we saw a couple of solid bounces last week. Below that, $3,167 stands out, representing the previous high from earlier this month before gold broke higher.

For me, the critical "line in the sand" is the short-term bullish trend line near $3,100. I’m not necessarily expecting a drop that far, but if we do get there, it could present a strong bounce opportunity. The long-term technical gold outlook will only turn bearish if we start seeing lower highs and lower lows form.

On the upside, resistance is now seen around $3,366, followed by $3,430. Beyond that, the next major hurdle would be the all-time high at $3,500.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R